Edelweiss Housing Finance 10% NCDs – July 2016 Issue

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Edelweiss Housing Finance Limited (EHFL), a subsidiary of Rashesh Shah’s Edelweiss Group, is launching its public issue of secured and redeemable non-convertible debentures (NCDs) from tomorrow, July 8th. The issue will carry a maximum of 10% coupon rate with monthly, annual and cumulative interest payment options and tenors of 36 months, 60 months and 120 months.

The issue is scheduled to close on July 27th. However, I think it should get oversubscribed in a day or two due to high demand. Let us check other salient features of this issue.

Size & Objective of the Issue – The company plans to raise Rs. 500 crore from this issue, including the green shoe option of Rs. 250 crore. The company plans to use at least 75% of the issue proceeds for its lending activities and to repay its existing loans and up to 25% of the proceeds for general corporate purposes.

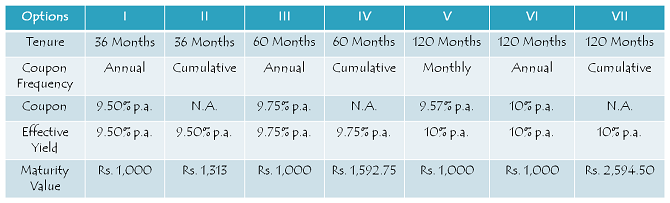

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 9.50% p.a. for a period of 36 months (3 years), 9.75% p.a. for 60 months (5 years) and 10% p.a. for 120 months (10 years).

Minimum Investment – Investors need to apply for a minimum of ten bonds in this issue with face value Rs. 1,000 each i.e. a minimum investment of Rs. 10,000.

Categories of Investors & Allocation Ratio – The investors have been classified in the following three categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Institutional Investors – 20% of the issue i.e. Rs. 100 crore

Category II – Non-Institutional Investors – 20% of the issue i.e. Rs. 100 crore

Category III – Individual & HUF Investors – 60% of the issue i.e. Rs. 300 crore

Allotment will be made on a first-come-first-served basis.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – CARE and ICRA have rated this issue as ‘AA’ with a ‘Stable’ outlook, while Brickwork Ratings has assigned it AA+ (Stable) rating. As mentioned above, these NCDs will be ‘Secured’ in nature.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will get listed on both the national exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can always sell these bonds on the exchanges.

Demat Not Mandatory – Demat account is not mandatory to invest in these NCDs as the investors have the option to apply for them in physical form as well.

TDS – Though the interest income would be taxable with these bonds, NCDs taken in demat form will not attract any TDS. The investor will have to pay tax on the interest income while filing his/her income tax return.

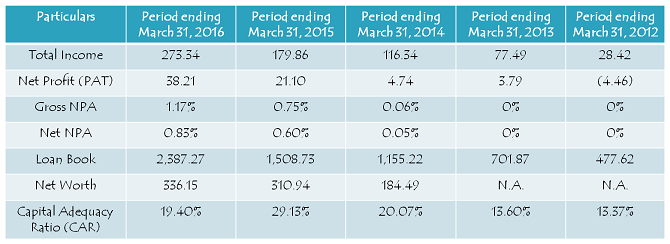

About EHFL & Its Financials

Note: Figures are in Rs. Crore, except per share data & percentage figures.

Edelweiss Housing Finance Limited (EHFL) is a non deposit taking housing finance company offering financing of various sort to individuals and corporates. Edelweiss Financial Service Limited and Edelweiss Commodity Services Limited are the promoters of EHFL and hold 22.39% and 77.61% stake respectively. EHFL offers home loans – 37% of loan book, loan against property – 26% of loan book, construction finance 20% of loan book and rural finance – 16% of loan book.

Should you invest in these NCDs?

Interest rates of 9.50% to 10% from a private company don’t attract me much. It will take 10 years for these NCDs to provide me approximately 160% return. I would rather invest in good quality stocks than take risk with these kind of NCDs. I think investing in diversified equity mutual funds will generate much higher returns in the long term than these NCDs. Moreover, the interest earned is taxable, which reduces our after-tax returns.

However, these NCDs are still suitable to those investors who are not liable to pay any tax or fall in the 10% tax bracket. Also, I would suggest investors to go for either 36 months option or 60 months option. Investing for a period of 120 months (10 years) with a private company becomes risky sometimes. Risk-averse investors, falling in 20% or 30% tax bracket, should invest in debt funds or tax-free bonds for medium to long term.

Application Form of EHFL Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in EHFL NCDs, you can reach us at +919811797407

Thank you so much Shiv for the info. I’ve gone for the 60 month option & hope I get full allocation.

Thanks Ikjot! It seems difficult to get full allocation in the retail category as the subscription there is healthy and should surpass its quota of Rs. 300 crore today itself.

Thanks for the reply Shiv. Always looking for your detailed analysis on new issues & really missed your post on Mahindra Finance NCD.

Thanks Ikjot! 🙂

Good post Shiv Kukreja. I have decided to go for 120 month monthly interest option but only with 10% of my FD portfolio. Let’s see how much allocation we get.

Thanks Divakar! Wise to have a diversified portfolio!

Hi Shiv – Any idea about subscription status. What could be the possible allocation ratio in retail category ?

Hi Rohit,

Retail allocation will depend on the subscription nos. of Category II & Category I investors on Monday. If any of these categories remain undersubscribed, then their unsubscribed portion will get reallocated to the retail investors.

Sir,i have query not related to Edelweiss.

I had applied for REC tax free bonds frommy demat account and was

alloted 28.The interest is to be payed annually.How ,when and where

will ireceive the interest payout?

I thought it would be March end/april.

but did not receive anything.

Hi Vanita,

If you made your investment in REC tax-free bonds in October 2015, then you would have received your first interest payment on December 28, 2015. This year onwards, you’ll get the interest paid on December 1 every year.

Interest will be credited to your bank account which is linked to your demat/trading account. If you have shares in your demat account, then the bank account in which you get the share dividend credited, you’ll get the interest credited in the same bank account on December 1 every year.

Day 1 (July 8) Subscription Figures:

Category I – Rs. 94 crore as against Rs. 100 crore reserved – 0.94 times

Category II – Rs. 51.214 crore as against Rs. 100 crore reserved – 0.51 times

Category III – Rs. 667.416 crore as against Rs. 300 crore reserved – 2.22 times

Total Subscription – Rs. 812.63 crore as against total issue size of Rs. 500 crore – 1.63 times

in edelweiss ncd no separate categories for HNI and RETAIL so how allotment will be done . if i applied 50 lacs ,can i get allotment like retail?.

Hi Amit,

From the allotment perspective, there is no differentiation between a retail application and an HNI application. So yes, you’ll get proportionate allotment.

I have applied in category 1 through oversight instead of categoriy 3 retail

on first day. How can I rectify now? Will they allot me Ncd Inspiteof this error?

Hi S K Bodiwala,

I think your application is liable to get rejected and it seems you will not get any NCDs allotted.

Shiv

Your comments on L&T Infotech IPO are welcome. Thanks

Hi Harinee,

L&T Infotech IPO seems to be fairly valued, with a scope of listing gains. But, nothing extraordinary.

sir is there any shareholder quota in l & t InfoTech ?

Hi Shiv,

It is mentioned that the issue is open till 28th July but I want to know whether they can close the issue before that date if it gets oversubscribed.

Also, are there any more companies launching NCD issues in the near future?

Thank you.

Hi Rohan,

This issue is getting closed today itself as the company has received more than required applications. I am not aware of any such issue as of now, but you can subscribe to our free newsletter to get such info.

hello shiv, what is allocation ratio to retail investor? can retail investor get full allotement if he/she has done the bidding early? bcoz in issue there is written first come first serve. thanks in advance for your reply.

Hi Anjani Kumar,

Approximate retail allocation will get determined by today evening, I will post that here after 5 p.m. Timing of your bidding doesn’t matter here, it is the day on which you bid matters. If you had placed your bid on Friday, then you would get proportionate allotment. If you bid today, you’ll not get any allotment.

i have write lac instead of lakh on cheque .

my question is is cheque will be cleared or bounced ?

Hi Vishal,

Lac or Lakh written on your cheque will not make any difference to your bank. It will get cleared.

is there any special quota for share holders of l & t in l & t InfoTech ?

No Amit, there is no special quota for the shareholders of L&T in the L&T Infotech IPO.

thanks u very much shiv. I made bid on friday.

Great!

Hello shiv kindly post the monday evening subscription data.

Hi Shiv,

Any idea about probable allottment ratio in retail category?

Regards,

bhushan

Hi Bhushan,

Retail category investor should get approximately 52% allotment.

Day 2 (July 11) Subscription Figures:

Category I – Rs. 94.01 crore as against Rs. 100 crore reserved – 0.94 times

Category II – Rs. 65.39 crore as against Rs. 100 crore reserved – 0.65 times

Category III – Rs. 684.27 crore as against Rs. 300 crore reserved – 2.28 times

Total Subscription – Rs. 843.67 crore as against total issue size of Rs. 500 crore – 1.69 times

The issue got closed on July 11 itself due to oversubscription.

10-year Indian G-Sec yield has fallen to 7.28% today, quite a steep fall in the last 2-3 days. Great news for the debt fund investors and bondholders.

Indeed it is Shiv..May be it’s time to start booking profit on TFB issues I invested since 2013

I’ll probably wait for the yield to fall below 7% to consider booking profits.

thanks Shiv.

Hi Shiv,

If the issue gets closed today itself due to oversubscription, should they not officially close and start process for allotment and refund now itself rather than waiting till official closure date of 27th July? Or will they use this extra money (@ 5%) till 27th?

Another question I’ve is abour Central Govt gold bonds. Subscriptions invited in Feb, allotted in May and still to be listed. Any idea?

Regards,

bhushan

Hi Bhushan,

Indeed they will do the same. They will not wait for 27th July yo start the allotment process. You’ll get the NCDs allotted in your demat account in the next 5-7 days.

Allotment/listing process of SGBs is very slow. I wonder what these government agencies do to take so long to issue/list these bonds. I’ll try to do a couple of posts in a day or two on SGBs tranche IV & its listing/trading on the stock exchanges.

Hi Shiv,

Thanks for your final analysis, and the reasoning behind it. It helps us to take the right decision. I agree that equity diversified MF is a better option.

Regards,

Melwyn

You are welcome Melwyn! 🙂

Sir,

I have applied 2 application of 10 lakhs each in category iii how much I shall receive allotment

Hi Satya,

Approximately 52% allotment will be made to Category III investors.

Hi Shiv,

Thanks for the post. 🙂

I didn’t understand the part option I where the invested amount is 1000 and maturity value is 1000 and coupon rate is 9.5% p.a.

Could you please explain.

TIA.

Hi Kishore,

Interest will be paid on an annual basis for 3 years in Option I. So, at the time of maturity, you’ll get your investment back along with the interest payment for the 3rd year. Maturity value will be Rs. 1,000 per bond and interest will be 9.5% p.a.

Pls. correct me if I am wrong.

Option I

First year interest: Rs. 95 (@ 9.5%)

Second year interest : Rs. 95 (@9.5%)

Third year interest: Rs. 95 (@9.5%)

Plus Rs. 1000

So in total Rs. 1285 at maturity (3 Years in this case)

Option II

Interest will not be paid annually but at the maturity. Interest will be re-invested.

At maturity we will get Rs. 1313

That’s right Kishore.

hello shiv!!

any website where i can check my allotment.

Hi Abhinav,

Once these NCDs get allotted, you can check the allotment status from this link – http://kosmic.karvy.com:81/ipotrack/

thank u shiv. bonds are allotted and refunds got in bank account. any idea when r they getting listed.

Hi Abhinav,

These NCDs should get listed by tomorrow or day after, no official announcement as yet. I’ll share the details once I get any.

18003454001 toll free number for ncd allotment

Thanks Vishal for this no.

hello shiv!!

Can you tell us expected listing price for 10 years monthly interest ncd?

Hi Vishal,

It is difficult to guesstimate the listing price for these NCDs, but I think it should be between Rs. 990 to Rs. 1,010.

Please add me and notify me

applied 101,allotted 53………..received just now.

That’s great!

Approximately 52% allotment will be made to Category III investors………………….shiv’s prediction bang on……….

Thanks! 🙂

Hi, where do I check the allotment status? I am not able to view it on this link (http://kosmic.karvy.com:81/ipotrack/)

It is yet to get uploaded by Karvy, will be available in a day or two.

I got a message that certain bonds are alloted. When do I get a refund for the balance money?

You should get your refund soon, probably today itself.

EHFL NCDs to get listed on the BSE & the NSE on Friday, July 22nd –

http://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20160721-9

Here are the BSE and the NSE codes for the same:

9.50% 3-year NCDs – Annual Interest – BSE Code – 935778, NSE Code – EHFL9.5

9.50% 3-year NCDs – Cumulative Interest – 935780, NSE Code – EHFL

9.75% 5-year NCDs – Annual Interest – BSE Code – 935782, NSE Code – EHFL9.75

9.75% 5-year NCDs – Cumulative Interest – 935784, NSE Code – EHFLA

9.57% 10-year NCDs – Monthly Interest – BSE Code – 935786, NSE Code – EHFL9.57

10% 10-year NCDs – Annual Interest – 935788, NSE Code – EHFL10

10% 10-year NCDs – Cumulative Interest – BSE Code – 935790, NSE Code – EHFLB

Deemed date of allotment has been fixed as July 19, 2016. Annual interest will be paid on July 19th every year. Monthly interest will be paid on 1st of every month starting October 1st, 2016.

Thanks for informing shiv. Keep on the good work as always.

Thanks Abhinav! 🙂

EHFL ncd 9.57% monthly option is trading at 1011, is it advisable to buy from NSE exchange.

It depends on your requirements Abhinav!

Hi Shiv,

There was in a news in Economic times that there two more similar NCD issues to follow. Any idea by whom and when?

Regards,

Hi Bhushan,

I think one is from DHFL and the other one is M&M Finance.

i heard india infoline and srei finance are also coming with NCD.

That’s great!

can you pl share your views on dhfl ncd please

How Much Coupon Rate Expected for 10 years for monthly payment?

My cheque for 1 lakh rs was debited on 13/7/2016 but till today no bonds have been alloted nor the refund has come.

Can any one help ?

18003454001 toll free number ask with your detail

details of dhfl ncd August 2016 and please which option you will select and the most attractive among all options

waiting for your detail view on dhfl ncd shiv

Hello Shiv sir,

What is your view on Dilip build con and S P apparel IPO?

Should one subscribe?

Is it good for long term..or for listing gain?

Dear Sir,

I have been a regular reader of your data on NCD’s and found it to be very useful. But first time, I got to read it in details along with comments from persons and great details including Listing Information which I was finding difficult to collate and link with my holdings.

I have found that for most of the NCD issues, the info is available hardly 2-3 days in advance of the Issue. Most of the recent NCD’s get full on first day itself. Hence it is essential to subscribe on the first day itself.

However, 2-3 days period is too small to arrange for money. Even Mutual Fund redemptions get T+2 days. Equity selling is also late.

Is it possible to get information on upcoming NCD’s at least 5 days in advance? That will be great help.

Regards.

does any one have got credit of ehfl ncd monthly interest credit in account .its suppose to be credited on 1st of every month. still not credited as yet.