Will 2014 be good for the markets?

As is customary, the new year brings forth several articles about whether the market will be up or down this new year, and what investors should do in the coming year.

I have been reading several articles about the markets and the answer to this question seems to be a qualified yes in the minds of most experts. If the election brings back a Congress led government or a weak coalition then that will probably be bad for the markets but outside of that everyone seems to think that the markets will do well this year.

I would have been surprised to read a different answer to the question simply because of how the past couple of years have been.

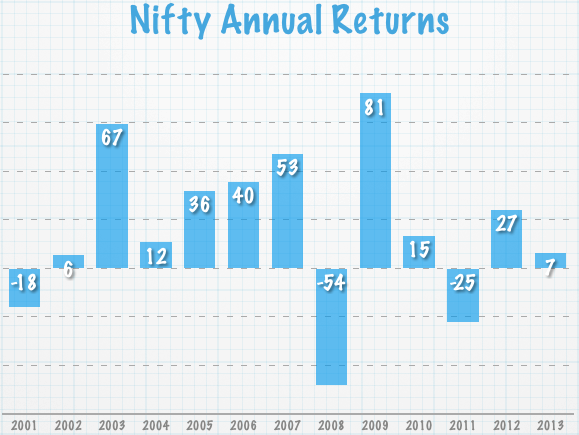

Here’s a chart that shows Nifty annual returns in the past few years.

The future is never more of the past

The chart above shows that things have been going okay for the last couple of years, and generally such an environment lulls you into thinking that more of the past will continue going forward in the future. I know for a fact that the general consensus was really gloomy when the market fell by 54% and absolutely no one expected that 2009 would be a +81% year.

In the short run, there is just no way to predict what the market will do. That is specially true of a year such as this where you have elections whose outcome is very uncertain.

If you are relying on short term market predictions to make your strategy then you aren’t going to be very successful in investing and you are better off sticking with fixed income investments.

What you need is a strategy that doesn’t require you to predict how the market will behave in this year or the next. If you are invested in the market then you do expect the market to be higher than where it is today in 5 or 10 years time but what happens in the short run shouldn’t make much difference to you.

What does such a strategy look like?

My own strategy is one of investing heavily when there is panic or the market crashes badly, and investing moderately and building up cash reserves at other times, and that doesn’t require you to predict the market; just be in a position to react to how the market moves.

As part of this strategy what I plan to do in the recent future is to be invested about 60% in the market and 40% in cash. Right now this equation is 75% in the market, and 25% in cash, and that ratio will change as I sell some of my better performing stocks, and also add more to my reserve. It is important for me to mention here that all of my investments are currently in the US, with about 20% of my equity invested in the India ETF – INDY.

How can you adapt this strategy?

The point of this post is to see if this strategy appeals to you, and if so, how you can adapt this strategy to work for you. I think the easiest and most practical way to do that is to invest below your comfort level of equity investment. For example, if you’re comfortable with investing Rs. 20,000 per month in equities, invest just Rs. 10,000 and put the rest in a debt fund which you can access at the time of a crash, and invest heavily in the market at that time.

Why not just keep everything in a debt fund and invest at the time of a crash? Well, because you don’t know when the crash is going to come, one year from today, two years from today, or five years from today, and how much the market will grow in the interim, so you don’t want to miss out on the gains that accrue in the interim.

In conclusion, as part of your investing journey you should try to develop a system for yourself that you can adhere to regardless of market conditions, and specially one that doesn’t require you to predict (guess?) where the market will be in ten months or twelve months from now.

Is it better to keep cash reserves in bank FD than Debt funds? When market crashes, the Debt funds will crash too ?

Good point raised by Ketki.

I would also like to know how is debt market and money market Funds affected during equity market crash?

Secondly is it wise to keep most of the money in Debt funds or FDs ?or in other words are Debt funds/Money market funds as safe as an FD?

Thanks

No debt funds shouldn’t crash the way equity funds do, a mix of debt funds, FDs and tax free bonds is a good idea to get exposure to debt.

Manshu,

Nice Article, same strategy I am using for mutual fund Investment.

Liquid Fund is the best option. Liquid fund is Mutual Fund Fixed Deposit Scheme.

Check below two schemes graph No single rupee fall since inception.

Reliance Money Manager Fund

Birla Cash Manager Fund

pl. tell me which one is safer & give better returns-

Reliance Money Manager Fund

Birla Cash Manager Fund

is this correct name Birla Sun Life Cash Manager ?

Dear Mr Shiv.

which place can we buy – India ETF – INDY ?

Thanks

Rohit

This is an instrument that investors based in the US use to get exposure to India. If you are in India already, you can’t buy this nor do you need to buy this.

Manshu,

Pls. guide the procedure on how an Indian can directly invest in US stock market. How to open demat, brokerage account, any legal constraints etc.

Mr Satish , thanks for very Important question … need answer from boarders & Mr Shiv regarding the same … we miss a LOTS of opportunity as we dont know the same.

Can you post an article on silver as an investment in 2014, both physical and ETF?

yes very interesting subject silver & gold for 2014 as per

http://www.kingworldnews.com the prices should EXPLODE Upwards !

pl. give your views Mr Shiv , any boarders who got some idea…

Good Informaion,Thanks a lot for sharing this useful information.