This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Volatile stock markets are again testing the nerves of Indian investors. People, who invested in stocks or equity mutual funds in the hope of some quick fixing by the Modi government, have been left disappointed with the kind of returns they have earned in the last one year or so. Some investors are headed towards safe fixed deposits where interest rates are continuously falling, while others are looking to invest in debt funds.

But, the recent problem with JP Morgan debt funds, in which the fund house restricted redemptions in two of its debt schemes – Short Term Income Fund and India Treasury Fund, has once again shaken the investors’ confidence in debt funds as well.

So, what do investors do in the current economic scenario? Stay in cash? Or invest in gilt funds and tax-free bonds only?

It is said that the best time to invest is when there is a panic. But, the problem is that it is very difficult to figure out whether the panic is based on some kind of reality or it is just a perception and a short-term phenomenon.

After a gap of one financial year, tax-free bonds are making a comeback this financial year and NTPC is the first public sector enterprise (PSE) to launch the public issue of such bonds from the coming Wednesday, September 23rd. As the company is confident of raising the desired amount very quickly, the issue will remain open for just seven working days to get closed on September 30th i.e. the next Wednesday.

Size of the Issue – NTPC has been authorized to raise Rs. 1,000 crore from tax free bonds this financial year and it has already raised Rs. 300 crore by issuing these bonds in private placement. The company will raise the remaining Rs. 700 crore from this issue.

The issue size of Rs. 700 crore is very small for a large population of investors waiting for these bonds for around 18 months now and for this reason, I think the issue should get oversubscribed on the first day itself.

Rating of the Issue – NTPC is India’s largest power generator and a ‘Maharatna’ company with market capitalization of Rs. 104,759 crore. Being a PSU with strong fundamentals and government backing, CRISIL, ICRA and CARE have assigned ‘AAA’ rating to the issue.

Moreover, these bonds are ‘Secured’ in nature and certain fixed assets of the company will be charged equivalent to the outstanding amount of the bonds.

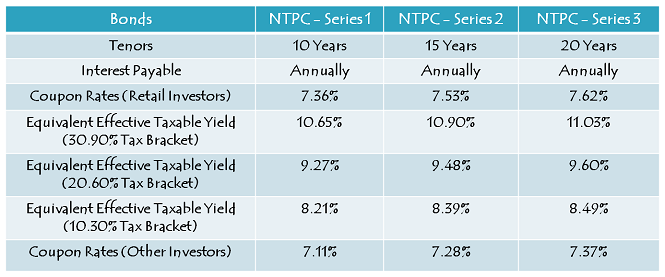

Coupon Rates on Offer – NTPC is offering yearly rate of interest of 7.36% for its 10-year option, 7.53% for the 15-year option and 7.62% for the 20-year option to the retail investors investing less than or equal to Rs. 10 lakh.

As mandated by the government, these rates would be lower by 25 basis points (or 0.25%) for the non-retail investors.

NRI Investment Allowed on Non-Repatriation Basis – Non-Resident Indians (NRIs) are also eligible to invest in this issue, but only on a non-repatriation basis. NRI investors will not be allowed to repatriate its interest amount or maturity proceeds outside India.

QFI Investment – Qualified Foreign Investors (QFIs) are not allowed to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue is reserved i.e. Rs. 70 crore

Category II – Non-Institutional Investors (NIIs) – 25% of the issue is reserved i.e. Rs. 175 crore

Category III – High Net Worth Individuals including HUFs & NRIs – 25% of the issue is reserved i.e. Rs. 175 crore

Category IV – Resident Indian Individuals including HUFs & NRIs – 40% of the issue is reserved i.e. Rs. 280 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – NTPC has decided to get these bonds listed on both the stock exchanges i.e. National Stock Exchange (NSE) as well as the Bombay Stock Exchange (BSE) and has successfully got the necessary in-principle listing approval also from these exchanges. The bonds will get allotted and listed within 12 working days from the closing date of the issue.

Demat Account Mandatory – This is one of the noticeable changes as compared to the last time. NTPC has decided to allot these bonds only in dematerialised form and thus, the investors do not have the option to apply these bonds in physical or certificate form.

So, if you want to apply for these bonds in this issue and do not have a demat account, act now as you have only two days with you to get a demat account opened. However, once allotted in demat form, the investors can rematerialise the bonds in physical/certificate form if they decide to close their demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the BSE or NSE.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – NTPC will make its first interest payment exactly one year after the deemed date of allotment and the deemed date of allotment will be announced just before the listing date. I will update this post as and when it gets announced.

Fundamentally, NTPC is a good company, ranked nineteenth among the top Indian companies by market capitalization. Also, at present, there are only seven central public sector enterprises (CPSEs) which have been conferred the status of Maharatna and NTPC is one of them.

Among the seven companies which have been authorized to issue tax free bonds this financial year, NTPC is the only company which has the ‘Maharatna’ status.

Should you invest in this issue?

There are many reasons why I think yield on government securities (G-Secs) should fall here in India. China slowdown, no rate cut by the US Federal Reserve on September 17 and falling WPI & CPI inflation – I think all these factors would make the RBI governor Dr. Rajan to think about cutting policy rates in its monetary policy scheduled to be held on September 29th. But, less than normal rainfall and less than desired improvement in the Indian economy & fiscal deficit, are a couple of reasons which might not work in favour of a rate cut.

Moreover, Congress playing spoilsport in the passage of important bills like GST and the land acquisition bill are also putting pressure on the Indian economy and thus making it extremely difficult for the Modi government to take further actions on the reforms front. RBI is keeping a close eye on the steps taken by the government to strengthen the economy and revive the investment sentiment.

If all goes well and the government is able to implement GST from April 1 and the land acquisition bill after the Bihar elections, I think India would replace China to become the most attractive investment destination for the global institutional investors.

Personally, I feel there is a good scope of 50 basis points (0.50%) rate cut by the RBI in the next 6-9 months and as a result, the 10-year G-Sec yield should fall below 7% by April-June next year. If that materialises, then there would be at least 8-10% appreciation in the market price of these bonds by the end of current financial year.

Application Form of NTPC Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in NTPC tax-free bonds, you can contact me at +919811797407

NHAI to come up with its issue of tax-free bonds worth Rs. 11,200 crore by this month-end:

http://www.hindustantimes.com/india/nhai-set-to-tap-bond-market-to-fund-projects/story-vrbolwYMDCapnfhXrTxjpJ.html

Any idea when these bonds will be credited to Demat? If I do not get bonds from NTPC, then I would go for PFC. Is there any chance of knowing this before 5th October when PFC issue opens for subscription?

Hi Jaydeep,

NTPC Bonds are expected to get allotted by Wednesday or Thursday.

Thanks Shiv

If someone invests over 5 lac in tax free bonds eg. 6 lacs but is allotted worth 3 lacs, will this be reported in AIR? So is the limit on amount paid or the amount finally allotted?

Hi SB,

I have no idea about it.

Amount applied will be considered for AIR , not amount allotted.

Yes. This is what happened for NHB issue. They report the amount applied which is an issue considering that a major portion is going to be refunded in the case of NTPC. This will restrict individuals from applying for maximum even though major amount is refunded and used for applying again.

I think the figure in AIR is for the bonds alloted and not for bonds applied. Also, if you use ASBA, then it will be automatically for bonds alloted and not for bonds applied, as only the money for bonds alloted will get debited from your account.

For all the tax free bonds I have applied in the past , regardless of ASBA or not , amount applied is considered for AIR and is seen in 26AS

It doesn’t matter as long as you are not using black money to buy these bonds.

Regards

Ramadas

you are right Mr.Ramadas.same happened with me.i even had to clarify it to IT deptt.

What is AIR and ASBA?

Amit :

ASBA (Applications Supported by Blocked Amount) is a process developed by the India’s Stock Market Regulator SEBI for applying to IPO. In ASBA, an IPO applicant’s account doesn’t get debited until shares are allotted to them.

Annual Information Return (AIR) of ‘high value financial transactions’ is required to be furnished under section 285BA of the Income-tax Act, 1961 by ‘specified persons’ in respect of ‘specified transactions’ registered or recorded by them during the financial year – Google it , its mainly above 5L purchases need to be reported by banks/companies to income tax department

Does AIR gets reported for a single issue or sum of multiple issues. for e.g. if one applies 1 lakh in 5 issues the total becomes 5 lakhs.

It is aggregate value of investment made in that category in the financial year. So if you have applied for bonds of 1 lakh value, 5 times in the financial year – it will be reported in AIR.

Please keep us posted on refund of the allotment money and date of listing.

Thanks!

AB

Sure AB, I’ll do that.

dear shiv

after repo rate cut,what will be the expected coupon rates in upcoming tax free bonds

It really depends on the timing of the issues Dr. Puneet. In the current scenario, the 20-year option should carry 7.37-7.40% rate of interest.

Dear Shiv,

do you think based on govt. polices any possibility of “infrastructure Bonds” coming back for Tax saving (80 C) this year or next year?

Hi Ashish,

I think you are talking about 80CCF Infra Bonds. This year, there is no possibility at all and I think there is a very bleak chance of that making a comeback next year as well.

Sorry, it is trading at 7.5779%.

Hi Shiv

From where do you get live G-sec yields? Can you please share the link

Regards

Ramadas

Hi Ramadas,

Here is the link you require – https://www.ccilindia.com/OMHome.aspx

10-year G-Sec yield trading at 7.63%.

RBI cuts Repo Rate by 50 basis points. G-Sec yield should fall further.

Why are these Govt Bond Issuers not coordinating with each other so that only after refunds/allotments of previous issue is fully completed, then only next issue should be floated. This way unsuccessful applicants can try their luck again. Should not SEBI consider this aspect too?

Hi SK,

I don’t think SEBI should intervene in such small matters. Controlling demand & supply in such manner would take away the liberty of issuers to time their issues.

While I closely look at the NTPC Tax free bond subscription and some of the responses in this forum, I have a feeling that many investors are desperate to invest in this TF bonds based on the success of previous issue 2 years back. But there is lot of difference between then and today. People got benefited during the last issue due to High coupon rates which is almost 150 Bps than current issues. 150 Basis points difference gives 15% appreciation to the capital above current coupon rates. So no comparison between last issue and present issues. One should look at their financial commitments, Cash flow requirements and Tax brackets and benefits before investing in these TF bonds. One should read the detailed analysis provided by Shiv in this post. It is self explanatory. By far I consider this as the best analysis for TF bonds provided by any forum.

I completely agree George, there has been a substantial fall in the G-Sec yield in the last 12-18 months. It is quite difficult for the yield to have a similar steep fall in the next 12-18 months. But, I think it is not impossible either. I think Modi government’s reform policies require a big push & honest implementation to have such a steep fall.

I still remember similar kind of trend emerging between 2001-03. Vajpayee government was doing a great job during that period. Disinvestment programme was working well, highways were getting constructed at a very high speed, Power sector reforms were taking place, most of the ministries were performing up to the mark, India emerged as a nuclear power, President Kalam was active in Nation Building and many such factors.

WPI Inflation fell to negative territory for a short period of time and remained in the 3-5% range for a long period. I remember 6.5% RBI tax-free bonds getting heavily subscribed in those days. 7.62% is still higher.

But, yes, the golden period of 8.8% to 9.01% TFBs has gone and I hope India grows substantially from here that we do not see such high inflation, high interest rate periods easily !!

Shiv, while we appreciate the right steps taken by the Govt to control inflation , it is also important to note that the current inflation level is mainly due to low oil price and good initiatives taken by Rajan during 2013 crisis. The oil price was above US$ 100 level at that time and below 50 now. It makes a huge difference for a country like India.

Yes, I agree that the Modi government has been blessed with lower crude & commodity prices and the fall is fairly significant for a country like India. But, then I see intent in getting things done. I have high hopes from this government and I’ll be very disappointed if they do not materialise.

Hi Shiv,

I have a query on tax free bonds.

Is there any tax free bonds opening this year?.

If yes, which is the best amongst all?. Please suggest me.

Where do i get an update.

Please let me know.

Best Regards

Geeta

Geeta, the answer is there in this post itself. This post talks about the issue which was closed and the upcoming issue of Tax Free bonds.

Hi Geeta,

Please check this link, it gives you the background to the issuance of tax-free bonds for the current financial year 2015-16 – http://www.onemint.com/2015/07/18/tax-free-bonds-notification-fy-2015-16/

NTPC tax-free bonds was the first such issue which opened on 23rd and got closed on 24th due to huge oversubscription. There will be at least six more such issues in the remaining 6 months. One such issue by Power Finance Corpoartion (PFC) is opening on October 5th.

You can subscribe to our free newsletter for latest updates on Tax-Free Bond issues – https://feedburner.google.com/fb/a/mailverify?uri=onemint%2Ffeed

I had broken up fixed deposits to invest in NTPC tax free bonds. Please advise how to invest the refund until next lot of Tax Free bonds.

Sorry, we do not entertain such advise requests here on this forum.

In your article you referred to ‘BIDDING OF APPLICATION FORMS’, otherwise our applications were liable to be rejected. Please explain/elaborate & oblige.

Bidding Process – In case of a physical application, you need to submit the bid/application details with the stock exchange. When you submit your application details to your broker, it is done by the broker. In case somebody wants our assistance in the bidding process, we do the bidding for those investors.

Please advise expected date of refund of application money. Does ASBA system not apply in case of this/ALL issue of Tax Free Bonds? My account got debited same morning of application. Will we earn interest on the application money until refund allotment?

Please advise what should we do with the Refund Amounts since I wish to apply for next tranche of Tax-Free Bonds but do not wish yo keep the funds idle?

1. Expected date of refund is October 7th-9th.

2. ASBA facility is available for all these issues. ASBA amount gets blocked by the bank till allotment. For ASBA applications, no interest is paid by the issuer to the applicant.

3. Sorry, we do not entertain such advise requests here on this forum.

Hi Shiv,

Do you have any dates or info which company is coming after PFC. I applied in category 3 and now find myself waiting for refund which unfortunately won’t be here for PFC issue. Very disappointed to see substantial amount blocked for only 10 to 15% allocation.

Hi Ikjot,

After PFC, no company has filed its prospectus for issuing these tax-free bonds. So, dates are not confirmed as yet. In case there is no rate cut by the RBI on 29th, there will a spike in G-Sec yield. I think then you won’t feel disappointed.

Thanks Shiv for encouraging words..

You are welcome Ikjot!

Shiv,

very nice info,I applied for only 10 units, is there a chance to get allotment ?

is it better to wait for Large Tax free bonds like NHAI & Housing Bank, so 1 will get sure shot allotment than blocking money in small 700cr issues?

Hi Ashish,

1. You will be allotted at least 2 units.

2. If you want to have 100% allotment against your application, then you should wait for NHAI or IRFC or HUDCO. National Housing Bank is not authorised to issue tax-free bonds this year.

allotment for NTPC is done. However I applied for 10 Units and should have allotted at least 2 units as per Shiv but I got 1 only!

very useless exercise!

should have waited for big issues

When is the allotment expected?

Hi SB,

Allotment is expected to happen between October 7th-9th.

Dear Shiv,

Will a person who has applied for only 10 or 20 bonds on the first day, get confirmed proportionate allotment of 2 or 3 bonds ? Or is the minimum allotment quantity fixed at 5 bonds, which was the minimum application quantity ?

Thanks

Hi TCB,

It will be proportionate allotment. Unlike share IPOs, there is no minimum bond allotment rule in these tax-free bond issues.

Day 1 (September 23) subscription figures:

Category I – Rs. 212.50 crore as against Rs. 70 crore reserved – 3.04 times

Category II – Rs. 1416.11 crore as against Rs. 175 crore reserved – 8.09 times

Category III – Rs. 940.76 crore as against Rs. 175 crore reserved – 5.38 times

Category IV – Rs. 1848.21 crore as against Rs. 280 crore reserved – 6.60 times

Total Subscription – Rs. 4417.58 crore as against total issue size of Rs. 700 crore

Extraordinary appetite for tax-free bonds. No point applying for the bonds tomorrow onwards. It is better to wait & apply for the PFC issue now.

Major concern is on refund. If it is delayed, the investors will find difficulty in applying for next issue.

Hi George,

Investors won’t get refund before the next issue opens on October 5th as there are two public holidays coming in between, Eid tomorrow and Gandhi Jayanti on 2nd.

Dear Shiv,

Regarding – Allocation would be between 15-16%.

Is the allocation on proportion basis. What does first come first served basis allotment mean? I applied through sharekhan at 9 am yesterday for full retail limit. Any chance I’ll get full allotment.

thanks.

ok i read the draft prospectus and understand it now.

“In case of over-subscription, Allotments to the maximum extent possible, will be made on a first-comefirst-serve

basis and thereafter on a proportionate basis in each Portion, determined based on the date of

upload of each Application into the electronic system of the Stock Exchanges, meaning full Allotment of

Bonds to the Applicants on a first-come-first-serve basis up to the date falling one day prior to the date

of over-subscription and proportionate Allotment of Bonds to the Applicants on the date of oversubscription”

Yes, the day the issue gets oversubscribed, proportionate allotment is made to all the bids made on that day.