Thoughts on Current Indian Equity Environment

Indian stocks have done terribly in the past few years, and the only people who are up on their equity investments are those who have invested in stocks heavily during market crashes, or the ones who added money to their SIPs during the crashes. Other than that everyone has had negative returns on their stocks.

The government and RBI announces one terrible policy after the other relentlessly, and the people pay the price for these by literally paying higher prices for everything they buy.

There is no indication that these terrible policies are going to change any time soon. No matter what coalition comes to power next year, there is simply no party that truly believes in liberalization, and economic reform.

What then should someone who invests in the stock market do?

Selling off shares in such a time is disastrous because they are already down a lot from where you would have bought it and you don’t want to sell them all at a loss. Buying more is increasingly difficult because of the painful feeling of watching your recent purchases go down 4 or 5 % in a week.

What then should give someone confidence to buy more shares or just stop from selling their existing holding?

The first thing that I remind myself during these times is that every time the market falls like this – you start feeling that this time the game is definitely over, and all hell will break lose now. The 2008 crisis always comes to mind because not only did it feel like Indian economy will reel for a long time, it felt like the whole world will be like that for a long time to come.

The second thing to remember is that it always feels like a lot worse than it actually is. In real time it is hard to be objective about what has been going around you. If at the beginning of the year – you would have asked me what I would say if the market were down 7% half way through the year – I would have probably laughed – what’s there to say? Come back if the market falls that much in one day. But that’s more or less where we are today but somehow it “feels” a lot worse than that.

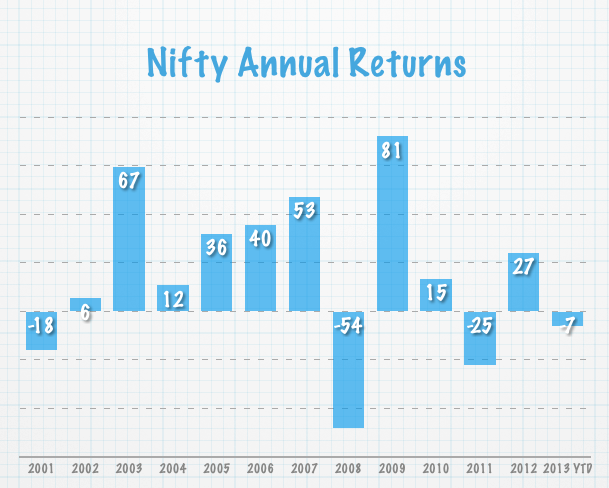

Take a look at the yearly returns for the past few years and 2013 till date yourself.

For me, the main takeaway from the chart above is the need to remain invested in the market. I’ve heard several people say that they will start investing when the market situation improves, and they want to wait for the bottom to hit or the uncertainty to subside, but guess what – you will never know when the bottom was hit, and there will always be uncertainty around you. It just doesn’t work that way.

As long as you are diversified – you don’t have all your eggs in the equity basket, and you’re in it for the long haul you should be able to go through these tough times and then book profits when the going is good.

Good post Manshu in these difficult times ! It serves as a moral booster 🙂

Thanks

Amit

I hope two or three years down the line we can look back at this and be grateful that we didn’t sell everything we had.

Manshu if I wasnt reading your blog I would have by now sold all equity and MF by now 🙂

That’s good to hear Harinee and I hope that you are rewarded for your patience by the market. How has your journey been so far? When did you start investing, and if you look at the mutual fund and share holdings – has the time spent in researching etc. been worthwhile for you?

I am very new so really havent seen any growth as last 3 years has been a awful market. Yet to see anything worthwhile but yes I am more systematic with MFs now and stick with it even its all red.Also I am more conscious of my cash flow than before. Hopefully will get rewarded someday 🙂

Yeah last three years have been bad and if you have just started then perhaps you weren’t able to take advantage of the crashes. I hope you reap rewards of your patience in the future.

I think current times are a big blow to mutual fund industry, both equity and debt. Far from being considered safe investments, debt funds have also become more volatile now.

You’re definitely right. A lot of people will simply give up on debt and equity mutual funds because the volatility is just killing whatever motivation people had to stick around and hope for a better market.

I personally do not invest in stock market at all as I am very bearish about the whole world economy.

For someone with a long term horizon, is it a good time to get into long-term debt mutual funds now? How about FMPs? I have seen 2 5-year FMPs released in August.