Sukanya Samriddhi Yojana – Calculating Maturity Value after 21 Years

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

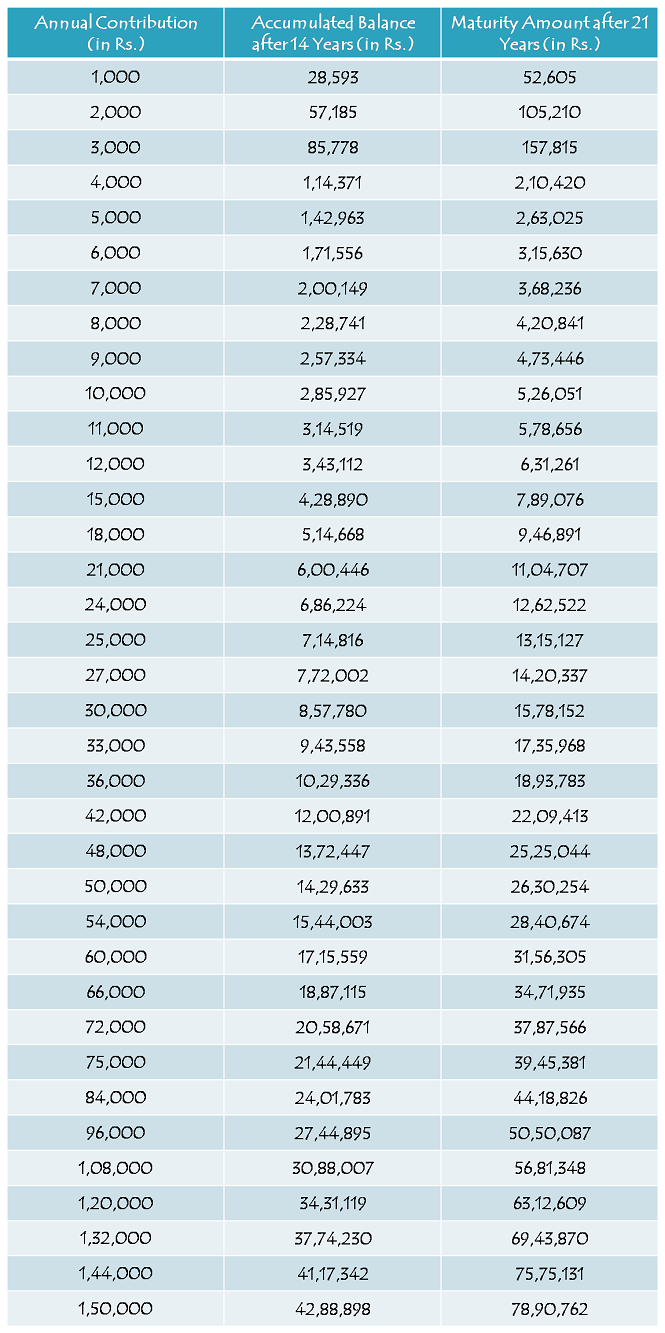

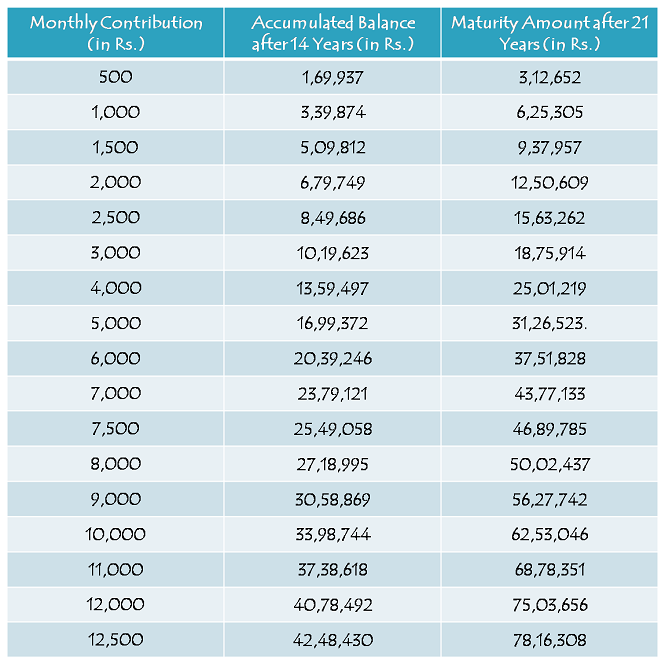

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

I cannot understand why would anyone trust their money with government. The government has no financial sense whatsoever, on managing it’s own (tax-payer’s) money.

A couple of questions to think about, what if this scheme is withdrawn after a few years or after a change in government. Or better yet, what if the tax benefits get withdrawn just like what happened to other otpions

If an individual has got a horizon of 21 years, does settling down for a mere 9% or 12.5% keeping the tax benefits at maturity & trusting the government.

Look what happened to baby boomer’s 401K accounts (retirement) of the USA.

I would never ever trust the government with my money. I’d rather make it a habit of learning the pros & cons of the different options & then make conscious decision of being in control of my finances and its returns.

Hi Sharath,

I understand your concerns, but I think you need to broaden your view. Small Saving Schemes like PPF, NSC etc. have been in existence for many years now and investors have got what they have been promised. I agree with you that the working style of the government is questionable and they need to improve their efficiency levels manifolds. But, then these schemes are for poor & middle class people and for them, safety of their capital is their primary motive. They cannot trust private companies with their hard earned money. Government is one institution where their money is highly safe. Whether it is put to use in an efficient manner or not is a different matter altogether.

I think you are a different kind of investor, most likely an educated investor, so you can understand many aspects of other investments. So, other schemes from private institutions might suit your risk appetite. But, common people of India probably require such kind of schemes for them to save for their basic financial goals.

kya ye yojana SBI ki associate Bank me bhi shuru rahegi ?

Abhi iski info available nahin hai.

what is the maturity value if monthly deposit is 100/- for 14 years?

Approximately Rs. 62,530 based on assumptions mentioned in the article.

Hi,

I had a few questions on this scheme:

1) Is the maximum investment possible Rs.1,50,000 per girl child? So, I have 2 daughters and so can I invest Rs.3,00,000 per year?

2) Can you detail what the maturity at “girl’s marriage” means? If the money available before or after marriage?

3) I presume on maturity the amount goes to the sole ownership of the girl child?

Regards,

sowmyanarayan.

Hi,

1. Yes, that is correct.

2. You cannot continue this scheme beyond your daughter’s marriage. As she gets married, you need to close this account and withdraw the balance.

3. Girl child will have the right over the maturity amount.

Hello,

if my early contributation is 1,50,00 per year.

how much will i get after 21 years ?

Thanks

Approximately Rs. 78,90,762, based on certain assumptions mentioned above.

ecs is possible in post office ?

This yojana koyi bank operator karagi?

Some authorised banks is scheme ko operate karenge.

Online facility shayad available nahin hogi post office mein.

sukanya simridhi yogna plz detail me .

this scheme is superb for people with girl child . But i must say that govt. launched this scheme without proper planning. No forms are available where ever you go.

Hi Gaurav,

Though the forms are now available online, banks are still not guiding people how to open an account. That is the bigger problem.

Hi,

I want to know if I will deposit for example Rs. 10,000 a year and will get Rs. 5,26,051 at the time of maturity as per the table, will the total amount of Rs. 5,26,051 is free from tax or it will be taxable once we received it.

Thanks

Hi,

It will be completely tax-free as per the latest budget provisions.

I want to invest 60000 per year which plan is best ppf, suknya smridhdhi yojna or bank FD or give other better option ?

Please provide best thing

Thanks in advanse

Among the three schemes you mentioned, I think Sukanya Samriddhi Yojana is the best.

My daughter is USA born and she is a US citizen am I still eligible to avail this scheme for my daughter. If so what documents do I need to submit. Thanks!

Hi,

I don’t think US Citizens would be allowed to open this account. I’ll share the info here as soon as I get any update.

Hi,

I would like to invest in SSY account.My daughter is 10 years old now,so how many years do i need to invest? For 14 years or till my daughter is 21 years?

Hi,

You need to invest for 14 years only, but the scheme will get matured in 21 years. Moreover, 21 years has nothing to do with the age of your daughter.

Hi,

Q1. Suppose if my daughter’s marriage is after 24 year, can I withdraw the money on 21st year?

Q2. What happen if I could not complete the 14 year payment?

Q3. What if the girl is not willing for a married life?

Please reply.

Hi,

1. No, you cannot. You can withdraw the amount either on maturity or when your daughter gets married, whichever is earlier.

2. There is a penalty of Rs. 50 for each year of non-payment, along with minimum deposit of Rs. 1,000 for each year.

3. The account will get matured after 21 years.

Sir,

If now girl child age is nine years then i deposit 1.5 lac per year then how much getting after maturity.

Pl. explain.

Thanks

Rajesh

Please check the table above, it is Rs. 78,90,762 as per the table.

1.)able ke mutabit jo calculation bataya gaya hai. Kya wo fix ammount hai jo after maturity milegi?? Ya yearly budget pe depend karta hai??

2) agar ye budget pe depend karta hai to aage ke 14 saal mein aapke mutabit kitna interest rate aa sakta hai??

3) 3000 per month pay karu to aage ke interest badlne par approx ammoeunt kitni mil sakti hai hame??

1. Jo calculation show ki gayi hai, wo amount fix nahin hai. Interest rate har saal 1 April ko change hoga.

2. & 3. Agle 14 saal kitna interest rate rahega, iska idea mujhe nahin hai.

1) Yearly interest rate will change and accordingly maturity value will also effect. This calculation is done based on assumptions only.

2) It should be equal or more than PPF interest rartes

3) That can’t be calculated now and we don’t know the future interest rates 🙂

Hi,

I would like to invest in SSY account. My daughter is 6 years old now,so how many years do i need to invest? Is it for 14 years of period starting from today or until my daughter turns 14 years.

Regards,

Venkatesh

Hi Venkatesh,

You need to invest for 14 years starting from the year you open this account.

Whether SSY account can be transferred from one post office to another ?

Hi,

My daghter is 2 and half years, I wud lke to invest in SSY and just want to knw should I invest till she’s 14 or a minium period of 14 years.

* In case the 2st year i pay 60,000 and 2nd year Im unable to make it upto same amout can I pay how much ever feasible.

Hi Jenny,

1. You need to invest for a minimum period of 14 years.

2. You can invest whatever amount you want to invest subject to a minimum contribution of Rs. 1,000 per annum.

My daughter is only 5 months old. Is she eligible for the scheme

I have bank account in Indian Bank, Can I open the Same with them as Post office doest have ECS option

You need to approach your bank to inquire about it.

Hi,

My daughter’s date of birth is 10.5.2004.

Is she eligible for sukanya samruddhi yojana. And if I start in april 2015, how many years should I invest, and what is the maturity date,and how much she will get after maturity if I invest 10000 per month.

Hi,

My daughter’s date of birth is 10.5.2004.Is she eligible for sukanya samruddhi yojana. And if I start in april 2015, how many years should I invest, and what is the maturity date,and how much she will get after maturity if I invest 10000 per month.

Sir, I m a Govt employee and want to invest my money for future needs of my 2 little daughters ( First is 2 years old and second is 6 month old). Monthly contribution will be 1000/-each. Which scheme namely SSY, PPF, SIP will be better for me. I have a PPF account also with SBI.

With Best regards.

hello sir,

my daughter s 2yrs old.

1) i will pay for 14yrs under this scheme i.e till she turns 16, so will amount at maturity wary depending on the age of my daughter.

Hi Samkit,

Maturity amount has nothing to do with the age of your daughter.

Hi Mona,

At present SSY seems better than PPF. Investment in Equity SIPs has given better returns than PPF in the past. So, if you can take risk, equity investment is the best option.

Sorry, Monu & not Mona.

Hi ,

The amount recieved on maturity (for eg 78lacs) is to be used for the marriage and Education only or can it be used for any other purpose? If marriage cost and education cost works out 50lacs what will happen to the remaining amount? Can the girl use it for any othe rpurpose?

Yes, it can be used for any purpose. The government will not track the final use of maturity proceeds.

Hi,My daughter’s date of birth is 10.5.2004.Is she eligible for sukanya samruddhi yojana. And if I start in april 2015, how many years should I invest, and what is the maturity date,and how much she will get after maturity if I invest 10000 per month.

Hi,

Yes, your daughter is eligible for this scheme. You need to invest for 14 years & it will mature in 21 years or when your daughter gets married. Please check the table above for maturity value.

Hello,

God forbid any of these happens to anyone… but life is harsh sometimes. So, I have three questions:

1. Can we assume that either of the surviving parent will be able to continue making payments in the event of death/disability of one the parents? Also, can either parent claim tax deduction?

2. Can kith or kin continue to make payments in the event of death of both parents? I doubt they can claim Tax deduction?!!

3. What happens to the corpus amount in the event of the death of girl child? Can either parent be made nominee?

Thanks

Nk

Hi Nk,

1. Yes, it is possible that the surviving parent can continue this account in the absence of one of the parents. Only the contributing parent/guardian can claim tax deduction.

2. It is still not clear whether kith or kin can continue this account in the absence of both the parents. I think there must be a provision for legal guardian to continue this account. Also, I think the legal guardian would be eligible to claim tax deduction.

3. Nomination facility is not there with this scheme. In an unfortunate event of the death of the girl child, the account will be closed immediately and the balance will be paid to the guardian of the account holder.

Sir, Can I make the payment online if I open it through bank?

Hi Nia,

Yes, you can do so if the bank is providing the online payment facility.

Sir, my daughter is 9 yrs now.After 9yrs when she will be 18 how much amount she can withdraw .Is it 50% of the maturity amount .?

Q2.If she got married at the age of 21 .Do we have to make the futher payments then.?

Hi Deepa,

1. It is 50% of the balance amount and not the maturity amount.

2. No, when your daughter gets married, you’ll have to compulsorily withdraw the balance and close the account.

Sir meri beti ki age 10 saal h . Iss hisab se wo 11 saal me hi 21 saal ki ho jayegi toh kya mujhe 14 saal investment k complete nhi krne pade ge pahle hi Rs mil Sakte h. Yadi main Sadi 21 saal baad krta hu plzzzzz reply me

Aapko maturity amount ya to beti ki shaadi pe milega ya phir account kholne ke 21 saal baad. Aapki beti ki age 21 saal se koi farak nahin padta.

My daughter is 9 yrs old fr how many year i hv to invest,how much i vll get if i want to invest 6000 per year

Please sir, tell me that 5000 yearly invest in S.S.Y after completion of 21 yrs. How many Rs. Will be return

Please check the table above. Based on certain assumptions and 9.1% rate of interest, it should be approximately Rs. 2,63,025.

Hello sir my daughter is 9 years old ,i want to know for how many year i hv to invest ?

N how much i vll get if i deposite rs.6000 per year

Hello sir my daughter is 9 years old ,i want to know for how many year i hv to invest ?

N how much i vll get if i deposite rs.6000 per year

N also i cn wthdrw fr her stadies ?

Hi Rajani,

1. You need to deposit the desired amount in this account for at least 14 years or till your daughter gets married.

2. Based on certain assumptions and 9.1% rate of interest, it should be approximately Rs. 3,15,630.

3. Yes, you can withdraw 50% of the balance as your daughter attains 18 years of age.

Sir,

I didn’t get my answers yet..

Hello Sir,

After maturity of account, i.e 14 years, who has the claim on maturity amount, the child or the parents????

The girl child will have the right on the maturity proceeds.

Give me and. Plz

Give me ans.plz

What’s your query?

Plz tell me kya us bachhi ko yaojna ka labh nhi mil sakta jiske parents nhi j

Mil sakta hai. Koi bhi legal guardian girl child ke naam pe account khulwa sakta hai.

Mere Bhaiya ki ladki h uski mumy ki dath ho gai or papa ki mansik halat thik nhi h or post office se bola ki vo bachhi yojna ka labh nhi le sakti

Post Office is wrong in doing so.

Par post office vale bol rahe h ki sirf mumy papa k signature hi honge vo log mana kar rahe h him kya kare plz thoda batao

Legal guardian account khulwa sakta hai girl child ka.

My daughter is born on 19.07.2010 i want to invest 10000 on monthly basic (Ten Thousand rupees only),for how long i have to depoist the money & when will the plan gets matured.kindly help me plzzz.awaiting for your reply.

You need to deposit money in this account for 14 years. The scheme gets matured in 21 years from the date of opening this account or when daughter gets married, whichever is earlier.

Hi sir

I am staying out of India for last five years but am an Indian citizen, I want to invest 12500 INR for my daughter who born in 2009, and she also an indian citizen, can I apply it online? ??

Hi Dr Prakash,

Online investment facility is not available with the post offices. Some authorised banks might provide this facility in future, but at present, these banks have no information to provide to any of the interested subscribers. So, you’ll have to wait for some more time to get clarity on this matter.

sir i want to know,

1.)at the time of 18 year where partial withdrawal will be granted or at 21st year 100% withdrawal ,who can withdraw this amount either girl child or the parent suppose if i am paying every month

2)what would be the scene in case of divorce of parent bec i am on the verge of divorce bt want to subscribe for my daughter this plan,please intimate

Hi Rohit,

1. As it is for the girl child, she will have the right to the maturity amount.

2. I have no idea what would be the impact of some family disruption on this scheme. But, if you are doing it for the benefit of your daughter, who I am sure has no role in your disputes, I think it hardly matters what happens at the end of this unfortunate event. I think you should go ahead and do that for your daughter.

Head postmaster ye post office ne hota h ya kisi badi branch par

Ye aapko apne post office mein pata karna padega ki wahaan ka Head Postmaster kahaan hota hai.

Dear Mr Kukreja,

Thanks for the guidance.

I have a different query. Actually I am availing Home Loan from PNB. I am paying approx Rs 70,000/- towards interest per year in addition to principal. Am I eligible for tax deduction of Rs 70,000/- which I am paying towards interest. I mean to say this Rs 70,000/- will be automatically deducted from my gross salary. It is also pertinent to mention here that still I am not in possession of flat. Litigation is going on in State Commission. It will take lot of time. My office says until and unless I am not in possession of flat, I am not eligible for tax deduction. Is it so, kindly guide.

Hello sir,

Need to deposit for upto 14 years right.But in Case if i deposied only two years, ofter unble to deposit Next 2 years.After this 2 years gap again if i will start to deposit upto 5 years-In this case amount will get back or will get interest for that money upto 21 years.

Dear Sir

Thank you for sharing this informatin.

Is NRI can invest in this scheme and take benefit.

Thanks for your help

Dear Sir

Thank you for sharing this informatin.

Is NRI can invest in this scheme and take benefit.

Thanks for your help

OK thank you sir

Dear Sir

Thank you for sharing this information.

Is NRI can invest in this scheme and take benefit. If the daughter is norn outside India but she and parents are still Indian citizens. Will they entitled for the benefit

Thanks for your help

Is yojana ke anusar har saal kitne rupey pay karna padega plzz ans

sir

Is it possible for NRI to open this account for their daughters and is the matured value tax free. my daughter is 2 year old now if i invest 150000 how much she will get on maturity at the age of 21

Thank you

sir my doughter is 2year6mounth and i am open this acc. 12000 per year

and got after 21year meturity ammount

Please check the table above. As per the table, it is Rs. 6,31,261.

In case of death of parents before 21 years policy or marriage of girl child what will happen to the invested money ? will it be refunded deposited amount with interest without continuing ? or child will be bound to pay remaining years or have to wait till marriage ?

You can make a request to prematurely close the account and withdraw the amount under special circumstances like death etc.

Dear Team,

Please tell me about this yojana and tell me minimum deposited rs. in annual and my daughter is 6 year 6 month 10 day so please updated me immediate.

Thanks

Nepal Singh Dhaked

Minimum annual deposit is Rs. 1000. Please check this post, it has all the details about this scheme – https://www.onemint.com/2015/03/03/sukanya-samriddhi-yojana-tax-free-small-savings-scheme-for-a-girl-child/

dear team,

please tell as my conditions,

1. in case of deeply incident/accident with applience than what to you do?

2. in case of applience is no more with any reason than what to you do?

3. in case of emergency personal/family work, we want to withdrawl some deposited payment than what to you do.

You can make a request to prematurely close the account and withdraw the amount under special circumstances, like death etc.

Sir,If she withdraw the 50 % amount after 9yrs i,e. ,when she will be 18 yrs old. Investing 150000 per year. How much will she get at the time of maturity?

Hi Deepa,

Based on certain assumptions & 9.1% rate of interest, it should be approximately Rs. 48.48 lakh after 21 years.

Good morning Sir,

Child girl is 8 year old so “ssy” scheme me 1000 rs. yearly dposite kerne k baad 10 year k baad uske merrige(in 18 year) k lea total kitna amount milega.

Thank you

Hi Rohit,

It should be approximately Rs. 16,654.80

Hi shiv Sir,

will the partial withdrawal be tax free?

Hi Vinay,

Yes, partial withdrawal will also be tax-free.

Sir,

Can you please tell me if i have opted for 10000 annually and in next year i wantto deposit 20000 in an account can I. And yearly how many times i can deposit.

Hi Dushyant,

Yes, you can do that. You can deposit any amount between Rs. 1,000 and Rs. 1.5 lakh. Also, there is no cap on the number of deposits.

hello Sir,

Can you please tell me if i have opted for 10000 annually and in next year i wantto deposit 20000 in an account can I. And yearly how many times i can deposit.

I have just posted an article having a sample duly filled application form, please check – https://www.onemint.com/2015/03/12/sukanya-samriddhi-yojana-sample-filled-application-form/

Dear Sir

What application I got from post office has the letters like SAVING/RD/TD/(1/2/3/5 YEARS/MIS. As you have mentioned in the application form sample SSA option is not there. what should I write in type of account? kindlt clarify.

Hi Janet,

You should write SSA or Sukanya Samriddhi Account there.

Sir

Meri beti ki age 2 years and 7 years hai to me yearly 1000-1000 diposit karu to 21 sall and 18 saal ke baad dono ko kitna milega??

Please check this post – https://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

If I open this account with 9.1 % interest. Will it be applicable for all 21 years

No, rate of interest for this scheme is not fixed and is subject to a revision every financial year like all other small savings schemes, including PPF. 9.1% rate of interest for SSY is for FY 2014-15 only. For FY 2015-16, the rate of interest will be announced soon in a few days time.

Today I enquired in PNB and SBI about SSY. Both the banks said forms are not available. when will we get the forms ??

Only these banks can tell you about that.

Kya ye yojna ek beema yojna ki Torah hi ? Jisme yadi patients ko kuch ho jai to bhi last me poora pesa Malta hi yadi nhi to kya hi ….

Nahin, ye scheme bima suraksha nahin deti. Agar parents ko kuch ho jaaye, to beti ko balance paisa mil jaayega.

Good investment

Hi,

Could you please tel me can we open two accounts for a single girl child, one account is opended by her grand father and another account is opened by father. does it possible.

Hi Suresh,

No, you cannot open two accounts for a girl child. It is not allowed.

Sir,

Can i open this account through online ?

Hi Abdul,

No, online investment facility is not available.

My daughter is only 8 months old. Is she eligible for the scheme.

Yes, she is eligible for this scheme.

sir 1000 per month dale or 5y tak dale to kitna milega

Jodh Singhji,

14 saal tak deposit karna hoga, 5 saal nahin. Aur monthly deposit karna zaroori nahin hai, saal mein ek deposit bhi chalega.

hello my big daughter birth on 31-07-2002 n second daughter birth on 24-11-2008 can we open her account for sukanya samruddhi yojana

Hi Deepak,

You can open this account for your younger daughter whose date of birth is 24-11-2008. Elder daughter is not eligible.

Hello sir

Kya Hume her month ik fixed amount hi deposit kerni hai. Ya change b ker saktey hai

.

Hi Manoj,

Aap amount change bhi kar sakte hain. Aur har month deposit karna zaroori nahin hai, saal mein ek baar deposit karne se account active rahega.

meri badiwali bacchi ki janam tarikh 31/7/2002 aur chotiwali janm tarikh 24/11/2008 hai Kay main unke naam se sukanya samruddhi yojana ka khata khol sakta hu aur agar is 14 Saal ke darmiyan uske pita/father ko kuch ho jayega to kya hoga

Agar in 14 saal mein father ko kuch ho jaata hai, to aap special request kar ke account close karwa sakte hain. Beti ko balance amount mil jaayega.

Beti bachav yojana aur sukanya samruddhi yojana me kya farak he

“Beti Bachao, Beti Padao” ek financial scheme nahin hai, ek social initiative hai. Sukanya Sammriddhi Yojana ek financial scheme hai.

Hi sir,

I wanted to know what’s accumulated balance and maturity amount.ie.if i deposit 1000 yearly and i withdraw after 14 yrs will i get 28593 and if i take it after 21 it is 50,000?..also whether each yr the interest change?the interest is calculated on the matured amount of the previous yr right?..

Hi Sheba,

Yes, the interest rate will be revised every financial year on April 1. You need to deposit money for 14 years and you can withdraw after 21 years or when the girl child gets married, whichever is earlier. You can withdraw 50% of the balance as the girl child attains 18 years of age. If you deposit Rs. 1,000 every year on April 1, it would be approximately Rs. 52,605 after 21 years.

Sir I wanna open this account. I want to know that if I get it open on yearly investment of rs.12000 and after some years before my baby completes 10 can I increase the investment amount in the same account? Or open a different account in the same plan with increased investment amount?

Hi Monikaa,

You can increase the amount whenever you want.

Sir, I also want one clarification abt the scheme. Whether govt. Employees (state/central/banks) can open the account?

Hi Pradeep,

Yes, govt. employees can get this account opened for their daughters.

Sir, can I withdraw from this A/c or it will be in lockin period of 21 years.

Hi Prakash,

You can withdraw 50% of the balance as the girl child attains 18 years of age. The account will get matured after 21 years or when your daughter gets married, whichever is earlier.

Hi sir

meri beti ki birth date 21 Feb 2009 hai agar main sukanya samridhi scheme me 1,50000 rs yearly deposit krti hu to Iska benefit kya hoga

Hi Jyoti,

Please check the table above, maturity amount as per the table is approximately Rs. 78,90,762. Ye amount aapko 21 saal baad milega, agar interest rate 9.1% rehta hai.

ntpc bonus debenture issue please let me know how I can apply & weather I have to be a share holder of this company &weather I am eligible to get debenture if I purchase only 1 share today

Record date is March 23. You need to have its shares in the demat account on or before this date to be eligible for these debentures.

Can I gate a agency for work with this ssy.

You need to contact post office for that.

I have 2 daughters and opened 2 SSA accounts. Please let me know if i can deposit 1.5 lacs (yearly deposit) per child or limit is overall 1.5 lacs.

Hi,

As per the wordings of the Circular – “the total money deposited in an account on a single occasion or on multiple occasions shall not exceed one lakh fifty thousand rupees in a financial year”. So, I think one can contribute a total of Rs. 3 lakh in two accounts. We will get further clarity on this in a few days time.

Thank you Sir.Please keep me informed if you get further clarity on this.

Sure, I’ll inform you.

hello sir,

i would suggest you to please add one more assumptions in your table i.e. you open the ssy a/c in the daughters birth year.

and a diclamer:

maturity amount will wary according to your dauhters age.

Hi Samkit,

Both your suggestions are welcome, but both of these are not required to be added here. Girl child’s age does not matter and also, it is not necessary to open this account in the birth year of the girl child.

Hello Sir,

Is there any time period given by GOV. to apply for this sukanya scheme or any suggestion from your side to enroll with this scheme. i.e. any financial year onwards we can use or engage with this scheme.

Regards,

SEEMA

Hi Seema,

There is no time period for this scheme. It will remain open throughout this year and in future as well.

OK, THANKS !

You are welcome!

sir please tell me how you calculate the 14 years amount and 21 years amount.

sir please tell me how you calculate the 14 years amount and 21 years amount.

I’ve calculated it in excel, which I cannot show to you here.

Sir mai agar a/c open karane ke baad agar parent expire ho jaye yaa beti hi expire ho jaye to in paiso ka kya hoga plz tell me

Agar beti ko kuch hota hai, to balance aapko mil jaayega. Agar Aapko kuch hota hai, to balance beti ko mil jaayega.

Dear Sir,

My daughter is new born. and if i invest in this scheme now. and this scheme is about 14 years. and the maturity will claim after 21 years. toh 14 years k baad account kaise rahega. active ya regular chalta rahega.

Regular chalta rahega till maturity i.e. 21 years or till your daughter gets married.

my daughter is born on December 2007 how much i should pay and how many terms how much i will receive after maturity

You need to deposit a minimum of Rs. 1,000 & maximum Rs. 1,50,000 for 14 years. After 21 years, you’ll get the maturity amount depending on your contribution & rate of interest.

What are the document needed to open this a/c.

You need birth certificate of the girl child, along with the identity proof, residence proof & 2 photographs of the guardian, to open an account under this scheme.

Sir Sukanya ki detal post office me koi nahi bata pa raha ha plz help

Vikasji, jahaan account khulna hai wo hi help nahin karenge, to aap bataiye hum kaise help karenge?

Meri batie 2-8-2013 ko hui ha mena 12-3-15 ko acount khol diya ha plz sir muja kab tak ja karna ha .monthlai ya yerli plz uski michyourti kini hogi

Aapko saal mein ek baar deposit karna zaroori hai, monthly zaroori nahin hai. Minimum Rs. 1,000 aur maximum Rs. 1,50,000 jama karwa sakte hain. 14 saal tak jama karana hoga aur 21 saal baad paisa milega interest ke saath mil jaayega. Jab bhi aapki beti ki shaadi hoti hai, to aapko saara paisa mil jaayega.

Dear sir, here any guarantee for maturity amount if i will deposit every year rs.1,50,000/. if yes tell me how much minimum.

It is a government of India scheme, so it is guaranteed. But, I cannot calculate what minimum amount you’ll get on maturity.

Sir,

My doughter DOB is 27/05/2007,every month I want to invest

1000rs. I will do marriage for my daughter at the age of 22 year

(2029). So kindly tell me how much amount I will get at 2029,which

Is 15 the year from stating .

Regards,

Vijaya kumar

It will vary as per the rate of interest & time of deposit.

First of all, thanks for sharing the details. My question is suppose I start this scheme with depositing 15ooo per annum. Now, is it mandatory to keep the amount constant OR depending on financial postion, I might increase/decrease the amount. Hope to hear from you.

Thanks Somnath,

It is not mandatory to deposit a constant amount every year, you can deposit whatever amount you like as per your comfort, subject to a minimum of Rs. 1,000.

Sir.

Meri beti 8 sall ki hai .1000 se act open kar ke usme jyada amoun v dal skta hu.18 hone ke bad mai usme se kitna amnount nikal skta hu.

Yes, aap is account mein Rs. 1,000 se zyaada amount bhi daal sakte ho. 18 saal complete hone pe 50% balance aap withdraw kar sakte ho.

Dear sir,

Thanks for ur co-operation.

Sir my doubt is , my daughter 8months old now, i will contribute the amount till14 years after that my duaghter gets married in the 19years old then we eligible to get the matured amount in 19years?

Yes, you’ll get the maturity amount as & when your daughter gets married.

Sir agar me 1000 par year jama karunga toh meri 14 year baad kitni mechurety banegi plz rply

Maturity 21 saal baad hogi, 14 saal baad nahin.

Sir,my daugher has completed 9 years .if i deposit 2000 per month how much amt i’ ll get on maturity i.e.21years and tell me how many years i have to pay( till 14th year of my daughter’s age or 14 year of now)

Wat is the ratio% of getting income tax rebate on this scheme

You need to deposit money for 14 years from now and not till 14th year of your daughter’s age. You’ll get rebate u/s 80C as per the tax slab you are in. Please check the table above for the maturity amount after 21 years.

Hi sir mein poochna chahti hun ki…interest ke percentage ki minimum aur maximum limit kya hai?

There are no such caps on interest rate.

What are the document needed to open the a/c

You need birth certificate of the girl child, along with the identity proof, residence proof and 2 photographs of the guardian, to open an account under this scheme.

Hello Shiv,

The previous comments are very helpful, I have a question, My daughter age is 5years now. I want to take this ssy account with 50,000 deposit per month. I will do marriage for my daughter at the age of 20 year, so here i want to take the amount at the age of 20 years means after 15 years, so how much amount i will get after 15 years?

Hi Prasad,

Firstly, Rs. 50,000 per month is not allowed, you can deposit a maximum of Rs. 1,50,000 in a financial year. Moreover, the maturity amount will depend on the deposit amount, rate of interest and the timing of your deposit.

i had one quires about how much should be paid per month to my daughter can i open an account now for her, she is just 1 year child .

what will be fixed installment monthly/yearly & amount will have to deposit up to how many year.

There is no fixed amount you need to deposit. However, you need to make deposits for 14 years.

SSA AGAR MAI 14/03/2015 KO KHULWATA HU TO MERA INTREST KAB JUDEGA 14/03/2016 ME AUR 1 MONTH ME 2 BAR DEPOSITE KAR SAKTE HAI AUR AGAR SSA POST OFFICE ME HAI TO MAI YE ACCOUNT IDBI BANK ME KAR SAKTA HU

1 month mein 2 baar paisa deposit kar sakte hain. Baad mein IDBI bank mein bhi migrate kar sakte hain. Interest calculation method abhi clear nahin hai, but mujhe lagta hai ye PPF ki tarah calculate hoga.

Hello Sir,

I want to know, how is this scheme better, if I invest 100000 in a recurring deposit every year for 14 years and stop depositing after that?

and also if I invest a particular amount in SSA for first few years and then onwards make no further investment, what will happen to the account in that case?

Hi Monika,

You need to deposit a minimum of Rs. 1,000 in a financial year. Not doing so will attract a penalty of Rs. 50 per year. This scheme is tax-free as against a recurring deposit.

Can any explain how the interest is calculated for every year. For Example – 12000 per year how the interest is 592? when its 9.1%

Hi sir

meri beti 6 year ki hai to kya mujhe beti ke 14 year hone tak amount deposit krna hoga ya regular 14 year amount deposit krna hoga jaise 2023 tak ya 2029 tak

Hi Jyoti,

Aapko 2029 tak amount deposit karna hoga.

Hi sir,

I just would like to know about all terms and conditions of this scheme. Request you to provide your valuable guidance.

With regards,

Jay

Hi Jay,

Please check this post, it has all the details – https://www.onemint.com/2015/03/03/sukanya-samriddhi-yojana-tax-free-small-savings-scheme-for-a-girl-child/

Res sir,

My daughter is 7 years old pls clear my confusion I have to deposit money next 14 years or till the age of 14 of my daughter…in sukanya suraksha scheme…

You need to deposit money for the next 14 years.

After complete the age of 21 years of my daughter can I withdraw full money from this scheme?

No, this scheme has nothing to do with the age of your girl child. You can withdraw the balance at the time of your daughter’s marriage or on completion of 21 years from the date of opening this account.

Sir

I want open ssy account on post office. Sir plz advice me supoues 1000/ rs deposit the amount if i want deposit next month 10000/ rs .sir i could deposit as above this amount next month .plz update guide me .

Thanks

VVirendra rana

Your query is not clear.

Hello Sir,

Meri daughter abhi 9 years ki h to mujhe kb tk jma krvana hoga. Me 50000/- rs. Yearly Jma kravata hu to jb vo 21 ki ho jaayegi tb use kitne pese mil jayenge.

Hi Onkar,

Aapko 14 saal tak minimum Rs. 1,000 jama karne honge. Aapko maturity amount aapki beti ki marriage pe milega ya is scheme ke 21 saal complete hone pe.

Sir my baby age is 15/5/2013.i want deposit 1000 per month upto 21yr.how much amout i got after 21yr .

You need to deposit for 14 years only in this scheme. Maturity amount after 21 years is given in the table above for various monthly/yearly contributions, please check.

Res sir,

At present this scheme is avilable in sbi or not… Pls clear me

As per the feedback we have received from the readers here, banks, including SBI, have not started accepting these deposits.

hi sir

meri beti 6 sal ki hai

mai har sal 2000 rs jama karta hu to

kitne rs jama karna hoga aur 21 sal ke bad

kitna milega

Hi Deepak,

Please table check keejiye, usmein maturity amount mentioned hai.

Ok sir thanks g

You are welcome!

Is the deposited amount tax free?

Yes, it is tax-free.

Good

The limit of tax free savings is 150,000.

Is the amount deposited in ssy consider in tax free savings I.e. in 150,000.

Yes, deposit in this scheme qualifies for tax deduction u/s 80C.

Is the maturity amount in this SSA scheme is tax free?

Yes, it is tax-free.

Hello sir

Sir I would like to know about the the process to withdraw the amount at the time of my daughters marriage.(the document I will require)

Hi Sandeep,

As of now, I have no idea about it. But, probably the marriage certificate or a declaration by the girl child or even an invitation card of the marriage would do.

hi sir,

meri beti abhi 1.6 Yrs ki hai uska birth orissa mai hua lejin hum kolkata mai rahte hai uska birth cerificate orissa ka hai to mai kya us certificate se kolkata mai a/c khol sakunga.aur uska identity proof kya du.pls mujhe mere mail id mai replu kijiye ga.

Hi,

Haan, aap Kolkata mein account khol sakte hain. Identity proof parents ka ya guardian ka dena hoga, beti ka nahin, beti ka sirf Birth Certificate dena hoga.

Sir

Keya ek month 1000 or next month 2000 and next month 500 ; es taraha sel me 10; ya 12 hajaar bala slab le sakte hai

Haan, kar sakte hain.

Hi sir

My girl is 6years old. I open a account with 5000 rupees per month. So please tell me how much I gain last.

Please check the table above for maturity value.

Merit beti ka d o b 25th jul 2004 hai agar 5000 monthly me deposits kiya to 2025 tak kitna maturity hoga

Jayantoji, please table check keejiye, usmein aapke contribution ke according maturity value mentioned hai.

Dear sir

is scheme me paisa dalena suru kar diya hai. Agar 14 saal se phele bacche k parents ki death ho jati hai tab kya hoga

Parents ki death ki situation mein aap request de kar balance paisa nikaal sakte hain aur account close kar sakte hain.

Parents ki death ki condition me scheme me kis tarah k sections hai

Ya is S S Y ke equalant koi lic plan hai

Parents ki death ki situation mein aap request de kar balance paisa nikaal sakte hain aur account close kar sakte hain. LIC plans aapko 5-7% return dete hain, koi LIC plan 9.1% guaranteed return nahin deta.

Sir

I want to say that if I open account with 1000rs per year and next year will I deposit more than previous installment (15000rs) and next year will I deposit less than (12000). Can it possible

Yes, you can do so.

Meri Beti abhi 8 mah ki hai kya mai es scheme me account khulwa sakti hu. eske liye form kaha se milega. kripya bataye ……..

Yes, aap account khulwa sakte hain.

meri beti ka date of birth 16 -08-2004 hai kya mai account khulwa sakta hu. kripya jankari dene ki kripa kare.

Yes, aap account khulwa sakte hain.

hi sir

if a girl born on 14feb 2004

then we can open d acct of this girl coz she cross 10 year age

1 year grace period has been given only for this year. You can get this account opened for girls born on or after December 2, 2003.

sir ,

if d amt of deposited r 6000 Rs per yearly for 14 year then how many amt r got d girl after completion of maturity date …

Hi Saagar,

Please check the table above for maturity value. It is approximately Rs. 3,15,630 as per the table.

Hello shiv

Jaise Aapne bAtaya Ki Kitane bhi baar account me money deposit kar sakte Hàí to phir kaise interest milege iss yojana me

Mean client kise bhi years me kitana bhi deposit kar sakta hai Kya kabhi yearly 10000/- to Kabhi 20000/- etc 1000/- se 150000/-ke beech me jo fund bAnega Uss par interest milege Aisa Kya

Pls shiv ji batate or clear kare

Hi Shobhit,

Iske interest calculation ka method abhi clear nahin hain, but most likely ye PPF ki tarah hi calculate hoga.

hi sir

thanks about it bt one thing i want to know that if a girl got death within 21 Yrs what will be after that ,amount will be withdran or not plz tell

In case of any unfortunate event with the girl child, the balance will be given to the parents/legal guardian.

Sir plz 1 More questions

Sir my daughter has birth certificate bt the address has mentioned with his maternal so is there any problem to open an account or it will do.

Address proof of the parents/legal guardian would be required. Girl child’s address proof is not required.

Plz let me know can I deposit money once in a year or we have to deposit every month ?

Thank u in advance .

You need to deposit money only once a year.

Thank u sir .

You are welcome!

Hello Sir,

Meri Doughter ka DOB 30/10/2003 (Years 11, Months 04 Days 18) hia. Kya mai Suknya Samridhi Yojna ke tahat Account Opening Kra sakta hu ? Please Repply me.

Hi Ayush,

Nahin, aap ye account nahin khulwa sakte.

Hello sir, sir meri beti dob 04.01.2006 hai. Aur 16.03.2015 ko main a/c open karta hu aur per year 100000 deposite karta hu to agar wo 21 year ki age main shadi karti hat matlab 2027 main to us time main kitna amount approx withdrawl kar sakta hu?

Aap apni beti ki shaadi ke time poora amount withdraw kar sakte hain.

Hello sir, meri beti ki dob 4.01.2006 hai.main agar aaj a/ c open karti hu aur per month 5000 deposite karti hu to uski shadi ke samay (2028) main a/c balance approx kya hoga. Aur us time main sara balance withdrawl kar sakti hu.aur agar sara balance nahi kar sakti to balance amount ka kitna % withdrawl kar sakti hu?

Hi Neetu,

Aap apni beti ki shaadi ke time saara balance withdraw kar sakte ho.

Maturity value ke liye upar pasted table check keejiye.

sir mere beti 27-12-14 ko hui hai to kya mai bhi sukanya samriddhi yojana se jur sakte hai

Yes, aap bhi ye account khulwa sakte hain.

Nice encouragement & expectation is highly solicited by me.

I have two girls and want to open account for each one. is 150,000 total limit of all accounts or each account. I mean to say can i add 150000 for each girls account i.e 3 lacs per annum.

As per the wordings of the Circular – “the total money deposited in an account on a single occasion or on multiple occasions shall not exceed one lakh fifty thousand rupees in a financial year”, I think you can deposit a total of Rs. 3 lakh in two accounts.

Source: http://www.indiapost.gov.in/dop/Pdf%5CCirculars%5Csukanya_samriddhi_SB_Order_2.pdf

So, I hope the government keeps it Rs. 1.5 lakh for each account and Rs. 3 lakhs for two accounts.

I would Like to know, whether scheme provide additional tax saving above the previous limit of 1.5 Lac. for Ex. if I am depositing Rs. 20,000/ per year, so can I avail 1.5 lac+ 20, 000 = 1.7 Lac as tax saving amount.

No, total exemption u/s 80C stays at Rs. 1.50 lakh. It is just that this scheme qualifies for 80C deduction.

Thank you Shiv..!

You are welcome!

i had one quires about how much should be paid per month to my daughter can i open an account now for her, she is just 1 year child .

Yes, you can get an account opened for her. Your other query is not clear to me.

my daughter her dob is 10-12-2005 can i open an account for her now in the post office

Yes, your daughter is eligible for this scheme. You can get an account opened for her.

hello shiv

i need to no 1 thing jab ye scheme metaured ho jayegi after 21 years

so iske jo returns hoge usme koi tax deductd hoha ya nahi?

Hi Vinod,

As this scheme stands tax-free now, there is no question of any tax getting deducted. So, no TDS would be applicable.

my baby birth 06.06.2007 per month 1000/= deposit after 21 year maturity value……..

Please check the table above, it should be approximately Rs. 6,25,305.

meri beti ki age 9 saal h or 1000 per month ke hisab se 14 saal tak m 168000 rs jama karwa dunga or beti us time 23 saal ki ho jayegi mujhe us time withdrawal karna h mujhe kitne rs. milenge plz tell me thanks

Hemrajji, aap is scheme se do baar paisa withdraw kar sakte ho, ek baar aapki beti ke 18 saal complete hone pe balance amount ka 50% aur doosri baar, uski shaadi ke time ya is scheme ke 21 saal complete hone par 100% balance. 21 saal ki calculation upar table mein di hui hai, please check.

yaar Mere mind main sirf ek question h agar main monthly 1000 rs add karta hu to mujhe 21 saal baad 607000 ke around fully amount milega ya usmain se bhi govt kuch % cut karege.

plz baatao

21 saal baad government kuch deduct nahin karegi.

Sir merit beti 1 saal ki h. Main agar abi 1000/- rs. Deposit karu n next months se 500/-rs. Per month deposit karu to chalega kya? N Usk naam se 2 accounts open kr sakti hu kya? Thnxs

Is scheme mein har mahine deposit karna zaroori nahin hai, saal mein ek baar paisa deposit karne se bhi chalega. Ek girl child ke naam se 2 accounts nahin khol sakte.

who can withdraw money at maturity as it is not clear ,daughter by herself or natural\legal guardien if he\she survives till that time as in form he is giving name as subscriber of this scheme for her daughter..please clear with rule position

The girl child will have the right to the balance amount as she completes 18 years of age and becomes major.

Res sir,

Pls clear my one confusion more.. Can I withdraws full money from this account after complete the age 21 years of my daughter ?

No, you cannot. You can withdraw the balance only if your daughter gets married on or before that.

who can receive money or can withdraw money after 18/21 years daughter hersely only or father too? pls clear with the rule position because in this part only so much ambiguity is there

The girl child will have the right to claim the balance amount after 21/18 years or whenever she gets married.

Res sir,

My daughter date of birth is 20-06-2008

How many years I have to deposit money in this scheme?

When I withdraw full money?

You need to deposit money for 14 years and you can withdraw money when your daughter gets married or when your account completes 21 years.

Res sir ,

How can I withdraw full money before her (my daughter ) marriage ?

Pls clear withdrawl procedure before her marriage ….

It is not possible to withdraw 100% balance before your daughter’s marriage or maturity date on completion of 21 years from the date of opening this account.

We can invest upto 14 years of age of the kid or upto 14 years from the date of opening of account???

Say, my kid is 5 years. If I start now, do I have to invest till 2029, or till she attains 14 years, i.e., till 2024?

You need to invest for 14 years from the date of opening this account. Age of the girl child has nothing to do with 14 years. So, you’ll have to contribute till 2029.

if I manage 1st year 1000Rs & next year I have sufficient money to deposit approx. 12000Rs. this condition is tolerable. please clear this confusion?

Yes, this is perfectly acceptable.

sir, i want to know that my daugher is 8and 1/2 years old, if i deposit rs -12000p.a the what maturity amt may she get at the age of 21 years(suppose getting marriiage)( 13 yrs of policy, secondly can i increase the amt in future

Yes, you can increase the amount in future. Your maturity amount will vary according to your contributions every year and the rate of interest in future years.

sir, i want to know that my daugher is 8and 1/2 years old, if i deposit rs -12000p.a the what maturity amt may she get at the age of 21 years(suppose getting marriiage)( 13 yrs of policy, secondly can i increase the amt in future

Yes, you can increase the amount in future. Your maturity amount will vary according to your contributions every year and the rate of interest in future years.

Res sir,

At the time of her marriage how can I withdraw full money from this account? Will withdrawl application submitt before bank manager or marriage card show to manager for withdrawl ? Pls clear it…

I am not sure about the government’s requirements in that case, but I think a declaration from the girl child would do.

Dear shiv kukreja ji,

My daughter age is 8 yrs and if I invest in march 2015.till how many years I have to pay the amount.

You’ll have to pay for 14 years or till your daughter gets married, whichever is earlier.

I have 6200 rd in post office for 120 months weather my investment will attract any tds or not

There is no TDS on recurring deposits in a post office till date.

sir, if the girl child gets married at the age of 30 yrs, then will it be possible to withdraw the amount then? and if she never gets married , then how will she claim the money?

You can withdraw the balance as & when the girl child gets married or on completion of 21 years from the date of opening this account, whichever is earlier.

SIr 1 question agar birth sartificat m galat naam he or beby 1 saal ki he to khata kholne m konsa naam likhege kya naam badal sakte he

Ye aapko post office/bank se pata karna padega.

Sir.

Kya meray bank account say automaticly har month is yojna may deposit hotay rahayngay ya har month mujhko bank jana padayga ?

Aapko is account mein har month deposit karna zaroori nahin hai, saal mein ek baar deposit karne se bhi chalega. Is account mein automatic transfer karne ki suvidha abhi nahin hai.

Sir,

Can we use this scheme for boy child

No, you cannot.

Rate of Interest (9.1%) is fixed for whole tenure or flexible ?

It is variable, not fixed.

My daughter date of birth is 16/09/2006, I deposit 12000/= P.A. How many amount get after maturity.

Please check the table above – it is approximately Rs. 6,31,261.

sir

if my daughter gets married before the maturity period can i continue or leave the amount till the completion of maturity period of 21 yrs

No, you will have to compulsorily close the account as your daughter gets married.

sir,

is there any other scheme like this for boy …

sir

is there any scheme like this for boy child…

No, there is no such scheme specifically for a boy child.

My daughter age 8 yrs. I deposit 14 yrs means till 2029 .but my daughter age in 2029 22 yrs.this is marrige age.can I withdrawl money

You can withdraw the balance and close the account whenever your daughter gets married after she attains 18 years of age.

dear sir,

my child dob is 14.nov.2004 ..she is eligible to open an account?

Hi Bhaskar,

Yes, your daughter is eligible.

Sir agar kisi ladki ki umar 10 Sal hai To after 14sal he will get marriege at The age of 24 Yrs In that condition u told that parents have to pay only 14 Yrs nd rest 7 Yrs will be paid by govr. Us condition me jo parents pay krenge wahi milega n govt ke taraf se kuch to nahi milega.

Akhileshji, jab aapki beti ki shaadi hogi, aapko ye account close kar ke sara amount withdraw karna hoga.

Sir . My daughter’s DoB is 6/11/2005 . I have opened the SSA acount yesterday i.e., 19 jul 2015 .. The account needs to be operated by me for 14 years … Means she would be 24 years … After that (1) what percent will the govt contribute (2) if she gets married by 24 -25 years , as per norms , the account needs to be closed … will the amount to be withdrawn contain the government contribution… or will the interest added amt will b the maturity amount …. 3. If we let it continue till 21 years is that possible

Sir, my daughter age 8 mmonths, I didn’t apply birth certificate, its compulsory for open SSY.

Yes, it seems it is compulsory. No other option has been mentioned in the Circular in its absence.

Hi,

Thanks for the above information’s, I do have few clarifications, kindly help me in the same.

1. My daughter is 7yrs 11 months ,( say 8yrs ) if i start with 2000/- monthly, for next 14yrs ( she would attain 22yrs ), i would have contributed 336000/-, if she gets married in the age of 25yrs what is the amt i get ? is it 679749 ? or with interest of additional 3 yrs ( 22yrs – 25yrs ) ? can you pls give one example of the calculation so that i can calculate if their is a variation in my monthly investment.

2. Do we have to show a proof of marriage to withdraw the money after the completion of 14yrs or they release the money only after the marriage?

3. If any unexpected incident occurs for the Depositor within 14yrs, do the money which is invested is returned back or with interest ?

3. Can i combine monthly & yearly deposit ? eg- first yr i just pay 10000/- as one shot, and the next yr monthly small amts ?

4. Can we wait till 21yrs to withdraw the maturity amt even after my daughter gets married during the 17th yr ( her age would be 25 then ) ?

Thanks …. Jonsie

Thanks Jonsie,

1. Interest for 3 years would also be added to your approximate calculation of Rs. 6,79,749. So, with 9.1% annual interest, it would be approx. Rs. 8,82,719. What kind of example you need?

2. The money will only be released as the girl child gets married. Though the government has not clarified about the proof for marriage in case of withdrawal as the girl child gets married, I think a declaration from the girl child would also do.

3. The money will be returned back with interest.

4. No, you will have to compulsorily withdraw the amount and close the account as & when your daughter gets married. You cannot keep the account open beyond your daughter’s marriage.

Thanks for the clarifications Mr.Shiv,

I just wanted to know the calculation step. If you could pls….

Regards… Jonsie

It is a simple calculation in excel, nothing extraordinary I think. There is no variation with what you had calculated and with that amount the interest for 3 years is added.

Hi Sir,

A quick query.In case I pay money monthly or yearly at the end of 21 years i observe as per the above chart returns are almost same.Just trying to understand how because I was thinking If I pay monthly return at end of 21 years should be atleast 20-25% less than we pay premims yearly.Can you help me understand more how is the premium calculated.

Hi Ram,

I don’t know how you are calculating it, but I think you are calculating it with monthly payments made at the end of the month. Calculate it by making it beginning of the month and if you still find a discrepancy, please let me know.

What happens if the government changes, will this yojana still be applicable?

I don’t think any government would like to stop a good scheme like this. They would not like to face public ire by making adverse changes to any scheme. Even the current government has not stopped a poorly drafted scheme called Rajiv Gandhi Equity Savings Scheme (RGESS). So, be positive, go ahead with this scheme and enjoy the benefits.

The interest rate for current year is 9.1%. What happens if the interest rates fall in the upcoming year that is to say 7.2 or even low due to high sales of this policy in the market or some other reason ? How will the calculation being done at this time for say if I invest 15,000 pa for year (2015-16) sn the intrest rate is 9.1% and in the year (2016-17) if the interest rate falls (for eg. 8.4 %) so how this be calculated for year (2016-17). Please advise.

It is natural that we’ll have to base our calculations based on the revised interest rate set by the government every year. If the government decides to change its interest rate from April 1, 2015 itself, then we’ll have to change our calculations as well and the maturity amount will then differ from the amounts given in the tables above.

1000 rs ka monthly plan le rahe hai to 14 year bad aur 21 year bad kitna milega total kitna milega

Please check the table above, calculated maturity amount hai tables mein.

sir i mean suppose i have girl child with 10 yrs old after 14 yrs he will be 24yrs old he will be eligible for getting marriege in that situation i will have to withdrawl amount from bank. so there is no government interest will be added bcoz u told that in 21 yrs i have to pay 14 yrs and rest 7 yrs will be paid by govt . but i will withdrawl within 14 yrs.

Government will not deposit any amount in your account for the rest of 7 years. The balance amount after 14 years will earn interest for these 7 years.

it will be more profit for those girl who is less than 5 yrs am i right shiv sir

No, I don’t think age of the girl child makes any difference. It is the time period, timing of the deposit and the rate of interest which will make a difference.

sir,

Please clear my doubt

My daughter dob is 17-06-2008, if i open ssa in her name in 2015 for Rs 1.50 lakhs yearly then the completion of 14 years of account opening and her marriage age(21) will occur in the same year. When and how much i get the maturity amount?. Thanks

Hi Devak,

This scheme is for 21 years from the date of opening this account (and not till a girl child attains 21 years of age). But, when the girl child gets married, she will have to withdraw the balance and close the account. So, if your daughter gets married at the age of 21 years, only then you can withdraw the balance which would be approximately Rs. 42,88,898 at the end of 14 years from now.

Monthly deposit karne aur yearly deposit karne me kaun sa benefit rahega

Jo aap jaldi se jaldi start kar denge, usmein zyaada benefit hoga. I mean agar aap April mein yearly deposit kar denge to aapko zyaada interest milega as compared to monthly deposit.

sir…if the girl child never gets married , then how will she claim the money ?

Hi Pallavi,

In that case, 21 years is the upper limit. This account will get matured after 21 years whether the girl gets married or not.

21 years is from the date of opening this account and not the girl’s age.

In the booklet/ pamphlet issued by Head post office Guna (MP) it is written that account can be closed at the end of the completition of the 21 yrs girl’s age. and also I have clarified online talking in the live program “Your Money” on CNBC AWAAJ the expert has clarified that maturity is 21 years of the girl’s age. Mr Kukreja You can clarify from head post office Guna 07542 -255212, 9406914114 With your opinion people are getting confused. So it is better you confirm before advise anybody

Hi Rajesh,

Please check this link – http://rbidocs.rbi.org.in/rdocs/content/pdfs/494SSAC110315_A2.pdf

The link is of the passbook specimen, issued by the RBI. If you read point no. 10 under its salient features, it is mentioned – “The account shall mature on completion of 21 years from the date of opening of account”. So, I think I need not clarify with anybody as of now. If what you are saying gets clarified by the government itself, I’ll update it here with a post.

sir, if the girl child never gets married ,

then how will she claim the money?

My daughter date of birth is 15/03/2014, I deposit 12000/= P.A. How many amount get interest per annual

It is 9.10% annual interest. So, if you deposit Rs. 12,000 on April 1, 2015, interest amount will be Rs. 1,092 on March 31, 2016.

Sir, interest calculation finennencial year keep last main hoga kind after 1year

Yes, interest calculation financial year ke end mein hoga.

Sir

Can i transfer money through netbanking i the account has been opened in the same nationalized bank as of my account from which i want to transfer

res sir ,

my daughter is 2 years old ..can i open an account ..and what will be the maturity amount if i pay 1000 per year ..

i have one more query my niece is 9years old if her parents open an account for about 1.5 lakh per year what is the maturity amount ..and if they marry her at the age of 19 can they withdraw the amount or have to wait till she gets 21..please help

Hi Nitish,

Yes, your daughter is eligible for this account. For maturity amount, please check the table above.

Your niece can withdraw the whole balance if she gets married at 19.

Sir,

Suppose Me 15dt ko account khola monthly scheme me or meri agli installment dt kab hogi Sir,

agli kisti dene me late ho gayi to fine hogi kya or hogi to kitni hogi Sir.

Hi,

This is not a monthly deposit scheme. Aapko saal mein ek baar deposit karna zaroori hai, monthly nahin.

Sir, I have gone through the scheme. You’ve mentioned that the amount can be withdrawn on the maturity after 21st year, or on the girl’s marriage, whichever is earlier.

Whereas I have read that half the amount can be withdrawn before the 21st year.

Hi Milind,

50% of the balance can be withdrawn as the girl child attains 18 years of age. Please check this post, it has all the details – https://www.onemint.com/2015/03/03/sukanya-samriddhi-yojana-tax-free-small-savings-scheme-for-a-girl-child/

Dear sir,

A news published in Facebook about Kanya Samridhi Yojana that a girl child between 0 to 10 yrs can deposit 1st time 1 thousand and then 100 per month upto 21 yrs , after 21 yrs its maturity value will be 650000 this news true or false please clarify about this Yojana.

Hi Dilip,

It is a misguiding news, ignore it. Please check this post for all the details about this scheme – https://www.onemint.com/2015/03/03/sukanya-samriddhi-yojana-tax-free-small-savings-scheme-for-a-girl-child/

Dear sir,

My sister date of birth is 2/1/2000 can i start this scheme pls explain.

No, your sister is not eligible for this scheme.

Red Sir,

My nephew is mentally retarded, so if we want to withdraw money in between for any treatment, can we do.

Hi Nashrah,

Under special circumstances, like death or medical support in life-threatening diseases etc., you can make a request to prematurely close the account and withdraw the amount.

agar ladki 9year ki h to use kitne saal kist bharni padegi or last me kitne amount milega

14 saal paisa deposit karna hoga. Maturity amount aapke deposit amount pe depend karega.

Dear sir,

Can we take maturity value after girl child marriage. ??

Hi Puneet,

Yes, you can withdraw the whole balance as & when the girl child gets married.

Thank you so much for giving complete information related to Sukanya Samriddhi Account.

Great work Sir. No need to find anything else, anyone visit your blog. He will get the complete information about Sukanya Samriddhi Account definitely. Thank you so much for this great work.

hi,

please tell me that can I deposit different amounts of money in different months (or years) in SSA?

Hi Swapnil,

Yes, you can do so.

Kya main Central Bank of India me yeh account shuru kar sakti hu kya ???

Yes, you can do so. Updated list of banks is there on this post – https://www.onemint.com/2015/03/16/sukanya-samriddhi-yojana-updated-list-of-authorised-banks-to-open-an-account-specimen-application-form-passbook/

Sir wat b the return amount after completion of ths policys if v ll deposit 25000 per year

Please check the table above, it is Rs. 13,15,127 as per the table.

Sir my daughter age is 4yrs I will pay 4000 per month , my daughter gets 25 age I mean maturity period is 21yrs till that time if my daughter is not married I will get full amount or not with that money only I should do marriage to my daughter.

Srujanji, aapki query clear nahin hai.

sir,

what is the best time for opening sukanya acnt now as early as posible or april 1st 2015 as of now ican pay less amount only after 6 months i can pay more next

it is good to open in bank or post office next

we can earn more interest on depositing 1.50 lac on april 1st every year or by monthly instalment but how can both be same

1. I think you should wait for next financial year’s interest rate to get announced. If it is between 8.7% and 9.1%, then you should go ahead and invest in this scheme. If it falls below PPF’s rate, then you should invest in PPF.

2. It is better to open this account in a bank which provides the facility of online transfer, like Axis Bank, ICICI Bank, SBI etc.

3. You’ll earn more interest by depositing Rs. 1.5 lakh on April 1st every year as compared to monthly deposits.

sair,

I want, I open a account my daughter age 9 yer’s 2015 ,but if I died on 2019. when my daughter withdraw deposit amount. or continue the policy run by daughter?

Hi Supriya,

Yes, it is possible for your daughter to continue this scheme in your absence. She can pay on her own and keep this account active till maturity ore till her marriage (Aapki beti aapki absence mein ye account chala sakti hai. Aapki beti khud bhi paise jama kar sakti hai).

Plz describ tha yearly contribution scheam,that I select 8000 rs. Contributions and I deposit 1000rs.

Than I can deposit remaing amount 7000 in installment in a year plz clear my queri.

Yes, you can do so. Yearly contribution can also vary depending on your financial condition.

Sir,

My question is that in Sukanya-samriddhi-yojana scheme , in the 1st year if i deposit Rs 50,000 per month in 2nd year on wards can i deposit more or less the 1st year deposit amount.

can i deposit like this scheme 1st year Rs 50,000

2nd year Rs 20,000

3rd year Rs 40,000

Please clarify my doubts.

Thanking You

Nigam Adhikari

Yes, you can very well do that.

Sir,

I would like to be know that, Please confirm In Sukanya Yojana interest rate 9.1% only for first financial year or tenure of hole 21 years. if not for hole tenure of 21 years then Maturity calculate according changing interest rate on every year.

Please reply best of knowledge.

Thanks,

Rajesh Panda

9.1% interest rate is only for this FY. It will be changed every year.

If the deposits are made for, say five years, and then for some reasons no deposits are made, can the money paid to date be withdrawn (1) prematurely (2) at the end of 21 year term? Will the interest on the deposited money continue to be accrued till the time it is withdrawn?

Hi,

Firstly, you can withdraw the balance only on completion of 21 years from the date of opening this account or whenever your daughter gets married, whichever is earlier. In some special circumstances, the balance can be withdrawn prematurely. Moreover, the interest will get accrued till the time it is withdrawn.

Sir,

Thank you for sharing such information. If you could help me with the following query:

I have two daughters.

If I open two accounts, what is the maximum limit I can deposit?

Is it 1.5×2, i.e. 3 lacs or is it still 1.5 lacs.

I have not been able to get a proper reply on this query. Would appreciate if you can help.

Regards,

Swarup

Thanks for your kind words!

As per the Government Notification – “the total money deposited in an account on a single occasion or on multiple occasions shall not exceed one lakh fifty thousand rupees in a financial year”.

Source: http://www.indiapost.gov.in/dop/Pdf%5CCirculars%5Csukanya_samriddhi_SB_Order_2.pdf

So, I think it is Rs. 3 lakh for two girl children.

Res sir,

Pls confirm me, at present is this scheme avilable in sbi branches ?

Hi Chandan,

SBI will be servicing this scheme. But, I don’t know from when.

Dear Shiv khureja,

I have posted my query in your site. Please read and explain according my comment.

Thanks

Rajesh Panda

What is your query Mr. Rajesh?

sir

Is it possible for NRI to open this account for their daughters and is the matured value tax free. my daughter is 2 year old now if i invest 150000 how much she will get on maturity at the age of 21

Thank you

smitha

Hi Smitha,

It is still not clear whether NRIs would be eligible for this scheme or not. You’ll have to wait for more clarity on this.

what is the total maturity after investment ?whether the investment amoun is fixed or varying ?

Investment amount is variable as per your desire. Maturity amount will depend on your investment amount, month of deposit and the rate of interest (9.1% is not for the whole tenure).

Sir, after my elder brother’s death I married with her wife. Am I legal guardian of his daughter in this scheme? If yes, what are requirements (papers or something else).

Sir,

My Daughter”s Birth day.26/08/2002.May I open this sukanya samridhhi yojana.Please guide me. Thank you.

No, your daughter is not eligible.

Hi Shiv,

US citizens (PIO) are eligible to open PPF and SSY accounts?

Hi Ravi,

It is still not clear, you’ll have to wait for further clarity.

Sir, after my elder brother’s death I married with his wife. Am I legal guardian of his daughter in this scheme? If yes, what are requirements (papers or something else)?

Yes, you are a legal guardian for the girl child. You need to contact the post office/bank for the documentation.

respected kukreja sahab mera prashna hai ki kya government bhi suknya samridhi account me contribute karegi .one person told me govt.will contribute 12000/- per year in each year for 14 year.

Nahin Arunishji, Government is scheme mein contribute nahin karegi. Ye account PPF ki tarah hi operate hoga.

sir if rate of inttt will vary this not risky because locking period is too long. gov may have many excues for reducing rate. or is there will some specific measurement or condition for reducing or increaing intt rate

Hi Vijay,

There is a mechanism as per which the interest rates are set for the small savings schemes. So, I would not blame the government for reducing interest rates for all these schemes. I think the rates are already on a higher side for all these schemes and the government should not keep rates so high which creates an imbalance for the interest rates in the market.

Can an NRI (Indian Citizen) open Sukanya Samriddhi Account.

It is still not clear whether NRIs would be eligible for this scheme or not. You’ll have to wait for further clarity on this.

Hi Shiv, do we have any table or calculator wherein we can calculate returns as per the age of child.

Hi Harinder,

No, we don’t have it here.

SIR

ISME CALCULATE KE HISAB SE LIKHA HAI KI 1000/MONTH KAREGE TO 631000 MILEGE TO ISME 14 SAL TAK HI JAMA KARANA PDEGA YA FIR 21SAL TAK JAMA KARNA PADEGA PLASE REPLY

14 saal tak hi jama karna hai.

2004 date of breath aaj open karte ha to 21 years ho ne par mauchaurti valu Kay hoga so list batao

Maturity amount aapke contribution & rate of interest pe depend karega.

If I will open an account at the 5 years of my daughter’s age(this year),and if I invest rs 2400 annually,then how much I will get and when???

You will get the maturity amount after 21 years from today or when your daughter gets married, whichever is earlier. But, it will depend on the rate of interest which will be announced every year in March and also the timing of your contribution.

Dear sir

Meri bati ka birth 29 november 2014 h

Kaya ye yogna meri beti ke liye eligible h .isme monthly plan le ya yearly kese diposit kar sakte h monthly ya yearly kon sa better h

Hi Vikas,

Aapki beti is scheme ke liye eligible hai. Is scheme mein yearly minimum Rs. 1,000 dalna zaroori hai. Saal ke shuru mein deposit karna zyaada beneficial hai.

Dear sir

sukanya scheeme ke liye post office ya bank me se kon sa better raheg aur sbi aur pnb me scheem account open challo h kya h aur monthly plan aur yearly plan me kon sa better h

Thanks

Hi, as per the scheme it matures at 21 years of a girl child or her marriage whichever is earlier. If a girl don’t marry at 21 but Marries at 25years we will still get money at 21 years of age

No, this account matures on completion of 21 years from the date of opening this account (and not on the girl child attaining 21 years of age). So, in your case, you will get the maturity amount when the girl child marries at 25 years of age or 21 years from the date of opening this account, whichever is earlier.

Dear Sir,

In this year (2015) my daughter age 7 years , I will be doposited 12000 per year , when my daughter age 21 years , suppose after 14 years or marriage time, how much matuarity amount will be received .

pl support..

Thanks.

Arun Kr. Dhika

9899924925

Faridabad (HR)

Please check the table above, it is Rs. 3,43,112 as per your annual contribution of Rs. 12,000.

hi sir meri beti ki umra 4year hai. mai 2000 per month jama karana chahata hu.to meturiti par kitana melega.

Hi Dileep,

Post mein jo table hai, please usey check keejiye. Table ke anusaar aapko maturity pe Rs. 12,50,609 milenge.

Sir. Meri beti Ki age 9 year 5 month hai aur mai 50 per year invest karna hai aur uski age 21 ho jayegi to how much matuarity amount will be recived

Aapko har saal minimum Rs. 1,000 jama karna zaroori hai. Rs. 50 per year is not acceptable.

Sir, I need sample – filled application form…

Please check this post – https://www.onemint.com/2015/03/12/sukanya-samriddhi-yojana-sample-filled-application-form/

Dear Shiv Kukreja,

Thanks for all the information. My daughter’s date of birth is 27.10.2008. Please tell me where it would be beneficial to open the account in Post office or Bank (Public or Private) . And also tell me what is the best time to invest , mean which month.

Thanks Rupesh for your kind words!

I think it is better to open this account in a bank as you’ll get online transfer facility in banks. Moreover, with a bank, you can deposit money in any of the branches in India. Also, the sooner you deposit money in this account, the more interest you’ll earn.

Dear sir