Sovereign Gold Bonds – Series I – FY 2016-17 – July 2016 Issue

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

After three unsuccessful attempts of raising any meaningful amount of money from the investors by issuing its gold bonds, the government is launching its fourth tranche of Sovereign Gold Bonds (SGBs) from today onwards i.e. July 18, 2016. This will be the first such issue in the current financial year and that is why it has been notified as Series I of FY 2016-17. The issue will remain open for five days from today to close on July 22.

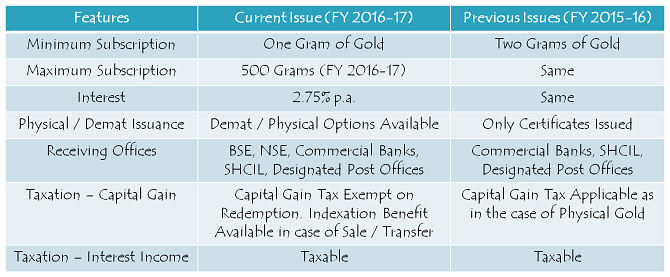

To make it more attractive, the government and the RBI have made certain changes this time around. Below is the table having salient features of these bonds, some of which are different from its previous issues.

Salient Features of Sovereign Gold Bonds – Series I of FY 2016-17

Issue Price – Price for this tranche has been fixed at Rs. 3,119 per gram of gold, which is substantially higher than the price of these bonds in the previous three issues. Issue price for the first tranche was fixed at Rs. 2,684 per gram of gold, that of the second tranche was Rs. 2,600 per gram of gold and it was Rs. 2,916 per gram of gold in the third tranche.

The government could raise only Rs. 246 crore from its first issue in November issuing bonds with around 916 kg of gold, Rs. 798 crore from the second issue in January with around 3,071 kg gold and Rs. 329 crore from the third issue in March with around 1,128 kg gold.

Issue Price Methodology – The issue price of Rs. 3,119 per gram of gold has been fixed on the basis of simple average of the closing prices of gold with 999 purity of the previous week (July 11, 2016 to July 15, 2016) published by the India Bullion and Jewellers Association Ltd. (IBJA).

Coupon Rate @ 2.75% p.a. – As in earlier tranches, coupon rate has been fixed at 2.75% p.a. payable semi-annually i.e. twice in a year. As mentioned earlier as well, these bonds offer two streams of return – one in the form of regular interest income @ 2.75% and the other in the form of increase or decrease in the market price of gold. A decline in their price would result in a negative yield from capital gains point of view, but 2.75% p.a. interest would remain fixed throughout its tenor of 8 years.

Allotment Date & Tenor of Investment – These bonds would get allotted on 5th of August and carry a maturity period of 8 years from the allotment date. However, the investors can ask for redemption of their bond holdings from the 5th year onwards. This option will be available for the investors in the 5th, 6th and 7th year of investment only on the interest payment dates.

Demat Option Available Now – In its previous issues, you were allowed to apply for these bonds in physical form only. But, in order to cut the allotment/listing time, the government has allowed to introduce the demat option as well. Now, you can get these bonds allotted directly into your damat account.

Tradability & Exit Option Before 5 years – These bonds are redeemable back to the RBI, but only from 5th year onwards. But, what to do if I want my money back in an emergency? So, in that case, you can sell these bonds on the Bombay Stock Exchange (BSE) or the National Stock Exchange (NSE) where they will get listed for trading after allotment.

However, previous issues of these bonds have faced a considerable delay in the allotment and listing of these bonds. Redressal mechanism of your grievances is also considerably poor. So, if you apply for these bonds now, you might again be required to have a lot of patience in getting them allotted and see their listing in a timely manner.

Online Bidding Platforms Launched – BSE and NSE have also launched their respective online bidding platforms for these gold bonds. With these platforms in place, applying for these bonds should become easier now. These bidding platforms will remain open for all 24 hours in a day for the next 5 days to close on July 22 at 12 midnight time. There will be a cooling off period of 30 minutes from 5:30 p.m. to 6 p.m.

Premature Redemption – In case of premature redemption (after 5 years), investors can approach the concerned intermediary 30 days before the coupon payment date. Request for premature redemption can only be entertained if the investor approaches the concerned intermediary at least one day before the coupon payment date. Redemption proceeds will be credited to the customer’s bank account.

Taxation in case of Redemption/Sale – Finance Minister Arun Jaitley in his budget speech had proposed to make these bonds tax exempt if redeemed after 5 years. These bonds also enjoy indexation benefits if sold after 3 years from the allotment date. As per the Budget speech “It is proposed to provide that redemption by an individual of Sovereign Gold Bond issued by Reserve Bank of India under Sovereign Gold Bond Scheme, 2015 shall not be charged to capital gains tax. It is also proposed to provide that long terms capital gains arising to any person on transfer of Sovereign Gold Bond shall be eligible for indexation benefits”.

So, as an individual, whenever you redeem these gold bonds after holding them for 5 years, you are not liable to pay capital gains tax. Indexation benefit will also result in a substantial tax saving.

Interest @ 2.75% is Taxable – Interest income earned every year @ 2.75% p.a. is taxable and the investors will have to show it as an Income from Other Sources in their income tax returns (ITRs).

Minimum and Maximum Investment – Investors are required to buy a minimum of 1 units of these bonds i.e. 1 gram of gold or a minimum investment of Rs. 3,119. In the previous issues, you were required to buy a minimum of 2 units of these bonds. On the other hand, you can buy a maximum of 500 units of these bonds or 500 grams of gold, which works out to be Rs. 15,59,500.

NRI/QFI Investment Not Allowed – Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in these bonds. Only Resident Indian Entities, including individuals, trusts, universities and charitable institutions are eligible to invest in these bonds.

Transferability – Though these bonds are tradable, trading is allowed only once it is notified by the Reserve Bank of India (RBI). Bonds can be transferred also by execution of an Instrument of Transfer, in accordance with the provisions of the Government Securities Act.

Collateral for Loans – If required, these bonds can be used as collateral for seeking loans from various lending institutions.

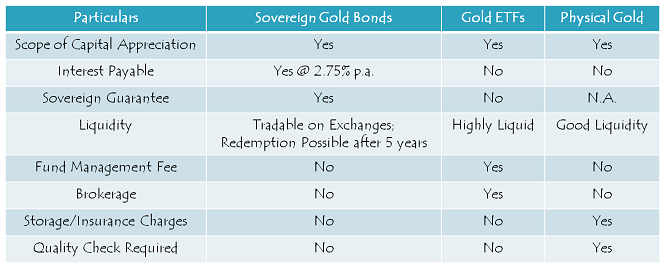

Sovereign Gold Bonds vs. Gold ETF vs. Physical Gold – A Comparative Chart

When I compare these bonds with Gold ETFs or physical gold, I am not able to find any point which goes against these bonds, except liquidity. As you can check from the table above, almost all the points of comparison are in favour of these bonds.

Should you invest in Sovereign Gold Bonds – Series I, FY 2016-17?

An uncertain global economic environment amid Brexit concerns, China slowdown, weak US jobs data and upcoming presidential elections in the US has pushed up the prices of gold in the last six months or so. But, whether this jump in gold prices will be able to sustain itself or is it a good time to sell your gold holdings and preserve your profits? These are million dollar questions to be answered with a high degree of accuracy.

Though I am bearish on gold prices and carry a view that these are not the best of the times to invest in gold, investors with a bullish view and a medium to long-term investment horizon can consider investing in these bonds. This way of investing in gold is cheap, tax efficient, risk-free in terms of a credit default and do provide you a stream of regular cash flows. If your portfolio has some scope of gold investment, I think these bonds are the best way to invest in gold.

Thanks Shiv for the timely post on SGB. 🙂

I would like to highlight/add one point while comparing SGBs with Gold ETFs (which I am fan of):

In case of ETF, we can do staggered investment e.g. if I want to invest in 10 gms/units of Gold, I can purchase 1 ETF unit every month. But it is not possible with SGBs.

But I agree with you (and pointed out clearly by you) that there are many other advantages of SGBs over ETFs.

Thanks Amlan!

You can make staggered investment with these bonds as well, buying them from the markets like Gold ETFs. Probably you’ll get a good price as well. But, I agree with you, Gold ETFs have a slight edge over these bonds in terms of ease of investing. 🙂

Hi Shiv,

Once listed, will the bond price track teh rpcie of gold using teh same logic that was done to fix the bond value?

Assuming that the price of gold falls over the next year of so (my view) – it will then be better to purchase these bonds in the secondary market?

Hi Sowmya,

Once listed, its price should track the price of 999 purity gold on a daily basis, probably on a real-time basis. It all depends on the liquidity available with these bonds.

Nobody knows where the prices will be next year, so it is difficult to time the markets. But, yes, it is always better to buy at a lower price than a higher price.

Shiv,

When will these bonds list? This is already 3rd or 4th issuance, but there no update from RBI/exchanges reg. when the earlier trances will be listed.

thank you for this writeup! wanted to check if the source of the funds invested in this scheme needs to be established?

Thanks Sonal!

KYC is required for making investment in these bonds. So, you must establish the source of funds.

Sovereign Gold Bond starts on 18 July, 2016

More info @ https://www.moneydial.com/sovereign-gold-bond-starts-on-18-july-2016/

Dear Sir,

Can you please email me a Application form for Sovereign Gold Bond 4th Tranche F.Y 2016-17(Series-I). I am not getting the said form from any Bank or Post Offices. You can also email me the site from where I can download the said Form.

Thanks & Regards

PARTHA MITRA

9830509890

Hi Partha,

Here is the link to download the application form for SGBs – http://www.unionbankofindia.co.in/pdf/HOLDC140115_FA.pdf

Thanks Sir.

With Regards

Partha Mitra

One of the issues I see is that the gold price comes down to 10% more than the dollar price of gold. Gold = $1321/oz (from http://www.kitco.com/charts/livegold.html). Whereas the equivalent price from the offer is: 3119 * 31.1 / 67 = $1447. Is gold usually priced 10% higher than in global markets?

Hi VS,

That is probably due to 10% import duty we have on Gold.

The 10% markup is due to the duty that was raised by our previous Finance Minister form 2 to 4 and then to 10. So if the govt tomorrow decides to reduce duty by 5% the value of your bond will also reduce by that amount.

A good balanced write-up on the bonds issue! Thanks Shiv.

Thanks a lot for your kind words!

Nice article in detail.. Thanks for the info..

Just one question I placed the order from my demat today 22 July around 6 PM so as per timeline u mentioned it will be considered for allotment right?

Hi Shiv

I am eagerly looking forward to your expert views/ advises on the Income Declaration Scheme 2016.

Thanks

Hi, Nice article. Not sure if this has been answered earlier. Does one need to declare gold bonds as part of schedule AL in the tax forms? Thanks.

Sir,

When the sovereign bonds will be credited to demat account?

Best regards,

R. Srinivasan

Hi Shiv,

When will these bonds be available in demat account? The allotment date was August 5th – does it take more time to get it shown in the demat account?

That’s right. I too do not see the bond allotments reflecting on the demat account as yet. Any update from any other investors here?

Finally got them allotted in demat account today!

I have applied for SGB july 2016 through sharekhan who maintains my demat account but bonds are not visible allotted yet in the demat.Sharekhan replied my mail on 11th august that it will reflect in my account within week time but while enquiring to day they again give the same reply.It seems they do not have any concrete knowledge for allotement.

I have also sent multiple emails to RBI email-ids too, but haven’t heard back. RBI appears pretty much lousy.