Before the financial crisis in 2008, emerging markets were very popular in the US and other developed countries, and people there wanted to take advantage of the relatively faster growth in emerging nations.

The word ‘decoupling‘ was used quite often and it was believed that the emerging markets no longer depended on the US for their growth, and the situation in the US wasn’t going to affect the markets of these countries substantially.

The financial crisis saw markets tumbling worldwide and people no longer expected emerging markets to remain isolated from the developed ones, and held that the global economy is intertwined and one can’t grow in isolation from the rest of the world.

The last few years however have seen a completely different phenomenon and one that at least I haven’t read about anywhere in advance. The US has outperformed the emerging markets, and the weakening currency of most of these countries has meant that it was far better for someone from India to invest in US in INR than it was for someone in the US to invest in India in USD.

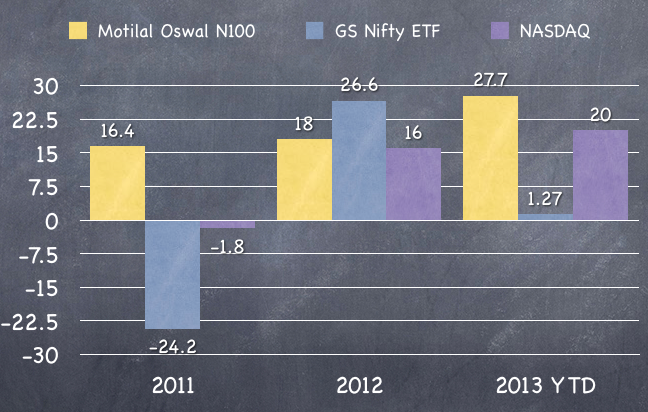

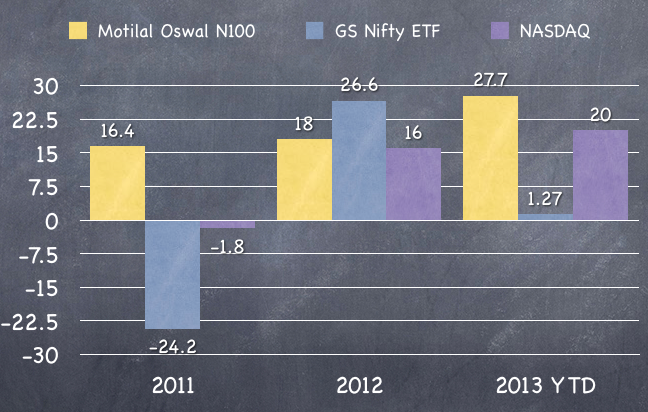

The chart above shows how you would have fared owning something like a Motilal NASDAQ ETF versus a GS Nifty ETS and I’ve also included figures from NASDAQ to show the depreciating Rupee has juiced up the returns.

The main shift in my thinking in the past six months or so has been that Indians need to protect themselves from the falling Rupee and real estate and gold is not the only way to do that. You can own US based funds in your portfolio and find another hedge for the Rupee and also benefit from the rising American markets.

Is this realization too late and is this the right time to buy American stocks? I think yes, the realization is late.

As far as timing is concerned it would have been ideal to predict this trend 1 or 2 years ago, and if you go US heavy right now you’re exposing yourself to the risk of buying into an asset that is going at all time highs and catching up with the trend.

As a long term strategy I feel that just as a few years ago Americans were looking to emerging markets to juice up their returns, Indians now need to look to US for stability and protection of their capital, but this has to be done in a slow and deliberate manner, not as a knee jerk reaction to what has happened in the last 3 or 4 years or so.

Apart from the rupee depreciation factor, I think geo-politically US is on a stronger wicket now than it was in 2008. The record Shale gas production plus reducing their involvement in two costly wars are two big advantages for the US economy in the next 7-8 years. Their soon-to-be-independence from Middle east oil will be a game changer. Already a lot of manufacturing jobs are shifting back to the US and this trend will only accelerate. Only an (highly unlikely) war with Iran may prove a speed-breaker.

That’s a good comparison. I remember, when ICICI US Bluechip fund was launched, you did a post, and we (including me) were worried about 2 risks: 1) US economy being down and lack of growth prospects in such a mature market and 2) Rupee appreciation. But, both these 2 were proven wrong. I think, one good point is that the large US companies are global leaders so there is enough diversification (across countries too) and strong competitive position which reduces the risks. Two thoughts

1. I just wondered, if we plot the dollar returns for a US based fund investing in Indian markets, the graph will just be a mirror image downwards for obvious reasons (depreciating rupee)!!!

2. Manshu don’t you think Sensex at 20,000 is still richly valued (in rupee terms); earlier we used to see a correlation between market and exchange rate movements, but I Feel its no longer the case. If you look at past, 20-21k levels in sensex were at higher rupee levels, but now rupee is down, but market isn’t overall. Do you think market is still not fully factoring in all the bad news because of currency (i would say steep forex losses for all major companies in Q1) and other difficult macro factors?

Yeah I think it would be an inverse, haven’t done it but that’s how I would expect it to be too.

See I am very pessimistic about the Indian markets with all these policies that kill growth and further worsen the deficit but I also know that it is when you feel the gloomiest is the time to invest and set yourself up for the future. More than the forex correlation I am worried that the current trajectory is simply unsustainable and there is no political alternative. The UPA might come into power again, and we see more of these policies that has absolutely stalled growth in the last four or five years.

I think it is still not time to give up hope completely on India stocks, but we are edging close to that point. Far days from the upper circuit that was hit when UPA came to the government a second time huh?

Even after such poor political position, if the market is still at 20k, it shows its overvalued or upside potential has run out.

Soon our finance minister will make an appeal to not buy gold and not buy US equity. 🙂 Because both the assets decrease our foreign reserves.

But it makes sense to buy US equity instead of gold because of cash flows given by US equity.

Sanjay – do you own any of these funds? I am curious to know if they have paid out dividends and if so – at what rate?

I think still it is a good choice (NASDAQ100) to invest.

There are two factors – Rupee depreciation & grwoth prospects of companies in NASDAQ100.

Many of these companies are technology majors, growth engines, pioneers, always ahead of the competition.

There is limited downside due less probability of both the two factors going wrong at the same time in my opinion.

My experience is that when you are at such a stage that you feel that the probability of something going down is low or the reverse when the market is so pessimistic that it feels like there is no way the market can go up – the market surprises you. Right now, it seems like such a good idea to buy US equities in INR and that’s precisely why I am skeptical about it.

Yes that’s a good idea. I think there are just 3 or 4 funds that allow exposure like this. I’m going to make a list of them this week.

Manshu,

Thanks a lot for this article.

I am definately looking forward to this list.

Thanks,

Amit

Thanks Amit – I think there might be just 3 mutual funds or ETFs allowing this and not the 4 that I originally thought – in either case, this is going to be a short list. Unfortunately there is no index fund that allows you to buy just the S&P 500 index – that would’ve been good.

Manshu,

How would you recommend the average retail investor to do this? Why not get exposure to US/international stocks via funds like PPFAS or Templeton India Equity Income so that tax is not an issue? This will also ensuzre the exposure is gradual.

The average retail investor can also open dollar investing accounts with many online US-based brokerages.