NHAI 7.60% Tax-Free Bonds – Tranche I – December 2015 Issue

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Having gained 20-30% on their investments made in tax-free bonds a couple of years back, investors’ hunger for tax-free bonds has grown considerably. With IRFC issue worth Rs. 4,532 crore getting 2.38 times oversubscribed on the first day itself, there seems to be no slowdown in the subscription demand for these bonds.

To cash-in on this huge demand and ending a long wait for its tax-free bonds, NHAI, which filed its draft shelf prospectus in the first week of October, will be launching its first tranche of tax-free bonds from the coming Thursday i.e. 17th December. As the issue size is considerably quite big at Rs. 10,000 crore, I hope most of the retail investors are able to get their share of bonds allotted at least this time around. The issue is officially scheduled to remain opened for two weeks and will get closed on December 31st.

Before we analyse it further, let us first quickly check the salient features of this issue:

Size of the Issue – NHAI is authorized to raise Rs. 24,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 3,872 crore by issuing these bonds through a private placement. Out of the remaining Rs. 20,128 crore, the company will raise Rs. 10,000 crore in this issue.

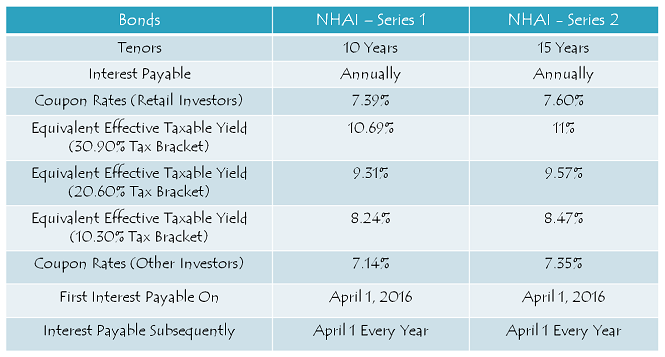

Coupon Rates on Offer – With rising G-Sec yield, earlier IRFC and now NHAI, both have been able to offer higher coupon rates as compared to PFC and REC. While IRFC offered 7.53% for the 15-year period and 7.36% for the 10-year period, NHAI is offering an even higher rate of interest at 7.60% for 15 years and 7.39% for 10 years.

For the non-retail investors, these rates would be lower by 25 basis points (or 0.25%).

Rating of the Issue – CRISIL, ICRA, CARE and India Ratings consider investing in these bonds to be safe and as a result, have assigned ‘AAA’ rating to the issue. Also, these bonds are ‘Secured’ in nature i.e. in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

NRI/QFI Investment NOT Allowed – Unlike PFC, REC & IRFC issues, Non-Resident Indians (NRIs) won’t be able to make investment in this issue. Qualified Foreign Investors (QFIs) are also not eligible to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue is reserved i.e. Rs. 2,000 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 2,000 crore

Category III – High Net Worth Individuals including HUFs – 20% of the issue is reserved i.e. Rs. 2,000 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 4,000 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – NHAI has decided to get these bonds listed on both the stock exchanges, National Stock Exchange (NSE) as well as Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. Whether you apply for these bonds in demat or physical form, the interest payment will still get credited to your bank account through ECS.

Also, even if you get these bonds allotted in your demat account, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchanges within 12 working days of the closing date.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates i.e. 7.39% p.a. for 10 years and 7.60% p.a. for 15 years, on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – NHAI will make its first interest payment on April 1st next year and subsequent interest payments will also be made on April 1 every year, except the last interest payment, which will be made to the bondholders along with the redemption amount on the maturity date.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

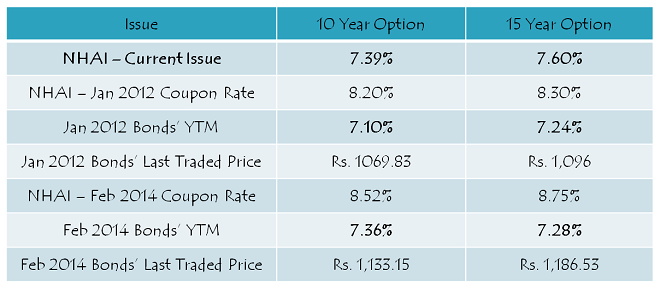

NHAI tax-free bonds issued in February 2014 are quoting at a yield to maturity (YTM) of 7.28% with the closing market price of Rs. 1,186.53. Also, bonds issued in January 2012 are carrying 7.24% yield and last traded at Rs. 1,096 on Friday.

Taking a clue from these already listed bonds, I think subscribing to the 15-year option makes more sense. Risk-averse investors with a long term view should definitely invest in these bonds. In the short-term as well, you can expect some listing gains with these bonds.

Application Form for NHAI Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in NHAI tax-free bonds, you can contact me at +919811797407

Thanks for the info Shiv.

You are welcome Ikjot!

Dear Mr. Shiv Kukreja,

Thank you for the excellent & informative write-up.

Request you to kindly share such valuable information as early as possible, since arranging the funds at short notice is a major challenge.

Strangely, there are no advance advertisements in leading newspapers by the TFB’ s issuers. Hence, most small investors are uninformed & are in the dark about such TFB’s Issues.

Thank you.

Thanks S.K. for your kind words!

Tax-free bonds are in demand these days, so the issuers do not feel the requirement to publicise them any more. That is why no ads get published these days.

However, I always try to share the info about these issues as soon as I get the details. I got the details about NHAI issue on Friday evening & shared it here in the night itself. However, it takes me time to analyse these issues and write a post. Still I’ll try to post these articles as soon as possible going forward. Thanks!

SK , Shiv updated about this TFB much before any site including that of NHAI published. Definitely advance info will be good, but we were discussing about this issue for quite some time.

Whether there will be Tranche II from NHAI, this financial year? If this happens, I expect more coupon rate for next Tranche as FED will increase interest rates this week. This might have some impact on GILT.

Hi Amit,

I don’t think Fed rate hike will impact Indian bond yields much as this event is already factored in by the markets. Indian markets will be driven more by the local issues now as compared to the global factors. Tranche II will definitely come in the new calendar year and I think it will carry a lower rate of interest.

Hi Shiv,

I always enjoy reading your analysis. Please keep up the good work.

Thanks AMD! It is my pleasure that you enjoy our posts. 🙂

Dear Shiv,

I am an NRI living in UAE. Is there any way I can invest in NHAI bond, may be thru resident family member in India? will highly appreciate your advice.

Hi Sanjay,

Yes, you can invest through a family member who is a Resident Indian.

I am not a tax payer and I have agricultural income and I usually pay nil return but I am regularly investing in these long term bonds because they are triple rated and are long term and are better than a 20 lacks apartment that gives you 5000 rent a month about 60000 per year but these taxfree bonds are giving 152000 per year so much better than a rental income on 20 lacks investment and the interest will be direct credited to your bank account where as in a rental income you have to go and collect rent every month and also some rental income may be reinvested to maintenance of apartment but in taxfree bonds no maintenance costs no paperworks and a secure taxfree income for along term so what do say dear shiv

Hi Nitesh,

You are comparing Apples with Oranges here. Real estate investment, equity investment, fixed income investment and gold investment, all have their own characteristics & cycles. Current real estate & fixed income scenario do favour fixed income investment over real estate investment. But, that is not always be the case.

Real estate & equity investments offer low income yield, but carry high capital appreciation scope. However, fixed income investment offer high income yield, but low capital appreciation scope. In the long term, equity, real estate as well as gold investments generate higher returns for the investors as compared to fixed income investments. At the same time, volatile asset investments are not for the weak-hearted people and require active research/follow-up by their investors.

Shiv,

Do you think there’s any chance that subsequent issues coming in the next 3-4 months will have higher rate of interest than 7.6%? Based on your response, I’ll plan my TFB-investments either totally in NHAI or will spare some for upcoming issues also.

Again, your timely posts are so very helpful!!

Hi Chaitanya,

Personally, I think there is a 80:20 probability in favour of rates falling going forward.

Hello shiv. Thanks for the update and as always enjoyed your analysis.

I had applied for the irfc bonds and my money is locked in there. Can I expect them to complete the allotment process and refund the unallotted amount before 17th ? Otherwise my money be blocked and I cannot apply for nhai bonds.

Vinod

Thanks Vinod!

I don’t think IRFC will be able to refund your money on or before 17th. I expect them to start allotment from Friday or Monday onwards. At the same time, I do not expect NHAI issue to get oversubscribed on the first day itself. So, there is some scope of the issue remaining open by the time your money reaches your bank account.

NHAI’s decision is not in favor of retail investors. hope nothing fishy to in support of Big players

what decision?

This seems to me some Kejriwal kind of statement. 🙂

Dear Mr. Shiv Kukreja,

Thank you for your informative & helpful write-ups. Appreciate your diligent efforts.

Was unable to understand who exactly are QIB’S & NII’s are & what do they do/role in our markets? Why are separate categories/reservations created especially for them?

Request you to kindly explain with illustrations & names please.

Thank you.

Thanks SK!

In short, QIBs are institutional investors like LIC, other insurance companies and mutual fund companies, while NIIs are mostly corporates like Reliance, Infosys, TCS etc. Separate categories are created for them so that they do not eat into retail investors’ reserved portion or other category’s reserved portion. I hope it satisfies your query to at least some extent.

Great article Shiv,

So much informative analysis you have done. a big thanks for sharing.

Thanks Ravi for your kind words!

Hi Shiv,

some of my money is locked in the IRFC bond issuance. is it possible to make two applications to NHAI, one say prior to the first date of issue and another application on another day when the refund from IRFC comes due, in case it is still not oversusbscribed ? will this even be entertained and if so how will they club the applications and allotment ?

btw, first time visitor and love your informative and relevant blogs and also the engaging comment section .

Sai

Hi Sai,

It is possible to submit two or more applications with the same PAN no. in the same applicant’s name. Those applications will be clubbed by the Registrar on the basis of their respective PAN numbers and allotment will be made accordingly. If your second application gets made on the day the issue gets oversubscribed, then partial/pro-rata allotment will be made against that application, but you will get full allotment against your first application. I hope it satisfies your query!

Also, thanks for your encouraging words! I hope you’ll visit our site more frequently going forward!

Thanks a bunch for the reply, Shiv. i really couldn’t find this information elsewhere especially on the allotment impact and i did search hard for it. So, i sincerely appreciate your providing this kind of clarity in quick turnaround given that the issue opens tomorrow and i wasn’t quite sure about the multiple app situation. i will certainly spread the word about your blog to the extent i can.

Thanks Sai for visiting our blog and making it more interactive!

Its not taking multiple applications via DMAT account. How can I apply multiple applications via DMAT?

Good and useful information Shiv, as always.

Many thanks for your good work.

Post NHAI, is there a possibility of other issues (IREDA etc.) to be opening up soon enough?

Regards,

Rakesh

Thanks Rakesh for your kind words!

IREDA is yet to even file its draft prospectus, but I think HUDCO issue should get launched soon. Howevet, exact dates & details of the issue are yet to get announced. I’ll update these posts as soon I have any info about any such issue.

If HUDCO were to come up with issue in Dec, the interest rate offered for 15 or 20 years will be 7.7 to 7.8%. Since the rating will be AA+, they can give 15 bps more than AAA issue.

Yes, that’s right.

HUDCO DRHP mentions AAA rating.

Where did you find HUDCO Draft Prospectus

http://www.bseindia.com/markets/PublicIssues/BondIssues.aspx?expandable=3

Thanks Shubh. Previous occasions they got only AA+. Now better rating and coupon will be on par with IRFC and NHAI.

They have even shown some of the bonds issued last time also as AAA rated in their prospectus which according to me was AA+ and got upgraded AAA.

Good..

Is the interest rate which one earns simple or compounded?

Is 7.39 ROI simple or compounded?

Hi Ashwani,

Interest on these bonds is simple and gets paid annually on the interest payment date. So, there is no scope of any compounding here.

Thanks

You are welcome Ashwani!

Thanks Shiv, will be subscribing to this one.

That’s great Bhaskar!

Sir

if i have invested 10000 for 15 years how much will be the maturity amount as i dont have knowledge in regard to annulaized return will i get the interest every year does that mean my invested amoutn will remain same or it will also be increased.

The interest is typically paid out annually (in this case of NHAI @ 7.60% of your investment amount which should be Rs.760 if the principal is Rs.10000). Therefore, the maturity/redemption amount should remain the same. (Request Shiv to correct if this isn’t right)

That is right Rakesh! Interest for NHAI bonds will be paid on April 1st every year, starting April 1, 2016.

Dear Mr. Shiv Kukreja,

Will it be advisable to break BANK FD’s prematurely, after they have been invested for about a year @8.75% on CUMULATIVE Basis. Have paid TDS/Tax @30% already in past FY.

How should one calculate the overall benefit of investing thus? Please advise a simple technique to determine benefit.

Finally, can we transfer money to wife/mother/son so that the chances if allotment are better? What should be done after allotment in such cases from tax point of view to avoid tax complications?

Request your valuable advice please.

Thank you.

Hi SK,

1. I think, if your FD is getting matured in January-February, then probably it is better to wait for some issue to come up during that period to invest in these bonds. But, if you have just invested in an FD, then probably it is better to break it and invest in tax-free bonds.

2. If you want to invest more than Rs. 10 lakh, then it is better to invest in different names. Otherwise different applications don’t stand to a better chance of allotment.

3. Please consult your tax advisor for its taxation aspects.

I have applied for 150 bonds for 15 years option so if I get full allotment then what interest on 1 st April I will get is it near about 3000 please give me the exact amount dear shiv thank you

Interest amount will depend on the date of allotment.

Shiv,

Tax free bonds starting from 2011 until now, offer annual interest between months Oct and April. No bond offer interest between May to Sept. It would be great if few upcoming bonds offer annual interest betn May to Sept. That way we can spread our investment across diff bonds to get interest in each month. As good as getting pension every month. If you have any contacts in finance ministry then let them know this.

Sorry Amit, I do not have any contacts in the Finance Ministry. 🙂

Haha. Shiv – the way you are the first one to know about upcoming tax free issues, we assume you have some khabri there 🙂

I wish I had somebody !! 😉

US Federal Reserve hikes interest rates by 0.25%, sets interest rate range to be 0.25-0.50% and says further interest rate decisions will be data dependent. Fed will carry only a gradual increase in interest rates, which would make markets feel that Fed is dovish.

Ultimate Effect – Firstly, a big event turns out to be a non-event. Moreover, I think it is the best outcome that global markets could have asked for and good for the Indian markets also as it ends uncertainty.

Q1: Is it possible to see subscribed values live (real time) on some NSE, BSE Websites? Or, is that a meaningless Q, as most upload will take place at close of the day??

Q2: Did not understand the ‘note’ in above post (i.e. As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected). What does this exactly mean?? esp if I apply online, say on ICICI-Direct site???

Hi Kothanda,

1. Here are the links to check the subscription figures on a real-time basis:

http://www.bseindia.com/markets/publicIssues/DisplayIPO.aspx?id=1029&type=DPI&idtype=1&status=L&IPONo=1104&startdt=12/17/2015

http://www.bseindia.com/markets/publicIssues/BSEcumu_demand.aspx?ID=1029

2. These figures are LIVE and very much relevant. Nothing extraordinary will get added to these figures at or after closing of the bidding hours i.e. 5 p.m. in the evening.

3. If you apply online, it is the responsibility of the online broker to the bidding on your behalf. For physical application, bidding is mandatory and “Bid Id” is required to be mentioned on the application form before submission.

Sorry i am new at this but if i go by the BSE demand data, all categories 2,3,4 have all seem to have been oversubscribed already. Hope someone can correct me if i am wrong.

Category: Number of times oversubscribed

Cat 1: 0

Cat 2: 2.83

Cat 3: 3.18

Cat 4: 1.24 (retail)

total: 1.7

I just read in the news that The National Highways Authority of India (NHAI) will raise Rs 1,000 crore by issuing tax-free, non-convertible bonds with a face value of Rs 1,000 each and that they have the option to retain oversubscription of up to an additional Rs9,000 crore, totaling Rs 10,000 crore.

So i guess the oversubscription numbers in the BSE data are for the amount of 1000 cr.

Yes, that is correct. BSE oversubscription figures are based on the base issue size i.e. Rs. 1,000 crore.

Hi Shiv,

Rookie question here. Do we have to add the data from both BSE and NSE bids to get cumulative values real time ? They are both publishing their bids separately. There is a cumulative bid link in BSE but it doesn’t seem to be providing any values yet.

like someone asked before, will this be accurate for monitoring the subscription or do we just need to wait for closing data ?

Yes this is the only way to monitor the issue on Real Time basis. I always found, that these numbers matches with the EOD numbers.

Thanks Rohit for your inputs!

Hi Sai,

1. Yes, we need to add both NSE and BSE figures to get the cumulative figures. But, BSE data is more important as majority of the bidding happens on the BSE itself. Keep a close eye on the “Cummulative Bid Quantity” as well – 2,83,32,305( 283.32% ) As on Dec 17 2015 12:00PM

2. “Cummulative Bid Quantity” will be very close to the day’s final subscription figures.

Thanks for sharing all the information, Shiv & Rohit.

You are welcome Sai!

Can we expect 100% subscription today?

Not in the retail category at least.

subscription or allotment?

Retail category is not 100% subscribed today, so, if you have applied in retail category, you will get 100% allotment.

If Today Retail subscription closes at 8 times, but Overall Subscription closes at 15 times, in this case, those Retail ppl who are putting money on Day 2 (18th Dec) in Retail Category, will get allotment ???

I anticipate it as Yes, on pro-rata basis if issue get oversubscribed on day 2, else they will also get 100%, like ppl who put in on Day 1.

Am I correct ???

Yes Thats right

Thanks George!

splendid responce look at category 2 20 times oversubscription category 4 times very big response toa very big issue it will definitely list 80 to 90 rs premium

Don’t compare oversubscription and listing premium. Whatever you say is true for equity IPO , not for TFB issue. 90rs premium means 9% return in 3 weeks. Extremely rare in debt. More importantly , yield at 1090 will drop to less than 6.5% which is very costly for a bond in this market when GILT is at 7.8%. Expect a maximum premium of 1-2% including accrued interest

Regards

Ramadas

Thanks Ramadas! Yes, that is correct. No huge premium on listing for NHAI bonds. 7.60% bonds should list with 1.5-3% premium.

If Hudco or IREDA comes with better coupon you may get NHAI is secondary market on par or less. REC 7.43 % which was allotted one month back was trading for Rs 1000 yesterday.

After looking at subscription figures, I feel that India is such a rich country.

Lets have a 98000 cr. tax free bond for bullet train. It also will get oversubscribed.

May be you are right. But think this way, we are 120 Crore people country and Trillion dollar economy. IRFC initiated this bond for railways only. But Bullet train need not be a priority. The retail investors mostly invest in these bonds by liquidating some of their portfolio in FD, MF etc. to take the benefit (I do this most of the time trading of some losses). As far as Corporates and HNIs are considered they are rich and have enough to put where the return is risk free and reasonable. Everyone is trying to get their wit to get 100% allocation subscribing on first day. Still 50% of retail is untouched.

Not a bad idea Amit! I think the government should bridge its deficit by selling tax-free bonds instead of selling their jewels like Coal India, ONGC, REC, PFC etc. Government sets its disinvestment target of Rs. 40-50K crore and able to achieve much less. These companies should be made super-efficient so that their share prices jump 5-10 times and foreign investors chase them at higher valuations.

Still chance for the Retail Investors.

Rs.1490 crore bonds are still to be subscribed under this category.

After going through today’s response my take is that this will oversubscribe on Monday with partial allotment for applications submitted on Mon. If one wants 100% go for it tomorrow.

I agree!

Ok. But going by the terms, should not the allotment be on a FCFS basis ?

Yes, it is on an FCFS basis. Today’s retail investors will get full allotment, tomorrow’s retail investors will get full allotment. The day it gets oversubscribed beyond the reserved portion in a category, only then proportionate allotment comes into the picture.

Thanks Shiv ! That clarifies. I misunderstood George’s earlier point.

Day 1 (December 17) subscription figures:

Category I – Rs. 8,145.01 crore as against Rs. 2,000 crore reserved – 4.07 times

Category II – Rs. 7,063.45 crore as against Rs. 2,000 crore reserved – 3.53 times

Category III – Rs. 3,490.15 crore as against Rs. 2,000 crore reserved – 1.75 times

Category IV – Rs. 2,508.10 crore as against Rs. 4,000 crore reserved – 0.63 times

Total Subscription – Rs. 21,206.71 crore as against total issue size of Rs. 10,000 crore – 2.12 times

Thanks much !!

Allotment process is still somewhat of a mystery to me. If total issue has been oversubscribed 17 times will they not close today itself? Or does each category have to be fully subscribed before issue closure?

Hi S.K.,

Only retail investor category and overall issue need to be oversubscribed for the company to close the issue. Oversubscription in other categories doesn’t matter much.

looking at its issue size great response from all the past issues isn’t it dear shiv

Yes, it is a very good response. It shows there is no dearth of money & investors in India.

Thanks Shiv for the information. Any visibility on when NHAI could possibly come with 2nd tranche? Also, how is the interest rate pattern looking like? Does it seem to be going upwards or downwards in next 3-4 months of this financial year?

Hi CVS,

I think even NHAI does not have this visibility. They are saying they will raise around Rs. 19-20K crore only. Check this – http://www.moneycontrol.com/news/business/aim-to-award-5000-km-projs-raise-rs-19-20k-cr-fy16-nhai_4598161.html

I think interest rates should be headed lower going forward with a 70-80% probability.

Rs.1200 crore bonds are still to be subscribed under the Retail Investors Category.

Will this issue be open till the end date, till its get fully subscribed by the Retail Category ???

Can & will Govt file Early Closure of this Issue, even if 1 category is under subscribed ???

The issue will be open till end of the day, on which Retail Category gets fully subscribed.

I think, NHAI can not close the issue early, though the MINIMUM subscription of Rs. 400 crore under the Retail Category is fully subscribed and NHAI is expected to (or compelled to) keep the issue open till the MAXIMUM subscription of Rs.4000 crore under the Retail Category is fully subscribed. (Shiv: Please opine)

Hi Shubh, Hi Rohit,

It is not that NHAI is under some compulsion or it cannot close the issue even if the retail investors category remains undersubscribed. It can very well do so. But, I think, going by past records, it will not do so. NHAI would like to have maximum retail investors on board and encourage maximum retail participation.

Shiv, I agree with you. NHAI may like to have more retail investors on board. In fact, they may have a kept a long ‘open’ window (till 31-DEC) to help retails investors gather refunds from other Issue Refunds and Other Sources till year-end to subscribe to this. I remember, some retail investors too were keen to get refunds to subscribe to this. So I think NHAI may wait till the Retail category too is fully subscribed.

By monday the IRFC refund will come and though that is not much and every one who gets refund need not apply, there will be some traction on the retail subscription. Today’s response was really bad in terms of retail. I am sure NHAI will keep the issue open to accommodate retail customers though it is better for them to allocate the remaining retail quota to non retail customers. Considering that the quota is fixed and the end date is specified, I think they will have to wait for the closing day, and it will not take that far any way.

Day 2 (December 18) subscription figures:

Category I – Rs. 8,160 crore as against Rs. 2,000 crore reserved – 4.08 times

Category II – Rs. 7,069.03 crore as against Rs. 2,000 crore reserved – 3.53 times

Category III – Rs. 3,496.13 crore as against Rs. 2,000 crore reserved – 1.75 times

Category IV – Rs. 2,793.44 crore as against Rs. 4,000 crore reserved – 0.70 times

Total Subscription – Rs. 21,518.60 crore as against total issue size of Rs. 10,000 crore – 2.15 times

Can someone apply Twice? I mean I have applied On the first day for 50 odd lot under category IV. Today i decided to apply for one more lot but i was declined. why so?

Yes Ashwani, you can submit more than one application. But, if you have applied for it through your demat account, then you need to contact your broker for the same.

Hi Shiv,

Are there any chances of listing gain on IRFC and NHAI??

If yes, what will be the range for listing gain??

Thanks !!

I guess at best it would be 4%. It may be even just 3%.

At the Price of Rs 1040, yield would work out to be around 7.15% – 7.10%.

Hi Sanjay,

It should be 1-2.5% for IRFC and 1.5-3% for NHAI at max.

I fully agree with Shiv. Immediate gain will be very less and going forward it will depends on GILT movements. Looking at US market movements after Fed rate hike, there is not much positive for next 1 month. Considering the brokerage and tax one should not be buying to sell for immediate gains.

Thanks Shiv for your prompt reply!!!

You are welcome Sanjay!

Yes, agree, steep brokerage charges by private banks like ICICI reduces effective yield and pushes up purchase cost. Can Mr. Shiv Kukreja please explain why such high brokerage charges to the extent of 1% is being charged at a time Govt/SEBI wants more people to participate in the markets. Shockingly, even on the humble NPS, ICICI even charges Rs. 20 + Service Tax etc PER TRANSACTION however small in nature. Even CRA/NSDL have announced some fee on NOS holdings. This way the already unpopular NPS will lose with small investors. Can you suggest a convenient, reliable and inexpensive brokerage house for small investors.

ICICI Direct is the best trading site without much issue at any time. They are costly 1% brockerage+tax for NCD/TFB trading. SBI Capsec charges 0.7% including tax. If we were to get anything below 3%, then it is not worth trading and computing the capital gain tax again.

My take is current issues will be good for long term investors and medium term investors. Definitely not for short term investors.

Yes, these charges are quite high @ 1% and unreasonable as well. I think SEBI should take certain steps to get it reduced. These charges should not be more than 0.50%.

Dear Shiv, This is the best site and best post in the internet for retail investors like us. Many thanks for always informative posts.

Thanks Pankaj for your kind & motivating words !! 🙂

Dear Shiv,

Can NRI’s buy this NHAI Tax Free bond in the secondary market as they are not allowed now to bid in the primary offerings this time.

Yes Ashish, NRIs can subsequently buy these bonds from the secondary markets.

dear shiv retail invester were complaining at ntpc pfc and ifrc issues that they have not got reasonable allotments due to over subscription so it is far better than that this time they will get full allotment with better coupon rates 7.60% highest among all the past issues of 15 years maturity isn’t this great shiv and ntpc 7.53% for 15 years is trading at 1050 on Friday then I think nhai 7.60% will definitely list above 1050 isn’t it right shiv

NTPC has accrued interest of roughly Rs15-20/- per share by now which NHAI will not have. That is why NTPC is at 1050. NHAI at max can list with 2%-3% premium. Given large size , probability of higher premium is unlikely though liquidity will be high. It is impossible to get a debt instrument listed at 5% premium. Those are only possible in a equity domain.

Thanks Ramadas!

Hi Nitesh,

I hope you are satisfied with Ramadas’ reply.

Hello Shiv. Thanks for the info. I am applying in the retail category looking for 3% odd listing gain and only applying for listing gains. Are these kind of debt instruments liquid enough for an early exit, say first week of its listing ?

Hi Rahul,

Yes, there will be enough liquidity for you to exit on the listing day or within few days of listing. But, I am not sure whether you’ll get your target listing gains of 3% or not.

Hi Shiv,

What if I buy bonds from open market say FEB 2014 having ytm of 7.36% and coupon of 8.25% trading at 1,133 rs. rather than gng for current issue of 7.39% coupon.

(I assume current issue will be better coz it has higher ytm=coupon of 7.39%)

Pls advice..needed little clarification..

Thanks in advance

Hi Krunal,

You need to compare Coupon Rates of 2015 bonds with the YTM of 2014 bonds and also consider the transaction charges/taxes for buying 2014 bonds. If “YTM of 2014 bonds – transaction charges” > Current Coupon Rates, then only you should buy 2014 bonds. You should also consider the duration period of both these bonds.

Hey Shiv, I weill be applying in retail category. Will it be differently listed for HNIs, or the listing will remain same ? Basically, I want to understand how liquid it will be ?

Hi Rahul,

Bonds allotted to the retail investors category are different, have distinct ISIN and BSE/NSE codes. As far as liquidity is concerned, there is usually more liquidity in the retail investors category as compared to the non-retail investors category as the non-retail investors invest for the longer term as compared to the retail investors.

Rs.980 crore bonds are still to be subscribed under the Retail Category.

No more TFB issues of this size (Rs.4000 crore reserved for the Retail Investors) are expected now.

Shubh – What is TFB please !

TFB stands for Tax-Free Bonds Pankaj!

When is next issue expected ? Any Updates ! I presume it will be this month only ! HUDCO !

Hi Pankaj,

No company has announced the launch date of its tax-free bonds. I’ll update this post as soon as I get any reliable info about the same.

Pankaj just shared this info – “IRFC has started the allotment today. They have deducted amount today which was blocked under ASBA”.

Yes, allotment on CAT 3 was 60%. Dont know how much was it on retail category, Now that IRFC has released the balance funds, NHAI will get fully subscribed on retail tomorrow.

Hi Vinod,

Around 79.1% allotment has been made to the retail investors. It is highly unlikely that the retail portion will get oversubscribed by tomorrow. Let us see how it goes.

The allotment for retail category Cat IV is 79.1%

Unfortunately the NHAI issue seems to be fully subscribed today itself. Shiv, correct me if I am wrong.

However, technically the issue will remain open till an ad is published about the early closing. This may happen tomorrow. However, though one can apply, no allotment will be received.

Hi Pandurang,

How come the NHAI issue has got oversubscribed in the retail category? Also, why no allotment will be made to the retail applicants who apply for it today i.e. 22nd December?

Dear Shiv,

I read the BSE site which showed that the retail portion was subscribed 5.5 times. Hence, my comment. After reading your clarification that the retail portion is subscribed only .75 times, obviously, I was wrong.

Regards,

Pandurang

Sure, no issues. Thanks!

Day 3 (December 21) subscription figures:

Category I – Rs. 8,160.03 crore as against Rs. 2,000 crore reserved – 4.08 times

Category II – Rs. 7,069.34 crore as against Rs. 2,000 crore reserved – 3.53 times

Category III – Rs. 3,500.87 crore as against Rs. 2,000 crore reserved – 1.75 times

Category IV – Rs. 3,019.20 crore as against Rs. 4,000 crore reserved – 0.75 times

Total Subscription – Rs. 21,749.44 crore as against total issue size of Rs. 10,000 crore – 2.17 times

Dear Shiv,

I read the BSE site which shows retail portion has been subscribed 5.57 times on 21st december 2015. Hence my comment.

I have now read your retail subscription figures of .75 times. Hence, obviously, I was wrong.

Pandurang what you saw was right. The issue is 1000 Crore with additional 9000 crore. When you saw 5.57 times , it was actually only 0.557 times.

Hi Shiv,

Though retail category is not fully subscribed, amount was debited yesterday for NHAI Tax Free Bonds. Does it happen like this? When can we expect the allotment? Can we expect 100% allotment in retail category?

Regads,

Vineet Garg

Day 4 (December 22) subscription figures:

Category I – Rs. 8,160.03 crore as against Rs. 2,000 crore reserved – 4.08 times

Category II – Rs. 7,054.45 crore as against Rs. 2,000 crore reserved – 3.53 times

Category III – Rs. 3,512.76 crore as against Rs. 2,000 crore reserved – 1.75 times

Category IV – Rs. 3,100.31 crore as against Rs. 4,000 crore reserved – 0.78 times

Total Subscription – Rs. 21,827.55 crore as against total issue size of Rs. 10,000 crore – 2.18 times

Hi Vineet,

Amount against your application gets debited as soon as the application gets processed and sent to the bank for clearing. Also, if there is no discrepancy in your application, you would definitely get 100% allotment. The company is supposed to complete the allotment process & exchange listing within 12 working days from the date the issue gets closed. So, if this issue gets closed on December 31, then you can expect allotment to happen on or before January 11.

Dear Shiv, 12 working days – that means Jan 18- correct.

Dear Pankaj,

Allotment should happen by January 11th & listing by January 13th or 14th.

Hi Shiv

Should we break our FD’s and invest in the NHAI bonds. I am in the 30% slab. Some of my FD’s are locked for 10 years at 9%. Are there tax free binds lined up in the future and do you expect the interest rates to remain the same or go down a bit.

Also what is the effect on the interest rates in India due to upward tick in the US Fed rates.

Thanks

Hi Gaurav,

I think if your FDs are less than 2-3 years old and do not carry high pre-mature withdrawal charges, only then you should break your FDs and invest the proceeds in these tax-free bonds. If your FDs are about to mature, then you should not break them.

There are at least 3 more tax-free bond issues left to be launched in the current FY. These issues will be available for the next FY or not, it will be announced in the budget in February. I personally expect interest rates to go down in future. I do not think there will be any big negative impact of Fed rate hike on the Indian bond markets. However, dirty politics & slow economic growth will definitely impact interest rates negatively.

Hi Shiv,

Applied today under retail category. Hope would get my 100% allotment. Awaiting your updates on the Day 5 subscription figures.

Thanks,

Subbu

Hi Subbu,

You would get 100% allotment as the retail category is still undersubscribed.

I have applied for 500 nhai bonds can I apply for 500 more in retail catagory or amend my application

Yes Vimal, you can do so.

Day 5 (December 23) subscription figures:

Category I – Rs. 8,160.03 crore as against Rs. 2,000 crore reserved – 4.08 times

Category II – Rs. 7,055 crore as against Rs. 2,000 crore reserved – 3.53 times

Category III – Rs. 3,513.96 crore as against Rs. 2,000 crore reserved – 1.75 times

Category IV – Rs. 3,168.19 crore as against Rs. 4,000 crore reserved – 0.79 times

Total Subscription – Rs. 21,897.18 crore as against total issue size of Rs. 10,000 crore – 2.19 times

I think retail is left with no more liquid money to invest. So many tax free bonds plus the Alkem, Dr Lal IPOs . I am done with my tax free bonds allocation.

Thanks a lot Shiv for your continuous update of the posts and taking time off to reply to each and every comment on the blog.

Thanks Bhaskar! 🙂

Dear Mr. Shiv,

Does the current slow retail participation indicate retail investor demand is satiated & that the subsequent issues would not see much retail demand?

Any news on the next tranche of HUDCO & IREDA TFB’s? Also heard that SBI is coming out with an issue of 1250 CRORES, please confirm if these would be TFB’s?

Hi S.K.,

I don’t think Retail demand is satiated. People have money to invest and they were not fully dependent on IRFC refund to invest in NHAI bonds. They will definitely invest in the upcoming issues of HUDCO & IREDA.

No news I have about HUDCO & IREDA issues. I think at least one of them will issue these bonds in January. SBI bonds are taxable bonds, issued through private placement only to some QIBs, NIIs or HNIs.

Dear Mr. Shiv,

Does the current slow retail participation indicate retail investor demand is satiated & that the subsequent issues would not see much retail demand?

Any news on the next tranche of HUDCO & IREDA TFB’s? Also heard that SBI is coming out with an issue of 1250 CRORES, please confirm if these would be TFB’s?.

I think SBI bonds are not TFB. It is only for private placement. Shiv – kindly confirm.

That’s correct Vineet, thanks for your inputs!

When will the amount in bank account get Blocked for NHAI TFB Retail ASBA application?

Hi H.D.,

Whenever the application reaches your bank for further processing, the amount gets blocked by your bank. So, it depends on your broker when it processes your application.

Day 6 (December 24) subscription figures:

Category I – Rs. 8,160.03 crore as against Rs. 2,000 crore reserved – 4.08 times

Category II – Rs. 7,055.67 crore as against Rs. 2,000 crore reserved – 3.53 times

Category III – Rs. 3,489.43 crore as against Rs. 2,000 crore reserved – 1.74 times

Category IV – Rs. 3,199.40 crore as against Rs. 4,000 crore reserved – 0.80 times

Total Subscription – Rs. 21,904.53 crore as against total issue size of Rs. 10,000 crore – 2.19 times

Sir,

I applied 200/ IRFC bonds vide app no 77660272.The amount was blocked by my bank. Upto 22nd Dec amt was blocked but I did not receive any bond.I went to Karvy site the registrar of the issue it showed there is no such application.pls guide how can I enquire.I submitted app.at Delhi.

Regards

Jyoti

Hi Jyoti,

You should contact your broker through whom you submitted the application. Only they would be able to help you in this case.

wants to apply on 28th Dec. under retail category. can i get my 100% allotment. Awaiting your updates on the subscription figures.

IREDA filed Draft prospectus on 18th Dec. We can expect HUDCO or IREDA very soon. IREDA is expected to have 15 Basis points higher coupon since it is AA+ rated.

Hi,

Pls let me know what Mathematical error I m committing.

On NSE site, I see price of NHAI-N6 as Rs 1204 around, which has coupon Rate of 8.75. Remaining Tenure is 14 years. (It was also issued to retail investors).

Its Yield as calculated by me using IRR method comes 7.12%. (similar is displayed by NSE site).

Now, these NEW bonds with coupon rate of 7.60%, will yield 7.12% at price of Rs 1042. (Using Same IRR methodology).

However, as per other ppl (including shiv), these bonds should have gains around 1-2%, that is should be priced at Rs 1010-1020.

I ll b thankful, if anybody can explain this to me.

Hi Rohit,

It is a matter of demand & supply due to which we are expecting these NHAI bonds to list at a premium of 1-2% only. As the older 8.75% bonds are trading at a YTM of 7.12%, 7.60% bonds should also ideally trade at a YTM close to 7.12% only. But, due to profit booking and lack of demand on the day of its listing, these bonds will not have 4%+ listing premium for sure. Don’t be surprised to have even no premium at all.

Rohit,

NHAI bonds with 8.75 % interest were issued in February 2014. Interest is paid on 15th March every year. While calculating yield youwill have to take into aaccount the accrued interest on these bonds. We will have to reduced the accrued interest amount and then calculate the yield. It would be then close to 7.6%. However, Shiv may be able to give a better reply.

In IRR Calculations, it automatically get considered.

CMP is my Outflow.

All future Interest Payments are Inflows.

Starting Inflow is Rs 87.50 on 15th Mar 16.

Ending is on 15th Feb 29 Rs 80.20 (for 11 month) + Principal of Rs 1000. In between every year Rs 87.50 on 15th Mar.

You are perfectly right. YTM is calculated after considering the interest accrued only. But you can not assume that NHAI 8.75 yielding is selling at yield of 7.12 and you can expect the same for the new issue. It will always depend on the demand and supply. As far as 8.75% is considered, the buyer can get his interest part by Mar 15th. He may even sell after that also based on market condition.The price which you mentioned the qty sold is just 50 and that’s the qty for whole day. When new bond gets listed considering that 4000 crore retail, the volume of supply can be high and demand will depend on the interest rate at that time. This is the reason why, one need not expect very high premium for IRFC and NHAI immediately.l

To add, Yesterday the IRFC 15 year bond was selling below par. (Rs 997-1001 range).

Yes George, seeing that I become curious to know why this is happening.

I thank you for pointing out other aspects also.

Thanks Shiv & Gurdeep.

Given the scenario, I feel that a person who is holding earlier NHAI bonds must Sell them and Buy from Primary market or through Exchange New bonds. Looking at the current order book at NSE, atleast Rs 10 lac worth N6 bonds will get sold out in no time till yield comes at 7.17%.

An arbitrage opportunity for people who are holding old bonds.

May not be that attractive if he were to buy new bonds. He has to pay 0.7-1% brockerage+tax and capital gain tax of 10%.

Actually IRFC rate is 10 basis points lower than the NHAI rate (Rs 1 less interest per bond per year). Given a choice, a “small “investor would try to subscribe to NHAI rather than pay Rs 1000 (same price) for the lower yielding security + brokerage. The volumes on NSE are quite low for the tax free bonds and debt in general so be prepared to sacrifice liquidity.

For some one exceeded limit in NHAI and have more to invest, IRFC at current rate with Brokerage still offers 7.45% for 15 years bond which is good or on par with any public issue.Those who are selling are having -ve capital gain or say loss.

Hi George,

I don’t think it makes sense to buy from the secondary market at or above Rs. 1,000 and paying brokerage unnecessarily. It would be better to wait for HUDCO, IREDA or NHAI Tranche II for such investments.

Yes , I agree with you considering 3 issues in the offing, it is better to wait. I was only suggesting for those who wants to top it up in IRFC to 10 Lakh retail limit if they have enough funds to invest in remaining issues also. I feel IRFC is trading on par only due to under subcription in NHAI retail which is to my mind due to the retail customers interested in it exceeded their limit. Still there is a large section of retail investors who are unaware or so not want to venture into TFB. If HUDCO or IREDA comes out with issues there will be enough interest considering that the same retail investors already invested in issued bonds will further invest. Once the NHAI gets closed , we will see some improvements in IRFC pricing in secondary market.

IRR considers the time value between payout of “accrued interest” to the buyer and receipt of interest from the debtor.

Yield formula does not do that. The price (buy price – accrued interest) is considered which may lead to a slight difference.

Thanks Gurdeep and George for your inputs!

Do SBi provide bonds

Hi Ravinder,

SBI came out with a couple of bond issues for general public in FY 2010-11 and received a very good response for both of them. But, subsequent to that, SBI hasn’t launched any such public issue.

If I remember correctly, these were not tax free bonds. In fact the concept of tax free bonds was not in vogue at that point of time.

Yes NN, that’s right, these were not tax free bonds. Tax-Free bonds got introduced subsequently.

Day 7 (December 28) subscription figures:

Category I – Rs. 8,160.03 crore as against Rs. 2,000 crore reserved – 4.08 times

Category II – Rs. 7,055.71 crore as against Rs. 2,000 crore reserved – 3.53 times

Category III – Rs. 3,491.45 crore as against Rs. 2,000 crore reserved – 1.74 times

Category IV – Rs. 3,273 crore as against Rs. 4,000 crore reserved – 0.82 times

Total Subscription – Rs. 21,980.19 crore as against total issue size of Rs. 10,000 crore – 2.20 times

Last 3 days of the issue left, but doesn’t seem that the retail portion will get oversubscribed.

Thanks Shiv Kukreja for updating subscription figures. it helped me for my investment..thanks once again.

You are welcome P.S.!

NHAI bond, Amount has been deducted today which was on hold. 100 % allotment. I think in Dmat it will reflect within day or two.!! thanks Shiv ji.

Hi Shiv,

For someone who has applied on Day-1 in retail category and get’s 100% allocation. How is the interest payment calculated compared to someone who has applied on Day-7 (in retail) and also get’s 100% allocation?

thanks,

Hemant

Hi Hemant,

The day the funds get deducted from your bank account for these investments, you start earning interest on your investment. So, Day-1 applications will earn higher interest as compared to Day-7 applications.

Thanks Shiv.

Been a long time since i invested in one of these.. But the concept is of interest on allotment money.. From the date of debit to your account to the allotment date.

The tax free interest starts from the date of allotment of bonds.

Hi Shiv,

Can somebody still get allocation if applied today.

Thanks

Yes Ash, Category IV investors will get 100% allotment in this issue, even if applied for these bonds on the last day i.e. tomorrow.

Sorry, could Mr. George explain his response of 29.12.15 regarding ‘paying capital gains @10% + brokerage if he were to buy bonds’. Why would a buyer need to pay capital gains tax?

SK, I told selling old Bonds he has to pay. Rohit is talking about arbitrage opportunity of selling old bolds at premium and buying. When you take into account the capital gain tax and selling charges of all bonds, it is better to hold old bonds.

Exactly, there is no sense in selling old tax free bonds and buying the new ones. ET had published an article saying there is arbitrage opportunity but there is none. Read – http://www.moneylife.in/article/sell-old-tax-free-bonds-for-new/44391.html

Mr. Shiv, Could you please advise how to speedily transfer TFB’s from a family member’s DEMAT Account to my own without incurring any charges like brokerage/fees? Please elaborate if there are any sort of restrictions/disadvantages in such transfer.

Hi S.K.,

You can transfer the securities from one account to another using the Speed-e facility of your depository OR submitting the delivery instruction slip with your DP. You can avoid the brokerage in this case, but I don’t think you can avoid transaction charges of the DP, which would be very low. There are no restrictions in such transfers, but you need to consider taxation aspects of such transfer.

Kindly let me know how to calculate the YTM & IRR. What is the difference between the two? Which is more accurate/helpful?

Hi S.K.,

For bonds/NCDs, YTM has significance. Please check this link for YTM calculation – https://www.onemint.com/2012/07/25/how-to-calculate-yield-to-maturity-of-a-bond-or-ncd/

Dear Shiv, i have 1100 hundred PFC tax Free bond for 20 years

so i am in the category of HNIS & the interest rate for this is 7.35%.

when i am trying to add this in demat A/c it is not appearing its showing only 7.60 % which is for retail investor .

please guide me to add this in my portfolio .

Hi Nisar,

Sorry, I won’t be able to help you in your problem, you should contact your broker for such issues.

Hi,

Just wanted to know, if there is any restriction on Institutions to Buy bonds which were originally issued to a Retail Investor.

I mean, can a Institution buy this new Bond which will list on BSE with ID similar to this 7.60NHAI30 ???

Hi Rohit,

Institutional investors can buy these bonds from the retail investors and there is no such restriction on such transactions.

Day 8 (December 29) subscription figures:

Category I – Rs. 8,160.03 crore as against Rs. 2,000 crore reserved – 4.08 times

Category II – Rs. 7,055.72 crore as against Rs. 2,000 crore reserved – 3.53 times

Category III – Rs. 3,492.16 crore as against Rs. 2,000 crore reserved – 1.74 times

Category IV – Rs. 3,313.19 crore as against Rs. 4,000 crore reserved – 0.83 times

Total Subscription – Rs. 22,021.10 crore as against total issue size of Rs. 10,000 crore – 2.20 times

Day 9 (December 30) subscription figures:

Category I – Rs. 8,160.03 crore as against Rs. 2,000 crore reserved – 4.08 times

Category II – Rs. 7,096.22 crore as against Rs. 2,000 crore reserved – 3.55 times

Category III – Rs. 3,492.96 crore as against Rs. 2,000 crore reserved – 1.74 times

Category IV – Rs. 3,360.64 crore as against Rs. 4,000 crore reserved – 0.84 times

Total Subscription – Rs. 22,109.85 crore as against total issue size of Rs. 10,000 crore – 2.21 times

Last day tomorrow.

Mr. Shiv, Please clarify on the ‘taxation aspects of off market transfer of tax free bonds between family members. Could you provide a few pointers please?

Thank you.

Hi S.K.,

Please consult your tax advisor/CA for more clarity on taxation aspects of these securities.

Dear Mr. Shiv, I had applied for Bonds in HNI category. However very few bonds were eventually allocated for less than 2L value. Since amount of allotment is less than the 10L limit I was classified as HNI. If I buy other bonds of same company from Retail Investors from Market which were at higher coupon rate, I understand I will get lower rate of HNI due to clubbing through PAN. Is this accurate? In case I buy other TFB’s Series of same company in retail category from open market will I again get lower coupon rate?

Hi S.K.,

You would get higher coupon rate in both the cases above.

Tax-free bonds give better returns than tax-saving FDs – http://www.business-standard.com/article/pf/tax-free-bonds-give-better-returns-than-tax-saving-fds-115122900709_1.html

Just as a piece of information.

I checked yield of various tax free bonds (including recently issued) and all trade around 7.30%, only exception to this is NEW 7.53% IRFC bond which is trading at pat i.e. 7.53% (Listed on 28th Dec).

Old IRFC trades at 7.30%.

Hope New NHAI doesn’t follow this exception New IRFC.

Been a long time since i invested in one of these.. But the concept is of interest on allotment money.. From the date of debit to your account to the allotment date.

The tax free interest starts from the date of allotment of bonds.

It is just a matter of time that new IRFC bonds will also start trading at par with other/older tax-free bonds.

IREDA (AA+) coming on 8th Jan…Retail 7.74% 15 Years and 7.68% 20 Years

Thanks for the update.. helps!!

thanks.. helps to plan

Thanks Sanjay for the update!

Dear Shiv Happy new year

Good news Ireda 7.74%,thanks for update

and also kindly clarify New irfc 7.53% trading in Nse NJ series.This 7.53% in retail category issued.when we buy in secondary market (Nse or Bse) same 7.53% interest we can get?

Thank you Raju, you too have a wonderful 2016!

Yes, you’ll get 7.53% interest with IRFC bonds if your investment amount does not exceed Rs. 10 lakh on the Record Date.

Good Morning Shiv

Actually i received 791 bonds in first allotment.and i want to buy in secondary market (Nse or Bse).Showing 7.53% irfc Nj series.already record date is Dec 21st 2015.

Now i need clarification there is any limit is there for get 7.53%interest when we buy in secondary market.

Good Afternoon Raju!

Yes, there is a limit of Rs. 10 lakh for you to get 7.53% interest. If your investment in this issue exceeds Rs. 10 lakh, then you’ll get 7.28% interest.

last time ireda was triple rated then why this time A is company is making some losses or something else and dear shiv which one you will prefer hudco or ireda as both are known A

Yes Shiv, would be great if you can give some insight on this. Both IREDA and HUDCO have A+ rating. Which one would you give more preference to?

Hi Nitesh & Nishi,

IREDA is AA+ and not A/A+ as you mentioned. No doubt ‘AAA’ rated bonds are considered to be the safest of the lot, but I don’t think it is a matter of huge concern to have AA+ rating for a PSU. Moreover, I don’t have any personal bias for or against IREDA & HUDCO, I think both are equally good companies to invest in.

Please let us have full detail on IREDA & HUDCO tax free bond..opening date with interest rate for category IV-retailors..

Final Day (December 31) subscription figures:

Category I – Rs. 8,160.04 crore as against Rs. 2,000 crore reserved – 4.08 times

Category II – Rs. 7,081.32 crore as against Rs. 2,000 crore reserved – 3.55 times

Category III – Rs. 3,494.16 crore as against Rs. 2,000 crore reserved – 1.74 times

Category IV – Rs. 3,420.07 crore as against Rs. 4,000 crore reserved – 0.84 times

Total Subscription – Rs. 22,155.60 crore as against total issue size of Rs. 10,000 crore – 2.22 times

IREDA 7.74% Tax-Free Bonds Issue – https://www.onemint.com/2016/01/02/ireda-7-74-tax-free-bonds-january-2016-issue/

Tax free bonds..

Chirag Gandhi 07:22AM

To: [email protected]

Hello,

I am a subscriber of One Mint.

I had been alloted 791 bonds from the IPO.

I wish to know if I buy more IRFC bonds from the market will I get the same rate of Interest at 7.5 percent or less?

Can I buy any number of bonds or my total holding has to be less than 1000 to be considered as a retail investor?

I am a bit confused whether I should subscribe for new offers which are yet to come or are there any existing bonds available in the market whose effective yield is better?

I am interested in buying bonds with highest possible tenure say 15-20 yrs.. And which offer best net effective yield.

Can u pls guide me on this.

Thanking you,

Regards,

Chirag Gandhi

Hi Chirag,

1. You’ll get 7.50% rate of interest if your total holding does not exceed 1,000 bonds in the IRFC issue.

2. I think you can subscribe to the IREDA bonds issue which is opening on 8th of January – https://www.onemint.com/2016/01/02/ireda-7-74-tax-free-bonds-january-2016-issue/

Hi Shiv,

I hold 200 NHAI bonds (for 10 years) allotted from 2013-2014 Tranch 1. I have applied for 1000 bonds (for 15 years) as part of retail category in NHAI Tranch 1 (Dec 2015). Will I get the same rate of interest as that of retail investors – 7.6%?

Hi Janaki,

Yes, you’ll get 7.60% rate of interest.

HDFC’s Keki Mistry, media entrepreneur Raghav Bahl, Bollywood bid for Rs 10,000-crore NHAI bonds

http://economictimes.indiatimes.com/articleshow/50460497.cms

Reliance invested Rs. 350 crore, SBI Rs. 3,000 crore, Akshay Kumar Rs. 65 crore and Kareena & Karishma Rs. 25 crore between them. Axis Bank, IDFC Bank and Yes Bank put in between Rs. 500 crore to Rs. 1,500 crore.

Hi Shiv,

The issue was closed on 31st Dec, do you know when the allotment of bonds will take place

thanks

Hi Parag,

NHAI allotment should happen by tomorrow or Monday.

Sir maine nhai bond me 120 bond ke liye apply kiya hua hai .kya aap bata sakte hai ki iski listing date kab hai aur kitna premium milne ki sambhavna hai

Hi Rajneesh,

NHAI bonds ki listing date abhi announce nahin ki gayi hai, but I think by Tuesday or Wednesday listing ho jaani chahiye. Also, I think NHAI bonds mein maximum 1-2% listing gain hoga. Kam bhi ho sakta hai.

When will be the NHAI bond allocated. Say we get the bonds allocated in the Demat account and hold it till it matures will the bond will be automatically redeemed or need to sell to the company on the maturity date

Hi Vinod,

NHAI bonds are expected to get allocated by tomorrow or Monday. Also, you need to do nothing on maturity, bonds will automatically get extinguished on maturity and maturity proceeds will get credited in your bank account.

Hi Shiv – the Retail Category (IV) is not subscribed fully. This means everyone will get the allocation.

Hi Parag,

Yes, every successful applicant will get full allotment.

Hi Shiv

I have applied for NHAI Tranche-I Series 2B Tax Free Bonds, whose last date of submission was 31.12.2015. May I know its allotment status.

Regards.

Anjan

Hi Anjan,

Allotment will start from tomorrow or Monday, so you’ll get message from the company as & when the allotment happens.

Hi Shiv,

I am Comparing NHAI issue & IREDA issue, wrt Subcription numbers.

On Day1 of NHAI, Institution Subscription was 4 times, while in this issue its till now less than 0.7 times.

Why institutions are staying away from this small issue.. while they were madly interested in bigger issue of NHAI ?? when its offering higher rate.

Hi Rohit,

QIBs normally prefer bigger issuers to invest their money, like NTPC, NHAI, IRFC, REC etc. A slightly higher rate of interest does not matter much to them.

Any news on NHAI trabche 2 for fy 2015-16 yet? When are they getting announced and expected rate of interest will be ?

Hi RS,

There is no info provided by NHAI about its 2nd tranche of tax-free bonds. I’ll keep this post updated as soon as I have any info. But, don’t expect that issue to come soon, as the company is yet to allot bonds for its 1st tranche. Also, NHAI doesn’t seem to be over enthusiastic about raising huge money going forward.

NHAI has allotted the bond. Amount has been deducted which was on hold. 100 % allotment.

Thanks Pankaj for this info!

Hi Shiv, by when do you think the allotted bonds should get credited to the demat account (with ICICI Direct in this case)?

Thx.

Hi SG,

Allotment will start from today evening and the bonds should start reflecting in your demat/trading account as soon as the trading starts. However, for ICICI Direct, I have heard that you need to get your bonds credited to your trading account for selling them. I don’t know the exact procedure though.

just got message from cdsl applied for 150 bonds and get full allotment and plus my agent will give back me rupees 500 as intensive to me so it is far better to get full allotment at 7.60 rather than 7.74 with only 55% allotment only .14 paisa is the difference between nhai triple rated & irdea double rated company what you say dear shiv

not much difference interest

Hi Nitesh,

No comments on the agent commission you have received. But, personally I prefer a better company to invest my money, so I think between NHAI and IREDA, I would go with NHAI.

Hi Shiv,

In Demat account under ISIN description something is mentioned like this “SR IIB 7.6 BD 11JN31 FVRS1000”

Can you please spare some time to explain the meaning of these terms?

Thanks in advance.

Regards,

Vineet Garg

Hi Vineet,

It is “Series IIB 7.60% Bond 11th January, 2031 Maturity Date Face Value Rs. 1,000”.

got them in my demat

That’s great! So, trading should start by Wednesday I guess.

Hello Shiv,

Its great to read your posts.

Regarding NHAI bonds, I have applied 1400 bonds and have got 100% allocation. I had initially thought that i would get just 40-50% allotment and hence applied double of what i needed. Now I just wanted your opinion, at any future date:: generally if I wish to liquidate the bonds@listed prices, how long can it take??? A friend opines that TFS are tough to sell as often there are no buyers? Is it realistic?

IREDA being a AA+ has got higher application compared to its issue size. Is there anything wrong with NHAI that it dint even get fully subscribed?

thanks in advance.

Thanks Krunal!

1. It is slightly easier to liquidate your bond holdings which are reserved for the retail investors. But, it is not difficult to sell your bonds to the non-retail investors either. So, you should not be overly worried about it.

2. There is nothing wrong with the NHAI bonds, except of the fact that NHAI issue was a relatively bigger issue. NHAI received bids worth Rs. 2,508.10 crore in Category IV on the first day as compared to IREDA which got bids worth Rs. 1,262 only.

listing date please

NHAI Bonds will get listed tomorrow.

Hi, Shiv,

Have u recd circualr for the smae

what is bse code of 15 year retial bond

NHAI Tax-Free Bonds allotment is complete now, you can check the allotment status from this link – http://kosmic.karvy.com:81/ipotrack/

the limit for retail investor is 10 lakhs, but will it appear in the AIR transaction in 26AS if one invests.

Yes, It will appear.

Yes Viswanathan, there is a high probability that it will appear in Form 26AS.

NHAI tax-free bonds to get listed on the BSE & NSE on January 14th i.e. Thursday – http://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20160113-4

Here are the BSE & NSE codes for the same:

7.35% 10-year bonds – BSE Code – 935582, NSE Code – N9

7.60% 15-year bonds – BSE Code – 935584, NSE Code – NA

Deemed date of allotment has been fixed as January 11, 2016. Interest will be paid on April 1st every year.

hello, did this bond get over-suscribe ever before 31st dec’15 at retail investor zone?

Hi Sandhya,

Retail portion got subscribed 0.85 times or 85% of the overall portion reserved for them. So, all successful applicants got full allotment.

As expected NHAI traded in large volumes and very low premium. Not sure why retail investors sell soon after allocation even when there was very minimum premium not even good enough to meet the brockerage charges. Possibly these are people who may be getting the commission for bidding and makes money that way and sell for no loss no gain.

But, why Old NHAI bonds are not trading at rate new one is Trading i.e. 7.50%.

Old Bonds are still trading at yield of 7.30%. (NHAI-N2, NHAI-N6).

One can say liquidity as one of the factor, as both had volume around 20 lacs, but difference of 20 bps does not fully justify that.

What could b other reason ??? and for this company what should be the 10-15 yrs yield to be considered ??? 7.30% or 7.50% ???

Hi Rohit,

Can you think of any other reason for this difference?

No, I m not able to think any other reason.

I don’t know which yield to tell anyone if he ask, how much NHAI 10-15 years bond Trades at ???

You are right in your assessment and the same with anyone. 3500 Crore retail bonds, naturally 10% are going to make it money immediately. It is the liquidity and for the same reason any day this bond is better than others. If you have to sell for some reason, you will get reasonable price. You will find it very difficult to get the right price for bonds which issued 1000 crore where retail is just 400 Crore.

I think 7.30% should be called as the fair yield because it does not have any artificial supply/demand to be factored into its price.

hi Shiv, read this today… so does that mean NHAI tranche 2 will not happen? http://www.financialexpress.com/article/industry/banking-finance/nhai-surrenders-rs-5k-cr-tax-free-bond-limit-to-govt-say-sources/197649/

Hi RS,

It will happen, but with a reduced issue size of Rs. 5,000 odd crore. Remaining Rs. 5,000 crore, which NHAI is surrendering, will be allocated to other companies, like IRFC, REC, PFC or NTPC.

Thanks Shiv.

Any idea when is the announcement(s) expected for the remaining tax free bonds in this FY.

We are expecting HUDCO issue announcement any time this week.

HUDCO tax-free bonds issue update:

Issue opens – 27th January

Issue closes – 10th February

Base Issue Size – Rs. 500 crore

Total Issue Size – Rs. 1,711.50 crore

Interest Rates for Retail Individual investors investing upto Rs. 10 lacs:

10 years – 7.27% p.a.

15 years – 7.64% p.a.

Shiv, with this kind of performance of NHAI & IRFC, who would like to put money in these Tax Free Bonds ???

If anyone wants to put money in TFB, he can Buy 76NHAI31 anytime from the market, which is trading at Par and will always hav better liquidity because of its size.

George, your comments pls.

Hi Rohit,

Not only speculators, but investors also invest in these bonds. So, I am 100% sure that this issue will also get oversubscribed on the first day itself. People, who so not have demat accounts, can’t buy these bonds from the secondary markets.

I agree with Shiv. This will also get oversubscribed. I am waiting eagerly for the refund from IREDA though not applied for full retail quota. I would like to buy some in the secondary market. No waiting required. Having said that many will be comfortable to apply for the public issue where no brokerage is there. The current situation was there even when the last time they issued TFB at the rate of 8.6% to 9% levels. There are many who sold at par after allotment. Even I have sold some of them to make sure that the portfolio is diversified. Any way I have emptied all those High yeilding bonds from time to time and invested part of the amount in the recent issues. Though I paid Capital gain and brokerage, I found better returns options.I have decided not to part with current TFB unless there is such urgent need of money or good premium available.

At present, I feel comfortable buying the recently issued bonds from secondary market.

Dear Mr. George,

Could you throw some more light on the other investment options which provided better returns than the earlier high-yield TFB’s which you sold off.

Your kind advice will be appreciated by the many readers of Mr. Shiv Kukreja’s blog.

Thank you.

SK, I have sold the bonds when YTM was in the range of 7% to 7.5% and there was FD investments available at 9% interest with Annual yield of 9.3%. I have moved some of the fund back to FD with 3-5 yrs locking and also to GILT funds. May not be better return, but when you look at 15 years 20 years locking moving to 3 or 5 years locking with taxable 9.3%, I see some benefits there. It all depends on how you look at it and individual requirements. Hope it answers your question. Again like share market, some time it is important to look at the right time to switch between investments. Some time you get it correct.

Shiv ji – enjoyed reading this line : “Not only speculators, but investors also invest in these bonds.” Well said. I will be applying for HUDCO, even though I got allocated IRFC, NHAI, REC, NTPC. I had skipped IREDA because of the rating downgrade concern. My thinking is we should be broadly diversified across different companies across different sectors..

Yes Bhaskar, it should be reasonably diversified.

Thanks for the update Shiv.

Is HUDCO rated AAA this time (I think it was AA earlier). The interest rate for HUDCO is marginally better than NHAI tranche 1 which was 7.6% for retail investor for 15 years

Thanks Shiv for the update. Hudco is rated AAA this time (isn’t it)?

Yes RS, it is ‘AAA’ rated this time as compared to ‘AA+’ last time.

HUDCO 7.64% Tax-Free Bonds Review – https://www.onemint.com/2016/01/21/hudco-7-64-tax-free-bonds-tranche-i-january-2016-issue/

Hi Shiv,

Thank you for keeping us updated.

I got 1000 NHAI bonds, but I haven’t received interest. By when can I expect that to be credited to my bank account?

Thanks!

Hi Santosh,

By now, it should have got credited.

Thank you for the reply Shiv, it got credited in my Dmat linked account.

Thanks!

That’s great Santosh!

dear shiv I think will get 11400 interest on 150 bonds on 2nd of April because of bank closing date isn’t it correct because I am receiving regularly interest of sbi n5 bonds on 2nd of April am I correct shiv

Yes, that is possible Nitesh.

When can one expect the allotment/refund of HUDCO TFB?Whether retail investors will get full allotment if they applied on the first day itself?

Hi Viswanathan,

HUDCO refunds would get credited on or before February 8. But, around 49% allotment would be made.

Hello Shiv

I had applied for NHAI bonds in the names of 4 family members. The application was made for physical form. We have recd physical bonds for 3 while the 4th one is still not recd. I had applied thru karvy brokerage which says it must be in post and they suggest me to wait. Now that its over 2 weeks since the other bonds were delivered to me, my discomfort is growing. Is there any place where i can directly contact NHAI and check the status of my missing bods???

Hi Krunal,

You should contact Karvy Computershare at 1800 3454 001 to know the whereabouts of your bond certificate.

Hi Shiv,

Thanks for the information.

You are welcome Viswanathan!

Hi Shiv,

Any idea , whether there will be any further issue of Tax Free Bonds this Fin Year , if so which one?

Hi Viswanathan,

3 more issues are expected – NHAI Tranche II, HUDCO Tranche II and NABARD.

Dear Shiv,

Since I missed to apply for this TFB, I want to purchase it now through my ICICI direct brokerage account. However when I searched for NHAI I got multiple entries. Do you know what is the official name of this TFB?

By the way, does it make sense to purchase this from the market, or it is better to wait for the 2nd tranche?

Hi Melwyn,

I don’t know how to search it in ICICI Direct account, but these NHAI bonds have the following BSE/NSE codes:

7.35% 10-year bonds – BSE Code – 935582, NSE Code – N9

7.60% 15-year bonds – BSE Code – 935584, NSE Code – NA

You can search NHAI bonds using these codes. Also, I would personally like to wait for the tranche II to invest in these bonds rather than buying them from the secondary markets. Different investors might have different opinions about it.

Thank you for the data and your opinion. I think I will wait for the 2nd tranche as well. Thanks.

Sure, thanks Melwyn!

IRFC will raise an additional Rs. 3,500 crore by issuing tax-free bonds this financial year – http://www.financialexpress.com/article/economy/indian-railway-finance-corporation-gets-rs-3500-crore-more-tax-free-bond-limit/211014/

I agree with SK, one must wait for 2nd tranche as buying from secondary market is a costly affair. Assuming that there will be no further issues this FY, I bought 300 NHAI sr II 7.60 11Jan31 @ Rs.1010.50 + brokerage at ICICI Direct.com. The total with all charges worked out to Rs.306700/- bringing down the effective YTM to around 7.40% p.a.

Hi Satish,

Was this the tranche 1 bonds that you bought (that was released in Dec 2015)? Also can you help to clarify how you worked out the effective YTM (what is the formula?). It looks like you paid Rs 6,700 extra for the entire lot of 300 bonds, which works out to 2.23% more.

(6700/3,00,000)*100 = 2.23%

Thanks,

Melwyn

Hi Shiv,

Any information on when the NHAI and IRFC TFB tranche II Issue opens?

What will be the issue size for these two ?

Thanks,

Amit

NHAI Tranche II update:

Issue opens – 24th February, 2016

Issue closes – 1st March, 2016

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

Total Issue Size – Rs. 3,300 crore, including Green-Shoe Option to retain Rs. 2,800 crore

HUDCO Tranche II update:

Issue opens – 2nd March, 2016, Issue closes – 10th March, 2016

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

Total Issue Size – Rs. 1,788.50 crore, including Green-Shoe Option to retain Rs. 1,288.50 crore oversubscription

NABARD Tax-Free Bonds Issue Update:

Issue opens – 9th March, 2016, Issue closes – 16th March, 2016, Issue Size – Rs. 3,500 crore

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.64% p.a.

Hi Shiv, As per the article, interest should be credited by 1st of Apr every year. But as of now, no interest is being credited to my account for IRFC tax free bonds tranche 1. Please advise.

got the credit. please ignore my query. Thanks.

I think you are talking about NHAI tranche 1 Dec 2015 bond of which Intt got credited on 2nd April ( 1st being holiday)

For IRFC Tranche 1 as well as 2 2015 bond , intt payable date is 15 Oct.

Dear Shiv, kindly confirm

Hi Shiv. Is the interest earned on the investment made in these bonds by NRIs through their NRE Accounts in india, taxable? Please advise, and are there any official links giving this specific information? Thanks.

AJIT