HUDCO 7.69% Tax-Free Bonds – Tranche II – March 2016 Issue

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

It seems like the hunger for tax-free bonds is just growing unabated and whatever the issue size be it would be gobbled up by the investors on the first day itself. HUDCO will launch its second issue of tax-free bonds from 2nd of March i.e. the coming Wednesday and though the company has fixed March 10 to be the closing date of this issue, I think there is no need to emphasize here on this forum that nobody should expect to get any allotment if the bid is not made on the first day itself.

It will be the ninth such issue of tax-free bonds for the current financial year, but none of the issues has lasted for more than one day to get oversubscribed, except for the NHAI Tranche I in December. Though I think for any issue to last for more than one day the quota for the retail investors has to be more than Rs. 2,000-2,500 crore, this issue has only Rs. 715 crore for the individual investors investing Rs. 10 lakhs or less.

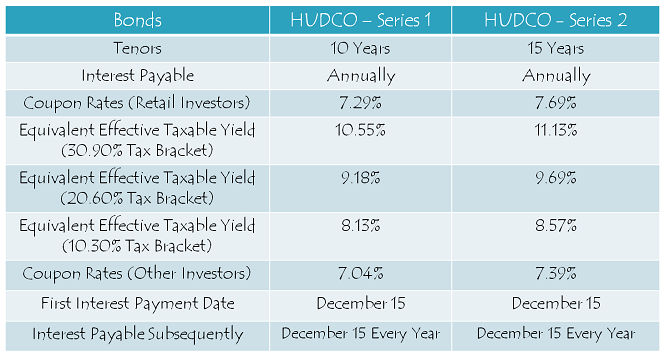

Here are the main features of HUDCO Tax-Free Bonds Tranche II:

Size of the Issue – Out of Rs. 5,000 crore allocated to HUDCO to be raised this financial year, 70% i.e. Rs. 3,500 crore should be raised through public issues. HUDCO raised Rs. 1,711.50 crore through its first public issue in January and it will raise the remaining Rs. 1,788.50 crore in this issue.

Coupon Rates on Offer – HUDCO issue will carry coupon rates which are absolutely same as offered by NHAI in its issue which got closed yesterday – 7.29% for the 10-year option and 7.69% for the 15-year option. Like the NHAI issue, this issue also will not offer the 20-year option.

For the non-retail investors, coupon rate will be lower by 25 basis points (or 0.25%) for the 10-year option and 30 basis points (or 0.30%) for the 15-year option, as it was the case in the NHAI issue as well.

Rating of the Issue – CARE and India Ratings have assigned ‘AAA’ rating to the issue, indicating that the issue is quite safe to invest and the company is highly likely to pay its debt obligations in a timely manner. Also, these bonds are ‘Secured’ in nature and in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

NRI/QFI Investment Not Allowed – Again, Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue is reserved i.e. Rs. 357.70 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 357.70 crore

Category III – High Net Worth Individuals including HUFs – 20% of the issue is reserved i.e. Rs. 357.70 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 715.40 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first-come-first-served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – HUDCO bonds will get listed only on the Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. Whether you apply for these bonds in demat or physical form, the interest payment will still be credited to your bank account through ECS.

Also, even if you get these bonds allotted in an electronic form, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchanges within 12 working days of the closing date.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – HUDCO will make its first interest payment on December 15 this year and subsequent interest payments will also be made on December 15 every year, except the last interest payment, which will be made to the bondholders along with the redemption amount on the maturity date.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

Budget 2016 will be presented in the parliament on February 29 and we will get to know whether we will have these tax-free bonds available or not for the next financial year. In case the finance minister Mr. Arun Jaitley decides against extending this facility to these public sector units, then I think there will be a rise in the demand for the already listed tax-free bonds and hence, we can expect a rise in their market value as well.

Also, a higher fiscal deficit number will result in an increase in bond yields, which in turn will result in a higher coupon rates for the IRFC and NABARD issues. So, in case there is a jump in bond yields, then you should wait for the these two issues to decide on your final investments. I’ll update this post on March 1 after the climax of Budget 2016 gets revealed.

Expected Launch Date of IRFC and NABARD Issues – 2nd week of March

Application Form for HUDCO Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in HUDCO tax-free bonds, you can contact me at +919811797407

Thanks for this info … KS

You are welcome KS!

saving ideas. com is showing 15th dec every year of payment of interest for this bonds actual interest payments date please shiv

Thanks Nitesh for pointing it out, I have corrected it above in the post.

Hi Shiv,

Looking at the size of issue, this issue will also oversubscribe on the first day isn’t it?

Regards,

CVS

Yes CVS, most likely this issue will also get oversubscribed on the first day itself.

Dear Mr. Shiv,

In case TFB’s are in DEMAT joint names, & first holder passes away, to whom will the Bond holdings pass on to? Will it be to the 2nd Joint holder in the Demat Account or to the Registered Nominee in the Account? Will submitting the death certificate be adequate for the transmission of all Demat Holdings? Please clarify in some detail & oblige?

Thank you.

Dear Mr.Shiv,

Is there any announcement for Tax Free bonds by Finance Minister for the Financial year 2016 and 17?

Hi S.K.,

In case the first holder passes away, the 2nd holder will become the only beneficial owner of these bonds. A fresh demat account in the name of the 2nd holder will have to be opened and a death certificate will have to be deposited along with the transmission form to get the holdings transferred.

Dear Mr. Shiv Kukreja,

Is only death certificate adequate in above case. I happen to read ICICI’s transmission form online, where lots of other documentation like succession certificate, letter of administration etc are indicated. I am somewhat confused why so many unnecessary requirements. Could you please clarify in detail .

Hi S.K.,

Different documentation is required for different situations. Please get in touch with ICICI Direct people to have a checklist as per your situation.

1- In case of the death of First holder the death certificate is sufficient, no other documentation is required for second holder. It may require a change in Demat Account Number from the

2-ICICI Securities has given you a common form. You should delete the inapplicable caluses and submit.

Sir,

If I am sell Tax free bonds after 02 years of Allotment date..thus Long term capital gain Tax apply for the Capital Appreciation or not..If Apply What is the Tax rate..

Hi Madhu,

LTCG tax for listed bonds is 10% (flat).

Sir,

If I am sell Tax free Bonds after 02 years from the date of Allotment ,Thus Long term capital gain tax is apply for Capital Appreciation or not..If Ltcg Apply ,what is the tax rate..

Dear Shiv,

Is there any announcement for new Tax free bonds for the financial year 2016 & 17 ?

Hi Nishar,

There is no clear announcement about tax-free bonds in the Budget. But, there are two statements in the Budget speech which indicate that these bonds have been allowed to get launched:

1. “To augment infrastructure spending further, Government will permit mobilisation of additional finances to the extent of `31,300 crore by NHAI, PFC, REC, IREDA, NABARD and Inland Water Authority through raising of Bonds during 2016-17”.

2. “This will be further topped up by additional Rs. 15,000 crore to be raised by NHAI through bonds”.

Thanks a lot . If any clarity after few days pls do let us know…

POST BUDGET – whether we will have these tax-free bonds available or not for the next financial year. ??

THANKS

I think it will be there. Some 33kcrore. Sir , can you please confirm

I had Mr. Jetali’s Budget Speech in Loksabha on 29.2.2016. He clearly said there won’t be TFBs for the next year.

I heard Mr. Jetali’s Budget Speech in Loksabha on 29.2.2016. He clearly said there won’t be TFBs for the next year.

What time in the morning of 2nd March does the issue open up for subscription ?

Hi Mr. Joshi,

Bidding will start at 10 a.m. in the morning.

Is it good idea to wait for IRFC and NABARD and will have better coupon or no point in waiting and they might have low coupon

Hi Vinod,

After a lower than expected fiscal deficit target of 3.5% announced in today’s budget, 10-year banchmark bond yield has fallen sharply to 7.626% from 7.783% on Friday. If IRFC & NABARD issues get delayed by 5-7 days, then I think they would carry a lower rate of interest than this issue.

Thanks Shiv

You are welcome Vinod!

I want to purchase current or old tax free

bonds..can u help me to get..

Shiv

Can you confirm hudco are available on “certificate” basis. It may be a good idea to purchase for some family members.

Yes nn, you can apply for these bonds in physical/certificate form.

I don’t hv deemat acount. Still I can purchase tax free bonds..pl help..

how can I. .

thanku.

Hi Anoop,

Please mail me your requirements on [email protected], I’ll try to help you buy these bonds from an interested seller.

Thanku sir..for helping me

I placed a bid on 10 am through hdfc security. May I lucky 1.?..

Hi Anoop,

You should get proportionate allotment.

Very informative

Thanks Paulose!

nabard credit ratings please

NABARD issue would be rated ‘AAA’.

Dear Mr. Shiv Kukreja,

Please inform where exactly & how precisely are TFB’s sale STCG/STCL are to be shown in I.T.R. Form while filing tax returns.

Please explain Taxation on STCG (less than 1 year of holding) & LTCG (after 1 year of holding).

Hi S.K.,

LTCG on these bonds is taxed @ 10% (flat) and STCG is taxed as per your tax slab. Moreover, please consult your tax advisor for ITR treatment of these bonds.

Dear Mr. Shiv

Pl advise me whether it is advisable to invest in current HUDCO TFB or wait for RFC and NABARD TFBs or wait for next FY 2016-17.

A.K. Jain

Dwarka

Hi Mr. Jain,

We still don’t know whether tax-free bonds will be there next fiscal year or not. Moreover, the 10-year govt bond yield has fallen to 7.608% from 7.876% in the last three days. So, I think going forward there will be a fall in the coupon rates of these bonds and their demand will rise. Considering these two things, one should definitely invest in this issue. In all likelihood, you won’t get full allotment for these bonds. You can invest the refund amount in IRFC and NABARD issues.

Unless you have boatloads of ready cash, it may be difficult to invest in the other bonds. Correct me if I am wrong, but the refunds are expected in approx 12 days from the closing.

I am following a different (risky) strategy..don’t know if it will work. Let the oversubscription play out for HUDCO and then hit NABARD. A 5-10 bps reduction in interest rate would not matter as long as one gets a higher percentage of allocation since it averages out on the higher allocation.

Hi nn,

Considering 50%+ allotment, I would have applied for the HUDCO bonds as I think refund would be available for at least one of the next two issues. But, if a lower rate of interest is not an issue, then probably one should wait for the next issue.

Expecting both of them to launch approx 9/10 with a max 5bps cut.

Let us hope i an wrong on the dates..

Expecting both of them to launch approx 9/10 with a max 5bps cut.

Let us hope i am wrong on the dates..

As per a news item in Times of India (1.3.2016), Govt will not issue TFBs from next FY onwards.

Clarity is still awaited regarding that Vin, let’s see when the government clarifies about it.

Dear Shiv kukreja ji,

Is it possible to see subscribed values

live (real time) on some NSE, BSE Websites?

I would like to invest in retail ct.

awaiting your early reply

thanks

Hi PS,

Please check this link for Live subscription figures – http://www.bseindia.com/markets/publicIssues/BSEcumu_demand.aspx?ID=1069

Very good response is een. Can the retail investors hope to get 50% allotment. I am happy that I did not wait for future TSBs. Also your advice in time helped to participate in NHAI.

i think full response is going on.

chances are very hard in retail to get 25 to 30 %..

let us wait and watch at 5 pm..closing figure.

As per ET, retail portion is subscribed about 2 times on day-1. So 50 % allotment can be expected in retail category.

Very good response is seen. Can the retail investors hope to get 50% allotment. I am happy that I did not wait for future TSBs. Also your advice in time helped to participate in NHAI.

I think retail category should get around 50-53% allotment.

Thank you, that is good news. Suddenly the demand has gone up.

I find the retail category 4 2000000 14018853 7.01 times. What does it mean?

It means the issue has got oversubscribed by 7.01 times on the base issue size of Rs. 200 crore for Category IV.

Subscribing here.

Dear Shiv

When Nabard & IRFC tfb coming…

Regards

Nagarajan

Hi Nagarajan,

IRFC and NABARD dates are yet to get announced.

Day 1 (March 2) subscription figures:

Category I – Rs. 3,195 crore as against Rs. 357.70 crore reserved – 8.93 times

Category II – Rs. 2,382.72 crore as against Rs. 357.70 crore reserved – 6.66 times

Category III – Rs. 1,237.72 crore as against Rs. 357.70 crore reserved – 3.46 times

Category IV – Rs. 1,401.89 crore as against Rs. 715.40 crore reserved – 1.96 times

Total Subscription – Rs. 8,217.32 crore as against total issue size of Rs. 1,788.50 crore – 4.59 times

Retail Category is subscribed by 1.96 times, so approximately 51-52% allotment will be made.

Dear Shiv,

Good Evening,

Thank you for the update.

Regards

Raju

Thanks Raju!

Thanks Shiv!!

I applied via ICICIdirect at 4:46 pm. Would ICICI have submitted that application real-time on-time or do you think this will be applied tomorrow, so in that case no allotment

Hi Chaitanya,

I have no idea about this, you should contact ICICI about for the same.

Hi Shiv,

When I see the BSE website I see that the retail category is oversubscribed 7 times. You said it’s only oversubscribed 1.96 times. See below:

http://www.bseindia.com/markets/publicIssues/BSEcumu_demand.aspx?ID=1069

Am I missing anything???

I think with a green shoe option it is 1.96 times.

I think the oversubcription on day-1 matters for allotment and not the total oversubscription.

Yes, that is right provided the issue gets oversubscribed on the first day itself.

Hi, anyone got allotment / refund on HUDCO tranche 2 bonds yet?

Hi Shiv,

Nice article..

You are doing great service and helping your readers by spending precious time of yours and that too promptly.

Regards

Praveen

Thanks a lot Praveen for your kind words! 🙂

I want to know that all the three credit agencies care crisil and icra have given nabard taxfree bonds 2016 “AAA” or not dear shiv because I generally invest only if al these rating agencies have given AAA rating to an issue specially icra so please clear my doubt shiv

NABARD issue is rated ‘AAA’ by CRISIL and India Ratings.

What are the likely dates IRFC and NABARD Tax free bonds and what’s their issue size ?

IRFC and NABARD issues are likely to get launched in the 2nd week of March with issue size of Rs. 2,450 crore and Rs. 3,500 crore respectively.

Dear Shiv

Thank you for the timely helpful informations for the readers. Wonderful job.

How many days it will take the refund from Last NHAI 2nd issue closed 3 days ago?

kind regards

Thanks Paulose!

I am expecting NHAI refunds to get credited starting Monday, 7th of March .

Thank You Shiv,

One more thing, Most TFBs says “first come first served”, does it mean apply ” just after midnight-12AM ” IST or After 10 AM of starting bidding?

kind regards

Paulose , this was clarified many times. Have a look in the earlier responses for the different TFB issues and many of the doubts will be clarified. First come first is any time in a given day. If applied between 10AM and 5PM , all are considered equal for that day. Again most of the brokerages for online application the cut-off time is 3:30PM. Hope this clarifies. Basically based on current trend , apply on first day between 10 and 3PM, you will get the proportionate allotment any retail investor gets.

Thank you George..Iam a new comer…:-)

You are welcome Paulose. I understood that and suggested you to have a look at all postings regarding TFB. That will give you a better idea.

Day 2 (March 3) subscription figures:

Category I – Rs. 3,195 crore as against Rs. 357.70 crore reserved – 8.93 times

Category II – Rs. 2,382.81 crore as against Rs. 357.70 crore reserved – 6.66 times

Category III – Rs. 1,245.22 crore as against Rs. 357.70 crore reserved – 3.46 times

Category IV – Rs. 1,422.10 crore as against Rs. 715.40 crore reserved – 1.99 times

Total Subscription – Rs. 8,245.12 crore as against total issue size of Rs. 1,788.50 crore – 4.61 times

This issue stands closed today.

How much allotment one can expect from recent NHAI tab in retail?

Hi Manoj,

Around 87% allotment will be made.

The government on Wednesday clarified that the bonds that infrastructure finance companies have been allowed to issue in the next financial year would not have a tax-free status.

“These bonds will not be tax-free. Tax-free bonds distort the market,” secretary in the department of economic affairs Shaktikanta Das said.

need your comments dear shiv….

Hi Dr. Puneet,

I think the government is right in stating that these tax-free bonds distort the market. But, to correct that, I think they should have changed the methodology to calculate their coupon rates. I also think the government’s logic applies to the post office schemes also. PPF, Sukanya Samriddhi Yojana, Senior Citizen Savings Scheme, all these schemes carry artificially higher rate of interest. So, the government should act on that front also.

Frankly speaking I consider the TFBs are good only for the investors, does not make any sense for the government. TFBs issued in the past would actually turn out to be a burden for the government in the coming years. Imagine several thousand crores of TFBs were issued for 9% few years ago. Where do we get secured 9% interest any where. Anyhow, let us use the opportunity till the government offers TFBs.

Ashok, It is wrong to say that the TFB help only investors. The TFB are issued by Infrastructure development cos. raising the resources from within for the development and needs to pay the coupon annually. The interest paid is not high in India considering the inflation and interest rate. People park their money in TFB considering the Tax free returns. 9% was given when the banks were offering interest rate between 9.5 to 10% with an annual yield on 10% to 10.5%. The TFB coupon rates are always offered 50 bps less that the Govt bonds. More over there is a risk when some one buys the TFB at the prevalent rate locking the capital for long term. So do not think that the concept of TFB was only to help investors.

Very well said.

Not to forget the fact that Govt does not have so much money in the first place to invest and its fiscal deficit numbers would slip if it is not going for TFB. If these companies have to borrow so much money where would they go to and what is the interest the charge and what would the impact this will have on govt ratings?

What if interest rates go up again? For eg. 3 years back REC TFB was issued at around 7.5% and later interest rate went up and and next year REC TFB was issued at 8% + . So investors are at loss if interest rate goes up.

So assumption that TFBs are always good for investors is a wrong opinion.

Its liquidity is very very low.

Also fixed deposit gets compounded quarterly. But in TFB it is yearly interest rate and the yield hence is low compared to coupon rate.

-Praveen

Mr.Praveen, thanks for your thoughts, but do you believe that the Interest rates would go up in the future. I don’t think so. If we bench mark our bank interest with all major banks in the world, no bank gives us the interest our bank gives us even today. I have no doubt the bank interest would have to keep going down year on year. In fact auto manufacturers want the loan lending rates to be reduced to improve consumer spending. Have you heard of negative bank interest system adopted by some banks in Japan for the borrowers. ?

I gave you an instance and George has also shared his experience. Hope this answers you question on interest rate.

Do you know that Japan is a developed country?

Do you know the GDP in Japan and GDP in India and how different we are?

Do you know that Japan is a surplus country which depends on giving loans to other countries but India is a country which needs lots of money and is hungry for investments be it FIIs, FDIs or loans from WB, IMF, Japan etc…

Anyway you are digressing too much..

>>but do you believe that the Interest rates would go up in the future

And to answer your other question , I am not an astrologer to accurately predict what will happen 🙂

I just try to cover various cases through asset diversification..

Yes Praveen. Some of the Tax Free bonds issued in the past are still trading below par. I had Tax free bonds purchased with coupon rates of 7.2 to 7.4 % with 50 Bps increment if retained for retail. It was trading at around Rs 900 for a bond when the 8.92% tax free bonds were released. When I purchased 7.2 % bond that time also everyone claimed that Interest rate will only go down and will not come up. Again any investment depends on what the investor wants. Real estate gives 100% in 3 years some time, but stays stagnant or go down for next 5 years. Property returns can not be measured by rent considering the appreciation or depreciation on the asset. Same goes with equity or Gold.

Nobody knows where the interest rates are headed, but in a world where most countries are fighting deflation and struggling to grow beyond 2-4%, I think Indian inflation of more than 6-8% is unacceptable. The government should encourage equity participation and should not provide subsidized rate of interest.

Hi George,

Personally I think 7.69% tax-free rate of interest is on a higher side. It is equivalent to 10% taxable rate of interest for the investors in the 30% tax bracket. I think the government should work on lowering inflation numbers rather than providing higher subsidized rate of interest.

Shiv, I also agree in current situation 7.6% is definitely good interest rate. If I can hold for full term it will give right cash flow and definitely a good investment. If inflation is low, one need not be worried about interest rate. Let us hope for the best.

I agree with you Mr. Ashok!

very correct dear Ashok that to interest is taxfree no not to worry about tds and directly interest credited in your bank account no paper work and that to for 15 to 20 years it is far better than investment in a real estate for steady income because no safe investments can give this type of income because if you purchase an apartment for 20 lacks by full cash and rent it out which will give maximum rent of 75-80 thousands yearly but in taxfree bonds it can give at least 150000-175000 yealy taxfree no maintenance of apartment no cooperation taxes I generally invest interest of these taxfree bonds in another year taxfree bonds or in ppf coments please shiv am I right shiv

nabard taxfree bonds on 8th of march coupan rate are almost same 7.39 &7.69 for 10&15 years

http://www.moneycontrol.com/news/economy/nabard-may-price-tax-free-bond-at-729-764-for-retail-part_5770801.html

This link says that for 15 years the ROI is 7.64 % p.a

Hope sharing knowledge and experience helps everyone in the forum. But if we were to test the knowledge, then it will be futile. Lets use this forum for better benefits of everyone. I have been part of this from the very beginning of second issue of TFB and found useful. Many come and leave based on their requirement. I continue to share my thoughts even if I am not investing in some of the issues.

I agree George, thanks for sharing your thoughts and spreading financial literacy!

sorry 10 years 7.29 & 15 years 7.69 for nabard taxfree bonds

Hi, Is that announcement of Nabard Tax free bonds in media? I could not find it.

http://moneydial.com/tax-free-bonds-from-nabard-of-worth-rs-3500-crore/

Thanks George. And this should be the last in this FY?

Thanks for sharing!

I noticed now that on this website along with NABARD there is information for IRFC tax free bonds.

http://moneydial.com/tax-free-bonds-from-nabard-of-worth-rs-3500-crore/

http://moneydial.com/tax-free-bonds-from-irfc-of-worth-rs-500-crore/

I was hoping that NABARD would open after HUDCO returns the money. But now that it is opening on Mar 8 and funds are locked up with HUDCO, it will not be possible for investors like me to apply for NABARD. NHAI and HUDCO have got oversubscribed on day 1. I assume the same with NABARD also. The last option could be IRFC now to reinvest the funds that are returned by HUDCO.

Investors should try getting overdraft facility against their existing investments in tax-free bonds or fixed deposits for a few days.

http://moneydial.com/tax-free-bonds-from-irfc-of-worth-rs-500-crore/

Dear Sir,

Waiting for tax free bonds details of NABARD and IRFC , as early as possible.

Thank you for everything. .

http://moneydial.com/tax-free-bonds-from-irfc-of-worth-rs-500-crore/

Hi PS,

I’ll share the IRFC issue post by today evening. Here you have the NABARD issue link – https://www.onemint.com/2016/03/06/nabard-7-64-tax-free-bonds-march-2016-issue/

Nabard will open on 9th only. NABARD and IRFC will have 60% of the issue for retail investors.

Thanks George for the info!

IRFC opens on 10th march 2016

http://moneydial.com/tax-free-bonds-from-irfc-of-worth-rs-500-crore/

Thanks Pradeep!

NABARD Tax-Free Bonds Issue Update:

Issue opens – 9th March, 2016, Issue closes – 16th March, 2016, Issue Size – Rs. 3,500 crore

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.64% p.a.

Thanks for the confirmation Shiv.

Between Nabard and IRFC if you had to invest only in one which one would it be?

I would prefer IRFC over NABARD, but you might not get full allotment with IRFC.

Thanks Shiv and any specific reason for preferring IRFC?

I also have the same doubt. Why you consider IRFC better than NABARD. Any way , from a diversification perspective, I would consider investing some amount in NABARD considering that I have some investment in IRFC. Thinking of skipping IRFC.

I have also the same question

I have similar thoughts. Am thinking to invest in Nabard only (from diversification perspective).

Shiv – Do we know if IRFC wld provide TFBs for 20 yr period?

Hi Bobby,

IRFC issue does not carry the 20-year option.

Dear All, if I sell these bonds (e.g., NHAI) in the middle of a year, will I be paid interest?

No Malcom, you will not get the interest paid.

Interesting. So, need to sell it after the interest is paid, assuming the bond price is at a premium at that point.

Hi Malcom,

On the “Ex-Interest Date”, the market value of the bond will fall by the interest amount paid.

In today’s Economic Times, there is a mention that for the IRFC and NABARD issues, 60 % of the bonds will be reserved for retail investors. If that happens, keeping the size of the issues, as indicated by Shiv, in view, retail investors may get good allotment.

There was an earlier post about long term capital gains in the period of holding was mentioned as 2 years. I think it is 3 years like in the case of debt funds, and the rate of taxation is 10% without indexation and 20% with indexation. Am I right?

I will also like to share my thoughts about buying TFBs in secondary market. Buying bonds in secondary market does not make much sense. I recently bought NHAI 10 year bonds issued in 2012 with 8.20 as rate of interest at average cost of 1085. (It closed at 1090 on 4 March.) After 6 years, on maturity I will get back only Rs 1000 resulting in a yield of about 7%. The lesson I have learnt is that the best option is to buy TFBs in public issue and the best duration is 15 years because 15 year bonds are more easily tradable, if one needs to sell them.

Your ?90 premium takes care of accrued interest from the last interest payment date.

Additionally if you were to buy the bonds at today rate, you would get say 7.64 whereas on these bonds you get 8.20. This difference is also priced in to the premium. Alternatively if you were to buy a irfc 7.04, after accounting for accrued interest, you would be buying it at a discount

Thanks Nn for your kind comments. I do realise that about Rs 34 of the Rs 90 premium is the accrued interest and the real premium is about 55 rupees. Even if one takes into account the current interest of TFBs of 10 year duration ie 7.29 against 8.20, don’t you think it makes better sense to apply for bonds in the public issues. Once the public issues are not available, one may buy in secondary market…

Buying in secondary involves a 1% cost.

8.20-7.29 = 0.91..so over the lifetime of the bond you get Rs 0.91 extra per year. Assuming the bonds are maturing in 2022 (and your interest calculations are correct cos it seems to be a huge premium)..you are likely to get Rs 6-7 more but you have paid Rs 55 more. So the bonds would seem to be overpriced in the secondary.

The reason may be that to move a huge amount of bonds, the institutions price it at close to the maximum interest rate allowed (linked to the gsec of a similiar maturity) so ideally a buyer would buy in the primary rather than pay a high premium.

The bonds are sold in the marked on a concept of YTM leading to a discount/premium and you seem to have paid a high price than neccessary. There are cases where the bonds are sold cheaper due to distress sales. For secondary buying..you need to set your price and wait rather than buying at seller price.

Thanks nn for your analysis. I now realise my mistake in paying such a huge premium. I now know that it is almost certain that one will get 100 allotment in NABARD as well as IRFC. Had I known this earlier, I would have waited for these issues.

You have also provided a very valuable tip which should be kept in mind when buying Bonds in secondary market ; don’t buy at the seller’s price but at your price.

dear vin and nn

difference of 0.91% will amount to rs.9.1 and not rs. 0.91 as bond is of 1000 and not rs.100.

so dear vin you got the bonds at a fair price

Thank you very much, drpuneet for your valuable input. The fact that the current price of these NHAI bonds is 1089/1090, and I bought them at 1085 which included 3 as brokerage, I paid fair price for these bonds.

Actually with a fair price, you get a additional benefit.

The premium you pay will be returned in the form of “tax free” income. But on the cost of 1090, the refund of capital will be only 1000. So you have a long term capital loss.

thanks. normally used to working with percentages..so messed up.

need to be careful : > )

Thanks, nn for providing another valuable input. On debt funds, long time cap gain is taxable at 20%. Long term loss from sale of these bonds will save me 20%.

Hi,

I need to correct my earlier post about capital gains. I have since learnt that in the case of TFBs, the holding period to qualify for long term capital gain is 1 year and long term capital gains are taxed at 10% plus the surcharges etc and that indexation is not not allowed.

That’s correct Vin!

I also have the same doubt. Why you consider IRFC better than NABARD.??

Awaiting for your reply,

Hi PS,

I consider IRFC issue to be better than the NABARD issue as I think Railway Ministry is working very professionally these days under the supervision of Mr. Suresh Prabhu. NABARD is related to the agricultural sector and rural development and we all know how these government companies like NABARD are made to subsidize and/or forego their lending book in the name of working for poor/economically weaker sections (for politics). So, my first preference would be IRFC over NABARD.

Thanks Shiv for that. But then why it has been given AAA rating. Aren’t the rating agencies professional.

NABARD has been assigned ‘AAA’ rating as there is a strong government backing and low NPAs.

Thanks for your reply and guidance.

will invest in IRFC.

My main important factor is to protect my principal amount.

once again thank you.

You are welcome PS!

I have applied for 150 bonds in Hudco on first day.

What are chances of full allotment?

Hi Mr. Varma,

You can expect around 52% allotment.

thanks

how many times retail investor portion oversubscribed

Retail portion got oversubscribed by 1.96 times Mr. Varma.

I agree with Shiv. IRFC raises money exclusively for the Indian Railways and there is no chance of Railways defaulting on its loans. NABARD provides credit support for rural development and prosperity and there is a possibility of a default on the loans it gives. Otherwise, it is a well managed bank which is almost 100% owned by the Govt.

that is the only reason why I have invested in nhai irfc & nhb because this all are AAA by all three credit agencies icra care & crisil &also they lists on nse as well as bse and are large issue of above 2000 to 10000 of bonds which makes us to buy and sell easier am I correct shiv

Rated ‘AAA’ by all the rating agencies and listed on both the stock exchanges is a minor positive for these bonds.

Can some one tell me what is the procedure to get NABARD tax free bonds in physical form? I don’t have a demat account.

you have to file physcial application

Can you tell me the procedure? Where can I get the application and where should I submit?

down load from registrar to issue

Hi Muthu,

Just download the application form from the link pasted above in the post itself, duly fill it and mail me the scanned copy on my email id [email protected]

NHAI refund/allotment process has started, please check your bank accounts for ASBA applications.

When is HUDCO II refund expected? Will it happen atleast on 14th so that there’s chance to apply for IRFC?

Hi Chaitanya,

I am expecting HUDCO refunds to get credited by Monday. Let’s see whether it happens on Monday or gets delayed further.

Mr. Shiv, any further news on the refunds from HUDCO? Do you think we can get refunds by Monday morning? How much amount will we get back if 10L were applied for?

Do you think there are any chances of us deploying the refunds for NABARD & IRFC (Tranche 2) before closing?

Hi S.K.,

I think HUDCO refunds should come either on Monday or Tuesday. If it comes on Monday, it could be used in either of IRFC issue or NABARD issue. But, if comes on Tuesday, only NABARD would be available.

Dear Mr. Shiv,

Thank you. Can I go ahead & issue cheques against both applications, since manual cheques will take couple of days for clearing? What will happen to our applications if cheques bounce if the refunds do not arrive in time?

Hi S.K.,

Yes, offline applications will give you an additional couple of days for arranging funds. You can stretch it to a maximum of Wednesday morning by when you should have funds in your bank account.

Dear Mr. Shiv,

What will happen to both our applications if cheques bounce in case the refunds do not arrive in time? Will it adversely affect or lead to cancellation of our earlier online application submitted through ICICI Direct on Day#1?

Mr. Shiv,

Could you please respond and oblige?

Thank you.

Hi S.K.,

In case of cheque bounce, your offline applications will get rejected, but it will not affect your online applications submitted on Day 1.

Mr. Shiv, Even upto yesterday i.e. Wednesday, both IRFC & NABARD offline application cheques were still not presented through clearing & hence my bank accounts have still not been debited so far. Hope that does not mean that both my offline, 2nd Applications were rejected by their systems.

No S.K., if your broker has successfully placed bid for your application and the application has been accepted by the bank, then clearance of cheque is not a problem. It will get cleared sooner or later and bonds will be allotted to you.

Hi Shiv, I understand from Karvy that NABARD is also closing on March 14 (as per the date given on the application form). How do you say that it would remain open on Tuesday?

Thanks a lot Janaki for pointing it out! You are right, the closing date is March 14th only. There is a big confusion here. The product note I received while writing the NABARD post had March 16 as the closing date, but it is March 14 on the form and the prospectus as well. So, it is closing on March 14. I’ll just make the necessary changes on the NABARD post. Thanks again for this info!

Thank you Shiv. I think since both NABARD and IRFC came up in the same week even before the refunds from HUDCO came in, these remain under subscribed till date. I only wish if NABARD gets extended even by couple of days, HUDCO refunds would be in and we can subscribe for the same. Do you suggest we take chances by submitting offline applications tomorrow for the calculated refund amount from HUDCO (about 45%) for NABARD / IRFC assuming that the refunded amount will be available in our bank account on Wednesday morning?

Yes Janaki, I think one should do that, it is worth taking such a chance. I am making many of my clients do that.

Good idea Janaki & Shiv!!

Thanks Chaitanya!

I HAVE APPLIED FOR HUDCO,NABARD AND IRFC TAX FREE BONDS AT 10.OOAM TO 10.30 AM ON EACH BONDS OPENING DATE.WILL I GET FULL QUANTITY OR PROPORTIONATE.

Hi DCA,

You will get 100% allotment in the NABARD and IRFC issues, but only around 52% allotment in the HUDCO issue.

THANKS.SAME AS YOU HAVE SAID 52% IN HUDCO.HOPE WILL GET 100% IN NABARD AND IRFC.

That’s great DCA!

any update on Hudco refund

No news on HUDCO refunds/allotment as of now Mukesh!

Can Mr. Shiv or the other readers of this extremely helpful Blog please update us, who are quite anxious, through this forum, as soon as they receive the refunds from HUDCO Bonds application money?

Will do that S.K. as and when I have any info.

HUDCO refunds have come. I had applied ASBA. 52.1% allotment.

Oh that’s great, thanks a lot Pankaj for this info!

HUDCO refunds have come.

any one who did not apply ASBA but got refund of hudco

Not yet Mr. Varma!

YES ABOUT 1.45PM HUDCO REFUND.

Thanks DCA for this info! Yours was an ASBA or a Non ASBA application?

ASBA

Ok, thanks DCA!

WITH ONLINE SBI A/C ONE CAN PLACE AS MUCH AS FIVE APPLICATIONS( SUBSCRIBER) UNDER ASBA FOR ANY IPO OR TFB ISSUE.

Applied for 1000 Bond & allotted 521. For everybody information please.

Regards

Thanks Shiv for time to time smart info

Thanks Smita for this info as well as your kind words!

Smita, thank you sharing this info. I have also applied for the same qty and expecting the allotment. We all, owe our thanks to Shiv Ji for nicely navigating us through the 4 TFBs with timely inputs, daily status update. As he had rightly mentioned few days ago, the print media reports were inaccurate and I don’t how many people lost the nice opportunity by staying away from these TFBs, on the assumption that the issues were already over subscribed. I also thank all the learned friends here.

Thanks Mr. Bala for being a part of this forum!

Smita – Which broker/bank you use for ASBA and how are their services?

Appeal to Mr. Shiv & other readers to please share Refunds related information with us as soon as they receive the refunds from HUDCO TAX FREEBONDS TRANCHE-2 in their own Accounts through RTGS.

Hi S.K.,

I might not be available tomorrow for your help, but I am sure others would do the needful as and when they get the refund amount credited in their accounts.

hudco bonds and refund still not credited for application through cheque. Anybody received bonds or refund please update

ONLY for APPLICATION done through ASBA, unused funds have been released.

All other applicants are wanting.

ASBA is excellent way of applying.

You are first to know.

OPVARMA

Thank you Sir

Mr Verma – Which broker/bank you use for ASBA and how are their services?

I am using ICICIDIRECT

it does not offer ASBA option

But my refund with interest credited.

ASBA facility is offered by Banks only, brokers do not offer ASBA. But, going forward, I think ASBA will become mandatory, like IPOs.

Recevid refund of HUDCO in ICICI Bank just now (Today, 15-March,8.50 am)

Thanks a lot Mr. Singh for this info, it helped a lot of people here!

Got the HUDCO Refunds credited just now in bank account through RTGS.

Are bonds credited to demat account?

Bonds must have got credited in all the demat accounts by now. Bonds will start trading from today on the BSE.

Yes I too got the amount . Demat not yet.

Please check it now.

I HAVE APPLIED FOR HUDCO TFB ON FIRST DAY (10.02AM AND 10.05AM). WHY IT IS 52.1% ALLOTMENT.AS THERE IS CLAUSE OF “FIRST COME FIRST SERVE” FOR BASIS OF ALLOTMENT.I SHOULD HAVE GOT 100% ALLOTMENT.

All application of each day or treated at par.

First come first allotment is on day basis

So all applicat will be allotted ful if issue is not oversubscribed on first day.

The prorata rule will apply to second applicant

Hope this clarifies.

OPVarma

DCA, I applied 03:05 am and still got 52.1%, I think Shiv has clarified in his earlier messages, all applications of first day are taken as one batch and processed accordingly, irrespective of the time we apply on that day. I agree with you fully, we are the early birds and we deserve better share, may not be 100%, at least 75%. What to do , they decide (lol)

That’s right Mr. Bala! 🙂

i got 87261 as interest payment instead of 87500.(for 875nhai29)what could be the reason?infact i should have received more as this is a leap year.

Check your bank statement for 16-Mar-15. You must have got 87739 instead of 87500 on that day. last year you got 239 more. this yr you got 239 less.

Interest Formula for All tax free Bonds

Say : Paid Rs.100000.00

Allotted : A =Rs40000.00 and Refunded R=:Rs.60000.00

I1= Interest % for application refund = 5%

I2= Interest % for Allotment amount = 7.69% -Hudco 15 Year Retail

(similarly for categories)

d= No. of days including date application and excluding date of allotment

Interest Paid : (RxI1+A x I2) x d/365

d = No.days for which interest between application and a day before allotment.

However, I not able to understand why Karvy Computer calculates lower interest by at least a Rupee in each case.

So remember you are not being paid more.

Even I got less interest compared to last year

even I got less interest compared to last year for 8.75% NHAI bonds? It seems the interest rate computes as per 8.7261%

interest for 364 days is being paid.God knows why.

I have written a mail to karvy once I hear from them will post here.

Got a reply from Karvy, that last year 15-March-2015 was Sunday hence interest was paid on 16-March-2015 for 366 days.

Hence this year interest is paid for one day less.

I also received less interest.

Last year NHAI interest was credited on 16-Mar-15 and they gave 1 day extra interest. Thats the reason they gave interest for 1 day less. Last year I got 12 rupees extra. This yr I got 12 rupees less. Hope this clarifies doubt.

I got refund credited in accout along with interest of 342

I use icicidirect for application of bond.

Thanks Mr. Varma for this info!

i have not received refund of hudco till now.is there any body else who have not received refund??

received few minutes back in icici bank account through neft

you should also receive in next few minutes as now NEFT refund are being credited

just got it.

all bank do credit

Hi Shiv ji,

I applied on 1st day (2/Mar, 2:45 p.m.) thru RelianceMoney trading account, but today I got full application money refunded along with interest.

Any idea, what could be the reason for Zero allocation, despite of applying on 1st day?

Regards,

CVS

Dear CVS, that is really bad. Sure, Shiv will give you some solution. We sincerely wish the issue gets resolved and you get your due share of allotment.

same position for me also.got full amount back with interest.

Hi CVS,

Reliance Money must have processed your application on the 2nd day of the issue. You should raise your voice and take up this matter to them. Also, as Mr. Varma pointed out, please check with them their Cut-Off time for online bidding.

May pl check up cut off time reliance money trading.

In case cut off time has passed it will be processed as application of second day.

Thanks Mr. Varma for your inputs!

Received SMS from NSDL about Allotment & credit of HUDCO Bonds to my Demat Account st 9.00 pm today. But still not being shown in my account with ICICI Direct even at 10.30pm. As usual poor service & inefficiency displayed by ICICI Direct.

Can other readers share their experiences with their service providers and share the brokerage & AMC & other charges if any. Recommendations & suggestions are welcome.

Is Demat portability possible? Can I shift to a different brokerage house without charges?

I’m with ICICI for last 7 years and having invested through them in almost every TFB issue since 2013 I can assure you with ICICI It normally takes day or two after refund for bonds to show in your demat account.

Ikjot, this late Demat display is just one of the problems of ICICI Direct. Even after it is displayed in Demat, it is not reflected in our portfolio. PFC TFB till date is not listed in the portfolio. The Brokerage & other charges are very high. They do not respond/act on your emails. Even the FEEDBACK PAGE on their website does not work! One laboriously fills up the entire page & all sections only to find that the FEEDBACK page refuses to respond & get accepted! Ultimate proof of their reluctance to respond to customer needs & improve!

I fully agree that they are worst service providers.

Most of the service providers in India lack professionalism and accountability. Despite of the fact that these tax-free bonds or other financial products generate a lot of revenue for these brokers, including ICICI Direct, they do not show any interest in improving their services and generating better experiences for their customers. The reason is simple – we just don’t want to work hard, we want free money.

Same is the case with AXISDIRECT. I received SMS from NSDL on 15/3/2016 @ 1900 hrs for crediting 156 HUDCO TFBs to my account. I checked up my account several times. Till date no credit. I wrote to helpdesk@axisdirect. No acknowledment. No reply so far.

I fully agree Shiv. Service standards for majority of brokers/banks/insurance companies are pathetic. Focus is not on customer but on revenue which can be extracted from customer.

It is a relief that people like you provide awesome contribution to investors through your blog without any financial incentive expectation. Hats off to you.

Thanks Ramadas for your kind words!

I fully endorse your views, ridiculously high brokerage of 1% they charge for every transaction dealing in NCD’s or bonds on top of the 500 or so annual fee. I’ve already started the process of moving to another brokerage firm and will soon transfer my holdings…

DMAT IS POSSIBLE TO SHIFT BUT OFF LINE transactions CHARGES are applicable which is equal to 1% of holding plus service tax.

Hi Mr. Varma,

I don’t think offline transfer involves any charges if transferred in the same name under same PAN number.

Hi Shiv

No charges is applicable only if someone is closing a demat account and moving all securities to another demat account of same name. if partial movement is done , offline transaction charges are applicable. For ICICI bank , charges are fraction of a percentage of value of securities plus service tax. I recently went through this process and had to pay the amount

Regards

Ramadas

Yes, that’s right Ramadas! I also meant that only, but could not elaborate it.

Dear M/s. Shiv/Ramdas. Would like to know if the Demat A/c to which all securities are being transferred to are in Joint Names with the first name being identical in the earlier/previous Single holding Demat A/c, would still transfer charges apply?

Due to wrong advice by ICICI we opened Demat a/c only in a single name, which was an erroneous decision.

Now we want to transfer to a new Demat Account with joint names for safety. How do you propose we go about it without incurring additional expenses. Will we have to pay for annual AMC for 2nd Demat A/c also?

Is it advisable/economic to shift to a different DP or continue with ICICI?

Dear M/s. Shiv/Ramdas. Would like to know if the Demat A/c to which all securities are being transferred to are in Joint Names with the first name being identical in the earlier/previous Single holding Demat A/c, would still transfer charges apply?

Due to wrong advice by ICICI we opened Demat a/c only in a single name, which was an erroneous decision.

Now we want to transfer to a new Demat Account with joint names for safety. How do you propose we go about it without incurring additional expenses. Will we have to pay for annual AMC for 2nd Demat A/c also?

Is it advisable/economic to shift to a different DP or continue with ICICI?

Hi S.K.,

To avoid charges, order of your new demat account has to be absolutely same as it is there in the old demat account and you’ll have to close your old demat account. AMC charges are there with most of the brokerages, so you may opt for one time demat charges of around Rs. 1,500 or so.

What is Hudco 7.69% TFB Listing price Expected ??

TodaY NHAI 7.69% TFB are closed at 1029 around

can we expect listing price of 1029 around???

vishal, no doubt about it. In fact NHAI started with 1010 and went up fast to 1020 in the first day. I feel Hudco would start with 1020 and go up to 1030 in no time. Surprising IREDA 7.74% TFB is trading @ 1000. Can anyone tell us why?.

Hi Mr. Bala,

IREDA is AA+ issue and a relatively lesser known company, probably that is why not many investors are interested in that.

Mr.Shiv, thank you, Interest and capital assured for next 15 years? shall I exit at good time?

Hi Bala , I am not sure where you find this 1000. It was trading above 1040. Probably this was one bond which was in demand last week.

In the beneficiary account, the last traded price of the security is shown. In case of 753IREDA26, it is being shown as 1000. It is a fact that about 7 days back , 10 bonds had got sold at 1000. I have been trying to buy these bonds since then at 1020, but there is no seller at that price.

As an aside, people who want to buy in the secondary market should opt for 15 years bonds because these have more liquidity as compared to 10 year bonds.

There may be no seller at 1000

Hi Vishal,

I don’t think it should list at Rs. 1,029. It should be around Rs. 1,020 +/- Rs. 5.

I am quite puzzled by the interest shown by people in the Listing Price of these TFB!! Is there something I am missing? I have been investing in these TFB’s to earn assured tax-free Interest till maturity … and looking at the “listing” as unlikely exit-route for emergency fund need. Please advise anyone? -KS

Tracking the listing price does not necessarily mean exit. It is the opposite.

Yes, I can understand people wanting to buy after getting less allocation or missing the bus altogether.

Probably, investors are just curious to know the premium their recent investment has earned for them, that is it. I don’t think many investors would like to buy from the secondary markets at higher prices and pay high brokerage as well or sell it too early.

774 IREDA31 closed at 1043 today and in case of 753IRDEA there is no seller like in the case of 729 NHAI26.

I think all brokers are the same. In my case also, HUDCO bonds are not showing in my Demat account. Maybe in the next day or so.

I agree! Most of the brokers are inefficient, have no concerns for their customers.

HUDCO tax-free bonds to get listed on the BSE today i.e. March 17th. Source – http://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20160316-3

Here are the BSE codes for the same:

7.29% 10-year bonds – BSE Code – 935672

7.69% 15-year bonds – BSE Code – 935674

Deemed date of allotment has been fixed as March 15, 2016. Interest will be paid on December 15th every year.

Hi

Can you summarize all the tax free bond issues in this financial year in one table format with their interest payment dates.

Hi Piyush,

I am doing that, will post it sometime next week.

today’s listing price please

gentlemen should ask tomorrow opening price.

HUDCO 7.69% tax-free bonds got listed on the BSE yesterday at Rs. 1,020.05, hit a low of Rs. 1,020, a high of Rs. 1,025.25 and finally closed at Rs. 1,024.62 per bond – http://www.bseindia.com/NewStockReach/StockReach_Debt.aspx?scripcode=935674#

Once name do not match it is treated as off line transaction

And charges as per broker will apply

So u suffer

tax free bonds if bought from secondary market the interest coupon rate as per ipo will be the same for the buyer or it will be different regards

Hi Mr. Agarwal,

You’ll get the same rate of interest with these tax-free bonds, except for some of the bonds issued during FY 2011-12.

what is the website where you can sec the trading priced of all tax free bonds which are listed in the market

Here you have the link to check the bonds listed on the NSE – https://www1.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

thanks sir

Sir can u please put the link of B S E Also regards

Link for Debt Instruments on BSE

http://www.bseindia.com/markets/debt/tradereport.aspx?expandable=0

http://www.moneycontrol.com/fixed-income/bonds/listed-bonds/

Thanks Surender for sharing these links!

There appear to be more sellers than buyers for HUDCO TFB’s in the resale market. Guess people want to cash in on the gains before they evaporate. Price seems to be stabilising at 1035

Rates will rise only

It is natural. There would always be more sellers than buyers when these bonds get listed. Very few people would be interested to buy these bonds from the markets at 3.5% premium immediately around listing.

I received an SMS from NSDL – 300 Bonds -IRFC -7.64% credited to my account on 22/3/2016. This is is full allotment as a had applied for only 300 Bonds.

However, AxisDirect Web site does not show the credit.

Thanks for sharing this info! I think bonds would soon start getting reflected in your Axis demat account.

Best of luck

Others will follow

Just received the intimation that Rs.816.00 of Credit interest for Nabard Tax Free Bonds, though no intimation of allotment of Bonds. It appears that I have been allotted full 300 Bonds as the interest @ 7.64% Full.

That is good news. Thanks for sharing. Happy Holi.

RS 293 credited for NABRAD BOND

Thanks for the updates. After reading the posts of Opverma and Surender, I also checked my account and found the NABARD interest credited. No news so far from NSDL regarding the credit of the bonds in my Demat account!

Received SMS from NSDL regarding creting 300 Nabard Bonds.

Credited in my account at 8.47 PM. Well done by IBRD!

NABRAD BOND CREDITED TO DMAT ACCOINT

NO MORE suspense.

1) Request you to kindly advise best 5-6 Debt Mutual Funds Growth Option where we can safely invest retirement savings for few years and which lend to safe companies. Also please advise MF DEBT FUNDS Short term & long term Capital Gains & suggest which option to choose.

2) Please advise best TFB’s buys in secondary market from earlier lots which are available at favorable prices, good yields & above all GOOD LIQUIDITY.

The information is useful and interesting. It would be worth while if information on availability of such bonds in secondary market is also provided so that those who are unlucky in getting issue can take advantage from secondary market.

Kindly explain the differences beteeen short & long term capital gains taxation for tax free bonds versus MF DEBT Funds.

In case we sell TFB’s and have a small STCG, where exactly is this to be shown in our ITR (FORM-2)

interest due in march not paid

any information

opvarma