IFCI Limited 10% NCDs – October 2014 Issue

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

IFCI Limited, in which the Government of India owns 55.53% stake, is coming out with an issue of secured redeemable non-convertible debentures (NCDs) from October 20th i.e. the coming Monday. IFCI plans to raise Rs. 250 crore in this issue with an option to retain oversubscription to the tune of Rs. 2,000 crore.

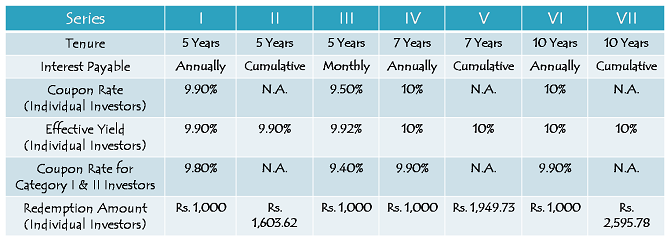

IFCI has decided to issue these NCDs for a period of 5 years, 7 years and 10 years and it is going to offer interest rate of 9.90% per annum for 5 years and 10% per annum for 7 and 10 years. The only exception is the 5-year monthly interest option, in which the coupon rate has been fixed as 9.50%. There is no monthly interest payment option with 7-year and 10-year investment periods.

Though the issue is scheduled to remain open for just over a month to close on November 21, I expect the issue to receive a good response from all categories of investors and get closed this month itself.

Categories of Investors & Allocation Ratio – The investors would be classified in the following three categories and each category will have the following percentage fixed during the allotment process:

Category I – Institutional Investors – 20% of the issue size is reserved

Category II – Domestic Corporates – 20% of the issue size is reserved

Category III – High Networth Individuals including HUFs – 20% of the issue size is reserved

Category IV – Retail Individual Investors including HUFs – 40% of the issue size is reserved

Allotment will be made on a first-come first-served (FCFS) basis.

Coupon Rates for Category I & II Investors – As shown in the table above, IFCI has kept the differential between the coupon rates offered to the individual investors and non-individual investors as 0.10% only. Though such an insignificant difference leaves me surprised somewhat, I think this move would make these NCDs quite attractive to the non-individual investors and one can expect a relatively quicker subscription in these categories.

NRI Investment Not Allowed – Foreign investors, including foreign nationals and non-resident Indians (NRIs), are not allowed to invest in this issue.

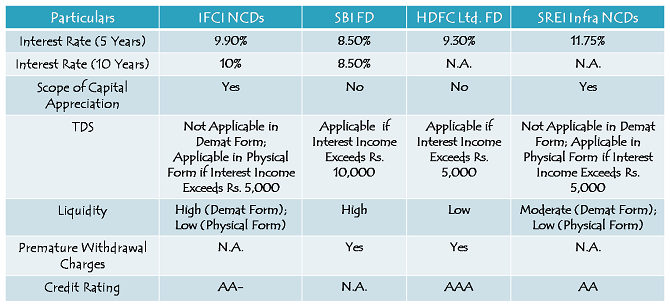

Credit Rating & Nature of NCDs – While Brickwork Ratings has assigned a credit rating of ‘AA-’ to the issue with a ‘Stable’ outlook, ICRA has given it a credit rating of ‘A’ again with a ‘Stable’ outlook. Moreover, these NCDs are ‘Secured’ in nature and in case of any default in payment, the investors will have the right to claim their money against certain receivables of IFCI.

Minimum Investment – These NCDs carry a face value of Rs. 1,000 and one needs to apply for a minimum of 10 NCDs, thus making Rs. 10,000 as the minimum investment to be made.

Maximum Investment – Anticipating a good demand from the retail investors, IFCI has kept Rs. 2 lakhs as the maximum amount one can invest in the retail investors category. Individuals investing more than Rs. 2 lakhs will be categorised as high networth individuals and there is no such cap on the investment amount for such investors.

Allotment in Demat/Physical Form – Investors will have the option to get these NCDs allotted either in demat form or physical form as per their choice, except for Series III NCDs. As Series III NCDs pay interest on a monthly basis, IFCI will allot these NCDs compulsorily in demat form.

Listing – These NCDs will get listed on both the stock exchanges, Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), within 12 working days from the closing date of the issue.

Taxation & TDS – Interest earned on these NCDs will be taxable as per the tax slab of the investor and tax will be deducted at source if NCDs are taken in physical form and the interest amount exceeds Rs. 5,000 in any of the financial years. However, there will be no TDS on NCDs taken in a demat form.

Moreover, if these NCDs are sold after holding for more than 12 months, the investor is liable to pay long term capital gain (LTCG) tax at a flat rate of 10%. However, if sold prior to the completion of 12 months, short term capital gain (STCG) tax is applicable at the slab rate of the investor.

Interest Payment Date – IFCI has not fixed any date in advance for the purpose of its annual interest payment and that is why its first due interest will be paid exactly one year after the deemed date of allotment.

For monthly interest option as well, first interest payment will be made exactly one month from the deemed date of allotment and subsequently on the same date every month, subject to bank holidays.

Interest on Application Money & Refund – IFCI will pay interest to the successful allottees on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment, at the applicable coupon rates. However, unsuccessful allottees will be paid interest @ 4% per annum on their money liable to be refunded.

Premature Withdrawal & Put/Call Option – Neither IFCI has the call option to redeem these NCDs nor will the investors have the put option to liquidate their investments. Once allotted, IFCI will not entertain any request for redemption of these NCDs. Investors will have to have a demat account in order to sell these NCDs on the stock exchanges.

IFCI NCDs vs. SBI & HDFC FDs vs. SREI Infra NCDs

Should you subscribe to IFCI NCDs?

With CPI as well as WPI inflation falling sharply, Brent crude prices declining from $114 per barrel to $84-85 per barrel, commodity prices also correcting substantially and 10-year Indian G-Sec yield falling from 9%+ to 8.39%, I think the interest rates should still head lower going forward. In the present macroeconomic scenario, it makes sense to subscribe to these NCDs. Long term investors in the 30% tax bracket will do well to invest either in debt mutual funds or explore tax-free bonds from the secondary markets.

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in IFCI NCDs, you can contact me at +919811797407

Once again thanks for this excellent indepth analysis Shiv..just 1 question considering the ratings of the company, don’t you think interest rates are low comparing to similar rated companies? Or Is it because it’s govt owned company hence the low rates? Thanks

Thanks Ikjot !!

Had it been a private company, I would have avoided this issue and considered the rates to be low. But, as you mentioned, IFCI being a government owned & controlled company, I think the rates are fine for me to consider this issue.

Though factors like financial condition & management efficiency of the company do not provide much confidence for me to invest in its equity, but I don’t mind investing in IFCI’s debt. I am hopeful that the Modi government would do one thing or the other to change the fortunes of the company in the coming months and years. Still I think the rates should have been at least 0.25% higher to make it more attractive for the retail investors. Let’s see how it goes.

Thank you so much for the info, Shiv.

You have mentioned no tax deduction if held in demat form but I have had a look at issue prospectus and it says tax will be deducted at source (even on NCD held in demat form) if interest is more than 5000 a year. Can you please clarify this.

Regards

Hi Ravi,

Sorry for this delayed moderation of your comment. I have taken the following text from the prospectus, please check – “However, no income tax is deductible at source in respect of the following: (b) On any security issued by a company in a dematerialized form and is listed on recognized stock exchange in India in accordance with the Securities Contracts (Regulation) Act, 1956 and the rules made there under.”

I hope it helps!

Thanks Shiv and hope you continue the good work.

Regards

Thanks !! 🙂

Dear Shiv,

From rating point of view, it seems, SREI infra is safer to invest than IFCI. Is it so ?

Thanks

TCB

Dear TCB,

Rating agencies have their own methodology as far as assigning credit rating is concerned. Simply put, we cannot strictly compare credit rating assigned to a government company with that of a private company. So, being a government company, IFCI is relatively safer to invest with than SREI.

Hi Shiv,

Generally the articles on this blog are quite informative and so is the case with this one.

Apart from agreeing with you on the fact that interest rates are NOT so lucrative considering its credit rating, I think one should NOT completely ignore the possibility of a stake sale by GoI in IFCI to private enterprises.

I guess in the past as well, GoI tried selling its stake in IFCI to private enterprises but the deal has fallen apart on valuation related aspects. Govt does not seem very keen on holding the majority stake in IFCI.

Therefore, IFCI which is now a Gol entity may NOT be so around 10 years down the line when these NCDs mature.

Thanks,

Jalpesh Patel

Hi Jalpesh,

I agree with your views to an extent, but as per IFCI’s CEO & MD, the government is trying to increase its overall stake in IFCI rather than decreasing it.

http://articles.economictimes.indiatimes.com/2014-10-17/news/55148361_1_preferential-shares-preference-shares-up-stake

Moreover, I wish the government decides to sell its controlling stake in IFCI. I think it would make IFCI’s management more investor friendly and really unlock the potential value of IFCI. At the same time, there is a risk if the government sells its stake in IFCI to a company with a weak management again.

Still, all these are just unknown factors as yet, so I would consider IFCI to be a government controlled company while investing in these NCDs.

Thanks Shiv, for this link to the latest news on IFCI.

Like all other investors, I also hope IFCI either remains with Govt or goes to only better managed private enterprises.

Just a slightly offtrack query which I have, but I would post it here as it is on NCDs:

Going by the generic trend on NCD’s subscription, I often find that the issues from Mumbai based companies like India Infoline / Edleweiss oversubcribe in a day or two. But NCD issues from equally strong (may be stronger) corporate group like Shriram transport does not fare that well in terms of day 1 or day 2 subscription figures.

Do you think that presence of Mumbai based comapanies in financial distribution & broking business could be one of the reasons for the stupendous overscription of their NCDs as they cross sell their products very well?

Would appreciate your view here.

Thanks,

Jalpesh Patel

🙂 I think it has nothing to do with the origin of the company, its just that IIFL, Edelweiss etc. normally offer higher rate of interest as compared to Shriram Transport. Also, these broking companies know how to attract retail investors or institutional investors. These companies offer features which naturally attract investors, like providing monthly interest payment option or offering higher rate of interest to their shareholders. Also, with their big sales teams around, these companies know how to market/sell their own issues.

Day 1 (October 20th) Subscription Figures:

Category I – Rs. 20.75 crore as against Rs. 400 crore reserved

Category II – Rs. 50.69 crore as against Rs. 400 crore reserved

Category III – Rs. 5.74 crore as against Rs. 400 crore reserved

Category IV – Rs. 7.09 crore as against Rs. 800 crore reserved

Total Subscription – Rs. 84.26 crore as against total issue size of Rs. 2,000 crore

Contrary to my expectations, its a very poor response on Day 1. Let’s see how it goes going forward !!

Hi Shiv,

Can we have today’s subscription figures please….thanks

Hi Shiv,

For 10% tax bracket people, which option is best?

Day 2 (October 21st) Subscription Figures:

Category I – Rs. 30.15 crore as against Rs. 400 crore reserved

Category II – Rs. 81.77 crore as against Rs. 400 crore reserved

Category III – Rs. 10.45 crore as against Rs. 400 crore reserved

Category IV – Rs. 15.13 crore as against Rs. 800 crore reserved

Total Subscription – Rs. 137.51 crore as against total issue size of Rs. 2,000 crore

dear mr shiv.

the poor Subscription figure as above .. does it mean deep discounted rates after listing ? I invested 6 lacs (3 application) so was worried .

Hi Rohit,

If I talk about the smart money, at least that is flowing in here. Plz check the subscription figures of SREI Infra NCD issue. Category I & II are not putting money in that issue, which indicates there will not be any premium on listing there. I am not sure whether there will be any listing gains with this issue or not, but this NCD issue is definitely better than the SREI Infra issue and in the long run, these rates are good, offered by a PSU.

will there be more such issues by PSU. There wont be any tax free bonds this year I guess.

Hi Pradeep,

Yes, you are right, there will not be any tax free bond issue this financial year, at least. Also, very few PSUs launch such public issues. SBI launched its last public issue in February 2011. Moreover, I have no idea whether any other PSU is planning to launch its issue in the next few months. IFCI might come with one more such issue if it is not able to raise all Rs. 2,000 crore in this issue.

Thanks for your guidance .. Early this year i invested in Tax free

bonds on your guidance with now trade approx 20 % over issue price ..

there were no takers that time now huge buy at 20 % higher rate ..

i guess same case with these ifci ncd by next 6months – 1 year ..

Wish you Mr Shiv & everybody on board very happy Diwali ………

If not the same case, I wish these NCDs also give reasonably good returns, say 15-17% in the next one year or so. If that happens, then I would call it a good investment decision. I hope it materializes.

I too wish you and your family a very Happy Diwali !! 🙂

Hi Shiv,

what does foreign national for this investment mean ? A dual citizen holding OCI (overseas citizen of india) but voting rights only in the foreign country..Is he or she a foreign national ?

Happy Diwali to you !!

A resident of india for tax purposes also.filling resident taxes in india…but OCI holder and citizen of foreign country with voting rights in foreign (USA)..is he/she a foreign national ?

Hi Ketki, thank you for the wishes & you too have a blasting Diwali !!

No foreign investor, including OCIs, NRIs, citizens of foreign country can invest in this issue. None of them will be considered Indian resident for the purpose of investment in this issue.

Hi Shiv,

I think this IFCI NCDs are offering 10% annualized interest rate. The compounding frequency in case of cumulative option is once a year like any other NCD.

For Senior Citizens, it fares poorly when compared with interest rates offered on 5 year FD schemes by NHB & LIC HF.

i. 9.6% Quarterly compounding NHB FD provides an annualized return of 9.95%

ii. 9.85% Half yearly compounding LIC HF FD provides an annualized return of 10.09%.

Though these FDs are not backed by any assets and hence an unsecured debt, I derive comfort from the facts that one is a Govt owned GAINT (LIC) and another one is also a regulator (home finance).

However, if some one wants to lock in his/her money for longer tenures 7-10 years then IFCI option can still be considered.

5 Year IFCI option does not leave anything on the table 🙁 apart from the fact that it is more liquid than FDs of NHB / LIC HF.

Thanks,

Jalpesh Patel

Hi Jalpesh,

I favour NCDs/tax-free bonds primarily bcoz there is a scope of capital appreciation. Today, India is a growing economy with high inflation & high interest rates. Sometime in future, I think India should have lower interest rates due to lower inflation, higher growth & relatively less volatile economic growth. At that time, one can exit these investments with a high capital gain. However, your points are perfectly valid. I would also prefer NHB & LIC Housing Finance over IFCI for any fixed income investment.

Yes Shiv,

Agree, considering your point on Capital appreciation, I think one can get a favourable tax treatment for NCDs under LT capital gains tax which is applied on profits after indexation. What is the timeframe for which one has to hold to get indexation benefits under LT capital gains tax as per latest budget?

I will now invest a small amount into these NCDs 🙂

Thanks,

Jalpesh Patel

It is more than one year of holding period for a listed NCD/bond to acquire long term capital asset status.

Thanks for the write-up

You are welcome!

Good Post by Shiv. But considering the rating, the coupon rates are on lower side. There are public sector banks still offering 9% PA (Yield of 9.3%). Considering that the liquidity will not be that good for these NCDs, unlike Tax Free bonds which is giving a good return in terms of premium, these NCDs will not be very attractive in secondary market. One need to look at all options before putting their money.

Thanks George for your inputs!

I think these NCDs are still better than bank FDs as there will be enough liquidity for a retail investor to exit his/her investment. Also, I think these NCDs should start trading at a premium either on listing or within a few days after listing.

sir pl. give subscription figures

after Day 2 ..

Day 3 (October 22nd) Subscription Figures:

Category I – Rs. 30.24 crore as against Rs. 400 crore reserved

Category II – Rs. 116.77 crore as against Rs. 400 crore reserved

Category III – Rs. 13.25 crore as against Rs. 400 crore reserved

Category IV – Rs. 20.13 crore as against Rs. 800 crore reserved

Total Subscription – Rs. 180.39 crore as against total issue size of Rs. 2,000 crore

Very disappointing numbers, apparently retail investors not interested in this issue…

Day 4 (October 27th) Subscription Figures:

Category I – Rs. 34.49 crore as against Rs. 400 crore reserved

Category II – Rs. 121.77 crore as against Rs. 400 crore reserved

Category III – Rs. 18.66 crore as against Rs. 400 crore reserved

Category IV – Rs. 27.86 crore as against Rs. 800 crore reserved

Total Subscription – Rs. 202.78 crore as against total issue size of Rs. 2,000 crore

Yes ifci ncd 2014 good investment. I am giving 1.20 % commission on total investment. Mb no 9462659179.

I want to invest in a NCD for 5 Years..currently there are 2 issues in offering…SREI and IFCI,..on interest rate front SREI takes it all; also that the credit ratings are at par for both these issues..

But still Want to know shud it be IFCI or SREI???

It is PSU v/s PRivate ????

Thanks Shiv..Information helped me

You are welcome!

sir pl. give subscription figures

after Day 4 ..

Day 7 (October 30th) Subscription Figures:

Category I – Rs. 74.38 crore as against Rs. 400 crore reserved

Category II – Rs. 131.98 crore as against Rs. 400 crore reserved

Category III – Rs. 26.97 crore as against Rs. 400 crore reserved

Category IV – Rs. 42.19 crore as against Rs. 800 crore reserved

Total Subscription – Rs. 275.53 crore as against total issue size of Rs. 2,000 crore

Whether a Educational Charitable Trust can invest their funds in the 12% NCD?

Which 12% NCD you are talking about Avadhoot?

nice info…got to learn about new numbers of oct 2014….

Day 12 (November 10th) Subscription Figures:

Category I – Rs. 114.84 crore as against Rs. 400 crore reserved

Category II – Rs. 165.45 crore as against Rs. 400 crore reserved

Category III – Rs. 60.12 crore as against Rs. 400 crore reserved

Category IV – Rs. 70.01 crore as against Rs. 800 crore reserved

Total Subscription – Rs. 410.41 crore as against total issue size of Rs. 2,000 crore

Dear Sir,

Can we have latest subscription figures please.

I am hopeful that the Modi government would do one thing or the other to change the fortunes of the company in the coming months and years. Still I think the rates should have been at least 0.25% higher to make it more attractive for the retail investors. Let’s see how it goes.

Day 20 (November 20th) Subscription Figures:

Category I – Rs. 237.31 crore as against Rs. 400 crore reserved

Category II – Rs. 317.21 crore as against Rs. 400 crore reserved

Category III – Rs. 130.88 crore as against Rs. 400 crore reserved

Category IV – Rs. 98.81 crore as against Rs. 800 crore reserved

Total Subscription – Rs. 784.22 crore as against total issue size of Rs. 2,000 crore

This issue is closing tomorrow.

when is the allotment ?

dear shiv.

pl. give listing details..

IFCI NCDs got listed on both the exchanges yesterday i.e. December 4th.

Here are the BSE and NSE codes for the same:

Series I – 9.90% interest, payable annually – BSE Code – 935311; NSE Code – NC

Series II – 9.90% cumulative interest – BSE Code – 935313; NSE Code – ND

Series III – 9.50% interest, payable monthly – BSE Code – 935315; NSE Code – NE

Series IV – 10% interest, payable annually – BSE Code – 935317; NSE Code – NF

Series V – 10% cumulative interest – BSE Code – 935319; NSE Code – NG

Series VI – 10% interest, payable annually – BSE Code – 935321; NSE Code – NH

Series VII – 10% cumulative interest – BSE Code – 935323; NSE Code – NI

Deemed date of allotment has been fixed as December 1, 2014. These NCDs will get matured after 5, 7 and 10 years respectively.

Interest will be paid on December 1st every year under the annual interest payment option and on 1st of every month under the monthly interest payment option.

dear shiv.

i want to buy : from secondary Market– BSE Code – 935321; NSE Code – NH

1. can we buy for more then Rs 2 lacs still qualify retail category (higher interest) as during application time upper limit was Rs 2 lac only for retail category .. ??

2. Would you advice sell Hudco9.01 bonds 30 % premium & buy these Ifci for Rs 10 lacs (if non-taxable IT file)?

I await your valuble guidance ….

Hi,

1. As an individual investor, you can buy as much as you want and still get a higher rate of interest. Higher rate of interest has nothing to do with a retail investor or an HNI investor.

2. It is a difficult choice to make, but I would say IFCI NCDs look attractive to me for a person whose taxable income is below the threshold limit for filing ITR.

Dear Sir,

please enlist govt or govt controlled company / bank etc bonds with interest rate of 9.90 and more.

thanks in advance

Dear Sir,

I am in 30% bracket and want to invest in taxfree bonds from the secondary market. Kindly provide the current listed tax free bonds with their nse/bse code, ytm, cost price, coupon rate, interest rate etc and advice on the best ones to take.

Thanks and regards

Priti

Hi Priti,

Here is the list of tax-free bonds which got issued last year:

https://www.onemint.com/2014/02/01/tax-free-bonds-fy-2013-14-interest-payment-date-date-of-allotment-maturity-date-bse-code-nse-code-other-info/