This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

It is that time of the year again when people start exploring tax saving options other than their routine 80C investments and one of those options is Rajiv Gandhi Equity Savings Scheme (RGESS). A few days back, Kunal asked me to review one such scheme launched by HDFC mutual fund under this category.

Here is what he had quoted:

Kunal February 9, 2015 at 12:08 pm

Dear Shiv

Can you please review the Mutual Funds coming up under Rajiv Gandhi Equity savings scheme. I believe right now – HDFC RAJIV GANDHI EQUITY SAVINGS SCHEME is Open. It would be good if you can review and list pros and cons of investing there as it seems like close ended with 3 year lock in, but normally everyone advertise equity mutual fund in long term more than 5 yrs or so. Is this scheme or others like it really worth the risk.

Regards

Kunal

Before I focus on HDFC’s new fund offer, let me first share some features of RGESS.

What is RGESS and under which section it provides tax benefits to its investors?

Investment in Rajiv Gandhi Equity Saving Scheme provides tax exemption to its investors under section 80CCG of Income Tax Act, 1961. Manshu covered RGESS when it got introduced during financial year 2012-13.

As per Section 80CCG of the Income Tax Act, 1961, a resident individual who is a ‘New Retail Investor’ and acquires listed equity shares or listed units of equity oriented mutual fund in accordance with the RGESS, is entitled to a deduction of 50% of the amount invested from his total income to the extent the deduction does not exceed Rs.25,000.

These schemes provide tax exemption of up to Rs. 25,000 on an investment of up to Rs. 50,000 i.e. 50% of the amount invested and carry a lock-in period of 3 years.

There are certain conditions which a retail investor needs to fulfill in order to avail tax benefits u/s 80CCG. Here are those conditions:

* The gross total income of the investor for the relevant year should not exceed Rs.12 lakhs.

* The investor should be a ‘New Retail Investor’ as per the definition of RGESS.

* The investment should be made in such listed equity shares or listed units of equity oriented mutual fund as specified in RGESS.

* The investment is locked-in for a period of 3 years as provided in RGESS.

Who is a New Retail Investor?

New Retail Investor means a resident individual:

* Who has not opened a demat account and has not made any transactions in the derivative segment before the date of opening of a demat account or the first day of the relevant year, whichever is later.

* Provided that an individual who is not the first account holder of an existing joint demat account shall be deemed to have not opened a demat account for the purposes of RGESS.

* who has opened a demat account but has not made any transactions in the equity segment or the derivative segment before the date he designates his existing demat account for the purpose of availing the benefit under RGESS or the first day of the Initial Year, whichever is later.

HDFC Focused Equity Fund – Plan A

HDFC Mutual Fund launched one such scheme last month called “HDFC Focused Equity Fund – Plan A”. This scheme got launched on January 15th and is getting closed tomorrow, February 13th. It is an 1100-days closed-ended diversified equity fund which will invest in “eligible securities” as per the terms of RGESS.

The eligible securities for HDFC Focused Equity – Plan A are as follows:

- Equity shares of those companies which are part of “BSE-100” and “CNX-100”;

- Equity shares of public sector enterprises which are categorised as Maharatna, Navratna or Miniratna by the Central Government;

- Shares issued in a public offer by companies covered in (a) and (b) above;

- Initial Public Offer (IPO) of a public sector undertaking (PSU) wherein the Government shareholding is at least fifty-one per cent which is scheduled for getting listed in the relevant previous year and whose annual turnover is not less than four thousand crore rupees during each of the preceding three years.

Objective of this scheme: The scheme aims to generate long term capital appreciation by creating a portfolio of eligible securities in RGESS.

Term/Duration of the Scheme & Liquidity: As it is a closed-ended fund of 1100 days, it will cease to exist on maturity i.e. after 1100 days and the investors will get their investment back along with the returns generated by this fund during this period.

Moreover, the units of this scheme will get listed on both the stock exchanges, NSE and BSE, in order to provide liquidity to its investors. But, if you sell your units prior to maturity, you’ll be liable to pay taxes on the amount of exemption you claimed in the relevant year.

Benchmark: The performance of the scheme will be benchmarked against S&P BSE 100, which is an index of the top 100 companies listed on the Bombay Stock Exchange.

Entry/Exit Load: Neither entry load will be applicable at the time of investment nor exit load will be payable by the investors at the time of maturity.

Is it mandatory to have a demat account to invest in HDFC Focused Equity Fund – Plan A?

If you wish to avail tax benefit u/s 80CCG, then it is mandatory to have a demat account in which the units of this fund will be credited by HDFC AMC.

How to open RGESS demat account with a Depository Participant (DP)?

You need to approach a stock broker or a registered DP to open a demat account under RGESS.

Profile of the Fund Manager

As I mentioned earlier in other posts as well, I think the fund manager is the most important factor to be considered while investing in any of the mutual fund schemes, especially an NFO. So, let me put some light on this scheme’s fund manager.

Srinivas Rao Ravuri, aged 41 years, will be managing this fund on behalf of its investors. He is a B.Com (H) and MBA (Finance) with over 19 years of experience in the Indian financial markets, primarily in equity research and fund management.

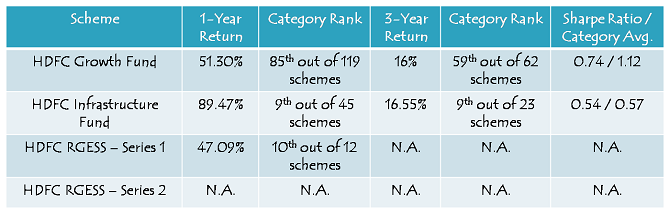

Prior to joining HDFC AMC, he worked with Motilal Oswal Securities Ltd., Edelweiss Capital Ltd. and Securities Capital Investments (I) Ltd. He has been a fund manager with HDFC Mutual Fund since October 2004 and is already managing four of its schemes, namely HDFC Growth Fund, HDFC Infrastructure Fund (jointly with Prashant Jain), HDFC RGESS – Series 1 and HDFC RGESS – Series 2.

Here is some relevant data for the schemes he is already managing:

As it is a new fund offer, it is not possible for me to review its performance. But, the past performance of other funds which are solely managed by Mr. Ravuri does not provide enough comfort to me to advise investors here to put their investment in this scheme. So, I think it would be better for the investors to explore other RGESS options for their tax saving u/s 80CCG.

If you are planning to invest in this scheme or any other eligible RGESS, then you please feel free to put any of the your queries here and I’ll try to respond to it as soon as possible.

any fund open now for investing via rgess.

I don’t think there is any such fund open for subscription.

Ohkk…Thx a lot Shiv!!!

You are welcome!

what about ecl ncd Feb2015 details & suggestions please

Here you have the post on ECL Finance NCDs:

http://www.onemint.com/2015/02/24/edelweiss-ecl-finance-limited-10-60-ncds-february-2015-issue/

Hello Shiv,

I have a query which is not in regards to the above column of yours.

A perrson holds some odd 550 TCS shares in Demat ,would it be a good opportunity to take the benefit of TCS and CMC merger in their respective share prices.

TCS 2638

CMC 1990

On April 1, the person holding CMC in his demat will get TCS according to the terms of merger (79 TCS against 100 CMC).

So, as is visible to me there is a crystal clear arbitrage opportunity.

My Question is-

So should that person take the benefit?

How come still there is a arbitrage opportunity in this market???

Thanks.

Hi Priyanka,

Yes, there is an arbitrage opportunity with the TCS-CMC merger. If executed, the investor will earn risk-free profits in most of the scenarios. But, as there is a capital gains angle as well in this arbitrage trade, investors should have held TCS for more than a year and also commit to hold them for more than a year once the shares get allotted again on or around April 1.

Thanks shiv

Hey shiv

Very good article. And thanks for asking people not to invest on these type of funds. I have used regss last year and this year also would like to use. Because of bull market got good returns in first year. As markets are heated up I would prefer to go with index etf like quantum index etf.

And I would like to hear much abt the flexible lock in regss scheme ! It was mentioned in NSE FAQ. But little tricky to understand.

Thanks, if you have time add that in the post.

Thanks Vignesh! I’ll definitely try to cover flexible lock-in feature of RGESS in a few days.