This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Markets are often driven by sentiment and there is a slump in the real estate market these days due to negative sentiment. There is a drastic fall in the number of sale-purchase transactions which has resulted in an overdue price correction and squeezed the liquidity from this market. The same liquidity seems to be flowing now to equity and debt markets. Such high levels of liquidity flows have resulted in stock markets and bond prices to touch their 52-week highs.

Encouraged by super demand for two back to back NCD issues of DHFL, SREI Infrastructure Finance Limited is coming out with its issue of non-convertible debentures (NCDs) from this Wednesday, September 7. The issue is scheduled to remain open for three weeks to get closed on September 28.

Size & Objective of the Issue – Base size of this issue is Rs. 250 crore, with the green-shoe option to retain an additional Rs. 750 crore, making it a Rs. 1,000 crore issue. The company plans to use at least 75% of the issue proceeds for its lending activities and to repay its existing loans and up to 25% of the proceeds for general corporate purposes.

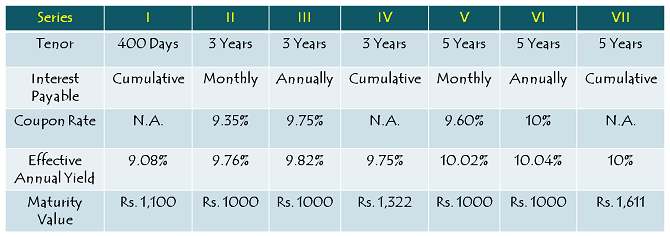

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 9.35% p.a. payable monthly and 9.75% p.a. payable annually or cumulative for a period of 3 years (36 months) and 9.60% p.a. payable monthly and 10% p.a. payable annually or cumulative for a period of 5 years (60 months). There is one more option of 400 days which offers an effective annual yield of 9.08%.

Minimum Investment – Investors need to apply for a minimum of ten bonds in this issue with face value Rs. 1,000 each i.e. a minimum investment of Rs. 10,000.

Categories of Investors & Allocation Ratio – The investors have been classified in the following three categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Institutional Investors – 20% of the issue i.e. Rs. 200 crore

Category II – Non-Institutional Investors – 20% of the issue i.e. Rs. 200 crore

Category III – Individual & HUF Investors – 60% of the issue i.e. Rs. 600 crore

Allotment will be made on a first-come first-served basis, as well as on a date priority basis i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – Brickwork Ratings has rated this issue as ‘AA+’. Debt instruments with such a rating are considered to have high degree of safety regarding timely payment of interest and principal. Moreover, these NCDs are ‘Secured’ in nature i.e. in case of any default on its payment of interest or principal, the bondholders will have the right on certain secured assets of SREI Infra.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will be listed on both the stock exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can sell these bonds on the stock exchanges if NCDs are held in demat form.

Demat Not Mandatory – Demat account is not mandatory to invest in these NCDs as the investors have the option to apply for these NCDs in physical or certificate form as well.

TDS – Interest income earned is taxable with these NCDs and the investors are required to pay tax on the interest income as per their respective tax slabs. TDS @ 10% will be deducted if these NCDs are held in physical/certificate form and annual interest income is more than Rs. 5,000. NCDs held in demat mode will not attract any TDS.

Should you invest in these NCDs?

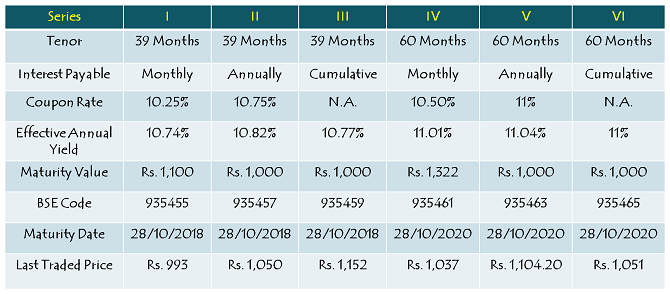

SREI Infra had its last NCD issue in July 2015. Below pasted is the table having issue details, BSE scrip codes and last traded prices of those NCDs.

SREI Infra NCDs always carry low volumes and that is why it is very difficult to calculate its relevant yield to maturity (YTM) for the interested investors. But, If I were to invest in SREI Infra’s NCDs, I would have bought them from the secondary markets as I think it is possible to invest in these NCDs at a YTM between 10.50% and 11.50%. Its current issue offers coupon rates between 9.35% and 10% which are not attractive for me to invest. However, conservative investors, who are not liable to pay any tax or fall in the 10% tax bracket or who trust SREI Infra’s management, can consider investing in these NCDs.

Application Form – SREI Infra NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in SREI Infra NCDs, you can reach us at +91-9811797407

Day 9 (September 20) Subscription Figures:

Category I – Rs. 31.1 lakh as against Rs. 200 crore reserved – 0.001 times

Category II – Rs. 15.45 crore as against Rs. 200 crore reserved – 0.08 times

Category III – Rs. 213.87 crore as against Rs. 600 crore reserved – 0.35 times

Total Subscription – Rs. 229.64 crore as against total issue size of Rs. 1,000 crore – 0.23 times

Thanks Shiv .Was wondering because india bulls and dhfl get lapped up in no time and close even..whereas this is plodding on still.

I have put in a very small amount and just would like to know if I will get my principal back at end of term.

Hi Vanita,

That is something nobody would be able to tell you with certainty. But, yes, SREI Infra issue carries a slightly higher risk as compared to DHFL & IHFL issues. The shorter the tenure is, the better it is. Also, one should opt for monthly or annual payouts as compared to cumulative option.

Agreed Shiv that the infrastructure sector is plagued by project delays and cost overruns. This discussion opens up to another genuine concern area. We go by rating provided by agencies to the issues. How genuine are the ratings and if the NCDs are secured against company assets, who has valued those assets? Is it the company itself or rating agency or an independent agency? Is the sector well regulated and monitored by SEBI/RBI etc. Is there a possibility of ending up like Sahara?

These are some of the concerns leading to the question how safe really these instruments are.

Regards,

I don’t bank on ratings of an issue for my investments. However, ratings give you an indication about the quality of the company’s financials and the sector’s future prospects. Concerns regarding these NCD issues by private companies are genuine. That is why I prefer such issues by government companies.

The company is not bad. I had subscribed in 2015 also and they had offered 0.25% additional interest to shareholders. So I had purchased some shares @ Rs 36 and that has now more than doubled. The reason for low subscription may be very reduced liquidity in the market due to three concurrent issues of better rating. Shiv, is there a chance of cancellation of issue if subscription remains poor?

Hi Bhushan,

I don’t think there is any chance of cancellation of this issue. Base size of the issue is Rs. 250 crore and I think by the time the issue gets closed, it would be closer to this mark. I don’t think three concurrent issues of DHFL and Indiabulls had any impact as far as liquidity for such a small issue like SREI Infra issue is concerned.

Such low demand for this. NCD.So many days and so low subscriptions. How bad can this company be? Its scary!

I agree with Bhushan, the company is not that bad. It is the sentiment towards infrastructure financing companies which is making people avoid SREI Infra NCDs. But, at the same time, some of the problems with these kind of companies are genuine as well.

Day 8 (September 19) Subscription Figures:

Category I – Rs. 31.1 lakh as against Rs. 200 crore reserved – 0.001 times

Category II – Rs. 8.95 crore as against Rs. 200 crore reserved – 0.04 times

Category III – Rs. 209.40 crore as against Rs. 600 crore reserved – 0.35 times

Total Subscription – Rs. 218.66 crore as against total issue size of Rs. 1,000 crore – 0.22 times

@Bhushan oke : I think figures quoted on https://applyipo.com are right since i have checked on BSE website and its on same line

Printed forms are not available.

Hi Shiv,

I’ve subscribed for Srei NCD in a big way because of better interest rate offered. However it seems the issue is not getting subscribed at all in category 1 & 2. This means there will practically be no liquidity for these NCDs in the market once it gets listed and I’m likely to be stuck with these till maturity. Do I read the situation correctly. If yes, it is a disaster for me as I invested money for a three to four year horizon and intended to get back my capital thereafter.

Also there are some conflicting subscription figures for day 1 itself at https://applyipo.com/blog/2016/09/07/srei-infrastructure-ncds-subscribed-0-50-times-day-1/

Could you please throw some light on this?

Thanks & Regards,

Hi Bhushan,

Yes, liquidity has been an issue with SREI Infra NCDs. You can check the 2nd table above in the post. There is a substantial difference between Series V & Series VI prices. Market price of Series V NCDs should be lower than Series VI NCDs. But, there is an anomaly due to lack of adequate liquidity. This kind of anomaly occurs very often with NCD issues in which liquidity is not sufficient. So, in order to liquidate your holdings, you might be required to compromise on the price front.

Day 7 (September 16) Subscription Figures:

Category I – Rs. 31.1 lakh as against Rs. 200 crore reserved – 0.001 times

Category II – Rs. 8.75 crore as against Rs. 200 crore reserved – 0.04 times

Category III – Rs. 199.96 crore as against Rs. 600 crore reserved – 0.33 times

Total Subscription – Rs. 209.02 crore as against total issue size of Rs. 1,000 crore – 0.21 times

I have written a comment on this thread yesterday but it is still awaiting moderation.

Sir,could you please check and reply.

Hello Sir,

I would like to know if it is possible to appoint a nominee when applying for Ncds and bonds.

I have been applying to NCDs online through my trading account via Asba.

I can see no option for nominee..it just says first applicant ,second applicant and third applicant.

Is it advisable to have nominee in ncds and bonds or does the nominee of my trading account automatically become the nominee in these too?

Hi Vanita,

Your nominee in the demat account is the nominee for all your investments held in the demat account. So, these NCDs/bonds too will have the same nominee.

Day 5 (September 14) Subscription Figures:

Category I – Rs. 31.1 lakh as against Rs. 200 crore reserved – 0.001 times

Category II – Rs. 8.40 crore as against Rs. 200 crore reserved – 0.04 times

Category III – Rs. 187.07 crore as against Rs. 600 crore reserved – 0.31 times

Total Subscription – Rs. 195.78 crore as against total issue size of Rs. 1,000 crore – 0.20 times

Day 4 (September 12) Subscription Figures:

Category I – Rs. 1.1 lakh as against Rs. 200 crore reserved

Category II – Rs. 8.38 crore as against Rs. 200 crore reserved – 0.04 times

Category III – Rs. 177.60 crore as against Rs. 600 crore reserved – 0.27 times

Total Subscription – Rs. 185.99 crore as against total issue size of Rs. 1,000 crore – 0.19 times

Shiv, please share subscription status of Srei till now

Corrigendum–

regret . pl read Re171.18cr for Re117.18cr as written by mistake at para 3rd

letter dated13-9-16.

Corrigendum—-

It is with ref to my letter dated 11-9-2016. Kindly read Re171.18cr for Re343.45cr where ever it is found written in the letter.

As per that report dated 9-9-2016 of shri Kukreja srei has recd Re 117.18cr

ie 68% of the issue(Re250.00cr) only in three days.I am sure it will oversubscribe before its expiry date.

shiv charan sharma

Indiabulls Housing Finance Limited (IHFL) 9.15% NCDs Issue – http://www.onemint.com/2016/09/12/indiabulls-housing-finance-limited-ihfl-9-15-non-convertible-debentures-ncds-september-2016-issue/

*INDIABULLS HOUSING FINANCE LIMITED*

Mode of the issue: Public Issue

Issue Opening Date: 15th Sept 2016

Issue Closing Date: 23rd Sept 2016

Type Of Instrument: Secured & Un Secured Redeemable NCD

Issue Size: 3500 Cr + 3500 Cr

Rating: CARE AAA, BWR AAA

*Interest Rate & Frequency for Secured NCD*

3 Years: 8.70% Annual

8.70% Cumulative

5 Years: 8.90% Annual

8.90% Cumulative

10 Years: 8.65% Monthly

9.00% Annual

9.00% Cumulative

*Interest Rate & Frequency For Un Secured NCD*

10 Years: 8.79% Monthly

9.15% Annual

9.15% Cumulative

Interest On Application Money: As Per Effective Yield

Interest On Refund: 6%

Face Value: 1000

Min Application: 10000

Proposed Listing on BSE

Physical and Demat mode

indabulls finance ncd is opening on 15th September details please shiv as soon as possible