How did CAG reach the figure of 1.86 lakh crores?

CAG’s report on coal allocation was the big news last week, and the figure of Rs. 1.86 lakhs got a lot of attention as you would have expected it to.

It has now become a regular feature of CAG reports to have a massive number which represents the loss to exchequer and I was curious to see how they arrived at the number for this report.

The full report is available at this link, and the calculation that leads to the notional loss is present in chapter 4 of the report which can be downloaded separately from that page.

I think the report does a good job in explaining how it reaches the number, and even someone like me who doesn’t know anything about coal allocation can get a fair idea of what they have done to arrive at the number.

First some history, before 1993 there was no specific criteria for allocation of coal blocks, and coal blocks were allocated based on the recommendation of the State Governments.

After 1993, an inter – ministerial screening committee was formed that gave inputs to the Ministry of Coal on coal block allocation. The CAG report states that there are certain parameters that the screening committee should follow while evaluating bids, and then give a decision. The CAG gives the example of Fatehpur coal block and Rampia coal block and states that while the screening committee recommended the coal block to a particular allottee, there is nothing in the minutes that has reference to a comparative evaluation to show how this decision has been reached.

In 2004, the government came up with the concept of competitive bidding that was supposed to replace the screening committee and was a method that could be “not only objective but demonstrably transparent”.

The CAG report then has a detailed timeline which shows what transpired between June 28, 2004 and February 2, 2012 and how adopting the competitive bidding process kept getting delayed in these 7 years.

According to CAG, the competitive bidding process could have been adopted in 2004, and had they adopted it in 2004 in place of the screening committee process, the government would have got higher bids for coal blocks and that’s how the loss in revenue is calculated.

So, that’s the first part of the loss in revenue calculation. There were 142 coal blocks that were auctioned since June 2004, and CAG has used these to calculate the loss in notional revenue.

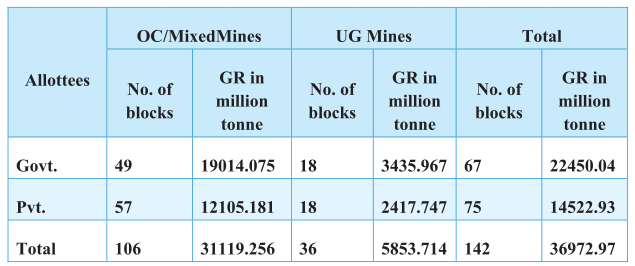

Here is a table from the report that shows the break – up of these coal blocks.

They have broken down the number of coal blocks into Opencast / Mixed Mines and Under Ground mines, and further they have broken it down to whether it was allocated to a private party or a government party.

For calculation of loss to the government, they have considered only the coal blocks allotted to the private parties so out of 142 coal blocks out of the 67 coal blocks get excluded there.

Further, the report says that underground mines are mostly loss making, so they have excluded underground mines from this calculation. That leaves 57 mines and within those 57 mines, only the Opencast part of the mines is considered in the CAG report.

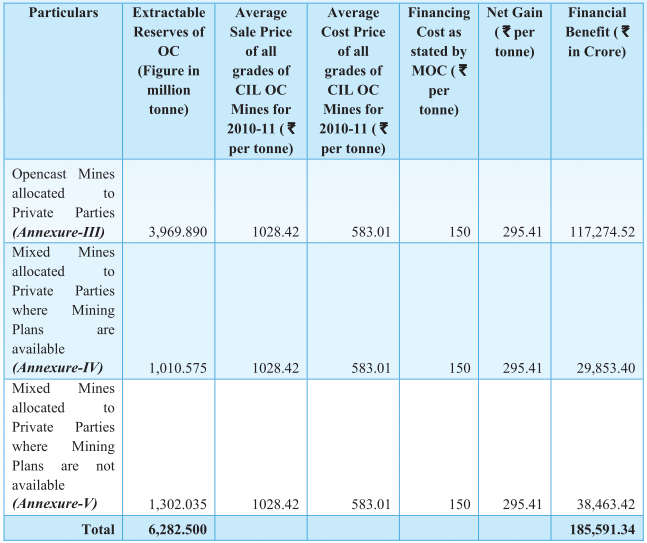

That leaves us with 57 coal blocks – and the next thing that the CAG has done is to see how much Geological Reserve each coal block contains based on the Mine Plan or other official sources.

It seems that the Mine Plan also has the Extractable Resource and wherever available, CAG has used that number, and when it was not available they have assumed that extractable reserves are 73% of geological reserve which they say is a conservative norm.

Based on this, they calculated the extractable reserves in each of these coal blocks.

Next question is cost, and they have used Coal India Limited and its subsidiaries’ average per ton cost of production for their open cast mines for all grades of coal for 2010 – 11 as the cost of production.

Next, they have added financing charge of Rs. 150 per ton on the cost, and this is from a number by the MOC.

So, you have the total reserves, and the cost. The last piece of the calculation is the sale price, and again, they took the average basis of all grades of coal produced in open cast mines of Coal India Limited for the year 2010 – 11 per their final cost sheet.

They have tabulated these results in the report as follows.

I learned more about this issue by reading these few pages of the CAG report along with the executive summary than I did reading most news reports and it gave me a good understanding of how the CAG has reported losses and you may or may not agree with their methodology, but you have to give them full marks for transparency.

Pasting this question here as relevant to this post:

“This is regarding your post on CAG,s Report on Coal India loss of Rs 1.86Lakh Crores.

The whole issue is very confusing to me. I shall be grateful if you can kindly clarify the following points.

1.What is this Coal allocation.I read that the allocation is made on the basis of requests from the respective state Govts.Is this allocation made one time basis or not?Is this a running contract?

What is the price at which Coal India sells to the respective companies? Obviously is not at market price.Who determines the price?

2.Why all this abstract presumptionous loss which CAG talking about?Instead why cant he calculate the actual loss for a given period for a given Company?”

Response:

1. Coal mining companies need access to coal mining blocks and this is done by the Ministry of Coal. This is an ongoing process and is done for different coal blocks at different times.

2. I think your confusion is between who incurs the loss. In this case, it is not a company that has incurred a loss. Since the government is auctioning the coal blocks, and the CAG says that the government is auctioning them at a price lower than what they could, it is the government that incurs the loss, not a company.

The CAG can’t give an actual number because there is no actual number, there are only notional numbers based on how much more they could have got from the companies bidding for the coal blocks.

I hope this provides some clarity to you.

No Sir, my confusion is not about who inccurrs loss. I know it is the Govt and not the company.I still do not understand the mechanics of Coal Block Allocation. I thought that baased on the recommendations of the State Govts the Ministry of Coal directs Coal India to supply coal to individual companies.If so in such directions will not the quantity and coal to be supplied be specified?If so are not the actual numbers available

This is about ore so coal blocks that contain ore that will be mined by companies to form coal. Coal India itself is not directly involved in most of the cases (except where they are partners).

Hi all

CAG report provided guidelines to government and people. Now government or people should think How to extract this from private players. That information also provided in the CAG report.

Think positively and do needful. Blaming the people will not provide right things to anybody.

Nice article that demytifies the CAG report. One thing that the CAG report does not mention in its table is at what cost has the government auctioned or given the mines to the pvt. companies ? From the table it looks like its zero. Is that even possible ?

From the recent revelation it seems like most of these companies havent actually mined any coal from these blocks. According to chidambaram all the coal is still present within “mother earth”. Its a laughable explaination. I think the real truth is that these companies are mining full swing but not declaring it as such to escape an taxation on profits. Needless to say in connivance with the govt. (state or center) which itself could be another major scandal.

///// There were 142 coal blocks that were auctioned since June 2004, and CAG has used these to calculate the loss in notional revenue./////

Actually , the wording used as ” auctioned ” has to be replaced with ” Allotted as per screening committe recommendation” . Because till now decision is not taken on auction method of coal allocation..

Good Article with relevant brief information.

Forgot to add one more point.

This Rs.1.86 lac crore is disputed by ruling party based on the contention that you cannot have same sale price for the entire duration of coal field. That is Rs.1 earned today cannot be the same as Rs.1 earned after 10 years. Similary sale price of Rs.1028.42 ( Average sale price ) cannot be same after 10-15 years depending upon the life of coal field. Hence, NPV calculation has to be used. Considering the inflation of 6 %, Rs.1 earned after 1 year would be Rs.0.94 ( 94 paise ) today. Similar calculation has to be used to arrive NPV figure of loss value.