As the government decides to sell stakes in PSUs in the coming months, you are going to see a slew of companies coming out with their stock offering and with the current economic environment, it is very easy to get carried away and invest a disproportionate amount of money in IPOs.

I’m already seeing the excitement around IPOs build up although the retail participation so far has been nothing compared to what we have seen in the past.

If you remember the MOIL IPO – the retail part of that was subscribed about 3o times over!Â

For most people, it is ridiculous to think about something that happened two years ago, and guess what? Most people continue to make the same mistakes over and over again.

Nothing about IPO investment has changed, and in the coming months, you will most likely see sentiment pick up and over-subscription levels reach ridiculous highs.

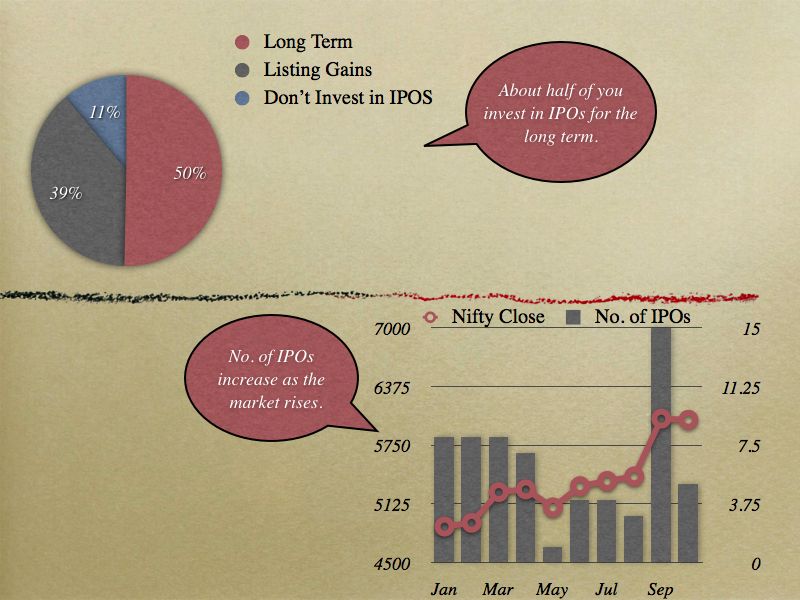

When that happens, consider this chart that I made over two years ago.

What this chart shows is that the number of IPOs rise when the market conditions improve, and that makes total sense when you think about it. Promoters are interested to extract maximum value out of their stakes and why would anyone who can wait sell their stakes when the markets aren’t doing well?

But at the same time, when the market goes down, all these stocks also go down with it, and that results losses on stocks you bought in IPOs and also much worse, stocks that you bought just after the IPO.

I took the MOIL example for this post because the company was doing and is doing quite well and the oversubscription was so high that people got allocated only a few shares, and then after listing bought more of it, and suffered losses on those too.

As the frenzy surrounds you in the next few months – Â be patient and at the very minimum avoid investing in any IPOs that have bad fundamentals.

As per recent guide lines of SEBI, the retail applicant who bid for minimum lot must be alloted. As chances of allotment is high even someone apply for few lots,so these days retail investors are not applying for maximum lot .As a result subscription in retail category is getting reduced considerably.moreover all the three IPOs came in the same time ,retail subscription is bound to be reduced.

In this regard sebi order No;-LAD-NRO/GN/212-13/18/5391 dtd12/10/12 may kindly be refered

Manshu- You’ve been able to hit the nail on the head

I’ve been closely observing the stock markets for more than 5 years now and all major IPO’s come when the markets are high. The Promoters prefer to extract the maximum from the public and launch it at that time only…

Reliance Power is a perfect example of the same… It never even touched the price at which it was issued and is currently trading at less than 1/3rd of its issue price…

I think Reliance is probably the one that people remember the most and for good reason, I feel that the IPO party came to an end after that.