PNB Housing Finance Limited IPO Review – Subscribe or Not @ Rs. 750-775?

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

India’s fifth largest housing finance company and 51% subsidiary of Punjab National Bank (PNB), PNB Housing Finance Limited (PNBHFL) is seeking your investment in its initial public offer (IPO) worth Rs. 3,000 crore. The issue opened for subscription yesterday i.e. October 25 and will close tomorrow on October 27.

Through this IPO, PNB Housing Finance will be diluting 23.37% of its post issue paid-up share capital at the upper end of the price band of Rs. 775, price band being Rs. 750-775. Assuming Rs. 775 to be the issue price, the company will command a market cap of Rs. 12,837 crore at this price.

Here are some of the salient features of this IPO:

Price Band – PNB Housing has fixed its price band to be between Rs. 750-775 per share and no discount has been offered to the retail investors or PNB’s existing shareholders. However, employees of PNB Housing would be entitled to a discount of Rs. 75 per share.

Size & Objective of the Issue – PNB Housing will raise Rs. 3,000 crore from this issue, by issuing 3.87 crore new shares at Rs. 775 or 4 crore shares at Rs. 750 per share. As it is a fresh issue of shares, PNB’s housing existing parents – PNB (51% stake) and Carlyle Group (49% stake) will not get any proceeds from this issue.

Retail Allocation – 35% of the issue size is reserved for the retail individual investors (RIIs) i.e. approximately 1.35 crore shares out of 3.87 crore shares. 15% of the issue size is reserved for the non-institutional investors and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

Reservations for Employees – PNB Housing has reserved 250,000 shares for its employees. As mentioned above, employees will also be given a discount of Rs. 75 per share, which makes this issue attractive for the employees of the company.

No Discount for Retail Investors or PNB Shareholders – PNB Housing has decided not to offer any discount to the retail investors or even PNB shareholders.

Anchor Investors – Out of 3.87 crore shares to be issued, PNB Housing has already attracted big anchor investors for a sizeable chunk of this issue at Rs. 775 per share. These investors have agreed to buy approximately 1.15 crore shares directly from the company, thus amounting to Rs. 894.19 crore. These investors include Citigroup Global Markets Mauritius, Government of Singapore, Morgan Stanley Mauritius, Government of Singapore, Acacia Banyan Partners and HDFC Trustee Company, among others.

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 19 shares and in multiples of 19 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,725 at the upper end of the price band and Rs. 14,250 at the lower end of the price band.

Maximum Investment for Retail Investors – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 19 shares @ Rs. 775 i.e. a maximum investment of Rs. 1,91,425. However, at Rs. 750 per share, you can apply for 14 lots of 19 shares, thus making it Rs. 1,99,500. Investors opting for the “Cut-Off Price” option should apply for a maximum of 13 lots of 19 shares.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on October 27. These shares are expected to list on November 7 on the stock exchanges.

Here are some of the important dates for this IPO:

Issue Opens – On October 25, 2016

Issue Closes – On October 27, 2016

Finalisation of Basis of Allotment – On or about November 2, 2016

Initiation of Refunds – On or about November 3, 2016

Credit of equity shares to investors’ demat accounts – On or about November 4, 2016

Commencement of Trading on the NSE/BSE – On or about November 7, 2016

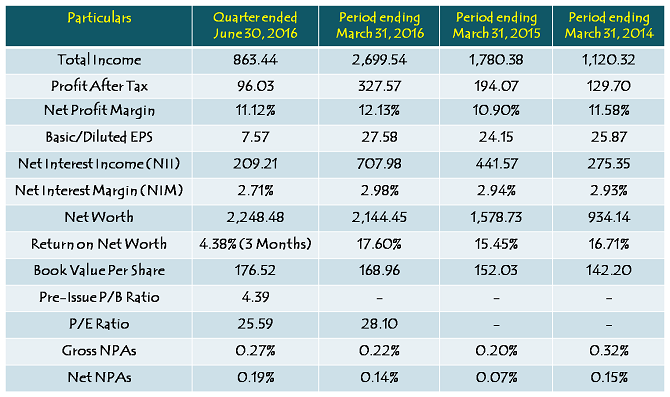

Financials of PNB Housing Finance Limited

Note: Figures are in Rs. Crore, except per share data & percentage figures

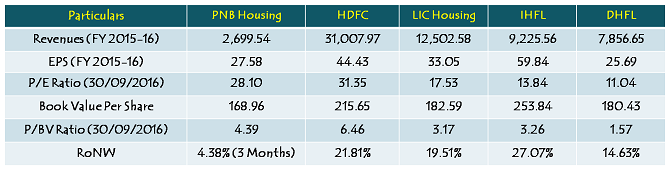

Comparison of the India’s largest housing finance companies

Should you subscribe to PNB Housing IPO @ Rs. 775 a share?

PNB Housing has performed remarkably well in the last 2-3 years. Between March 31, 2014 and March 31, 2016, the company has grown its loan book at a CAGR of 60.19% from Rs. 10,591.21 crore to Rs. 27,177.27 crore and its revenues at a CAGR of 55.23% from Rs. 1,120.32 crore to Rs. 2,699.54 crore. This growth momentum has continued in the first quarter of this fiscal year as well. As on June 30, 2016, its loan book stands at Rs. 30,901 crore and it reported revenues of Rs. 863.44 crore for the quarter.

What is even more remarkable is PNB Housing’s asset quality. The company reported a gross NPA of 0.22% and a net NPA of 0.14% for the fiscal year 2015-16. Though these numbers increased marginally to 0.27% and 0.19% respectively in the quarter ending June 30, 2016, they are still one of the lowest in the housing finance industry.

However, I think it would be very difficult for the company to maintain such kind of high growth momentum going forward. Even if the company is able to maintain a growth rate of 20-30% for the next couple of years with stable asset quality, it would be able to attract a lot of big ticket investments from foreign as well as domestic institutional investors.

From PNB Housing point of view, I think the company has priced its IPO to perfection. Though I think it is not cheap at these valuations, but given a positive sentiment towards housing finance companies and an exceptional growth registered by the company in the past few years, it is expected to list at a premium of up to 10% to its likely issue price of Rs. 775 per share. I think one should subscribe to this IPO for listing as well as short term gains. Long term wealth creation would be possible only if the momentum is maintained.

The EPS has gone down to 7.57 but P/E is still 27 please explain. Also doesnt the fall in EPS and PAT means they are not doing so good!

Rs. 7.57 is quarterly EPS and 25.59 PE Ratio is based on an annualised EPS of Rs. 30.28 (Rs. 7.57 * 4). PAT and EPS are not falling in this case.

Hi Shiv,

Many Thanks for helping again to thousands of retail investors with your unbiased advise & good analysis.

May god bless you with health & energy to serve the society in this manner.

Best Regards

Vasu, Hyderabad

Thanks a lot Mr. Vasu for your kind words & wishes! 🙂

Dear Shiv,

Wish you and your family a happy and blessed Diwali

Thanks a lot Christy for your wishes! I hope you too had a great Diwali! I wish you and all OneMint readers have a wonderful year ahead! 🙂

Hello sir,is it advisable to apply for Varun beverages IPO?

Again,my comment awaits moderation.

This causes a lot of delay in the query reaching you.

My Query was..as i posted earlier…is it advisable to apply for

Varun beverages IPO?

Hi Vanita,

I have not been able to properly analyse Varun Beverages IPO, but it seems expensive to me at Rs. 440-445 a share.

Thank you Shiv sir!

Also,would like to know,at close of issue of PNB housing finance the

retail subscription is oversubscribed 1.29 times only.

Does that mean chances of getting allotment are quite bright?

Hi Vanita,

Yes, retail investors will have a good allotment in PNB Housing IPO.

Wish You a Happy & Prosperous Diwali to Shiv and also to all participants of this blog.

Under valuable advise from Shiv Ji & through our forums sure we all can prosper.

Happy Investing.!

Wish You a Happy & Prosperous Diwali to Shiv and also to all participants of this blog.

From valuable advise from Shiv Ji & through our forums sure we all can prosper.

Happy Investing.!

Hi Shiv!

Fine analysis indeed!!

Retail investors genuinely need such kind of unbiased articles before deciding upon their investments.

Apart from the above metrics, I believe that the investor needs to ascertain the purpose to which the funds raised by the IPO would be put by the bank. It will determine to a large extent the certainty of expected returns from the investment.

Hello Sir,

Your thoughts on Green signal Bio IPO ? please .

Hi Sir, Can you give your opinion on Green Signal Ipo pls…whether to subscribe or not?

Rs 500 and Rs 1,000 note will be Invalid from 8 Dec, 2016: 16 Points to Know

More info@ https://www.moneydial.com/blogs/rs-500-and-rs-1000-note-will-be-invalid-from-8-dec-2016-16-points-to-know/

20 FAQs Regarding the Ban of Rs 1,000 and Rs 500 Currency Notes.

More info@ https://www.moneydial.com/blogs/20-faqs-of-common-man-regarding-the-ban-of-rs-1000-and-rs-500-currency-notes/

Download Rs 500 & Rs 1000 Note Exchange form and how to fill it.

#exchangeform #RS500 #PMmodi #RS1000

More info@ https://www.moneydial.com/blogs/download-rs-500-rs1000-note-exchange-form-and-how-to-fill-it/

Money Dial suggest 4 Things Should You Carry for Exchanging of Rs 500 and Rs 1,000 Note.

More Info @ https://www.moneydial.com/blogs/4-things-should-you-carry-for-exchanging-of-rs-500-and-rs-1000-note/

Interesting Fact and figure in the post, Enjoyed a lot..!! Thanks for sharing..!!

8 Things Government of India Relaxed in Demonetisation: Especially for Farmer and Wedding Families.

More info@ https://www.moneydial.com/blogs/8-things-government-india-relaxed-in-demonetisation-especially-for-farmer-and-wedding-families/

Shopkeepers can’t charge 1-2% extra on Debit Card Payment – RBI.

More info@ https://www.moneydial.com/blogs/shopkeepers-cant-charge-1-2-extra-debit-card-payment-rbi/

Adhaar Card Issued Toll Free number: You should Know.

More info@ https://www.moneydial.com/blogs/adhaar-card-issued-toll-free-number-you-should-know/

CBDT Updates on Demonetisation: PAN Compulsory if total Deposit is More than Rs 2.5 Lakh.

More info@ https://www.moneydial.com/blogs/cbdt-updates-demonetisation-pan-compulsory-total-deposit-rs-2-5-lakh/

5 New Updates on Demonetisation: RBI put Restriction on Cash Payment in Marriages.

More info@ https://www.moneydial.com/blogs/5-new-updates-on-demonetisation-rbi-put-restriction-on-cash-payment-in-marriages/

Sheela Foam ltd IPO of Worth Rs 510 Crore.

More info@https://www.moneydial.com/blogs/sheela-foam-ltd-ipo-of-worth-rs-510-crore/

Indian Railway Update on Demonetisation on 21 Nov: Waives off Service Tax on Rail Ticket.

More info@ https://www.moneydial.com/blogs/indian-railway-update-on-demonetisation-on-21-nov-waives-off-service-tax-on-rail-ticket/

Service Charge Waives off on all Digital Financial Transactions till 31 Dec, 2016: Demonetisation Updates.

More info@ https://www.moneydial.com/blogs/service-charge-waives-off-on-all-digital-financial-transactions-till-31-dec-2016-demonetisation-updates/

SEBI Board Meetings Updates on 23 November 2016: Good News for Angel Investors.

More info@ https://www.moneydial.com/blogs/sebi-board-meetings-on-updates-23-november-2016-good-news-for-angel-investors/

Demonetisation Updates on 24 November 2016: Cannot Deposit Old Note in Bank PPF Account.

More info@ https://www.moneydial.com/blogs/demonetisation-updates-on-24-november-2016-cannot-deposit-old-note-in-bank-ppf-account

Old Rs 500 Notes can be used at Toll Plazas till 15 December-Demonetisation Updates.

More info@ https://www.moneydial.com/blogs/old-rs-500-notes-can-used-toll-plazas-till-15-december-demonetisation-updates/

23 Places Where You can Use Old Rs 500 Note Till 15 Dec.

More info@ https://www.moneydial.com/blogs/23-places-can-use-old-rs-500-note-till-15-dec-demonetisation-updates-25-nov/

Please visit to apply personal loan in bangalore:

http://www.personalloan-bangalore.com/

If you are looking for home loan in bangalore, visit us:

http://www.home-loan-bangalore.com/

please detail of reliance home finance ncd December 2016

and script code of reliance home finance ncd after listing dear shiv

Dear Mr. Shiv,

I am a great fan of you for below reasons.

– Your Selfless and honest advise

– Well researched analysis with quality content

-Great patience for responding to each and every one., even answering silly queries as well, to keep all happy.

With the same faith, I did invest heavily in this stock (PNB Housing Fin) which has already appreciated 30%+ and not stopping..

Many thanks to you for this great service of helping countless retail investors.

Best regards

Good analysis . Thanks for the information.

Searching for a loan in Bangalore with lowest interest rate. Apply online on LoanBeku for faster approval.