ICICI Prudential Bharat 22 ETF NFO – November 2017 Issue

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Bharat 22 ETF – Allotment Status

Finance Minister in his budget speech had set Rs. 72,500 as the disinvestment target for the current fiscal year 2017-18. In order to meet this steep target, the government has decided to sell its stake in 22 of its holdings, by forming an altogether new index called “S&P BSE Bharat 22 Index”. As its name suggests, this index has been designed by the Bombay Stock Exchange (BSE) in consultation with the government. Unlike Nifty CPSE Index, which has all its constituents to be the CPSEs, Bharat 22 Index has CPSEs, PSUs and 3 private companies (L&T, ITC and Axis Bank) as its constituents.

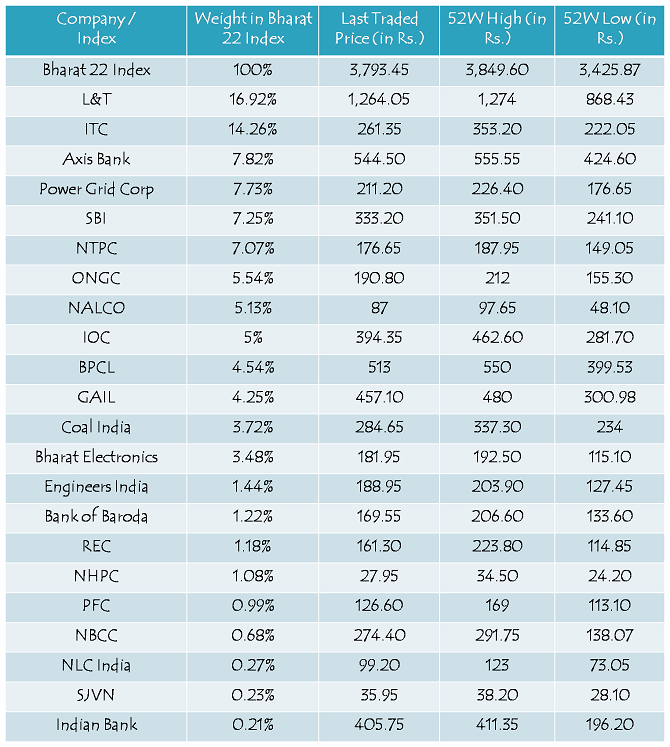

Here is the list of all its 22 constituents and their weightage in the index:

ICICI Prudential Bharat 22 ETF is an open-ended index scheme, to be listed on the stock exchanges in the form of an Exchange Traded Fund (ETF) tracking the S&P BSE Bharat 22 Index. This ETF has been launched by ICICI Prudential Asset Management Company and is named as Bharat 22 ETF.

Investment Objective – Bharat 22 ETF intends to generate returns that closely correspond to the total returns earned by the securities as represented by the Bharat 22 Index. However, the performance of the scheme may differ from that of Bharat 22 Index due to tracking error and also due to the scheme expenses.

NFO Opening & Closing Dates – This scheme will remain open for four days, only one day for the anchor investors i.e. November 14 and then three days for the non-anchor investors, including retail investors. For the non-anchor investors, it will open for subscription on November 15 and run for three days to close on November 17.

Reference Market Price/NAV – New Fund Offers, or popularly known as NFOs, normally get launched at Rs. 10 per unit as their NAV. This will not be the case with this scheme. During the NFO, each unit of this scheme will have a face value of Rs. 10 and will be issued at a premium, equal to the difference between the face value and the allotment price.

NAV of this scheme will be based on the Bharat 22 Index, and the allotment price would be approximately equal to 1/100th of Bharat 22 Index and calculated post adjusting the 3% discount offered by the government to Bharat 22 ETF for buying the underlying Bharat 22 Index shares.

3% Discount for All Investors – Investors making an investment during the offer period will be given a 3% discount on their investment. This 3% discount on the “Reference Market Price” of the underlying Bharat 22 Index shares will be offered to Bharat 22 ETF by the government of India.

Categories of Investors & Allocation Ratio

Anchor Investors – 25% of the total amount raised or 25% of Rs. 8,000 crore, whichever is higher, has been reserved for the anchor investors.

Retail Individual Investors (RIIs) – 25% of the total amount raised or 25% of Rs. 8,000 crore, whichever is higher, has been reserved for the retail individual investors also.

Qualified Institutional Buyers (QIBs) & Non-Institutional Investors (NIIs) – QIBs and NIIs too will have 25% of the issue reserved for each of their categories. In case of undersubscription in any or both of these categories of investors, unsubscribed portion will be allocated to the retail investors.

Target Amount to be Raised – The government has decided to raise Rs. 8,000 crore from this scheme. However, in case of oversubscription, the government would like to retain the whole of oversubscription in order to bridge its disinvestment target gap. So, it is highly likely that full allotment will be made to the retail individual investors.

Minimum/Maximum Investment Size – Retail individual investors can invest in the scheme with a minimum investment amount of Rs. 5,000. To remain a retail investor, the investment limit has been set at Rs. 2 lakhs.

Allotment & Listing – As per the offer document, investors will get the units allotted within 15 days from the closing date of the issue and listing on the stock exchanges will happen within 5 days from the date of allotment. However, like earlier CPSE ETF issues, I expect the allotment and listing to happen within 7-10 working days from the date the issue gets closed.

Demat Account Mandatory – As you cannot hold and trade ETFs in physical form, it is mandatory to have a demat account for you to invest in this scheme. Applications without relevant demat account details are liable to be rejected.

No Lock-In Period – As this ETF do not provide any tax benefit, there is no lock-in period for the non-anchor investors. Investors can sell their units whenever they want to do so.

Entry & Exit Load – There is no entry load to invest in this scheme and there is no exit load either as and when you decide to sell its units on the stock exchanges. You will be required to pay just your normal brokerage and other government taxes when you sell these units.

2.21% Dividend Yield – As per the BSE website, constituents of Bharat 22 Index are generating 2.21% dividend yield for its investors based on the dividends paid in the last one year. Though dividend yield is not a significant factor for me to invest in stocks or mutual funds/ETFs, I think this dividend yield of 2.21% is not too great for me to reconsider it for my portfolio.

20.28X PE Ratio – Price to earnings ratio (P/E Ratio) of Bharat 22 Index at present is ruling at around 20.28 times. If you consider Nifty to be trading at a P/E multiple of 26-27 times its trailing EPS, I think Bharat 22 Index is not too attractively valued considering most of its constituents are CPSEs or PSUs. You can only bank on their earnings recovery in order to expect a gradual rise in their share prices.

Should you invest in ICICI Prudential Bharat 22 ETF NFO?

Except 3% discount, there is nothing extraordinary in this ETF which attracts me to apply for it in this NFO. As most of its constituents are already trading close to their 52-week highs, you can consider this ETF to be trading close to its 52-week high. However, this should not be considered as anything negative for this ETF. If a stock is trading at or close to its all-time or 52-week highs, it doesn’t mean that it cannot go higher from those levels. Similarly, this ETF too has the potential to scale newer highs if its constituents continue rising as they have been in the last few months.

However, as most of these companies are CPSEs and PSUs, I think it is the government policies which are going to drive the share prices of these companies and thereby this ETF. Let us consider the decision taken by the government to recapitalise the public sector banks (PSBs) with Rs. 2.11 lakh crore worth of infusion over the next 2 years. Though it is a very positive measure announced by the government, but after all it is just an announcement and nothing concrete has taken place to actually strengthen these banks’ balance sheets and most importantly, this bank recap has done nothing to resolve the basic problems of PSBs – 1) extraordinary high levels of NPAs, and 2) poor level of accountability the managements of these public sector banks have shown over the past many years in which many of the private sector banks and NBFCs have flourished to higher levels over the opportunities lost by these PSBs.

Still, this announcement of bank recap has resulted in 36% returns in Nifty PSU Bank Index since Muhurat Trading on Diwali, from 2942.7 on October 19 to 4001.45 on November 10. What I want to say here is that if just an announcement of doing something good for the health of the public sector enterprises or overall economy can deliver such high returns in such a short period of time, then I think nobody has truly imagined the actual potential of these CPSEs and PSUs if the government honestly gets serious with its duty to run these companies professionally. If you trust the intentions and policy execution capabilities of the Modi government, then only this ETF is worth investing your money at these levels, or otherwise, go for the diversified equity mutual funds.

The expense ratio of BHARAT 22 ETF is upto 0.0095% for three years from listing of units of BHARAT 22 ETF.

Thanks Kris for sharing this info!

Compare to traditional MFs, will it not have less expense ratio?

Also No entry/exit load, no lock in period.

So can this not be considered as an alternate and preferred option to MFs?

Kindly suggest.

Hi Niraj,

1. Yes, as mentioned by Kris above, the scheme will have an expense ratio of 0.0095% only.

2. Yes, ETFs do have certain benefits over mutual funds. But, MFs too have certain benefits over ETFs. You need not have a demat account for dealing in MFs, there is no brokerage while buying/selling MFs directly, MFs do not require active monitoring like ETFs require.

Also, ETFs like Bharat 22 ETF track a particular index and therefore it does not require extraordinary skills to manage it. On the other hand, a mutual fund manager can pick any stock he finds attractive from growth perspective.

Thanks a lot Shiv for your kind reply.

One query, unlike traditional MFs, in this ETF if weightage percentage is fixed for scripts, then fund manager will not have flexibility to increase or decrease the exposure to any script, is it?

so what role they’ll play in this ETF?

Please correct me if this understanding is wrong.

Your understanding is correct to a large extent. Fund managers of ETFs similar to CPSE ETF or Bharat 22 ETF or any other passive mutual fund have very little role in managing our money. They are supposed to buy/sell shares as per the changes made in the underlying index/benchmark, as per which they are mandated to invest the corpus.

Thank you Mr. Kukreja for this write-up. I am still confused about the allotment price. Will it be fixed & declared on the day of the issue? Or will it be declared ONLY on allotment? Please clarify for the benefit of all your followers please.

Thanks S.K.!

Allotment Price = (Approximately 1/100 of S&P BSE Bharat 22 Index) – 3% Discount

Allotment price (or NAV of this ETF) will be declared only on allotment.

High Thnxs Mr Kukreja on your write up on BHARAT 22 ETF.. I always wait for your expert comments on Financial equity matters. I have very High Regards & Respect for your valuable & expert comments.

MY querry on BHARAT 22 ETF : Will there be DIVIDEND PAYOUT to BHARAT 22 ETF holders ? or the DVND recd from equity will increase NAV/Value of ETF. Somewhere I had read that Bharat 22 ETF will declare & PAY DVND as & when possible ?. Pl look into my querry seriously & apprise your valuable readers about thesame.

Thnxs.

VKGupta

M: 9829006715

Thanks Mr. Gupta for your kind words! 🙂

These kind of ETFs never announce/distribute any dividends. CPSE ETF too has never announced any dividend. Whatever dividend their constituents declare, the fund manager use that money to reinvest it back in these companies in order to align its portfolio with that of Bharat 22 Index.

contd:

out of 22 stocks of BHARAT 22 ETF, four stocks are looking weak:

Engineers India, NHPC, SJVN & Indian Bank . Pl. apprise us with your expert views.

Thnxs again

VKGupta

I don’t think any of these 4 stocks is looking weak. In fact, I think these stocks are trading close to their 52-week highs.

please provide link to check anchor investor subscription figures

anchor investors oversubscribed by 6 times economic times

dear please give us link to check live subscription figures of Bharat etf

Hi Nitesh,

Unlike IPOs, there is no such link to check subscription figures for this NFO.

Hi

For a retail investor investing in this ETF will it make a difference investing through the current broker or applying directly through ICICIPru website?

Hi Aneesh,

Your broker might charge you brokerage for investing in it. Direct investment will have no brokerage.

Hi Shiv,

For applying directly in MF, we’ve a MF category called “Direct”, so here also will there be any such “Direct”/”Regular” category?

I was under impression that it is like a normal script, and broker will charge only STT and not any MF agent like commission.

Can we really apply directly through ICICI MF and will it really make any difference?

Hi Niraj,

Please check this link – https://www.icicipruamc.com/InvOnline/APP/ASPX/frmExistingInvestor.aspx

There is an option for ‘Direct’ investment if you don’t want your broker to charge brokerage on this investment. You should ask your broker if there is any brokerage on applying through him. Brokerage will vary from broker to broker.

1) Is it better to invest in ULIP (ICICI LIFE TIME CLASSIC) plan or better to invest in MF???

It is always better to go with mutual funds for your investments. Insurance should be taken only to protect your dependents in your absence.

Dear Sir

I’m newcomer in MF inesting segment and want to start SIP with around 3000 per month for 5 year and more. So can u suggest which fund is better for me pls.

Hi Mit,

You should invest in MFs as per your risk profile and financial objectives. We provide such services to our clients on paid basis.

Can anyone apply multiple application from single demat account or can do only one application. If i have made application for 10,000. can i do more investment before 17th ?

Hi Mr. Gupta,

You can submit multiple applications, but it should not cross Rs. 2 lakh for you to remain categorized as a retail investor.

any update on today’s subscription figures please

No update on subscription figures.

Shiv Ji,

In my view it shouldn’t matter , whether we buy now during this NFO period or at a later date, except 3% discount. Unlike IPOs there is no price discovery on listing.

As the market is in consolidation mode, and domestically there seems to be no big trigger till Gujarat Election outcome, along wth with crude price volatility . Don’t you think it’s good strategy to buy this ETF in staggered manner over few months.. ?

Yes Vasu, it doesn’t really matter except 3% discount and brokerage on the buy side. If you feel that the markets or the constituents of this ETF are not going to fall much from here, then you should not miss on its 3% discount. However, if you think otherwise, then it is better to wait for a correction to invest in it or initiate an SIP kind of transaction with your broker.

Hello sir,

What is expected return on this ETF for an investment of 5 years?

Hi Guru,

Returns will be market-linked and therefore, nobody can estimate it. I think its returns will be dependent on the measures the government will take in order to boost India’s economic growth and fiscal health of these cos.

Dear Sir,

Thanks a lot for your information, Great job keep it up

Hi Shiv Sir,

Thanks for sharing these article. it is really helpful for the newcomers. Got to know many things through your articles. Its really informative and helpful.

is the issue closed today and how many times subscribed

Hi Shiv,

How much was the Retail Subsription in this ETF NFO ?

Sir,

I am invested Rs.5000/- in this fund. So want to know, what is unit price of this particular fund and how to invest more money in this fund for our profitability in future for next 10 year

latest news on subscription figures please

robust response 4 times oversubscribed and they will retain oversubscription so all retailers wi’ll get full allotment

Dear sir,

I am one of your silent admirers for your unbiased and clear posts. Keep up the good work.

I am curious to understand how the ETF will work…

If there are 10000 rs in the ETF initially, then 1692 will be invested in L&T.

Q1

Now if the share price of L&T doubles, will it be sold.

Q2

If the price falls to half, will more be bought.

Q3

How will incremental money into the ETF be invested.

Thank you and regards,

ss

When bharat 22etf units alloted

N whn transfer to demat…

Allotment date/period given here for Bharat 22 ETF is wrong. I do not know if you have really read the offer document. It clearly says within 5 days of closure date of NFO which is 17 November 2017. As of 25th November, I have not received any info about allotment which should have been over on 24th November. Should get it by evening I hope.

CKP Leisure IPO-Upcoming IPO in 2018 in India.

? Fresh Issue consist of 1,248,000 Equity Shares of Rs 10 aggregating up to Rs 3.74 Cr.

? Offer for Sale of 2,600,000 Equity Shares of Rs 10 aggregating up to Rs 7.80 Cr.

? CKP Leisure IPO issue price is Rs 30 per equity shares.

? CKP Leisure Limited fast growing niche leisure market in India comprising of night clubs, fine dining restaurants, multiplexes, banquet halls, etc.

More @ https://sharpcareer.in/blog/ipo-upcoming-ipo/ckp-leisure-ipo-upcoming-ipo-2018-india/

HG Infra IPO-Upcoming IPO in India in 2018

ISSUE DETAILS OF HG INFRA IPO:

? Issue Open: Feb 26, 2018

? Issue close: Feb 28, 2018

? Issue Type: Book Built Issue IPO

? Issue Size:

› Fresh Issue up to Rs 300.00 Cr

› Offer for Sale up to Rs 0.60 Cr

? Face Value: Rs 10 Per Equity Share

? Issue Price: Rs 263 – Rs 270 Per Equity Share

? Market Lot: 55 Shares

? Minimum Order Quantity: 55 Shares

? Listing At: BSE, NSE

? Retail Allocation:35%

More @ http://www.sharpcareerfinancialupdates.in/investment-updates/hg-infra-ipo-upcoming-ipo-india-2018/

Hindcon Chemicals IPO-upcoming IPO in 2018 in India.

Objective of the Hindcon Chemicals IPO:

There are there objective of the IPO.

• To Meet Working Capital Requirement

• To meet General Corporate Expenses

• To meet Issue Expenses

Issue details of Hindcon Chemicals IPO:

• Issue Open: Feb 26, 2018

• Issue close: Feb 28, 2018

• Issue Type: Fixed Price Issue IPO

• Issue Size: 2,760,000 Equity Shares of Rs 10 aggregating up to Rs 7.73 Cr

• Face Value: Rs 10 Per Equity Share

• Issue Price: Rs 28 Per Equity Share

• Market Lot: 4000 Shares

• Minimum Order Quantity: 4000 Shares

• Listing At: NSE SME

#upcomingipo #iponews #ipo #initialpublicoffering #HindconChemicalsIPO

More @ http://www.sharpcareerfinancialupdates.in/investment-updates/hindcon-chemicals-ipo-upcoming-ipo-2018-india/

Nifty Next 50: Junior is the new Senior

https://thesplendidguru.blogspot.com/2018/02/nifty-next-50-junior-is-new-senior.html?

Sarveshwar Foods IPO-Upcoming IPO 2018.

Objective of Sarveshwar Foods IPO:

• There are four objective of the IPO. They are

• Meet the issue expenses.

• For General Corporate Purpose.

• Part finance long term working capital requirement.

• Investment in subsidiary.

Issue Details of Sarveshwar Foods IPO:

• Issue Open: Mar 5, 2018

• Issue close: Mar 7, 2018

• Issue Type: Book Built Issue IPO

• Issue Size: 6,467,200 Equity Shares of Rs 10 aggregating up to Rs 54.97 Cr

• Face Value: Rs 10 Per Equity Share

• Issue Price: Rs 83 – Rs 85 Per Equity Share

• Market Lot: 1600 Shares

• Minimum Order Quantity: 1600 Shares

• Listing At: NSE SME

• Retail Allocation: 50%

#upcomingipo #ipo #upcomingipo2018 #initialpublicoffering #SarveshwarFoodsIPO

More @ http://www.sharpcareerfinancialupdates.in/investment-updates/sarveshwar-foods-ipo-upcoming-ipo-2018/

Inflame Appliances IPO-Upcoming IPO 2018.

There are four objective of the Inflame Appliances IPO. They are

• To meet Working Capital requirements;

• To meet Capital Expenditure;

• General Corporate Expenses;

• To meet Issue Expenses.

1. Issue details of Inflame Appliances IPO:

• Issue Open: Mar 6, 2018

• Issue close : Mar 8, 2018

• Issue Type: Fixed Price Issue IPO

• Issue Size:1,200,000 Equity Shares of Rs 10 aggregating up to Rs 6.48 Cr

• Face Value: Rs 10 Per Equity Share

• Issue Price: Rs 54 Per Equity Share

• Market Lot: 2000 Shares

• Minimum Order Quantity: 2000 Shares

• Listing At: BSE SME

Click @ Inflame Appliances IPO (https://sharpcareer.in/blog/ipo-upcoming-ipo/inflame-appliances-ipo-upcoming-ipo-2018/)

Bandhan Bank IPO- Bandhan bank ipo Price in India.

• Bandhan bank ipo date:

• Issue Type: Book Built Issue IPO

• Issue Size: 119,280,494 Equity Shares of Rs 10 aggregating up to Rs [.] Cr

› Fresh Issue of 97,663,910 Equity Shares of Rs 10 aggregating up to Rs [.] Cr

› Offer for Sale of 21,616,584 Equity Shares of Rs 10 aggregating up to Rs [.] Cr

• Face Value: Rs 10 Per Equity Share

• Bandhan bank ipo Price: Rs – Rs Per Equity Share

• Market Lot:

• Minimum Order Quantity:

• Listing At: BSE, NSE

• Retail Allocation: 35%

More @ https://sharpcareer.in/blog/ipo-upcoming-ipo/bandhan-bank-ipo-bandhan-bank-ipo-price-india/

#BandhanBankIPO #BandhanBank #IPO #initialpublicoffering #upcomingipo #iponews #ipofaqs