The CSO released GDP growth estimates for 2012 – 13 today, and they estimate the growth for 2012 – 13 to be 5%. Â This is lower than any their own earlier estimates and also from RBI’s 5.8% which was released a few days ago.

There were several articles today that discussed whether these estimates are pessimistic or not and whether the actual growth could be higher. No one can really say whether growth will be 5% or higher but at this point the chances of being 4 point something are much much higher than the possibility of being 6 point something. And if you spoke about 8% which is the 12th plan target then you will be laughed out of the room.

This is quite unfortunate, mostly self inflicted and quite in contrast to the euphoria that existed a few years ago.

Does anyone remember the time when Sensex hit two upper circuits on the same day?

Here is an excerpt from an ET article from May 2009.

Markets have stopped trading for the day as the benchmarks hit another upper circuit Monday as soon as the trade resumed after 2 hour break. Investors are euphoric after the United Progressive Alliance emerged victorious in the 2009 general elections.

Bombay Stock Exchange’s Sensex was locked at 14272.62 up 2099.21 points or 17.24 per cent. National Stock Exchange’s Nifty was locked at 4308.05, up 636.40 points or 17.33 per cent. According to media reports turnover including cash and F&O was less than Rs 1000 crore.

High inflation and low economic growth is a very sorry state of affairs for all retail investors. The high inflation of the past few years has meant that the real rate of returns on fixed products have been negative, and the low stock market return has meant that even the damned nominal return has been negative!

There are three things that immediately come to mind when thinking about this.

1. Savings are the only thing in your control: You can’t control government policies and you can’t control the nature of inflation or the returns of the stock market, but you can control how much you save, and in this kind of environment saving more becomes very important. That’s the only thing you can control, and you can still build a big education fund, or retirement fund or accumulate wealth for any other purpose if you have disciplined savings.

2. Avoiding financial mistakes is in your control: If you lose money by punting penny stocks, trading heavily, pay a lot of money in credit card interest then these are mistakes that are committed by millions of people before you and you should be learning from their mistakes, and not repeating them.

To quote Eleanor Roosevelt

Learn from the mistakes of others. You can’t live long enough to make them all yourself.Â

3. Reality check: The quick run up in the market has made many forget how brutal downfalls can be but more importantly how some of the long standing problems facing the economy have not really been tackled. The Rupee is well over 50 to the USD, the deficit is very high, inflation is still quite high, and growth is low. While the market can certainly go up and down over a few years time, in order to have a long term upwards trend, the economy has to strengthen and the country has to resolve the economic issues it faces.

While this post may sound a tad too pessimistic, there are always things we can do to take control of our finances and be prepared for facing situations that await us.

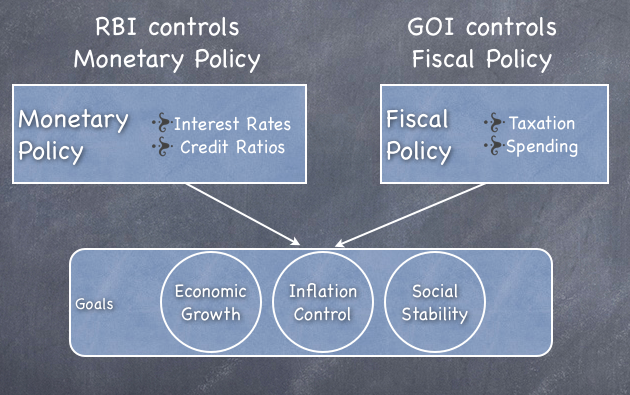

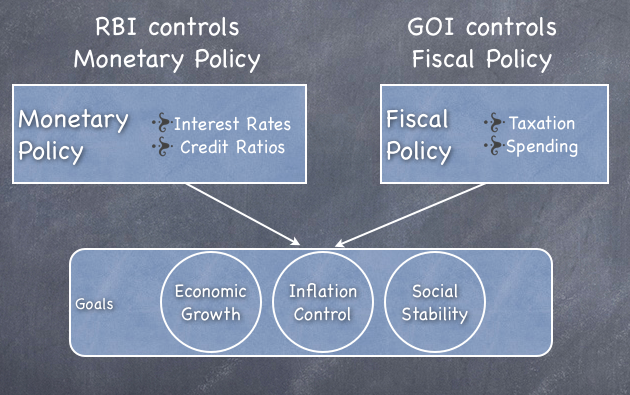

Interest rates and money supply are controlled by the ECB (European Central Bank) and they target inflation at 2% which is how the monetary policy is transmitted across all Eurozone countries.

But the fiscal policy is a bit harder to control because each country has its own budget and are free to tax and spend as they like. The Eurozone countries have an overall deficit target of bringing down their fiscal deficit to 3% of GDP, but because each country’s current fiscal situation varies so widely it is hard for all of them to bring down their deficit to 3% immediately, and so they have intermediate targets, but largely, they get missed too.

For example, in March last year Spain said that it wouldn’t be able to meet its target of a deficit of 4.4% of GDP and would be at somewhere around 5.8%. Spain had overshot its target in 2011 also, and I’m unable to find the final number for 2012.

The Eurozone countries all have quite varied fiscal positions, and this link shows the latest numbers for all countries that are part of the EU. You can see that this ranges from Sweden’s 0.2% surplus to Ireland’s 31.3% deficit!

Last year the EU countries also came up with a ‘golden rule’ which had certain conditions that each EU country that agrees to it will abide by like retaining the deficit under 0.5% if your debt is more than 60% of GDP, and under 1% if the your debt is less than 60% of your GDP.

There are a lot of other rules as well, and framing these rules and having these intergovernmental treaties is a way to synch up fiscal policies with monetary policy.

The last few years have shown that this has not been really successful and there is little reason to believe that things will change in the future. They do however are a good example of what needs to be done, and in a perfect world how it could be done.