NCDs are getting increasingly popular in the Indian market these days, and soon after I wrote about the India Infoline NCD – I came across the NCD of another NBFCÂ (Non Banking Finance Company) – Shriram City Union.

Shriram City Union is part of the Shriram group of companies, and its primary business is lending in the small loan segment of Rs. 1 – 10 lakhs. This is the second NCD from this group as you will probably remember the NCD from Shriram Transport Finance in June this year.

The company had revenues of Rs. 1320.91 crores and a net profit of Rs. 240.58 crores in the last fiscal, a decent profit margin of 18.2%, and in the last 5 years the net income has grown at a CAGR of 40%, and profits have grown at a CAGR of 47%. They have a NPA (Non Performing Loans) to Net Asset Ratio of 0.43%. Their CAR (Capital Adequacy Ratio) was 20.53% against a RBI mandated 12.00%, and just for reference, the IIFL NCD that I recently reviewed showed that their CAR was 29.95%.

Like the IIFL NBFC, the Shriram City Union NBFC also draws on the brand and the ecosystem of their parent to grow their customer base. The promoters hold 53% of their stock.

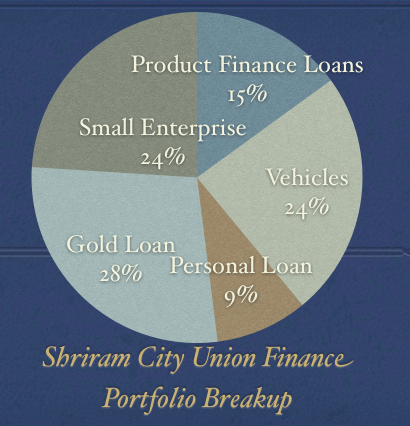

The company lends to various segments, and it’s portfolio mix from the various segments is as follows.

As you can see, the company’s income streams are pretty well diversified. Shiriram City Union Finance has a business model of serving the under – banked community. They use the outlets and know – how of their group companies to get a target customer base, and then lend to them. One example is lending to the customers of Shriram Chits, who then keep the chit money as collateral. Looking at the large number percentage of vehicle finance – I think there should be a similar setup with Shriram Transport Finance as well.

Most of the categories are pretty self explanatory, but I wasn’t so sure what product finance meant. I looked it up and was surprised to see that product finance comprised of two – wheelers, electrical appliances, and other white and brown goods. The average yield for this category is a pretty good 24%, and that is true for other categories as well with yields over 20% in them.

Having looked at the business of Shriram City Union, let’s take a look at this NCD in particular now.

Shriram City Union Finance NCD Terms

Shriram City Union is going to open for subscription on August 11th 2011, and will close on August 27th 2011. CARE has rated this issue CARE AA, which according to them indicates a high degree of safety. CRISIL has also rated it AA – or stable, which indicates the same thing as CARE’s rating.

This is a secured debt issue which means that the debt that the company issues, which can be up to Rs. 750 crores, will be backed by some collateral. It doesn’t mean that your money is guaranteed. It simply means that if the company were to go bankrupt, they will sell off the assets that were earmarked to pay this debt, and pay you with them. The same assets will be earmarked for other debt, or they may not recover as much as they expect to and in that case you will not get all of your money back. Bankruptcy for this company will be an exception rather than the norm, but it is a possibility and one that you should keep in mind while investing in Shriram City Union NCD, or in fact any NCD at all.

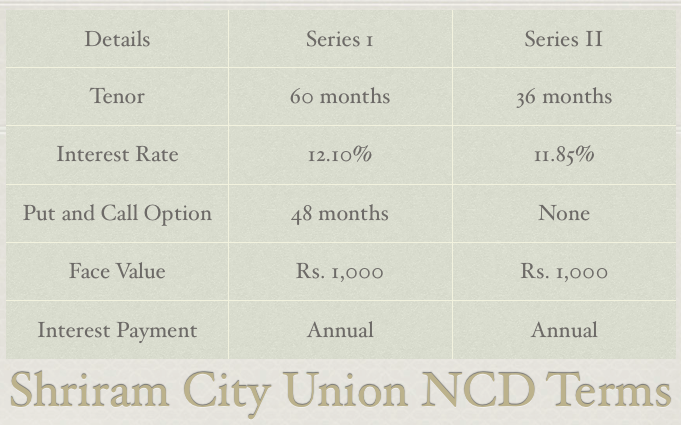

Here are the important terms and conditions for this NCD. The interest rate is shown for the reserved portion of retail individual investors, and those will be the ones who apply for less than Rs. 5 lakhs.

The call and put option for the 60 month series means that at the end of 48 months, either you or the company can decide that you no longer want to continue the NCD and then redeem it at that time, instead of waiting 12 more months.

Here are the other conditions.

Given, that the other NCDs have over – subscribed in the recent past, I won’t be surprised if this one oversubscribes too, so if you do want to invest in them, then you should subscribe to them as quickly as possible.

I have covered the topic of what a NCD is in quite a bit of detail in this post, so I won’t get into that here, and my post about how to buy a NCD describes that process so I won’t get into that as well. If you have any other questions, then please leave a comment, and I will try to answer them.

i m the one of employee of shriram city nd this company goin to banking sector very soon.

I have applied in Shriram City Union Finance NCD – Rs.10000 through icicisecurities. You have raised a doubt that our money is not a guaranteed one. I am afraid. But they have mentioned interest rates like FD. Whetherthe company will intimate and issue statement of receipt to me.

Yeah, they will issue the receipt to you and I only wanted to emphasize that money in NCDs is not guaranteed in the way some people equate it to a bank deposit – that’s all. It doesn’t make it a cause of worry or anything right now. Just that you need to know all the facts before investing.

Hi,

I have applied in Shriram City Union NCD with total amount of 10000 INR. I want to know whether the allotment has started. If not when would it be announced? If already allotted then I would like to know the status of my application number:12150045.

Thanks,

Raju Modi

I’m afraid I don’t know if the allotment has started yet or not.

Dear Manshu,

Do you think Mannapuram NCDs are worth investing only from listing gains perspective ?

Listing is only on BSE. Is this not a negative from listing gains perspective ?

How to you rate Mannapuram NCDs in comparison to Shriram City NCDs ? Superior or Inferior ?

I really have no idea about how listing gains and how they work so unable to say anything.

Manshu,

Any ideas where to look for the data relating oversubscription of NCD’s as is available for the ipos on the nse and bse sites…I tried searching but did not get any info.

Logically since these bonds have to be listed on the exchanges so the exchanges shoule provide the details like how many times a paritcular issue has been subscribed on day 1 and so on and so forth.

I tried to google but no information on the subscription numbers.

Thanks in advance…

Hi Kapil,

As far as I know, they don’t publish this information right now. It’s a good point though, and I think with time there will be regulation that makes them do that, but it isn’t happening right now.

can this NCD be purchased offline?

Not as far as I know.

When IFCI 10.75% bonds today are available at BSE at a discount of 400 rupees per bond, does it really make sense to invest in all these sudden wave of NCDs floating around for past few weeks? Why so many NCDs now? Does it have any relation with incresaed interest rates.

I think its more because companies see there is a demand for these FDs and it gives them another avenue to raise cash.

IFCI 10.75% bonds today available at bse at a discount of 400 rupees per bond. So surprising!

Please guide about all the bonds ncds available on bse/nse and their codes and other relevant details.

Thanks

Sahil

I’ll try to write a post about them soon Sahil – thanks for the suggestion.

I would like to know all the NCD issues which are curently listed , their details and market quotes.

I read on many sites that the commision of 1% is given to all those who apply after allotment

My question is 1)Does City Union Finace local branch offers this division ? or the broker from whom I get the form offers this commision ?

2)I do not get a list of all its branches in mumbai .Where I can get this information

Milind – I’m afraid I’ve never heard or come across this information so can’t say how true it is or where you can find the details.

Hem Securities is offering 1% to 1.3% commision on the total alloted amout only (as per other websites)

Since I never tried I will be applying directly from Shriram Fortune which is 10 mins away from home

Since Shriram Transport was oversubscribed 3 times I think this should also get subscribed atleast 2 times on 1st day Any comments / risk you see in this

As you said, this is a Chennai based company and living in Coimbatore for the past decade, I have not heard about this division of Shriram group. Are they well diversified geographically as well or there’s high concentration in Chennai alone?

They have a high concentration in South India, but not Chennai alone. From what I read about them it seems that they use a lot of the facilities of their sister concerns to carry out their business.

Hmmm… so that means most of their customers are the ones who are having “chit” accounts with them… Living in TN, I’ve never heard of this division of Shriram before they started doling out ads prior to this NCD. I’ve a bad gut feel about this particular NBFC. Staying way for the same reason!

Thanks for sharing that Krish – always good to hear from someone who is actually close to where the company operates and has a general feel for it.