Reliance MF CPSE ETF Further Fund Offer (FFO) 2 – March 2017 Issue – Click Here

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

In an attempt to meet its disinvestment target for the current financial year 2016-17, the government of India has decided to launch one more tranche of the CPSE ETF to raise Rs. 6,000 crore by selling its partial stakes in some of the listed public sector undertakings (PSUs). The first tranche of the CPSE ETF got launched during the tenure of the UPA government in March 2014 and it successfully raised Rs. 3,000 crore from various investors. This second tranche is getting launched this week on January 17 and would remain open for four days only to close on January 20.

While January 17 subscription is reserved for the Anchor Investors, retail investors and other non-anchor investors would be able to submit their applications starting January 18. Once successfully allotted, its units are expected to get listed on the stock exchanges on or before February 10.

CPSE Nifty Index – It is one of the indices of the National Stock Exchange (NSE) carrying 10 public sector undertakings (PSUs) in which the central government has more than 55% stake and these companies have more than Rs. 1,000 crore in market capitalisation. All these companies are profitable and are either Maharatnas or Navratnas.

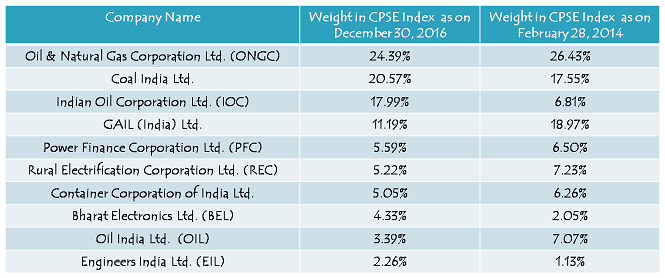

CPSE Index Composition as on December 30, 2016 & February 28, 2014

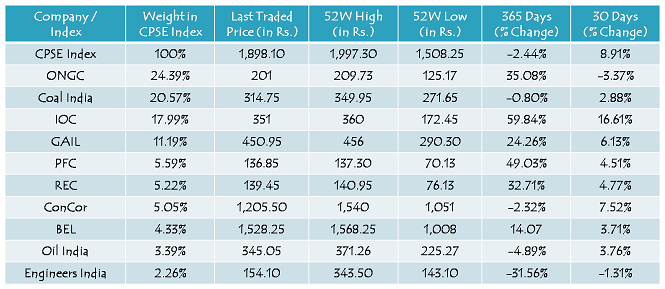

CPSE Index Composition as on December 30, 2016 & Trade Data as on January 13, 2017

CPSE ETF or Central Public Sector Enterprises Exchange Traded Fund – This ETF got launched in March 2014 by Goldman Sachs Asset Management Company and listed in April 2014 on the stock exchanges. While the retail investors got its units allotted at Rs. 17.45, it quickly touched a high of Rs. 29.82 in less than 2 months in May 2014 when there was a euphoria after Mr. Modi took charge to serve this big nation as the PM. However, even after more than two and a half years, this ETF has not been able to cross its previous highs made during that euphoric period and is currently trading at Rs. 26.87 a unit.

FFO Opening & Closing Dates – For Anchor Investors, this fund will open for subscription from January 17 and for non-anchor investors i.e. retail investors, QIBs and non-institutional investors, subscription will start from January 18. This FFO will remain open for four days only to close on January 20.

Features of CPSE ETF Further Fund Offer (FFO)

High Dividend Yield & Reasonable Valuations – All the constituents of the CPSE Index are profitable and pay reasonably high dividends on a regular basis. Though high dividend yield does not guarantee positive returns, but it reduces volatility in returns as downside in their market prices gets fairly limited. Moreover, I think these CPSEs are trading at reasonably fair valuations and bold reforms, if taken post elections, could result in unlocking value for their shareholders.

5% Discount for Investors – Like most public offers of government companies, this FFO will also offer a 5% discount to the retail investors as well as other categories of investors. This 5% discount will be calculated on the “FFO Reference Market Price” of the underlying shares of the Nifty CPSE Index and will be passed on to the CPSE ETF by the government of India.

Reference Market Price/NAV – As mentioned above, CPSE ETF is currently trading at Rs. 26.87 on the stock exchanges. This is also its reference market price or NAV. As the investors get allotment and FFO units get listed on the stock exchanges, market price of each unit of this ETF will be linked to the Nifty CPSE Index and its returns would be quite close to the returns generated by the CPSE Index. Investors will get their units allotted post an adjustment of 5% discount offered by the government to CPSE ETF for buying the underlying CPSE Index shares.

Investment Objective – The scheme intends to generate returns that closely correspond to the total returns generated by the Nifty CPSE Index, by investing in the securities which are constituents of the Nifty CPSE Index in the same proportion as in the index. However, the performance of the scheme may differ from that of the Nifty CPSE Index due to tracking error, scheme expenses and the initial discount of 5%.

Unlike NFO, No Loyalty Units in FFO – Retail investors in April 2015 received 1 additional unit as bonus against their investment of 15 units of CPSE ETF, as a reward for being loyal to this scheme for one full year from the date of allotment. However, the current scheme does not offer any such loyalty units this time around and that makes it slightly unattractive to me.

Minimum/Maximum Amount to be Raised – This ETF would target to raise Rs. 6,000 crore during this 4-day offer period, including the green-shoe option to retain Rs. 1,500 crore over and above the base target of Rs. 4,500 crore. However, in case of oversubscription beyond Rs. 6,000 crore, partial allotment will be made to the investors.

Minimum/Maximum Investment Size – Individual investors can invest in the scheme with a minimum investment amount of Rs. 5,000 and there is no upper limit on the investment amount. However, in order to get preference in allotment as a retail investor, you need to keep your investment amount capped at Rs. 2 lakhs.

Allotment & Listing – As per the offer document, units of this ETF will get allotted within 15 days from the closing date of the issue and listing on the NSE and BSE will happen within 5 days from the date of allotment. However, I expect the allotment and listing to happen sooner than these indicative times.

Demat Account Mandatory – As this is an exchange traded fund, the units of the scheme will be available only in the dematerialized/electronic form. So, you need to mandatorily have a demat account to apply for its units. Applications without relevant demat account details are liable to get rejected.

Tax Saving u/s. 80CCG – This FFO is in compliance with the provisions of Rajiv Gandhi Equity Savings Scheme (RGESS) and thus qualifies for a tax exemption of up to Rs. 25,000 under section 80CCG. However, most of the investors would find it difficult to fulfill its two most important conditions to avail this tax exemption. These two conditions are – one, your gross total income should not exceed Rs. 12 lakh in the current financial year and two, you must be a first time investor in equities. Though it is quite difficult to satisfy both these conditions together, people who fulfil both these conditions can avail tax exemption u/s 80CCG by making an investment of up to Rs. 50,000.

Lock-In Period with Tax Exemption – Investors, who seek tax exemption u/s. 80CCG, will be subject to a lock-in period of 3 years – 1 year of fixed lock-in and 2 years of flexible lock-in. The fixed lock-in period will start from the date of your investment in the current financial year and will end on March 31st next year i.e. 2018.

The flexible lock-in period will be of two years, beginning immediately after the end of the fixed lock-in period i.e. beginning April 1, 2018 till March 31, 2020.

No Tax Benefit Availed – No Lock-In Period – Investors who do not avail any tax benefit out of this ETF, would be free to sell their holdings any time they desire to do so. There is no lock-in period applicable to those investors. However, in order to avail long term capital gain tax exemption, it is advisable to hold on to your investments for at least one year.

Entry & Exit Load – You are not required to pay any entry load or exit load with this fund.

Categories of Investors & Allocation Ratio

Anchor Investors – Maximum 30% of Rs. 6,000 Crore i.e. Rs. 1,800 Crore will be allocated to the anchor investors.

Retail Individual Investors – After the anchor book gets over on January 17, retail individual investors are allowed to take up all of the remaining portion of this FFO whatever remains left out of Rs. 6,000 crore i.e. 70% of Rs. 6,000 Crore i.e. Rs. 4,200 Crore + under-subscribed portion of Anchor Investors.

Qualified Institutional Buyers (QIBs) & Non-Institutional Investors (NIIs) – QIBs and NIIs will have nothing reserved for them in this FFO. They will be allotted units of this FFO only if the subscription numbers of the retail investors and/or anchor investors fall short of their reserved quota.

Fund Manager – There has been no change in the fund manager of this ETF. As it was the case with this ETF at the time of its NFO, its 36-year old fund manager Payal Kaipunjal, who is an MBA from Wellingkar Institute of Management and also a Financial Risk Manager (FRM) from GARP University, will continue managing this ETF with further infusion of funds. She has a total experience of 12 years and worked with Benchmark Asset Management Company and then Goldman Sachs India before it got acquired by Reliance AMC in 2016.

Risks

High Exposure to Oil & Gas Sector – CPSE Index has an exposure of approximately 57% to the oil & gas sector, having ONGC, GAIL and Indian Oil as 3 of its top 4 constituents. So, any adverse event for the oil & gas sector might result in a sharp fall in the stock prices of these companies resulting in negative or low returns for the CPSE ETF.

High Exposure to Public Sector Enterprises – Public sector enterprises are often used by the governments to either bridge their fiscal deficit targets or to meet any of their political obligations. Moreover, managements of these companies are often driven by objectives other than value maximisation for shareholders. As their objective of adding value to shareholders gets diluted, it becomes a pain point for the shareholders. So, the investors need to consider this as a big risk for their future returns.

Passive Management – ETFs are passively managed funds and their performance largely depends on the index they track. As CPSE ETF tracks the CPSE Index, its performance will completely hinge on the performance of the constituents of the CPSE Index. So, there is little scope for the fund manager to show her skills in picking high growth stocks and outperform the benchmark index in a significant manner.

Should you invest in this FFO of CPSE ETF?

I covered the NFO of CPSE ETF in March 2014 and recommended investors to invest in it for a few reasons – 5% discount to the investors, loyalty units after holding it for more than a year, depressed valuations of its constituents at that time and most importantly, hope of a strong government at the centre taking bold measures to turnaround these CPSEs and make their managements run them professionally.

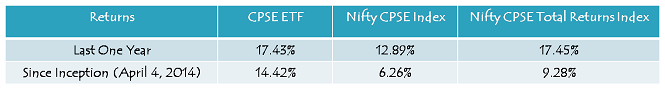

Compounded Annualised Returns as on December 30, 2016

While many factors have turned in favour of these CPSEs and in a way the CPSE ETF investors and we also have a reasonably strong government at the centre with a clear majority, I think we are yet to have desirable results for our investments. I think there is still a lot of scope of making these companies truly competent and add a significant value to their stakeholders. I strongly feel that it is not the job of the government to run many of these businesses and hence most of these companies should be sold to the private players strategically.

This government has recently taken a decision to sell its 26% stake in BEML, after which the government’s stake will come down to 28%. I think it is a great move by the government and I strongly wish to see many such decisions get taken after the upcoming elections in five states. If this government succeeds in increasing the pace of reforms in the last two years, then I think it would not be difficult for these CPSEs to generate 50-100% returns for their investors in the next 2-3 years.

From investors point of view, it would have been great had the government offered issuance of loyalty units in a similar manner as done earlier, but it is still not bad to have a 5% discount. I think running these companies in a professional manner and making their managements accountable for their duty of creating value for their shareholders is much more important than offering loyalty units or any such freebies. I still have high hopes from this government and on the basis of that, I would invest some part of my money in this offer and would advise my clients also to take some exposure to this ETF.

Application Form – CPSE ETF FFO

For any further info or to invest in the CPSE ETF Further Fund Offer (FFO), you can contact us on +91-9811797407 or mail me at skukreja@investitude.co.in

Hi Shiv,

Thanks for the detailed article as usual. Anytime I hear/read about launch of any such financial instruments (NCD/IPO/NFO/Bonds etc.), by default I open “www.onemint.com” to get broader understanding and reliable analysis.

I’ve one specific query w.r.t. one of the sections.

In Section “Compounded Annualised Returns as on December 30, 2016”, % returns for CPSE ETF for “Last 1 year” and Since Inception” are higher by approx. 4.5% and 8% respectively compared to Nifty CPSE Index. However, if CPSE ETF is supposed to track the Nifty CPSE Index Composition, how can the returns be so different?

It is understandable, if it was 1-1.5% lower considering the fund management and other expenses etc.

Can you please help me understand this?

Regards, CVS

Thanks CVS for your encouraging words! 🙂

Higher returns for the CPSE ETF seem to be due to its policy of investing dividends from its constituents back in these companies. It could also be due to tracking error, but not in a major way.

Thanks Shiv.

To have better understanding on my side… from our (investor’s) perspective – is this to be treated as “Equity Mutual Fund” or “Direct Equity Investment”?

If as Mutual Fund, then does the retail investor have options such as “Dividend/Growth” to choose from?

FYI… RelianceMoney Online trading account shows this under “IPO” section and shows the prince band as “5000 – 5000” i.e. fixed price. Selecting “Cut-off Price” as “5000 Rs.” I think, I can apply for “40 units” (shows cost as: 200000) to be considered as “Retail Investor”. Please advise, if this is the correct approach.

Regards, CVS

Hi CVS,

1. It is more of a “Direct Equity Investment” as compared to “Equity Mutual Fund”.

2. No such option is there. It is ‘Growth’ option by default.

3. I think by Rs. 5,000, Reliance Money wants to convey the minimum investment amount to be Rs. 5,000.

Hi Shiv,

Thanks for the wonderful information. I have my demat account with lets say ANGEL BROKING and I manage my online account with them. Now, in Mutual Fund Category , I can see CPSE-ETF fund under Reliance AMC. So if I purchase or invest my money from there then is it same as other process of getting this applied through forma and cheque?

So, basically what i would like to know is , if i am doing it online using angel broking account then it should go in right direction with 5% of discount and all.

Hi Saumil,

If you are investing through Angel Broking and it is the FFO & not the already listed ETF, then it is perfectly fine, you will get the 5% discount.

Shiv – Could you pls share the NSE or BSE link that would provide the current subscription numbers for this ETF? I tried locating it myself but could not 🙁

Hi Bobby,

As bidding is not mandatory for this FFO, real time Live data is not available on any of the stock exchanges. It is not possible to get the subscription numbers as well.

Hi Shiv,

Million Thanks for detailed information, have small query.

I tried to apply for CPSE ETF through HDFC Securities online trading platform. Why applying it shows the floor price Rs.1/- and if we apply for 40000 units it blocks only Rs. 40,000/- while the current trading price is 26.67.

So my question is if I apply for 40000 units and amount blocked is only Rs. 40,000/- and allotment is full 40000 units so in this scenario do I need to pay additional amount or registrar will allot units equivalent to Rs. 40,000/- in accordance to market determined price.

Many Thanks.

Thanks Javeed!

I don’t know why HDFC Securities platform is giving you an option to opt for units when they have fixed the floor price to be Re. 1. I think you should opt for 150000 units there and pay them Rs. 1,50,000 upfront so that your application gets considered to be of Rs. 1,50,000. I think paying Rs. 40,000 would mean you have opted for Rs. 40,000 worth of units only and you would get allotment accordingly.

Hi Shiv,

Most of the CPSE stocks are at almost 52 week high. So the index is also high. Is it advisable to apply for this FFO?

Hi Sarala,

Market price of this ETF could move either ways. If it is near its 52-week highs, that doesn’t necessarily mean that its upside is capped. Movement in the price of this ETF would really depend on the government policies w.r.t. these companies. If the government takes some reform measures to make these companies more efficient, then you would see a great uptick in their market prices. However, if the government is not able to make any significant change in the way these companies are working, then there could be a downside as well. So, you need to take a call which way you see the tide would turn.

Hi Shiv,

This ETF has nearly 60% of its holding in the Oil and Gas Sector. During last 2 years the Crude import prices were drastically down, which helped it to maintain the NAV at the current level. But the Crude prices already showing an increase due to production cuts announced by major producers, will it be possible for the Fund to generate good returns in future, without diversifying its portfolio (which may not be possible due to CPSE label). Please clarify.

Hi Mr. Nair,

Lower crude prices are negative for its biggest constituent i.e. ONGC and a jump in crude prices in the last 2-3 quarters has actually resulted in ONGC rising by more than 35-40%. Moreover, higher crude prices are not affecting Oil Marketing Companies (OMCs) like IOC, HPCL, BPCL as they now have more control over retail fuel prices than before. So, I don’t think higher crude prices has affected or would affect this ETF in a major way, if the government walks on a reform path.

Can you please suggest the price at which the ETFs will be allotted or the particular day of reference for allotment during this fpo

Thanks

Hi Sourav,

CPSE ETF is currently trading at Rs. 26.67. So, if its constituents do not fall or rise much from here, then it should be allotted @ Rs. 26.67 – 5% discount = Rs. 25.34 a unit.

Hi Shiv, In addion to 5% discount does this FFO offer loyalty bonus units after 1 yr? I read so in an article in economic times. Can u pls clarify

Hi Kumar,

Information related to loyalty units in this FFO is incorrect. Investors will not get any loyalty units with this ETF this time around.

Thanks Shiv for clarifying this. You are really gem of a person who guides common man correctly while few other blogs publish incorrect info. Keep up the good work

Thanks a lot Kumar for your kind & encouraging words! 🙂

Thanks Biren! 🙂

Performance of this ETF would really depend on the policies of the current government. This ETF touched its high of 29.82 in May 2014 when expectations were getting euphoric w.r.t. government’s economic policies. I have high expectations from the current government for its remaining tenure and that is why I expect this ETF to provide more than 20-25% returns p.a. going forward. If the government fails in its economic policies or it doesn’t get re-elected in May 2019, I would exit from this ETF and invest my money elsewhere.

Excellent information…. Impressed.

How do you see it for long term investment point of view (i.e. 10 years)

Hi Shiv,

Please help to understand the FFO a little bit more. Can we buy this ETF directly from the market? If yes, what would be the difference between FFO and direct market purchase?

What is the difference between FFO and actively managed MF already available (whose portfolio contains same stocks) in the market?

Hi Ravi,

1. Yes, you can buy this CPSE ETF from the stock markets through your equity trading account. The only difference is that you will not get the 5% discount offered by the government to the retail investors for subscribing to this ETF in FFO.

2. Actively managed funds, having the same stocks, can increase or decrease their proportion of investment in each of these stocks. They have no obligation to follow & alter their portfolio as per the Nifty CPSE Index. Whereas CPSE ETF has to follow CPSE Index. Moreover, you will get 5% discount only with this FFO and not with other mutual funds.

Hi Shiv,

Thanks for the post.

How will be the taxation for gains – Short term and long term.

Will it be in line that of equity based mutual funds.

Hi Pankaj,

Yes, taxation for this ETF will be like equity shares or equity mutual funds. LTCG will be tax exempt and STCG will be taxed at 15%.

Dear sir,thanks lot for this kind of information about ffo etf.I got sufficient idea about it by read ur article

That is great Sujit! You are welcome! 🙂

is is mandatory to have demat to apply for this…. can i apply like do in any other mutal fund.

please help as i dont have demat a/c but i want to apply for this FFO

Hi Aura,

Yes, demat account is mandatory to apply for this ETF. Without a demat account, your application is liable to get rejected.

Hi Shiv,

Many Thanks for your informative article.

Great help.

Best Regards,

You are welcome Vasu! 🙂

Sir

What will happen on listing day. Can it go below allotment price and how much listing gain we can expect.

Hi Ritesh,

Market-linked investments can move either way of the return matrix. So, the returns of this ETF could also turn negative if stock prices of its constituents fall after you get its units allotted. But, a 5% discount provides some kind of cushion in such a scenario. Moreover, one should not invest in this ETF only for its listing gains. In the event of unfavourable listing, you might have to sell your units at a loss or keep holding it for a longer time than actually planned for.

Thank you Sir for the information.

i am a bit confused as to where/how to apply.

I have a demat /trading account and was wondering when i log in

will this be in the IPO section or OFS section since you say this is a a FFO

Or should i apply /look for it in the mutual fund section as New Fund Offer.

Thanks Vanita!

It really depends on who your broker is. You need to check it with you broker under which section it would come.

But Sir,

I do not have a broker.

i have a demat account with my bank and i operate it online.

I checked today and it was not in any category.

Issue starts today no?

Hi Vanita,

Issue has opened, but only for Anchor Investors. It will open for the retail investors from tomorrow.

Given that high likelyhood that this will get oversubscribed, and with a sort of desire / guarantee to give 5000 Units to each in FFO prospectus. Given CMP of @ 26. Is it not prudent to put in say 135,000 Rs or so rather than blocking 200,000 Rs in IPO application?

Hi Ajit,

It really depends on the final subscription in the retail investors category. If it gets highly oversubscribed, then you may not even get 5,000 units allotted. But, if it remains undersubscribed, then you might get full allotment. But, you are right, in case of oversubscription, it is prudent to apply for 5,000 units only.

Hi Shiv,thanks for the detailed article. I am bit confused with the example of 5000 units stated above. Could you please clarify thisin bit more detail

Hi Kumar,

As per the offer document, in case of oversubscription, retail investors would get at least 5000 units of CPSE ETF allotted. So, if you apply for Rs. 2 lakh worth of its units and the issue gets oversubscribed, then you will not get full allotment. So, if you expect the issue to get oversubscribed, then it is better to apply for 5,000 units only so that you get full allotment.

Hi Shiv,

If I apply for 4 lakhs and allotted only 1.5 lakhs due over subscription, Will I be considered as retail investor and get 5% benefit?

Hi Ravi,

If you apply for more than Rs. 2 lakhs, you’ll not be entitled to a 5% discount. Your investor category depends on your application amount and not on the allotment amount.

Shiv – As always, many thanks for the timely and a very useful share.

Thank you Bobby! 🙂

Dear Shiv,

Great analysis as always. Please clarify the following :

1) Allotment is on first come first serve basis or not ?

2) Can multiple applications be put in this issue ?

3) Is it mandatory to apply only through cheque and not ASBA ?

4) Is it necessary to issue cheque from same bank account which is linked to demat ?

5) Is it necessary for applicant to be KYC compliant for mutual funds ?

Thanks

TCB

Thanks TCB!

1. Allotment will be made on a proportionate basis as it is done in case of IPOs and not on a first-come first-served basis. In case of oversubscription, efforts will be made to allot 5,000 units to each of the retail investors.

2. Yes, you can submit multiple applications. But, to be considered a retail investor, the sum of all applications should not exceed Rs. 2 lakhs.

3. ASBA facility is not there in this offer. So, you need to submit cheque or DD along with the application form.

4. No, it is not mandatory to use the cheque of the same bank account. You can use any bank account to make payment. However, third party payments are not allowed.

5. Yes, the applicant is required to be KYC compliant in order to invest in this scheme.

Dear Shiv,

Thanks for reply.

Which KYC compliance is necessary for the applicant – CVL, NMDL, DOTEX, CAMS or KARVY ?

If an applicant is not KYC compliant, can he submit KYC form with necessary documents along with the application form of this ETF ?

Thanks

TCB

Hi TCB,

1. Any relevant KYC would do in this case – CVL, CAMS or Karvy.

2. Yes, you can submit your KYC documents along with the application form.

Hi Shiv,

Thanks for the answers.

ASBA is not there, does this mean we can buy this using broker’s online portals. Buying offline through forms is the only way out?

Thanks,

Hi Madhab,

Most brokers are providing the facility of online investment, you need to check with your broker if they are doing it or not. Buying offline using application forms is definitely an alternate way of investment.