This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

It was Modi Government’s first budget on Thursday and it made the investors sit on a roller-coaster ride in the stock markets. Some must have enjoyed the ride, but some would have found themselves caught at a higher level even after having a so called “Excellent Budget”.

Before we find out why the markets fell even after having a good budget, let’s first look at some of the hits and misses of Budget 2014 from a retail investor’s perspective.

Hits:

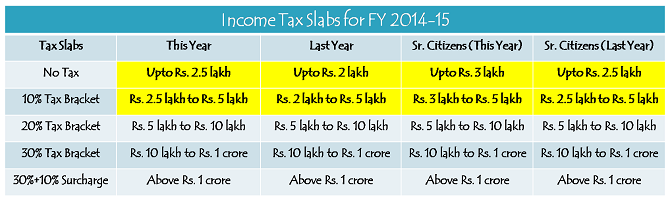

* Basic tax exemption limit has been increased to Rs. 2.5 lakhs as against Rs. 2 lakhs earlier – The proposal will help you save Rs. 5,150 in tax irrespective of the tax bracket you are in.

For Senior citizens, the limit has been hiked to Rs. 3 lakhs from Rs. 2.5 lakhs earlier. So, even if you are a Senior citizen or a taxpayer in the 30% tax bracket, the benefit will be of Rs. 5,150 only.

* Exemption under section 80C has been increased to Rs. 1.5 lakhs as against Rs. 1 lakh earlier – The proposal will help you save Rs. 5,150 if you are in the 10% tax bracket, Rs. 10,300 if you are in the 20% tax bracket and Rs. 15,450 if you are in the 30% tax bracket.

* Exemption limit under section 24 on account of interest on home loan in respect of self-occupied property has been increased to Rs. 2 lakhs as against Rs. 1.5 lakhs earlier – If you have taken a home loan and the property is a self-occupied property, then this proposal will help you save another Rs. 5,150, Rs. 10,300 and Rs. 15,450, if you are in the 10%, 20% and 30% tax brackets respectively.

* Investment limit in PPF has been hiked to Rs. 1.5 lakhs as against Rs. 1 lakh earlier – The proposal will help the Senior citizens or investors who are saving for their retirement years or the conservative investors in building up a healthier corpus for achieving their financial goals.

Misses:

* LTCG Period & Tax Rate on Debt Mutual Funds Hiked – This is one bad news for the debt fund investors, especially the fixed maturity plan (FMP) investors. April 1, 2014 onwards, your investment in a debt mutual fund will have to wait for 36 months (or 3 years) to qualify for the status of a long term capital asset as against the 12 months period earlier.

Though the step has been taken to stop the corporate investors from using these debt fund schemes as a tax arbitrage opportunity, this proposal is definitely going to reduce retail participation in debt mutual funds in a substantial manner. Overall, it is going to hit the mutual fund industry very badly as they have majority of their assets under the debt category.

Moreover, this financial year onwards, the tax rate has also been hiked to 20% from 10% earlier. So, it will be a double blow for the debt fund investors.

* RIP Tax-Free Bonds – In his budget speech, Finance Minister Arun Jaitley did not mention anything about tax-free bonds which got extremely popular with the investors in the last 2-3 years. So, like Infra Bonds which used to carry tax exemption u/s 80CCF till a couple of years back, I think fresh issuance of tax-free bonds has also been discontinued now. So, now onwards, the investors will have to explore some other investment opportunities which could earn them a tax free income.

* RGESS Left Untouched – UPA’s fractured investment scheme, Rajiv Gandhi Equity Savings Scheme (RGESS), got no treatment from the NDA either. In fact, Arun Jaitley did not even mention the scheme in his budget speech. So, all those investors, who were expecting the Finance Minister to make some changes in this scheme, got nothing but a big disappointment.

* Infrastructure Bonds u/s 80CCF Not Reintroduced – After getting ignored by the former Finance Ministers, investors were hoping for a revival of exemption for infrastructure bonds which used to give Rs. 20,000 exemption under section 80CCF or a new investment opportunity with a separate tax exemption. But, their hopes were dashed by Mr. Jaitley as no new exemption got introduced by the new Finance Minister.

So, why the stock markets fell even after having the so called “Excellent Budget”?

It is not the budget disappointment which caused our markets to fall equally sharply after zooming up 475 points intraday, it was the fear & fall in the European markets which caused such a panic selling by the smart money here.

The panic was caused due to concerns of a possible default by the Espírito Santo Group and a sharp fall in the share price of Banco Espirito Santo, Portugal’s leading financial institution, which later got suspended for trading.

Most of the European stock indices were trading lower when our markets got closed for trading at 3:30 p.m.

Coming back to our budget, I think, with no tax-free bonds around this year and a quite unfavorable tax treatment for the debt mutual funds, the investors will find it very unattractive to deploy their money in some of the fixed income investments. Also, as it is termed as a progressive budget by most of the market experts, it was the best that Finance Minister Arun Jaitley could have done for the economy in such a short period of time.

Every clue is guiding the investors to invest their money in equities this year, what we need is a smiling Rain God. So, after a very long time, will the markets oblige with some healthy and steady returns this year? Only the time will tell.

A gentle reminder Shiv – Can you please through some light on arbitrage funds. I understand that the budget has provided some tax sops to these funds which has made it attractive for retail investors to invest in these funds now. It will be helpful for us if you could let us know the pros, cons and pitfalls of these funds so that we can take informed decisions

Hi Shiv,

(1.5 lakhs investment in PPF)

I heard that the bill in parliament is passed on 80c . So have the banks/PO started accepting the additional 50 k that we can invest in PPF now?

Hi RS,

SBI has not started accepting the additional investment of Rs. 50,000, which is over and above the earlier limit of Rs. 1 lakh. So, I think you’ll have to wait some more time for the government to notify this enhanced limit.

It seems we can deposit the additional 50,000/- in PPF account now (I mean between 1st and 5th of September 2014).

Shiv – do you have any news/update? Can you please confirm?

RBI has notified the enchanced limit of Rs 1.50 lakhs for PPF about 2-3 days back. I learn that SBI is ready with modified software for accepting the increased amount. Let us wait for SBI to announce the acceptance.

SBI HAS STARTED COLLECTING PPF AMOUNT UPTO Rs 1,50,000 EFFECTIVE TODAY

Hi Shiv

I little off the topic but have been wanting to ask same. Can you please advise on tools used for stock analysis or general market analysis by traders and any open source(free) ones which are easy to use for retail investors? Apologies to post this off-topic.

Thanks

Hi Harinee,

I am not sure whether Manshu has posted any such article in the past. I’ll ask him and if he hasn’t, then I’ll try to cover it.

Sorry to break the bad news. If one sells the debt mutual funds after 10 July 2014, the holding period should be more than 3 years to avail LTCG benefit.

So even if one had made an investment on 30 July 2011 and sold today (26-07-2014) one will have to pay tax as per his applicable tax slab. The big lesson for investors is not to trust the govt. for any investment of substantial tenure. Our PF, PPF, Tax free Bonds, Insurance policies, retirement and pension funds are under real and serious threat of being declared taxable by the time it reaches maturity. And it will not be possible to chalange in courts.

The relief is only for those investors who sold their debt mutual funds before 10 July 2014 and the holding period was 365+ days. Only plan for 1 year at a time and take things from there again with 1 year view.

No retrospective tax on debt mutual funds. It has been made clear by the finance minister himself. So, the investments made in debt funds prior to July 11, 2014 will not fall under the new taxation laws.

http://www.livemint.com/Industry/fSMLsmL698pZfblsejiQsJ/Govt-exempts-debt-mutual-funds-from-new-tax-for-a-short-peri.html

Thanks Shiv for sharing the update from FM.

I believe this relief is partial… and it doesn’t depend upon the “investment date” as mentioned by you above, it will depend upon the “redemption date” i.e. anything redeemed before 11th July 2014 will be as per old tax rules.

If I had invested in 1 year FMP in July 2013 and it is maturing after 11th July 2014, it will not be considered as LTCG.

Copying some part of the text from the link you have provided:

Jaitley’s clarification on Friday implies that investors who had invested before—or just before—the previous fiscal year (2013-14) ended in the hope of getting double indexation benefits would be taxed at the higher rate (20%) if their funds come up for redemption before they complete three years.

Thanks Amlan, you are right! Investments made on or before July 10, 2014 and not redeemed till the same date will also fall under the new taxation laws. It is very disappointing for the investors.

Hi Shiv,

Can you please through some light on arbitrage funds. I understand that the budget has provided some tax sops to these funds which has made it attractive for retail investors to invest in these funds now. It will be helpful for us if you could let us know the pros, cons and pitfalls of these funds so that we can take informed decisions.

Regards,

SB

Sure SB, I’ll try to cover arbitrage funds and their taxation as I get free from filing income tax returns for my clients by 31st July.

Wanted to update you all that today I have received a letter from DSPBR regarding one of my FMPs (368 days) that is maturing on 28th July 2014.

They have mentioned:

“In accordance with the provisions laid under Regulation 33(4) of the Securities and Exchange Board of India (Mutual Funds) Regulations, 1996, as amended till date, it is proposed to roll over (i.e. extend the maturity) the Scheme, for a further period of 24 months.”

So it seems fund houses have started giving the opportunity to the retail investors to extend the FMPs up to 3 years so that people will be able to avail the new rules of LTCG for debt funds!

Thanks Amlan for sharing this update!

Am I right in assuming that the definition of “Long Term” being extended from 12 to 36 months is only for Debt MFs and not Equity or Balanced MFs?

Hi Bhavin,

Yes, you are right! The new taxation rules for mutual funds apply only to the debt mutual funds. Equity or equity-oriented mutual funds will continue to enjoy the same taxation benefits that they were enjoying earlier.

Hi Shiv,

Thanks as usual. I was trying to find the budget summary specific to retail investors and where else could I have found it ?

There is one more point that caught my attention but could not find any details. I heard FM talking about divesting some share in some banks to only retail investors. Did not get a chance to find out the details, but certainly looked to me a decent opportunity for retail investors. Could you please elaborate if you get a chance ?

Thanks Sagar!

Yes, it has been announced in the budget that the government will be looking to recapitalize PSU banks by encouraging these banks to go in for FPOs or OFS. But, I think it is not going to be exclusively for the retail investors. Rather they will be given a priority over the institutional, corporate investors.

Also, it is not going to start happening immediately. Government first needs to address the problems of bad asset quality of these banks, then it needs to make the management of these banks more accountable for their deteriorating health and then only fresh funds infusion should be allowed.

Some Relief Likely for Investors in Debt Mutual Funds

http://profit.ndtv.com/budget/some-relief-likely-for-investors-in-debt-mutual-funds-588696

for FMPs which were invested before April 1 2014, the 3 year LTCG rule applies or not ? I am still confused.

Yes is too hard to believe…takes away my trust from even tax free bonds…tomorrow govt., can change rules for tax free bonds too. I am stuck in FMPs. But shall i sell off the tax free bonds too ? Shiv, please advise…

Hi Ketki,

I don’t think there is any reason to panic. Decisions taken in panic result in losses in most of the situations. Adverse tax ruling for debt mutual funds has in fact resulted in a price jump for tax free bonds. Let the finance minister clarify what exactly he wants with the investments done in the debt mutual funds prior to April 1, 2014 and then you should take a calculated decision based on that. No doubt, retrospective taxation is always painful.

Thanks Shiv, for the timely advise. I am holding off on selling the TF bonds……Are you planning on writing any article on upcoming REIT and public sector IPOs ?

thanks a bunch !

Let us have some details about REITs & public sector IPOs, then I’ll definitely share my views about them. Thanks!

Shiv,

If I want to purchase tax free bonds from the secondary market, what return or coupon will I get? Can these bonds be easily purchased?

Rgds,

Anuj

Hi Anuj,

Tax Free bonds are yielding around 8% to 8.3% in the secondary markets and for a retail investment, I think it is not difficult to make a purchase. I never faced any problem except with the quantity at which I was willing to make a purchase or a sale.

Thanks Shiv.

The returns are not bad for persons in highest tax bracket.

I am going to try this for the first time and will share my experience by end of month.

Great, will wait to hear from you !!

Hi Shiv,

I tried buying bonds but not able to do so. The YTM is coming at around 7.5% through :

http://www.nse-india.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

Should I expect 7.5% instead of 8.0% +?

Are there some specific securities that I can look for? Are there people who help in buying these bonds?

Rgds,

Anuj

Hi Anuj,

With the demand being very high for these tax-free bonds, their yields have been falling very sharply. YTMs have fallen to a range of 7.40% to 7.65% since the budget day. So, with the falling yields, we have no choice but to tamper down our expectations.

We help our clients in buying these bonds, please let me know what kind of assistance you require in buying these bonds? You can mail me on my email id if you don’t feel comfortable writing here on a public forum.

Please check this link also:

http://economictimes.indiatimes.com/markets/bonds/as-demand-rises-tax-free-bonds-outperform-equities/articleshow/40106762.cms

Thanks Shiv.

I think I will wait for some time and decide before buying the bonds at low yields.

I will drop a mail as and when I decide.

Thanks a ton for your guidance and help.

Rgds,

Anuj

Sure, you are welcome Anuj!

Very bad news for Debt Fund investors! 🙁

Shiv – I have the same question as Sanjay… Will it be applicable only for funds purchased after 1-Apr-2014 or anything that will (mature)/(be sold) after 01-Apr-2014?

Indeed a very bad news for the debt fund investors Amlan! I think Equity investment is the way going forward.

I have responded to your query in my comment above.

Hi Shiv,

Debt fund will be taxed at 20 % for long term after 3 year and normal taxable slab before 3 years. If i have invested some money 1 year back and withdraw now , will I have to pay new tax rate or old rate( long term tax rate after 1 year) will be applicable. pl. inform.

Hi Sanjay,

It is applicable for the purchases made on or after April 1, 2014. So, the investments made prior to that will keep enjoying the earlier taxation rules.

Hi Shiv

Dont think investments made earlier will have old taxation rules. All investments maturing in FY14 will bear this impact. Government has clarified even units redeemed before budget in this FY is taxed as per new budget. Very bad news for everyone who invested in FMP. Debt fund investors atleast has an option to wait for more than 3 years whereas FMP investors less than 3 years are doomed

Regards

Ramadas

Agree with Ramadas comments – FMP investors (like me) are very badly impacted. 🙁

We still need some clarification/confirmation whether new rules for LTCG is applicable for investments made before 01-Apr-2014.

Investments made before 01-April-2014 is also impacted. There is no mention in budget that it will not be impacted and government clarified yesterday that new tax rules apply to all redemptions in this FY which means even old investments are impacted. We have no option but to pay up as per tax slab 🙁

Regards

Ramadas

Hi Ramadas,

As far as applicability of tax is concerned, it has now been clarified that it is effective April 1, 2014. I did not have any doubt about it as April 1, 2015 doesn’t make any sense.

Transactions of which year(s) it would cover, there is still no clarity about it. Plz check this link – http://www.valueresearchonline.com/story/h2_storyview.asp?str=25641

I am fairly confident that Mr. Arun Jaitley would not levy this tax on the purchases made prior to the current financial year. But, if he decides to do that, it would be quite disappointing.

Hello Shiv,

Does the 3 year LTCG rule for debt funds also apply for individual bonds/NCD. If I buy a zero coupon corporate NCD, does the duration have to be 1 year or 3 year, to qualify at LTCG at redemption ?

Hi Ketki,

The new LTCG rules for debt mutual funds do not apply to the listed tax-free bonds and NCDs. So, they continue to enjoy the same old taxation rules of 10% LTCG tax.

Dear Shiv,

Pl accept my compliments once again for the well written post, which is easily understood even by a lay reader.

I wish that your presumption about Tax Free Bonds does not come true and the TFB’s do not “RIP”….!

best wishes

S S Bakshi

Hello Col. Bakshi,

Thanks for your encouraging words Sir !! More than anybody else, I am deeply disappointed with the FM’s decision to discontinue these bonds. This is going to cut a big portion of my hard earned bread and butter.

But, nothing can be done about it. As there is no announcement till now, we’ll have to live with this bitter pill. For individuals, it is a good budget. But, for individual investors, the number of investing options have been cut down and it is very disappointing.

Hi, Shiv.

There is no clarity of tax treatment of LTCG of Debt fund. Earlier it was like this. Lesser of 10% tax on LTCG or 20% tax with indexation on LTCG for debt mutual fund. Now it is 20%. Is there any indexation benefit for LTCG now?

Pls clarify this.

Regards,

Hi Darshan,

Yes, the indexation benefit would be there with 20% tax rate.

Excellent exposition, Shiv. Everything is very well laid out. Regarding the 20% tax rate, I imagine the way interest and inflation rates are at the moment, the effective tax rate is well below 10% of the interest earned. So, while the 10% cap has been removed, it does not make a difference in current circumstances because the effective tax rate is below 10%.

Thanks Mr. Mukerjee!

20% tax rate is probably not a big problem, but the 3-year holding period for getting the LTCG status is. With real estate investments, it is fine. You do not tend to buy/sell them every 12-18 months. But, these debt fund investments are different, you cannot wait for 3-year period just to get the LTCG status. It is a long period for a debt investment which doesn’t guarantee you a fixed return. You will see their AUMs fall by more than half in 1-2 years time.

Ramdas, Johnny,

FM mentioned AY 2015-16, which is basically FY 2014-15. So, this is applicable from Apr 1, 2014. He would have mentioned it in next budget if it were from Apr 1, 2015 !!

Regards,

Bhushan.

Thanks Bhushan for your inputs !!

Thanks Bhushan. The bank websites still show as 1 lack as the limit. Hopefully they will update soon.

Hi Bhushan

There was indeed a confusion with budget wordings where it was clearly specified new rules was applicable from April 1 , 2015. This is now clarified by government and now rules are applicable from April 1 , 2014

http://www.business-standard.com/article/economy-policy/govt-clears-confusion-on-date-of-debt-mf-tax-hike-114071200163_1.html

Regards

Ramadas

Hi Shiv

Is the new PPF limit effective immediately or from 01 Apr 2015

Thanks

Hi Johny,

Though it is effective April 1, 2014, but as nobody would have deposited more than Rs. 1 lakh till date, it should be considered as effective immediately. As you don’t earn any interest on PPF deposits made between 6th to 30th/31st of a month for that particular month, one should now deposit money in the first five days of August to reap its full benefits.

Thanks Shiv. I have already invested 1 lack for FY2014 in April. I would like to add 50K more for FY2014. Can you tell me if I can go ahead and do that. I want to be sure about this as investing more than the specified limit is not allowed.

Thanks

Hi Johny,

Just wait for the budget to get passed in the parliament and the government to notify this increase in the investment limit. Probably it will take another 20-30 days for the government to do that. As suggested earlier, you should do that in the first five days of August.

I suggest that those desirous of adding additional 50,000 may do so during first five days of month immediately following that in which budget gets passed. Most likely Sept 1-5 will be the window. Some persons may have difficulty using this window because the bank software have been written to limit the PPF investment to Rs 1 lakhs. Investment beyond Rs 1 lakhs may will be possible only after bank software is changed,

Hi Shiv,

Whether budget is passed in parliament? Google search revealed nothing.

Hi Amit,

The Finance Bill got passed in the Lok Sabha on July 25th. I am not sure whether it has been passed in the Rajya Sabha or not. I think it should have been by now.

Hi Shiv

Thanks again for the wonderful review. In the section on debt mutual fund taxation , in most of the newspapers , it is mentioned this change will be effective from April 1 , 2015. You have mentioned April 1 , 2014. I know usual budget recommendations will be effective that financial year itself. Looks like this specific change is not effective 2014 . Can you please double check?

Regards

Ramadas

Hi Ramadas,

Thanks for your kind words! As far as debt fund taxation is concerned, I have no reason to believe that it is effective April 1, 2015. Effective April 1, 2015 means Assessment Year 2015-16. I am quite sure that it is with effect from April 1, 2014. So, even if somebody has invested between April 1, 2014 and till the budget announcements were made, 20% tax and 36 months LTCG period is applicable in case of debt mutual funds.

Hi Shiv

Government clarified yesterday on this confusion and ensured this is effective April 1 , 2014.

http://www.business-standard.com/article/economy-policy/govt-clears-confusion-on-date-of-debt-mf-tax-hike-114071200163_1.html

This is now applicable to investments made last FY and before as well. FM in one hand is against retro taxation and here investors are subject to retro tax. For example , my investments made in 2011 and matured in April 2014 , slightly less than 36 months are now called STCG.

I seriously hope they dont do this for Tax Free bonds as those are 15- 20 years in tenure and government can always come up with strange legislations 5 years down the line

Regards

Ramadas