Indian Oil Corporation (IOC) Offer for Sale (OFS) – August 2015

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

The government has just announced its decision to sell its 10% stake in Indian Oil Corporation (IOC) through Offer for Sale (OFS) route. OFS will take place on the stock exchanges on Monday i.e. August 24th and will have approximately 24.28 crore shares for sale to the investors.

Here is the link to the Notice of Offer for Sale issued by the Ministry of Petroleum & Natural Gas to the stock exchanges. 20% of the shares on sale will be reserved for the retail investors and they will get a 5% discount as well on the allotment price or the ‘Cut-Off’ price, whichever is higher.

IOC Offer for Sale Details

- Issue Type: Offer for Sale (OFS)

- OFS Opens & Closes: Monday, August 24, 2015

- OFS Bidding Time: 9:15 a.m. to 3:30 p.m.

- Floor Price: Rs. 387 a share

- No. of Shares Offered: 24,27,95,248 Equity Shares

- Lot Size: 1 Equity Share

- Minimum Issue Size: Rs. 9,302 Crore

- Proposed Listing: NSE and BSE

- National Stock Exchange (NSE) LIVE OFS Link

- Bombay Stock Exchange (BSE) LIVE OFS Link

Floor Price – The government has fixed Rs. 387 as the floor price for each IOC share in the OFS. IOC’s stock price fell by 0.72% on Friday to close at Rs. 394.85 on the National Stock Exchange (NSE). So, the floor price of Rs. 387 has been fixed at a discount of 1.99% to its market price, which would fetch a minimum of Rs. 9,302 crore to the government.

Shares on Sale – The government currently has 68.57% stake in IOC. After this OFS, the stake will come down to 58.57%. A total of 24,27,95,248 shares will be sold by the government in this OFS, out of which 20% shares i.e. 4,85,59,050 shares will be reserved for the retail investors investing up to Rs. 2 lakh.

20% of OFS & 5% Discount for the Retail Investors – Unlike Dredging OFS, in which the government was expecting a muted response from the retail investors and hence offered only 10% OFS shares to them, 20% of the shares offered in this OFS have been reserved for the retail investors. Again, the government will give a discount of 5% to the retail investors. This discount will be given to them on the price at which the retail investors successfully bid in the OFS or the cut-off price set by the government, whichever is higher.

Brokerage – Unlike IPOs, stock brokers levy brokerage charges on these OFS transactions. These charges are normally higher than the rate of brokerage investors pay on their routine transactions. So, if the allotment price is fixed at say Rs. 390, the retail investors will get it at Rs. 370.50 a share plus applicable brokerage charges and taxes thereon. So, the retail investors should consider these charges in their overall cost of acquisition.

Cut-Off Option – Made compulsory by SEBI recently and introduced with the PFC OFS, the ‘CUT-OFF’ price option will be there in this OFS as well. But, in the absence of an upper price cap, I think this option is of no use in increasing your chances of getting allotment. I think SEBI should introduce an upper price cap for the retail bidders in these OFS or some other innovative method of bidding should be worked upon.

Only a Single Day OFS – IOC OFS will remain open for a single day only and that too, during the trading hours of the stock exchanges i.e. between 9:15 a.m. and 3:30 p.m. If successful, you’ll get the shares credited in your demat account by Tuesday.

Bidding will start on the stock exchanges at 9:15 a.m. on Monday and you can check the LIVE bidding status on the websites of the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

How does an OFS process work?

If you are investing in an OFS for the first time and want to know more about the process, here is the link to check the details about it. If you have any query regarding the process, please share it here, I’ll respond to it as soon as possible.

How to invest?

You need to contact your broker to know how it is facilitating the bidding process. I think most of the broking firms must be providing the investment facility through their online platforms. If you don’t have access to the online platform, you should contact the customer care department of your broker and get your bid placed through telephonic confirmation.

Fundamentals of IOC

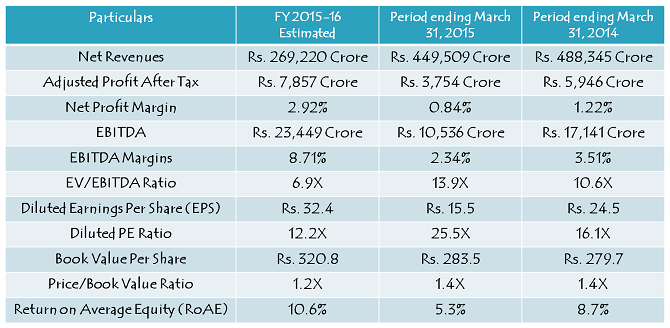

For the financial year ended March 31, 2015, IOC reported net revenues of Rs. 449,509 crore as against Rs. 488,345 crore for the year ended March 31, 2014. The company reported profit after tax (PAT) of Rs. 3,754 crore for the financial year ended March 31, 2015 as against Rs. 5,946 crore for the financial year ended March 31, 2014.

In the current financial year, the company is expected to see a turnaround in its financial performance due to falling crude prices, reduced subsidies and most importantly, flexibility in setting retail prices of petrol & diesel. The company is expected to report a very healthy EBITDA of Rs. 23,449 crore as against Rs. 10,536 crore it reported in the previous financial year.

At Rs. 394.45, the stock is currently trading at 12.2 times its estimated EPS of Rs. 32.4 for FY 2015-16 and 1.2 times its estimated book value of Rs. 320.8.

Should you invest in this OFS?

Firstly, I think this is one of the best times for the government to sell its stake in oil marketing companies (OMCs) like IOC, BPCL and HPCL. Global crude prices are down and down beyond almost all of our expectations. If crude prices stay below $60-65/barrel levels for a meaningful period of time and the government remains committed about keeping petrol/diesel prices market-driven and reducing subsidies beyond current levels, then I think IOC is attractively valued at these levels and could potentially reward its shareholders with 20-30% returns in the next 9-12 months time.

But, a sharp reversal in crude prices or unfavourable decision making with respect to the retail prices of diesel, petrol, LPG, kerosene or subsidy sharing could pose risks to its stock performance.

What is the Best Strategy to successfully get IOC shares allotted and also make some reasonable profits?

Firstly, you should analyse the fundamentals of the company. Based on your analysis, you should decide whether you want to bid for its shares or not. If you decide to go for it, then you should consider the fact that IOC OFS issue is relatively a bigger issue as compared to the earlier ones. I don’t think it will get as bumper a response as REC or PFC or Dredging OFS got. So, the retail investors should not remain in a hurry in placing their bids at too high a price, like beyond Rs. 400 or above.

Best strategy is to wait till as late as possible to analyse the bids at various price points, IOC’s stock price movement during the day and place your bids accordingly. If the retail quota does not get fully subscribed by 3 p.m. or so, then it is best to place your bids checking the ‘Cut-Off’ price option.

In case of a healthy subscription, I think bidding between Rs. 392 and Rs. 397 could be the best strategy for the keen bidders. But, let me be clear that it will not ensure IOC’s stock price from falling below Rs. 380 in Tuesday’s trading session, which could happen due to profit booking or the number of sellers outnumbering the number of buyers by a huge margin.

To be on a positive side, a genuinely good response to the OFS and some noticeable improvement in the market sentiment globally could push its price up in the days to come.

Instead of buying in OFS of IOC at 368 (retail price) it is 100 times bettet to invest in REC at 253 in secondary market. With a severe crash which is certain on Monday (after dow crashing 500 points on Friday) one can easily catch REC at 240 to 245. Remember just 4 months back how all of us missed out and felt sad at not getting REC for 319 price. Even at time everybody was so comfortable with its financials like 22% return on equity less than 1% GROSS NPA etc and rightly so. Now the same jewel available at 22% discount to OFS retail price. Let us not waste hard earned money in unreasonable OFS . Mark may words on Monday LIC will be forced to subscribe to save the costly IOC OFS. Hath kangan to aarsi kya aur padhe likhe ko Farsi kya. JAAGO INVESTORS JAAGO. Soch kar Samaz kar Invest kar.

I agree with you Sanjay that REC shares are very attractively valued at these levels.

In March 2014 ONGC &OIL were alloted IOC shares @ 220. Now in just 17 months how come 75 % rise in OFS price (68% rise for retail OFS) when the fall in crude is just 40%· Moreover latest qtly profit jump is simply based on inventory gains a one time event. How smart to bring OFS just within few days of abnormal qtly profit figures. NO ULLU BANOING. People are no longer mesmerised by such trick.

If crude prices stay below $60-65/barrel levels and the government remains serious about keeping petrol/diesel prices market-driven & reducing subsidies, I don’t think it is richly valued at these levels. In fact, share prices of BPCL & HPCL have risen beyond IOC’s share price and rightly so. Also, it is natural for the government to sell IOC’s shares at the most opportune time. Should the government sell SAIL share or ONGC’s shares at point in time? I don’t think so.

I am new to investing, If i bid through my HDFC sec account at Rs. 387 at around 10am on 24th aug, would i be assured of the shares? Or is the OFS also same as normal trading shares, Prices keep fluctuating throughout the day? What price should I quote to guarantee shares? Please help.

Also let me know how offer for sale works and how should retails investors bid for it.

1. No Mayur, bidding at the floor price early in the morning does not ensure successful allotment.

2. OFS is not exactly same as normal trading and it is not exactly same as FPO/IPO either. Here is an old link to understand the OFS process – https://www.onemint.com/2012/12/28/offer-for-sale-ofs-process-explained/

3. I think no strategy guarantees a simultaneous successful allotment as well as guaranteed profits.

4. I’ll try to share my view on the best strategy soon in the post above.

This is going to be very interesting. In my opinion, on what I have read so far, the following things are in favor of investors:

1) Cheap valuations and add 5% discount on top of it. The stock is trading at less than 10 PE.

2) This issue is 10 times bigger than PFC. Allocation will most likely happen at floor price.

3) The stock has already corrected from its highs.

4) Oil prices are falling across the globe and OMCs are likely to get benefitted. Hence OMC stocks may be in demand.

5) IOC’s recent results have been very good. They have posted excellent numbers, but the stock has not moved to factor in the results, on the backdrop of OFS coming around.

6) This OFS is a huge, more than 9000 crores! It will take a lot of investors to pump in good amount of money to get it fully subscribed. Still the size is almost half the size of Coal India OFS that happened earlier and retail investors made a lot of money. Post the OFS Coal India rallied for few months from 358 to 450ish levels. Its only recently that the stock has came down.

The following things are against the investors:

1) The recent history of PSU OFS is not very encouraging. Investors have lost their money.

2) IOC has a debt of around 52000 crores. Would one really want to invest in a company that has huge debt?

3) Oil prices in general do fluctuate a lot. So that’s an added volatility.

4) Markets are in bearish phase right now. Global sentiments are negative. Any small rally that happens, quickly gets sold into.

So to conclude, if the stock falls 3-4% tomorrow, then its better to buy a small quantity from markets itself, rather than from OFS. The fall may become steep after 3PM. The final decision should be taken after analyzing the situation after 2PM.

Thanks Veeral for your inputs!

IOC is currently trading at Rs. 383.40, down 2.90% and also below the floor price. It looks extremely difficult for the issue to get fully subscribed, both in the retail category as well as in the non-retail category. If this OFS fails, then the stock will see a sharp fall today & tomorrow. Probably global fall has happened at a wrong time for the government.

I read in the IOC OFS document that, if the OFS is not fully subscribed, and if people bid in the 5% discount price range, they could get allotment. Which means:

Floor Price = 387

Discount: 5%

Discount Price: 367.65

If you bid at 367.65 and if the OFS is not fully subscribed, you can get an allotment at 367.65.

To be on the safer side, if one is absolutely bullish on IOC, he/she can apply for a small quantity at 367.65!

Yes, that’s right.

I personally feel given a choice between IOC and REC , REC wins hands down. Also remember REC is cum div Rs.2.70 (Final div) Further full year div is.9.50 for REC vis a vis 6.60 for IOC. Though these shares belong to different sectors investment should flow where the reward is best. In this context I give a thumbs down to IOC.

Between IOC and REC, I agree with you REC is very attractively valued. But, that doesn’t make IOC a richly valued stock to own. Market sentiment is extremely poor, but things are not bad for IOC at this point in time. Future movement depends on the government policies and global market trends.

Hi Shiv

probably chasing you in all the post :-). Now I am totally confused on cut off price. If that is not the minimum price on which the shares are allocated and neither that guarantees the share allocation to retail investors then what is it and why that option given to retail investors ?

Hope you’ll be able to clarify

Thanks

Vikash

Hi Vikash,

Cut-Off price could be the minimum price on which the shares get allocated, but it definitely does not ensure allotment. This option is there for the investors who want to get the shares allotted at the price determined by the seller (government in this case). But, I think Cut-Off price is a misfit in the absence of a upper price cap.

This OFS is not at all cheap. Iam not all impressed by the latest qtly results which are boosted by one time gains. Tomorrow LIC is going to become the BAKRA. Just wait for 1 day and the fiasco will be out.

Do we know how the price is trending now?

Thanks

It is already trading around Rs. 380-381.

As predicted this OFS is complete failure. Actually it was common sense behind such prediction. On Friday DOW has fallen by 500 points, so at least 800 points fall in sensex is common sense. So govt should have cancelled the OFS on Saturday itself. Instead it went ahead and fixed up an aggressive pricing as if people are fools. Those day of dhoti lota investors are gone. Investors are now completely savvy and cannot be taken for a ride. If any sense is still left the OFS should be cancelled right away otherwise LIC will be made BAKRA and hit with entire 9500 crores costly OFS. It is yet again proven that COMMON SENSE IS THE MOST UNCOMMON THING. To add fuel to the fire the DOW futures are down another 500 points. So tommorow another 800 to 1000 points fall likely. Time to look at some jewels in IT and pharma which shall be the prime beneficiaries of the sharp fall in rupee. REC is mouthwatering.

This OFS is definitely heading towards a failure. It seems some big institution like LIC has already put in a big bid to buy shares in the OFS. This is despite of the fact that market price is trading at Rs. 380-381 and floor price is Rs. 387. Most likely it is the LIC which has placed this bid.

Retail portion has not so far been covered 10% . So every chance is there to get allotment if we apply at floor price. I assume issue may get fully subscribed at the last hour . If we get the shares at Rs.387/= which will be equivalent to Rs.368/(after 5% discount) , not so bad . But my concern is that European market are not recovering at this hour , so downtrend of the stock may continue tomorrow. The stock may also go ex-dividend on 4th sept(dividend =Rs.6.6/per share) , that may be a plus point

A sharp fall in its price tomorrow is definitely on the cards. Only thing which can avert this fall is the rate cut by the RBI today after market gets closed or tomorrow morning before market gets opened.

Shall I buy OFS with RI set as Market Price ? Good or bad?

I think it is not a good idea to subscribe to this issue with the current market sentiment. IOC stock should go down sharply tomorrow.

oh crap!!.. I think my trade has been placed..and I am unable to discontinue that. How do we generally know if we have been allotted the shares ? Is it like normal stocks ? can we sell them when we get them back?.. Sorry for basic questions as I m new to this

I have placed order as Market Price for 25 shares.

Whatever has happened, has happened, you should not be overly worried about that. You can sell them as soon as you get them in your demat account. You’ll get a 5% discount and that should cover your losses otherwise.

yeah thanks Shiv !!

IOC OFS is fully subscribed and that is not a great news I think. It seems it has been bailed out by LIC only. Stock price has closed down at Rs. 378.10 as against the floor price of Rs. 387.

Clearing Price for the retail category as well as the non-retail category is Rs. 387. Its stock price touched a low of Rs. 378.60 on the NSE and closed at Rs. 378.10. With US futures down another 4%, it seems there would be another black trading day tomorrow.

Let’w wait to see tomorrow morning !!! DOW down 1000 points ! Recovered a bit .. but there may be blood bath tomorrow !

The Dow has recovered and its only down by about 200 points around noon ET. Lets see the market close. But the US market is fundamentally sound and its going through the overdue correction(plus global sell off) that did not come for the past few months.

Eventually the session closed down by 588 points. But it recovered half the points.

IOC trading up 9.6% at Rs. 415 🙂

Yes,IOC proves today that movement of stock price is really unpredictable and that is the beauty of stock market.

I agree !!

Today IOC closed at 394.75+16.50 (+4.36%). So long term, looks like it could work from the floor price level.

Dow is up by 330 points in the morning session.

Dow closed down 204.91 despite China cutting interest rates. That is one more example of unpredictable stock markets. Timing its rise & fall is just not possible.

No post for a long time. Really need your views on the current market scenario. Its quite freaky for some of us who are in MFs with even Debt funds showing signs of burst, a scenario we never envisaged 🙁

What you expect in current market scenario. How you see NIFTY in next one year