This is another post from the Suggest a Topic page, and today I’m going to write about how you an access the P/E ratios of various Indian sectoral indices and a few thoughts on this data.

The new NSE website makes it quite easy to get the P/E, P/B, Dividend Yield on all the main indices and here’s how you can do that.

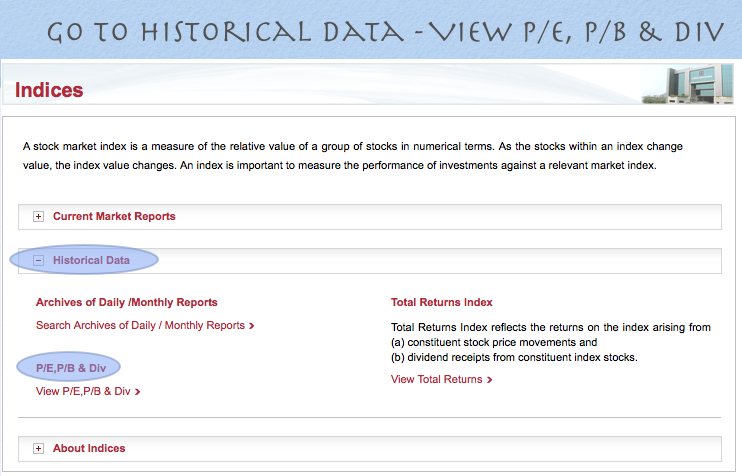

First go to the NSE website and look for Products –> Indices.

Next, look at Historical Data, and View P/B and Dividend Yield.

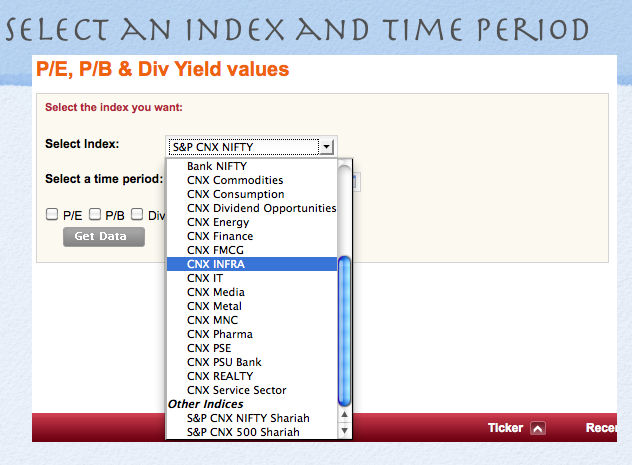

And finally select an index and a time period to generate data for that.

The second part of the question was what is the average of the various indices, and if this information is even useful.

I don’t know how useful the average will be and my guess is that you are better off looking at a median and that too just for reference, and specifically to tell you of extreme situations.

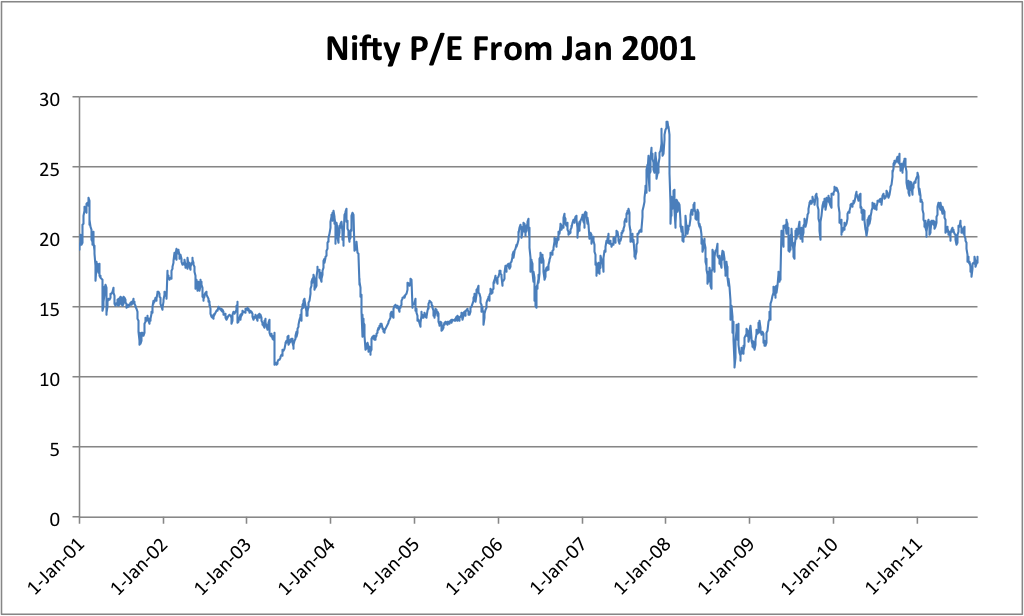

A chart that I have used here quite often is the historical Nifty P/E Ratio data, and here is the latest chart for data from Jan 2001 till yesterday.

If you look at the chart above you will see that the Nifty P/E has never gone above 28, and has never fallen into single digits either.

So, when the P/E of this index is close to these numbers it gives you an indication that the market is cheap or expensive.

But, that’s only in hindsight.

In real time – you can’t be sure if the world is going to come to an end or if the world has discovered a new system whereby old economic cycles don’t matter anymore.

I think a great example of this is my own post from October 2008 in which I wrote about P/E ratios being the lowest in the past 8 years, and despite that investor interest being very very low in the stock market.

If you can remember the mood, and I certainly can – you will remember that the share market was the last thing that anyone wanted to talk about.

So, my take on the P/E ratio is that it can be and is indeed a useful measure but I’m really skeptical of people who say we will start investing when the P/E falls below this level, and start selling when the P/E rises beyond that level because I haven’t seen that working well in the real world.

Can we get Historical PE chart for individual stock?

te site of NSE is permitting to access the above data for a period not more than 365 days only .Is there a way out ?

Nice post. I could get a tabular value of p/e at all historical positions that I chose, but could not get that beautiful graph that you have shown. Please give some more tips on how to do that…

Hi Nice post. Where/how do i get PE for SENSEX?

Dear sir,

i want yearly data of P/E ratio of NSE (nifty) from year 2004 onwards.

Please assist on the above as the data available on NSE site is monthly and not yearly.

Heena, you can get 15 year Nifty PE data at

http://craytheon.com/charts/nifty_pe_ratio_pb_value_dividend_yield_chart.php

Dear sir,

i want yearly data of P/E ratio of NSE (nifty).

Would like to read more on nifty p/e to make the concept more clear.

What is nifty p/e in jan2013 ??

Thank You Sooo much. Was very very helpful.

Hi,

Just wanted to clarify – have you used the trailing twelve month PEs or 1-year forward PEs in the above chart?

Good article. Cheers.

Thank you!

Hi Manshu,

No comment on such a superb post suggests that still people are not ready to invest in equities. 🙁

Thanks Hemant – this is what happens when people are not diversified to begin with and don’t have enough in fixed income. I would like to see the guys who were commenting about comparing FDs to equity returns a few months ago and see what they are doing today.