Post Office Small Saving Schemes – FY 2015-16 Interest Rates – PPF @ 8.70% & Sukanya Samriddhi Yojana @ 9.20%

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

New Post for FY 2016-17 – Post Office Small Savings Schemes – FY 2016-17 Interest Rates – PPF @ 8.10% & Sukanya Samriddhi Yojana @ 8.60%

The Finance Ministry on March 31st announced the applicable interest rates for all the Post Office Small Savings Schemes, including PPF, Sukanya Samriddhi Yojana and Senior Citizens Savings Scheme (SCSS). These rates would be applicable for the current financial year, 2015-2016 and have come into effect immediately from 1st April, 2015.

Positive Surprise for Small Savers

To make these schemes more attractive, the interest rate for Sukanya Samriddhi Yojana has been increased to 9.2% from 9.1% earlier and for Senior Citizens Savings Scheme, the rate has been hiked to 9.3% from 9.2% earlier. The interest rates on all other schemes have been left unchanged, including PPF which is going to earn 8.7% for you this financial year.

At a time when interest rates are falling sharply and the Government is putting considerable pressure on the RBI to lower down its policy rates, this move of keeping small savings rates higher/unchanged has left me stunned. I did not expect such a move from a government which seems to me a progressive government as far as its economic reforms are concerned.

If there is a scientific method of calculating interest rates on these small saving schemes, then I think the current rates have been fixed abnormally higher. In the last 12 months or so, the yields on Government Securities (G-Secs) have fallen from a high of around 9.1% to 7.65% recently. Though keeping interest rates higher has left me disappointed, this move by the government would make small savers & senior citizens happier, for at least one more year.

The increase of 0.10% interest rate on Sukanya Samriddhi Yojana (SSY) should encourage more and more investors and parents to join this scheme now. In fact, the interest rate differential of 0.50% between PPF and SSY would make some of the investors to contribute more towards SSY now.

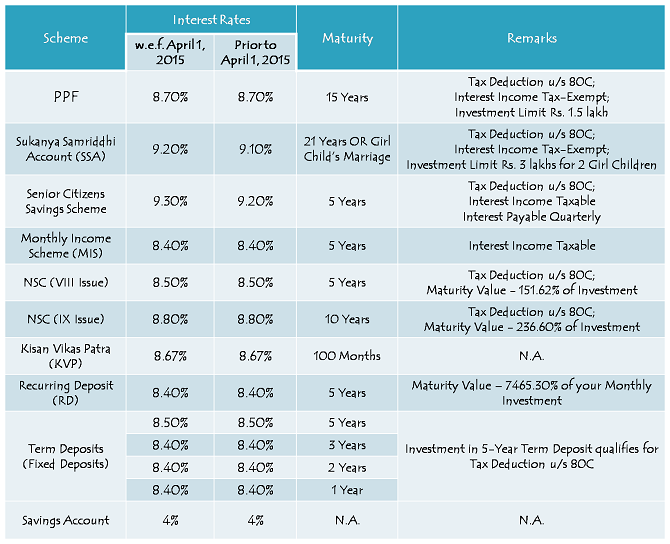

Here you have the table having all the small saving schemes with their applicable interest rates and tax benefits for the current financial year:

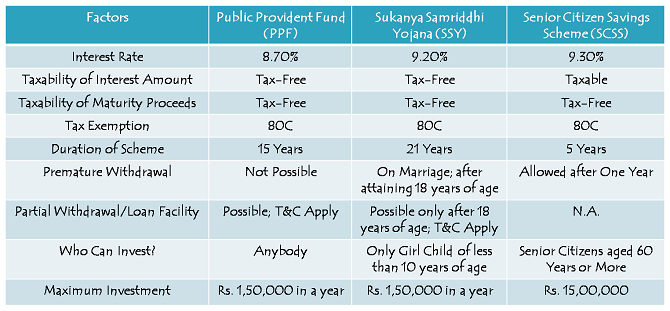

Public Provident Fund (PPF) – There has been no change in the interest rate offered by PPF, India’s most popular small savings scheme. PPF will earn you 8.70% for the current financial year as well. Interest rate will continue to remain tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Sukanya Samriddhi Accounts (SSA) – Sukanya Samriddhi Yojana accounts will carry 9.20% for the current financial year, 2015-16. I was expecting the government to marginally reduce the rate here, say between 8.80% to 9%. But, in a surprise move, they have actually gone ahead and increased the rate to 9.20% from 9.10% till March 31st. I think the government’s move will increase the popularity of this scheme.

Moreover, like PPF, the interest earned will be tax-free on maturity and the investment amount up to Rs. 1,50,000 will get you tax deduction under section 80C.

PPF vs. Sukanya Samriddhi Yojana vs. Senior Citizen Savings Scheme

Senior Citizens Savings Scheme (SCSS) – Senior citizens will also feel happy about the changes announced by the Government as the interest rate on Senior Citizen Savings Scheme has also been increased by 0.10% to 9.30% from 9.20% earlier. Though your investment amount will get you deduction under section 80C, the interest earned is taxable and subject to TDS as well.

Post Office Monthly Income Scheme (POMIS) – Once quite popular with a terminal bonus of 10% and then 5%, Post Office Monthly Income Scheme is getting more and more unpopular these days. As against MIS, investors are getting attracted towards bank fixed deposits (FDs) these days as they get a higher rate of interest, better liquidity and quarterly interest payments. Interest rate has been kept unchanged at 8.40% for MIS.

National Savings Certificates (NSCs) – 5-year NSCs & 10-year NSCs will keep earning 8.50% and 8.80% respectively in the current financial year. Also, your investment will earn you tax exemption under section 80C.

Kisan Vikas Patra (KVP) – Your investment in KVP can double your money in 100 months, which makes its effective annual return to be 8.67% if held till maturity. Investment certificates in this scheme bear no name and can easily be transferred from one person to another.

Recurring Deposits (RDs)/Term Deposits (TDs) – Interest rates on recurring deposits and term deposits have also been kept unchanged at 8.40% for all tenures, except term deposit of 5 years tenure which will yield 8.50% per annum. 5-year term deposit with a lock-in clause will provide you tax deduction under section 80C.

Post Office Savings Account – Your savings account in a post office will continue to earn 4% annual interest and interest amount up to Rs. 10,000 will be tax exempt under section 80TTA.

At a time when banks are already struggling to keep their credit growth in double digits, I think keeping interest rates higher on these small savings schemes is not a wise move. It will make it really difficult for the banks to lower their deposit rates and hence there will be pressure on their net interest margins (NIMs) and profitability. I don’t know what exactly is the logic behind this move, but small savers will definitely benefit out of it. You should take full advantage of these high rates till the time the government realises its mistake.

Are you sure sukanya samriddhi scheme is having EEE status ?

Which means interest earned and amount at maturity is not taxable.

pls confirm.

Yes Yogesh, it is confirmed, Sukanya Samriddhi Yojana qualifies to be an Exempt-Exempt-Exempt (EEE) scheme.

Do we have any schemes for 1 year baby boy

this is great news

Yes, it is a great feature which is making this scheme quite popular as well.

Is there any scheme for boys, age -12yrs

scheme looks very similar to PPF and its advantage is that it has higher rate of return.

Yes, that’s right!

NRI can open this account ?

It is still not clear Yogesh.

My daughter is 4yrs old ..I need to deposit money for 14years till she is 18years right and then maturity will be at 21years of her age ..

No, maturity will be after 21 years from the account opening date or when your daughter gets married, whichever is earlier.

My guess is that government will come up with formula to offer high coupon rates for upcoming tax free bonds. It will be like G-sec+1%.

Hi Amit, how have you guessed it, any indications?

can a husband can invest 15 lacs separately & her wife can invest 15 lacs in a post office senior saving scheme

can a husband can invest 15 lacs separately & her wife also can invest 15 lacs separately I a post office senior citizens saving scheme

Yes, both husband and wife can have their individual investments of Rs. 15 lakhs each in Senior Citizens Savings Scheme.

I would like to invest Rs 900000/-. Which one is better MIS or SCSS. Please advise.

I think SCSS is better than MIS.

sir ye bataye ki meri bati 8 saal ki ho gaie h agar uske sadi 18 ke hone per karte h to pase mil jayege kay

Hi Geeta,

Yes, aapki beti shaadi ke time saara balance amount withdraw kar sakti hai.

If we exclude Senior Citizens Savings Scheme (SCSS), SSA has the highest interest rate among all small deposit schemes. And from the words of Mr. A.K. Chauhan, Joint Director of National Savings Institute, we can expect that Sukanya scheme will have preferential interest rates in future also.

This is indeed a very good initiative & Govt. is trying their level best to promote this scheme. Hope to see more such initiatives in coming days.

Yes Manidipa, it is a good scheme and hope we have such good schemes from the government.

I .e I m deposit 100 only .after 18 yrs old how much.

Please any reply me

Hi Raaz,

Ye post check keejiye, ismein maturity values di hui hain – https://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

Sir…agar hum 10sal kai age mai karvate hai to is plane ka maturity kab hogi….agar eucation ka liya pre mature withdraw karte hai to interest milega..

Hi Surya Prakashji,

Is scheme ki maturity account khulne se 21 saal baad ya phir beti ki shaadi hone pe hogi. Agar beti ki age 18 saal hone pe education ke liye withdraw karte hain to 50% balance withdraw kar sakte hain, jispe aapko poora interest milega.

my daughter’s age is one month so plz can you tell me in 21 years what I will get if I deposit 500 per month.

Hi Shiv,

With Rs. 500 per month deposit, you will get Rs. 317,327 @ 9.20% per annum after 21 years –

https://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

Sir….

Maine post office me iske lia enquire kiya,

Wahan batya gaya ki is tarah ke iskim ka koi letter nahi aaya hai.

Sir, plz. Iske bare me detail se bataye

Kahan khulega….

Hi Alok,

Ye account post offices aur banks mein open ho raha hai. Agar post office account nahin khol raha, to aap kisi bank mein ja ke pata keejiye.

hello sir mujhe apni beti ka SSA account khul wana hai meri beti 3 years ki h abhi may monthly 1000 deposit kar skate hu please help sir Thank You.

please call me 9867587961 Shiv kukreja thank you

Mere husband ne 150lac yearly wala sukanyasaridhi yojna bharte h. …

Ab mai v ek or 12000 wala isi beti k name se sukanyasaridhi yojna krna chahati hu kya ek hi beti k liye alg. ….alg dono mammi papa kr skte h…….plzzzzzzz sir answer me

Pleas give me some idiyas my girl 5years

which is best,secure post scheme for age 55? investment amt 4 lakh.preference for cumulative scheme & pre maturity facility.

Sir,

I have 2 girls.Elder one is 7yrs and younger one is 3yrs. Can I do the scheme for both.And one thing what will happen if I am not able to deposit continuously in every month???? In that case can i continue and will my daughter get the benefit after 21 yrs.

Hi Jayant,

Both your daughters are eligible for this scheme. Also, you need not deposit money every month in this account, once in a year is sufficient.

Dear sir maine 15 may ko account. Open kiya to uski next deposit 15th June ke bad hogi ya June start hone ke bad b kar sakte h please clear kare

Hi Ravi,

Is scheme mein saal mein sirf ek baar deposit karna zaroori hai.

can nri invest ? any clarity now ?

Hi Yogesh,

NRIs cannot invest in this scheme.

Sukanya Samriddhi Yojana is one of the best plan/ Offer suggested by Honourable PM Modi G for the girl child.Its best suit for all the medium as well as lower medium class public in India. Thanks………

Request : Please make Post office online , so that premium can be easily paid for the SSA. Banks are still not much more aware about this scheme.

Raman T

Thanks Mr. Raman for sharing your views & suggestions!

Hello sir mujhe apni girl child ka samridhi karvana hai. Mera account hapur dist mai hai

Jagdishji, aap apne nazdeek ke kisi post office ya bank mein ye account khulwa sakte hain.

Sir, meri do betiya he to kya Mai suknya samrudhhi yojana me dono ke naam se account open kar sakti Hu.. Plz guide to me..

Hi Babita,

Agar aapki betiyon ki date of birth December 2, 2003 ya uske baad ki hai, to aap ye account unke naam pe open karwa sakti hain.

Yes you can.

Hi sir mujhe meri beti ke liye palan samjhana h aap bataye sir ji

sir

can I deposit the amount for my daughter having girl child 2 yr of age.

but my daughter is living in USA.

Hi Dr. Jain,

NRIs/OCIs are not eligible for this scheme.

Dear Mr. Shiv Kukreja,

Can you please guide me ways and means how to do monthly remittance in Sukanya Sammridhi Account.

1 – Should I remit cash/cheque in the same post office where account is opened or any other near by post office in my SSA?

2 – Can I do a fund transfer through internet banking (NEFT)

3 – Can I remit cash or cheque in any bank authorised by India post in the Sukanya Samriddhi Account

Looking forward for your guidance..

Hi Mr. Arun,

1. You need to deposit cash/cheque in the same post office where account has been opened.

2. Post offices do not offer online fund transfer facility.

3. No, that is not possible.

It is better to get this account opened/transferred to a bank which is offering online transfer facility.

sir pl tell me that my douther age is 01 month 17 days upto till date so this policy i can take it.

Hi A B Sarkar,

It is an ongoing scheme and there is no last date as such for this scheme.

whether TDS on Recurring Deposits of post office is applicable for year 2015-2016?

Hi Nilesh,

Post Office Recurring Deposits (RDs) are exempt from TDS, even for FY 2015-16.

i would like to invest Rs.1070000/-

which one is better MIS or KVC, please advise

i would like to invest Rs.1070000/-

which one is better MIS or KVC and , please advise

Hi Mintu,

You cannot invest more than Rs. 4.50 lakh in MIS in a single name. MIS is for 5 years, as compared to KVP which is for 100 months. Rate of interest is 8.40% payable monthly with MIS, as against 8.67% payable on maturity with KVP. Rest you need to take a decision.

Hallo. Sir my daughter is 10year old.if I open a ssy account for my daughter.how much amount I wihdraw in her 18year for his marriage.if I deposit 12000?per year

Hi Binay,

It is difficult to calculate it as it depends on your timing of deposits and annual rate of interest.

Sir, what is better!! Fd in bank or post office for five years!! Also Rd in bank or post office!!

Hi Pooja,

Rate of interest is the prime factor for deciding which is better.

Sir,

I am newly married and would like to have some money in future.After all the payments i can save 1000, so with this amount is there any possibility for me to deposit, if so what is the deposit scheme and benefits??Thanks in advance in helping out..

Hi Tarun,

You should go for mutual fund SIPs with such an amount.

Sir ,

I am college student and I want to deposit max. 500 per month till 3 yrs . Is there any scheme related to this ? And hw mch interest I wil get on this deposit..

Plz suggest me

Hi Ashi,

You may go with mutual fund SIPs with such an amount.

sir . i want to know about tax on interest of senior citizen scheme. if total interest income is less than income tax slab . then interest is tax free?

Yes Mr. Lalit, if total interest income is less than income tax slab, then you are not required to pay any tax.

sir ji

mani pnb me pata kiya tha to wha par maneger ji bola ki ye hamari head office me hi khulega

Hi Suneshpal,

PNB ki sab branches ye account open nahin kar rahi. Aap kisi aur branch mein check keejiye, ya phir post office mein.

Mutual fund SIPs ? Sir Please elaborate

Sir Maine apni baiti ka ssa mai a/c khulvaya hai baiti ku age 8 year hai

Sir my daughter DOB..20/02/2007

Can she withdraw all amt after 20/02/2028 ?..

No Bhaskar, 21 years will be calculated from the account opening date and not from your daughter’s DoB.

Hi sir. If I deposited one thousand in a year and deposit same one thousand each for fourteen years how much my daughter’s gate after 21 year’s

Hi Harjeet,

Please check this post for maturity values – https://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

sir,

How many senior citizen account opened in calender month

Hi Sudhir,

Your query is not clear to me.

Sir.

Meri beti ka date of birth -18.05.2009 ka hai . our mai 2000/. Thousands/ month deposit karta hu to 21 years ke bad kitna milega.??

Hi Mukesh,

Please check this post for maturity values – https://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

Start one year RD in post office by agents for bissnessmen

dear sir,

is it possible the following ?:-

1)i want to transfer my SSA from Post Office to Allahabad Bank.

2)i want to balance check by any other post office.

3)i want to check my balance at a glance by using mobile or any other option. if it is possible than what is the process ?

Hi Satya,

1. Possible

2. Not Possible

3. Not Possible

Sukanya Samriddhi Yojana is one of the best plan/ Offer suggested by Honourable PM Modi G for the girl child.Its best suit for all the medium as well as lower medium class public in India. Thanks………

Request : Please make Post office online , so that premium can be easily paid for the SSA. Banks are still not much more aware about this scheme

Thanks Mr. Tiwari for sharing your views. I agree that post offices should provide online facilities and be made more efficient.

Sir.

July 2010 me r.d. per kitne % tha.

Hi Yatendra,

Hamare paas 2010 RD ka data nahin hai.

Hello,

Is it possible to open SSA account in two different location by two different people with same name with one year difference. Dad and Uncle, Dad or Mom. If no, How it is possible for them to check. Even PAN no ll be different. What are consequences if we open account and found later.

Amit,

I would not like to respond to such queries.

Sir, mai ye jankari chahiye yadi hum 12000 ek sath deposit kare to in par intrest @ 12000 par milega ya 1000 per month ke hisab se milega bcoz mai chahata hu k 12000 ek sath deposit karu plz tell me ne milta haito hum 1000 per month deposit kare

Thanks!

(J P Singh)

09411951964

Jitendraji, agar aap Rs. 12,000 ek baar mein jama karte hain, to aapko poore Rs. 12,000 pe interest milega.

Hi sir jankari leni hai agar ek hazar mahina dalte hai to kya amount milega bitya ko date of birth hai 7/1/2006

Hi Chandan,

Rs. 1,000 mahina daalne pe aapko 21 saal baad approx. Rs. 634,654 milega @ 9.20% per annum – https://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

Sir Namaste mai anjali meri daughter 5month ki hai Mai 2000 ka monthly jama karungi tu 21 year me kitna maturity hoga plz reply me

Hi Anjali,

Rs. 2,000 monthly deposit karne pe aapko 21 saal baad approx. Rs. 12,69,307 milega @ 9.20% per annum – https://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

hello sir meri do beti hain 3year n 6year me is yojna me kkitne saal tak paise deposit karoo or kitne year hone par mujhe sara amount milega

Sir aap apna no. De skte h.

Bhaailog pls help.mi mujhe fixed deposit karna hai 1 lakh ka Jodouble hue kaunsa scheme aacha hogaa aurr kyaa calcuation hogaa aur scheme ka naam kya h pls tell mi

Hi Nicky,

Post Office ke Kisan Vikas Patra (KVP) mein invest karne pe aapki investment 100 months mein double ho jaayegi.

Sir can an NRI invest in post office schemes in India.Please Reply.

No Mr. Bajaj, NRIs cannot invest in post office small saving schemes.

sir… i can save Rs. 1000-2000 per month from my salery.Which one schemes best for me & tell me Also its banefits. …plz reply

Hi Mohit,

Every investor has his/her own risk profile and financial goals. You also should invest your money as per your risk profile and financial goals. If you can take risk and have long term financial goals, then investing in equity mutual funds is a good option. If you don’t want to take risk, then Sukanya Samriddhi Yojana (SSY) & PPF are good schemes to invest.

i have one boy, 3 years old. i want to know the saving schemes with high interest and safety in Indian Postal Service for him. kindly guide me for the above.

Hi B.Gomathi,

I think PPF is the best small savings investment for a boy in post office.

Best rd scheme monthly 5000 in five yrs large intest schme

Sir mai sukanya samriddhi yojana ke bare me janana chahata hu. Callculation bhi

Bataiye Suresh, kya poochna chahte hain?

Sir,

i want to invest around 10 lakh for lomg term,as bank FD rate now gives lower interest rate,therefore where should i invest like KVP,NSC or post office term deposit.

Regards,

partha

i have good business ideas , my whatsapp number is ( 7014287798)

Abhi intrestrate% kya hai. Our intrestrate uper niche bhi ho sakta hai.kya.

SSY ka current interest rate 9.20% hai aur ye increase/decrease ho sakta hai.

Whether Post office Recurring deposit accounts will also attract TDS provisions with effect from 1st June 2015?

No Shriram, Post Office RD accounts have been exempt from the new TDS rules.

HI

Is it not possible to withdraw the amount at the time of education at the age of 16 /18 years of child in SSY?

Yes Rajneesh, you can withdraw 50% of the balance amount as the girl child turns 18.

Good morning sir.

I want to know best saving scheme with max interest rate if i want to deposit 1k-3k per month and if i have need of money in this deposit period then i can get my saving with good interest rate.

Hi Akash,

None of the Post Office savings schemes allow you to withdraw money in-between easily. So, it is better to invest money with a bank for easy liquidity.

i had a 3 years girl child and i can save minimum 500 rupees per month so what type of savings can i do my future . If save rs 1000 per year in ssy what amount did i get after 18 years so please suggest me how i can save for my future

Hi Afroz,

Sukanya Samriddhi Yojana (SSY) is a good scheme for girl children. So, you can go with that. But, with SSY, you’ll get the maturity amount after 21 years from the account opening date and not 18 years.

Sir

I am investments for Rs -1000 per month

is it possible to ssy account .I am 30 years old my child about 6years

Yes Suryajeet, aapki beti SSY account ke liye eligible hai.

Sir want 30000 taka per month for my family support but i don’t know how can do it . First i want to save money from my salary for those amount per month. Plz tell me how can i do this. I may be help me. Thanks.

Sir

I am investments for Rs.1000 per month SSY.

What is known as nsc 5 yrs and 10 yrs I don’t get to know correctly is it safe and after maturity within how many months I can expect my amount

It is safe if you keep the certificates safe. Makesure to note the nsc certificate number and the date of issue and keep it safe. By chance if you miss the original certificate the certificate number details will help you get the duplicate certificates

Hi Baranish,

It is 100% safe and on the maturity date itself, you can get the maturity cheque made.

Sir, ppf 15 year k liye hi hota h ya 25 year ka bhi hota h. M 10000 rs per month invest kr skta hu ppf jyada best hoga ya Rd.

Ppf me 15 year or 25 year pr final kitna rs milega or Rd me 5 year after kitna milega if 10000 rs per month invest kru to.

Hi Naveen,

1. PPF 15 years ke liye hota hai, but aap apne PPF account ko 5-5 years ke liye extend kar sakte hain.

2. I think PPF investment is better than an RD.

3. PPF aur RD ke maturity amounts aapki contributions, rate of interest aur deposit timing pe depend karte hain.

sir, i have around 2 to 2.25 lakhs rupees. i want to invest it in postoffice but dont know what is the best for me because i belong from medium class family.so kindly tell me whats the best saving scheme for me in postoffice.i want at least 20-25 thousand per year as interest. is it posssible? then tell me…else tell me best interest rate point of view..

thanks.

Sorry Vikash, we do not entertain such individual queries here on this forum.

few years ago…i had open an acount of 50000 rupees in postofffice(dont know the scheme name). i am getting per month 999 rupees as interest. i want to know is this exicts now..? if yes then i want to know can i deposit 2 lakh under this scheme to get more interest..?

plz tell me sir, i am waiting for your response..else tell me another best option as best monthly interest scheme point of view

It must be Post Office Monthly Income Scheme (MIS) as only post office MIS provides monthly interest payments. This scheme still exists and you can invest in that.

If you invest 100 rs in nsc 5 years bond, after the specified 5 years your bond certificate which was issued by postoffice will give you rs.151.62. If you invest the same 100 rs in nsc 10 years bond after 10 years you will get 234.35 rs. To encash the certificate you have to go to the post office and have to give the certificate and copy of your id proof on or after the maturity date specified on the certificate. Date of maturity and the amount you will receive will be mention in the certificate while you purchase it

My father being a Senior Citizen wants to invest Rs. 15 lakhs. Would it be better to invest in Senior Citizen Saving Scheme in Post Office? How much can the interest rate come down in this Scheme in future? Is this Scheme also available in Banks and is the Interest rate the same in Banks?

Hi PC,

1. SCSS is a good scheme, but it is an individual decision to invest or not in this scheme which you people need to take.

2. Rate of interest remains fixed in this scheme for the whole tenure.

3. This scheme is not available in banks.

Hi Shiv,

Regarding the last point you mentioned,

SCSS can be done via designated banks as well.

Oh Sorry, yes it is available in banks, it just slipped off my mind. Thanks Prasun for pointing that out!

sir i want fix rupee1,20,000 in indian postal . what will be the rate percent and what will be the charges ? sir if i wish to withdraw my money before tenure what amount will be deducted. i want for 3 years.

Which scheme you want to invest in Alok?

m sure FD is best, with small amount.if a person plan to get a bike after one year, he should open FD, before one year, because then he will be prepare for the installment,tension free.

Thank you for your comments.

I have been going through various articles and came across the news that the Interest rate on SCSS was increased to 9.3% from 9.2% from April 1, 2015. What does this mean. Is the Interest rate now fixed for 5 years for those who join in this Financial Year? Then those who joined last year would continue to get 9.2% only.

Another site informs that this Scheme is also availed in 24 Banks including 1 private bank viz. ICICI Bank.

Kindly clarify.

Thanks

Hi PC,

The interest rate will remain fixed at the ongoing rate for the duration of 5 yrs in SCSS. In case the rate is changed in the next FY, it wont affect your current investment.

You are right; SCSS can also be done via the 24 banks you mentioned. Please contact the banks for detailed info.

dear shiv my post rd account of 6000 monthly is maturing next year can I extend it by another 5 years and I am getting 8.40 % from 2011 so will the interst rate will change or it will remain same

Hi Nitesh,

RD account cannot be extended. You can start a fresh RD account.

hello sir

i want invest 1000 or 1500(monthly) in post office which schema is best for me in short-term goal (2years or 5 years)

Hi Kranthi,

It depends on your risk appetite and financial goals which scheme you should invest in.

PO FIXED DEPOSIT INTEREST RATE IS SIMPLE OR COMPOUND?HOW IT IS CALCULATED?WHAT IS THE INTEREST OF RS.1000 IN ONE YEAR AND TWO YEARS?

Hi Mr. Prasad,

Interest rate on Post Office term deposits is compounded quarterly. For 1-2 years, rate of interest is 8.4%.

TDS deduction on SCSS in Post Office can save by submitting 15H ?

Sir,

Mere beti abhi 8 sal ki hai. Main har month Rs.500 jama karenge to beti ko 21 sal bad kitina Rs. Milaga.

Hi Kailash,

21 saal baad aapki beti ko Rs. 317,327 milenge @ 9.20% – https://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

I want to know some good investment scheme which can be useful for my parents in future time.

Hi Naveen,

PPF, Senior Citizens Savings Scheme, equity mutual funds etc. are good investments for long-term.

Tnk sir

Sir

Hamari 3daughters hain hum unke naam at a time 1-1 lakh fd karna chahte hain iske liye acha faydemand scheme bataye. Ladkika age 6 – 4 – 2.

Hi Ramesh,

Sukanya Samridhi Yojana is a good scheme for girls.

Sir my daughter is 13years old and type of scheme will better when she comes around 21st age

Hi Shabeer,

Your query is not clear, please reframe it.

Sir

National savings scheme mein 2-6years ke naam deposite hota hainke nahin? Is scheme 10years ke depositepar maturity amount kitna hoga & iske fayde bataiye pls.

Hello sir

I want to invest like 1crore in post office scheme. Which scheme will fetch me d highest rate of interest.

Hello Sir

I want to invest over 1 crore in post office scheme. Can any of d schemes can fetch me a return of more than 9.5% annually.waiting 4 ur reply.

Hi VK,

None of the post office schemes can generate more than 9.5% return for you.

Hello sir

Mai Rs1.60.000 post office me rakhna chahti hun…kon c sceme mere liye achha rahega..

Hi Leena,

Which scheme would suit you depends on your requirements, time horizon, age etc.

TDS deduction on SCSS in Post Office can save by submitting FORM 15H ? I had submitted this question on 14.09.2015. But, you have not give any reply till date. Kindly, give reply as early as possible.

Yes Mr. Aarup, you can submit Form 15H in post office to request Post Office not to deduct TDS on your interest amount.

Many many thanks for your reply.

Hello sir, main 1,50000 ka fixed deposit karna chahti hu 1 year ke liye please suggest bast plan

Sorry Neha, we do not provide advice in this manner here on this forum.

Sir my 1000000 ten lakhs deposit karna chahatha hu monthly interest kith na hata hai 5 to 10 years thak scheme ka name please I am intrest invest only post office please reply me through mail

Sir,

I am ravinder and i want to open account in post office for 5 year’s So tell me what is the best plan for me

Hi Ravinder,

Please check the table above and select the best plan as per your requirements, risk appetite and financial goals.

does the interest for senior citizens are higher or the same in post office saving schemes??

Hi Bala,

It is the same across all the schemes.

Sir mene 15 sep 2015. Ko rd post office me karwayi h 5 years k liye kitna tax lagega

Hi Rakesh,

Tax aapke tax bracket ke according lagega.

Hi,

I want to deposit 5 lacs for 5 years Post office schemes. Which one is better NSC for 5 years or Term Deposit for 5 years? Both have same interest rate of 8.5%. Will any of the two schemes have TDS?

Hi Lakshmi,

NSC will have cumulative interest option and will also provide 80C tax benefit, so I think NSC is better than term deposit.

Thanks Mr.Shiv. Is there TDS for NSC? Can i nominate for NSC? But i am a house wife and can non-employees invest in NSC?

Hi Lakshmi,

There is no TDS on NSC. You can nominate as well for NSC. Non-employees can also invest in NSC.

Thanks Mr.Shiv for your reply. Can i open the NSC online? Or i have to open only at Post office? And will i get the amount immediately if i cancel it like we get from banks when closing FD or it will take some days to get the amount from Post office? And is there any limit on how much i can invest in a NSC in one year?

Who can open simple saving A/C ? Can a candidate having 10 years old open a Saving A/C ?

Savings account can be opened by any Indian citizen, including a minor.

Good Evening sir,

Mai monthy Rs.5000 investment karna chahata hu.Ek mera PPF a/c Bhi chal raha hai mujhe koi esi scheme bataye jisse muhje 10 year mai 20Lac Earn ho jaye. No . risk earn conform.

Kyo ki mai Pvt. Naukari sales line mai karta Hun age 39

Kuldeep singh

Agra

Hi Kuldeep,

Rs. 5,000 per month invest karke 10 saal mein Rs. 20 lakh risk-free earn karna possible nahin hai. Ya to aap apna contribution increase karo ya phir expectations kam karo.

Sir gdevng, l have no idea to deposit or invest….. Sir I want to deposit 50000 rs on name of my son. Pls gv me an idea which one is best

Hi mynu,

You can get a PPF account opened or do an equity SIP for your son.

Sir ,please can you tell me what is the rate of interest for Recurring Deposit in 2015????

Hi Dr. Swamy,

It is 8.40% for the current financial year.

Hi…nice article. .. may I know that out of two scheme. ..(1)MIS+autoRD & (2) NSC 5yr… which one is more rewarding…thanks

Hi DDS,

MIS + Auto RD would be more rewarding.

Can I open Sukanya Samriddhi Yojana (SSY) for my sister’s daughter. Or only child has to open

Hi Yadu,

You can get an account opened for your sister’s daughter by becoming her legal guardian.

Hello sir

Meri beti 4yr ki h maine suknya smridhi yojna me 2500/ par month deposit kr rha hu 18yr & 21yr bad kitna Rs. milega.

Hi,

18 saal ke baad aap accumulated balance ka 50% amount withdraw kar sakte hain. Account open hone ke 21 saal baad aapko approximately Rs. 15,86,634 milenge @ 9.20% – https://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

hi shiv,

my mom want to deposit 1 lacs for 1 year or 5 years Post office schemes. Which one is better for her MIS or SSY or any other for 1 0r 5 years please tell me? my mom age 56 year what is the best scheme for her. if any other scheme in you mind please tell me. We are belong in village area post office in uttarakhand. and please mention in your reply all scheme which she has eligible with 1 and 5 years fix deposit interest rate .

Thanking You

Hi Maya,

For 1 year, I think Bank FDs are good as there is no volatility in returns. For 5 years, I think debt mutual funds should do better. But, debt funds do not provide any fixed returns.

Hi dear , You can search the total amount after 14 or 21 Yr in the attached chart. This calculation is based on the current rate of interest decided . The actual total amount will be increased at te maturity time.

Hope to solve Your doubt .

Raman thakur

7048193563

Thanks Raman!

only sent me savings schemes

Please send the all savings schemes in a chart.

Hi Subrata,

You can save the table above as an image and take its printout, if required.

My daughter is 4 years old If I invest 25000 a year in SSY how much maturity amount will I get when she turns 21?

Hi Savio,

21 years must be counted from the date of account opening, and not when your daughter turns 21.

Tax Deduction Limit U/s 80C for Senior Citizen Savings Scheme, applicable in AY 2015-16, may kindly be confirmed.

The investment limit has been specified at 15.00 Lacs.

But Tax Deduction Limit has not been specified.

Please clarify if Tax Deduction Limit U/s 80C for Senior Citizen Savings Scheme, specified for AY 2015-16 is 1.00 Lac or 1.50 Lacs.

Hi Suprio,

Tax deduction u/s 80C for AY 2015-16 stands at Rs. 1.50 lakh.

Sir,

ppf a/c kaha se khol sakate hai , kam se kam kitana invest kar sakate hai?

Dear as per your culculatr chart maturity if i deposit 1000 per month for 14 year than I WL get maturity 6.25Lac as per interest Rs 9.2% but this interest is aplicabal only this financial year So how to insure that meturiti 6.25Lac if interest Rs dicris than what I will get.

Hi

Muje Apane Bhai ki daughter ke liye money save Karna he to muje koi baby girl ke liye sceam send kajiye Abhi mere Bhai ki daughter 1 month ki hai please I want best planning money save

CContac

Hi

Muje Apane Bhai ki daughter ke liye money save Karna he to muje koi baby girl ke liye sceam send kajiye Abhi mere Bhai ki daughter 1 month ki hai please I want best plae

Hi

Muje Apane Bhai ki daughter ke liye money save Karna he to muje koi baby girl ke liye sceam send kajiye Abhi mere Bhai ki daughter 1 month ki hai please I want best planing money save

Contact 09723121040

sir,ppf mai 10000 per annually deposit karta hun after maturity kitna milega

Sir. I am paying every month but sometimes 1000/ n sometime 5000/. Behalf of my daughter poorvi.It is OK. May I pay online.pls advice me…

Sir

I an expatriate aged 59 working in QATAR now.I want to return in 2017 Jan and have a retired life.I will have a corpus of 1 crore by then.Can you suggest to me a programme where I can earn a monthly income of 9 – 11% without tax deductions for a 5 year period subject to renewing after 5 years .

If I invest 14000 per month in post office rd for 5 years hw much I get after maturity

Ppf Kay hai

Please tell the status of TDS deduction at the time of maturity of Term Deposit in Post office

Dear Sir ,

I wanted to gift to my grand children’s in Post Office Small Saving Schemes – FY 2015-16 Sukanya Samriddhi Yojana @ 9.20%.

1) Chahna R Gopani ….. I the Nanaji ( Chana is my Daughter’s Daughter aged about 2 year)

2) Shanaya D Vanani.. I am grandfather ( Shanaya is My Son’s Daughter aged about 4 month).

Can I open account in above scheme ? If yes then what is the procedure & Documents required. I will be thank full, for your guidance. As I am retiring from the service on 31.12.2015.

Thanks in advance for your guidance

Regards

Nagji Vanani

VADODARA-Gujarat

hello Sir,

My daughter age is 8.5 years(DOB:28-07-2007). If, i want to take SSY in this year dec 2015,i want to pay monthly 2500 RS upto 14 years i will pay. After that my daughter turns 22 y so i want to draw money for her marriage .How much amount i will get immediately after 14 yeras payment period? Can you plz calculate & tell………….

sir maina apni bati account opne kawana hai kya karu

s.k.s yojna yrer12000 /-14/21= banifit

I want to invest rs 5 lacs pls suggest under which should i invest

Sir,

Please let me know tds % or amount on scss interest rs.20k

Sir meri beti one year ki hai uski ocanunt khulwAna hai .to kya dacument lagega aur ese kaha kaha khulwa sakte hai

thanx

sir : keya interest par tax lag ta hai ya nahi ? agar han to bhi aur nahi to bhi dono ke lie karan bhejie. please

Sir I want to invest money and wants Monthly interest I much money should I have To deposit

Sir, I want to know that senior citizens saving scheme interested rate will announce every year? If so what it’s trand decrising or increasing for last five years?

Thanking you

What is interest in time deposit as on 20/12/2015 for senior citizen

1000 par months jams karne par 21 sal bad kitana milega

1000 par months jama karne par 21 sal bad kitana milega

Sir, Interested to invest 5,00,000/- in 10 years scheme.

My question is – At time of maturity (complete withdraw of money to saving account)

A- is it added to Income of that year?

B-is it necessary to declare in I.T. return, if yes, in which section to save the tax from tax slab?

Sir,

Interested to invest in 10 years scheme.

My question is-

A-At the time of maturity (complete withdraw to the saving account)

is it added to income of that year and tax will deducted as per tax slab?

1ooo par months kitne sal tak jama karna hoga

Hi sir.

Sir me 20 saal ke liye ppf me 2000 monthly daalun to kitna milega.

sir meri beti 2 Sal ki hai mai per year 150000 jama Karne par 16 ka bad kitne paisa mileage?

hi, my name is ALTA F AHMAD, and i want to know that i have to invest 5,00,000 but i do not have any idea please suggest me some idea.

My dougther born on 27March 2003 can i get chance to open SSY ,? if yes, then give idea ? how many money i invest per year ?thank you

Sir,

I am bijay kumar & I want to open a SSA a/c for my doughter please reply me what I do for this & where is found the form for SSA a/c.

Hello Sir, I have a girl child 3 year old.I want to invest RS. 10000-12500/-pm in SSY scheme. Pls tell me what’s the amount i receive at the time of maturity.

hi i blessed with baby boy recently.. shall i invest this savings.

i have a post offive rd i have pay RS 2000 per month.I will the amount till 5 years .I have paid a 8 month premium if i want to discontinue the policy before maturity then i will get the amount paid or not

i have a post office rd i have pay RS 2000 per month.I will the amount till 5 years .I have paid a 8 month premium if i want to discontinue the policy before maturity then i will get the amount paid or not

Dear sir pls mujhe bataye mei 1000 rs monthly deposits karunga sukanya samirdhi scheme m to mujhe 14 year deposit Karna h ,21 year m kitna paisa milega.

Hello, i had opened sukanya acc in post office and want to transfer the account in pnb , is it possible???

Please send me calculations SSY….girl child…7 and 10 years…Rs.1000 pm.

Dear sir .

1000 par month deposit Karane par kitane Saal deposit karan aur kitan milega.kitane Saal me use withdrawn kar sakte

maine 14.12.2016 ko 1 yr td me jama kiya iska pre maturity abhi le sakta hu ya nahi. post office me kaha gaya ki 6 months ke bad hi milega. 6 month locking wala rule kab se lagu hua hai

deposit date 08.12.2015 aur 14.12.2015 hai . galti se14.12.2016 type ho gaya hai march me mere daughter ki sadi hai

Sir. I am self employ man. Can I open three rds in post office of 5000 each in joint with my wife. Is these will be tax free or not at the time of maturity.

Dear sir i shall be retiring from Govt public sector undertaking in the year

2019 oct. I would like to invest around 50,00000,/- for my further day to life. As no pension is available to me in this organization. Please suggest any saving scheme/plan where by i can get substantial monthly interest amount to carry on with life.

Pl advise Thankyou

regards

aksharma

Sir agar mein early 12000 deposit karta hi tho 14years me in kit a deposit karma hoga

Sir

Can i open this account in idbi bank.

Sir when will banks start this scheme

Hello

my daughter age now 5years how to open this a/c

Sir meri ladki 06 saal ki he, to mere ko pesa uski14 saal ki age tak hi bharna he ya jayada tak

dear sir,

can i open this a/c for my cousin sisters name ?

what between the deference post office and bank for this a/c ? (i mean interest rate)

how can i recieved this maturity amount in my a/c?

how can i link my saving bank a/c to SSA a/c therefore all installment auto deducted by my saving a/c

which is better… savings account or RD??

sir my daughter age is 7 years and i opened the ssaccount if i save yearly 12000 rupees, so how much i can earn the age of her marriage. Is it possible if her marriage age is in 20years, so the policy runs only 13 years can i get that ammount proper marriage time. Please given me the details.

i want know five year saving plan

Dear Sir

I have deposit under RD scheme Rs-8000/- PM for 5 yr. from may-2013. I want to know how much amount deducted from my maturity value under taxation at the time of maturity. And how much amount I get during Maturity.

Please say how can I save the deducted amount (taxable amount) if deducted under rule.

thanks

p.s.deo

Dear Sir meri beti ki age 01 month hai agar main 1000 per month Sukanya Samriddhi Yojana mein 14 saal tak jama krta hoon to mature kab hogi

Firstly I really appreciate your efforts to guide ppl like us to do the small savings wisely .

But I have a problem that my daughter is 13 years of age now and is not eligible for sukanya Samriddhi yojna which is really impressive so can you please suggest me sth parallel to it which is tax exempted and helps me to do good savings for her college years . An investment for 5 years . I will be really thankful to you

Sir,

I want to know that what can i open an account under SCSS by INDIA POST as I am a retired person (VRS holder) at the age of 54 and VRS benifits has been recieved by me on 31/03/2016 from U.P government

sir

I was open RD acct in post office rs 3000/-pm on

31mar 2011.may I know what is the amount after 5 yr (after maturity(.

Interest rates reduced. Check out http://blog.webcalculatorz.com/2016/04/07/ppf-interest-rate-reduced-from-8-7-to-8-1-effective-april/ for more details

hi,

me apni didi ke beti jo 9 years ke hai uske liye Sukanya Samriddhi Yojana me account open karna chathi hu kya me kar sakti hu?? procedure and minimum amount bata sakte ho??… .

I have opened SSA account in post office during last year (2015). monthly installment is Rs.1000.00. whether this scheme is applicable for Income tax deduction????.

Sir,meri daughter abi 1year ki hai uske liye kon si scheme me invest kiya jye .jisse uske feature me kam aaye ..please guide me…

Dear Mr. Shiv Kumar,

Thank you for compilng aii the details re post office saving schemes, though it is overdue for updation.

However one finds glaring omissions of ” NSS 1992″ as well as “NSS 1987”

I had sent an Email one month ago to ‘pmg_mr’ enquiring about NSS1987 status and details re taxability but there is no responce till date inspite of reminders. Local post office also is not in position to give the details barring updating its pass book with the interest accrued for the previous year.

HI SIR MERI SISTER SHE IS 10 TH COMPLETE 5YEARS DEPOSITS KOUNSI BENFIT RAHEGA PLEASE REPLY

HI SIR PLEASE TELLME 5OR 6YEARS SAVINGDEPOSIT SCHMES .MORE INTREST AND 1LAKH ABOVE SCHMES.PLEASE REPLY

Sir mujhe 4 sal me apbi sister ki shaadi ke liye 10lac rupay chahiye ap btaye mai kitna investment kru

Plz suggested me sir

sir maine post office me ek rd khola tha jisme mai monthly 2000 rs deposit krta tha.kuch din dposit kiya uske bad kisi reson se kr nhi paya.sir kya mai wo depisit paisa nikal skta hu ya nahi

2.2.2008birthday h to useuse to use passs kb milega ???

Sir,

My annual income is 4 lac,unmarried age 25 wish to save 3000- 6000 per month, which policy will be better for me? only one or two three separate policy need to start? Please suggest me.

Regards

Krishna

meri beti 3 sal ki hain or maine pahle hi sal 12 hajar jama kara diye hain to ab aage kam ya jyda kra sakte hain. please reply me.

Can i get tax benefit if my father takes SCSS .

Hi Sir,

Help me in getting answer on following question regarding ;Sukanya scheme: . On Maturity amount will Recieved in fathers account or daughters account.

Thanks

Umesh kumar

dear sir

plz tell me the best short period investment scheme for students with lowest investment. now my age is 19yrs i want best returns in low investment as my income is low.

Sir,

The maturity value of NSC for Rs 10000/- has been shown as Rs 14761/- with rate of interest as 8.1% compounded six monthly, which should have been Rs 14864/-. It appears that interest has been computed as compounded yearly. You are requested to take up the case with appropriate authority for correction in maturity value.

I have one girl 10 year old want to save money please confirm.

Sir me per month karib 10000saving kar sakta hu. Mujhe 5years me return chahiye.

Mujhe konsi sceam me deposit karna chahiye aur kitna 5years me return milega.

Plz tell me

pradhan mantri thank,s..but int.low,pls nest….

sir humne rs100000 ka nse liya hai par kaise proof hoga ki ye shi hai please tell me

I am intranceted

I have a son of 2 year ,2 month old . I would like to invest some amount for his future and has already taken a lic and abpy upto 1000rs and now my other issues are would i purchase a nsc/kvp/ppf or any other best investment plan for his future because am a single parent and earning only 12,000pm

Can I open sukanya account of my daughter her birth date is10-2-2003

Dear portal , i want to ask about sukanya samriddhi yojna , that maximum deposit from our side is 150000 rs, in fifteen years , so we have to deposit this much in fifteen years , that means 10000 per year , & what is the starting stage to withdraw the amount , if we want use this amount for personal use of our girl. kindly clear all the details about this scheme. so that i can open the account for my daughter.

Best Regards,

Mukesh Joshi

Sir.

I keep small amount fixit system…which one is good schem..less then one hundered twenty thousand pls advise me

Sir if I deposit 5000/per year how much I get back when my daughter is 21yrs

If any schem for 1 year old baby girl

Sir if I deposit 6000 / per year how I get back when my daughter I’d 21 years

Sir have any scheme for 1 year old baby girl

my baby boy is 1 year old. i should be invest in fd Rs. 50,000/- for 15 year

pls suggest scheme & benifits after 15 year?

Is there any scheme for boy child

sir my son is 11 yr old suggest mi any scheme which would be useful for his education

hi, any scheme for 1 year old baby boy.

if i deposit Rs 10000 . with baby boy name how much amount i will get after 21 years

Any saving schemes for 8year girl.

Sukanya samrudhi yojana is for Girl child only who are below 10 years. You can choose it which is best among all investments.

Iam 28 years old suggest me any 2 year plan which is suitable for me

This scheme is only for baby girl

Rs. 1000/- to be deposit in each month or each year ? For 10 year is it correct ?

Dear sir, I m looking for my one year old baby girl investing scheme in post office please sir send me the details if something is in your knowledge

dear shiv post rd account can be extended for another 5 years year to year basis for the same interest rates on the opening time my agent is saying that isn’t it true dear shiv can I extend my rd account for another 5 years at the same interest rates

Sir mere beti ki Date of birth 22/7/2012 air main ne 17 /4/2015 KO sukhanya yojan main open ki thi main ne meri beti ka Jo account per month 500 ke hisab se open ki hoon tu uska meri beti KO 21 saal ke baad kitna milega plz info plz account KO 14 year deposite Karna hai ya beti ke 14 year hone tak

14year take jams karna padega

It is very good plan

Hi, very informative article.

I am a prospective investor and was looking for profitable options to invest. I wanted your views about Peer to peer lending and is it a viable option to invest?

Which account is small saving account in post office

Sir,

Kindly tell me

1) Can I transfer SSA fm Post office to SBI.

2)If yes then what would b charges/docs/procedure.

3) How can I claim tax rebates, by showing copies of SSA PASSBOOK?

4) Can I deposit in post office in any other state with same a/c no.

5)Can I link post office a/c with SBI a/C for online trx.

6) Can I get a/c statement of my deposits in post office through online,

7) In case of loss of passbook, can I get all details fm post office

Kindly provide few light on my queries

Regards

Achhi he Salem save gerl.

Good

Any good scheme for boy up to 5 years…..plz suggest……for the same.

After retirement name best available schemes where rate of interest is higher and money is safe. The money can also be withdrawn at any point of time as n when required.

Also suggest long period investment schemes and schemes where we can keep some money in liquid form for day today expensea.

If I pay a 1500/- per month of SSA on my daughter…after 18years how much amount I Will get?

After 14 yr Rs 509812/- & after 21 yrs Rs 937957 /- . After 18 yrs apprx. Rs 7 lacs.

Yah count karna Galt hai har year Ka alg-alg byaj hoga teble ke anusar nai milega.Har year % gatta hai badhta nahi hair.

if any good scheme to my son please suggest me

My baby girl age is 5 Year, and second baby girl is 10 Year age,I pay monthly 1000 per month, how much benefite 18 Year age.

Ssy me koi nischit % nahi hai yah dawn hei hota jaeyga .

is Sukanya samruddhi yojna also for baby boy ?

suggest.

1)Can I transfer SSA fm Post office to SBI.

2)If yes then what would b charges/docs/procedure.

hi, any scheme for 1 year old baby

if i deposit Rs 1000 . with baby boy name how much amount i will get after 21 years

I just love this plan thank you so much for the explanation with the above chart…..

From long time I was searching scheme

But this scheme is just awesome….?????

Very good plan

Sir muje koi achi scheme btaiye jisme ma monthly saving KR saku.. 10 yr thk ke liye

Meri beti 8month ki hai agar mai hr mnth mai 1000daugi 14 sal to mujhe kitna milega 21year ko

Sir,

What is the applicable rate of ineterest on R D Account (Post Office)for the financial year 2017-18 and interest is credited monthly/quarterly/half yearly

Sir, meri beti ka dob 25.1.12 hai aur Maine uska sukanya account 10.8.17 Ko opening 2500 rupees per month se karwaya beti ke 21 years hone par use kitna milega.

Na

Sir meri ladki 2018me 7year ke ho gayi hai Sukanya Samruddhi mekitne year tak paisa dalna padega