I am sure a lot of you have come across this article that presents a number of charts presenting the USD-INR rate in a time period before the general elections and shows how the Rupee has depreciated every time there has been an impending election.

I came across this article on Saturday, and didn’t think much of it which shows how poor a blogger I am, not because of the substance of the article but because I completely missed its potential to go viral.

I have the following reservations about the claim:

1. How does Congress influence the exchange rate? How do they actually make the Rupee depreciate per their will? Why don’t they just reverse the trend once the election is over? Don’t they have to hoard money the next time there is an election, why don’t they reverse the trend during non election periods?

2. If Rupee was being brought into the country, the price of the Rupee would appreciate, not depreciate.

3. UPA has taken a series of very unpopular steps to try to rein in the Rupee fall, and in the current case, the fall of the Rupee has angered a lot of people who are already quite frustrated with the efforts of the government is every direction. How does the ruling party decide that the 20% extra cash is worth the pain it causes to the populace (in terms of lost votes) and the fodder it gives to the Opposition to exploit this depreciation?

4. Speaking of Opposition, how is it that only Congress is able to benefit from this depreciation, and not the BJP?

5. How much of an outlier is a 15% fall?

In one of the comments, the authors have explained point number 2 by saying that politicians deposit USD in Swiss accounts of businessmen and then those businessmen transfer money in INR in India itself so that takes care of the Rupee not appreciating. If this were happening then yes, I think this is certainly a way that they could overcome the problem of Rupee appreciating when it is send back to India, but I find it hard to believe this is actually happening.

The other points speak for themselves except for 5.

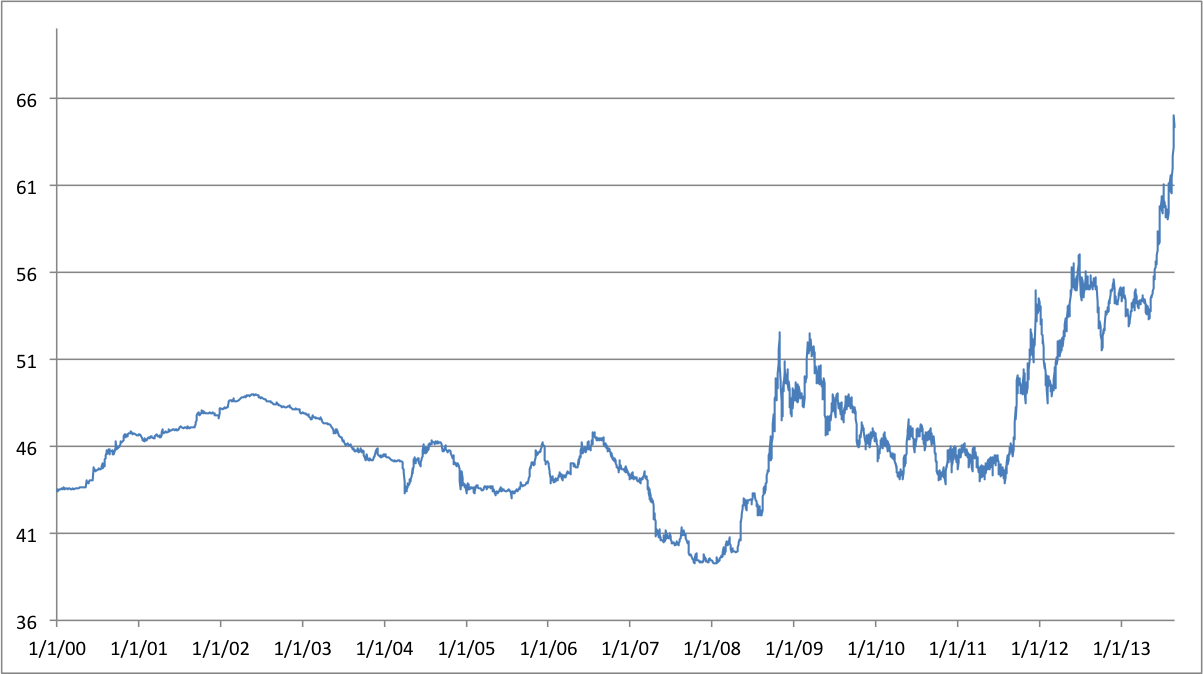

I dug up some exchange rate data since the year 2000, and with some simple Excel work – found out how many times has the Rupee depreciated more than 15% in a 12 month period since the beginning of 2000. Now if you were to just look at months, then there would be just many many months after 2008, but I tried to lump together the data so that when I started with September 2013, the month before that was at least 6 months earlier. Here are the results of that.

| Month and Year | Rupee Fall |

| September 2013 | 16% |

| September 2012 | 21% |

| January 2012 | 20% |

| May 2009 | 23% |

| December 2008 | 24% |

After 2008, these falls in a 12 month period have been much more frequent than before 2008. The data in the Havala post is different because at times their range is less than 15%, and at other times their period is more than 12 months. I increased the time frame on my datas-set to 18 months to see what would happen and even those numbers are similar. Prior to 2008, not many big moves, and after 2008, quite a few moves.

Here is a chart on how the Rupee has moved against USD from the beginning of 2000.

This chart also shows that the Rupee has been quite volatile post 2008 but prior to that moved in a narrow range. That’s the only conclusion I can draw from this movement, linking it to Congress bringing back black money during election times makes for a good conspiracy theory, but I simply don’t see how this can be actually carried out.

This is a post from the Suggest a Topic page.

@Anshuman

In that case , we should see a decline in land prices.

I think we are going to see decline in land price in the next few years! Not because politicians selling land, but nobody wanting them as growth will be less! Several industries are slowing down expansion plans or have shelved many(Eg Maruti Gujrat plant)! So more land at cheap rate! Fingers crossed!

I happen to hear a completely reverse logic to what is being discussed here.. There is large amount of money which is invested in land banks by various corrupt politicians and associated business house. Since there is uncertainty of the current government to come back to power during elections hence the they start pulling out their invested money and send it abroad for safe keeping till the situation stabilizes.

Any thoughts?

Unfortunately we Indians connect every incident to politics or Mr Modi::::

If congressmen have such divine powers thro which they can control foreign exchange rates

let us all vote for Congress::::

1. By taking data from 2000, this article ignores the fact that the rupee was indeed far less volatile in non election time, while during election time it did depreciate from 12% to 20%.

2. Hawala link article (on newslaundry.com) did not say that the rupee can not depreciate during non-election time, rupee is free to fall due to economic reasons (high inflation, low investor confidence on Govt policies etc). However, just coincidence that it highly depreciated in the period (0.5-1.5 yrs) before election raises some doubts.

3. Regarding depreciated rupee bringing 20% extra cash VS lost votes, lets try to assess how many people in India understand the USD-INR dynamics and its impact on the economy. 5%, 10% or at max 25%. Its safe to assume that who understand this dynamics are habitual of sitting in AC rooms and watching polling trends on TV than standing in queues to actually vote on the polling day. Am I wrong? So as per me, people who understand economics so much never mattered for Cong (remember their vote bank).

4. Yes, BJP could not or did not gain from depreciated Rupee as a) they did not have so many funds in foreign currency (they ruled only for 6 yrs against 50 yrs rule of Cong and they are yet to master the art of corruption); b) the confidence of investors and people (who understood economics was high as they always thought NDA will get re-elected…but again they did not vote while Cong supporters did.

Notwithstanding above counter arguments, I appreciate that you put the effort to prove that Hawala article was not completely logical.

Your assesment has raised very valid points on an over-generalised view of politicians manipulating rupee for election funding. The businessman will keep depleting his domestic cash if he transfers funds to politican’s accounts. (anyway he needs separate cash to feed the politicians as bribes).