This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Avenue Supermarts Limited, which operates a chain of 118 supermarkets under the brand name ‘DMart’ primarily in the Western, Southern and Central India, is all set to enter the primary markets and has launched its initial public offer (IPO) from today i.e. March 8. The company wants to raise Rs. 1,870 crore from the issue in the price band of Rs. 294-299.

At the upper end of the price band i.e. Rs. 299 a share, the company will issue approximately 6.25 crore shares representing 10.02% of the post issue paid-up capital. Ace investor Radhakishan Damani and his family members presently own 91.36% stake in the company, but they are not selling any stake in this IPO. As always, the issue will remain open for three working days to close on March 10.

Before we take a decision to invest in this issue or not, let us first check out the salient features of this IPO:

Price Band – The company has fixed its price band to be between Rs. 294-299 per share and no discount will be offered to the retail investors.

Size & Objective of the Issue – Avenue Supermarts will issue around 6.25 crore shares in this issue at Rs. 299 a share to raise Rs. 1,870 crore from the investors. Out of this amount, the company plans to use Rs. 1,080 crore for repayment/prepayment of some of its loans and redemption/early redemption of its NCDs, Rs. 366.60 crore for the construction and purchase of fit outs for its new stores and the remaining proceeds for general corporate purposes.

Retail Allocation – 35% of the issue size is reserved for the retail individual investors (RIIs), 15% is reserved for the non-institutional investors and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

No Discount for Retail Investors – As mentioned above also, the company has decided not to offer any discount to the retail investors.

Anchor Investors – Avenue yesterday finalised allocation of approximately 1.88 crore shares to the anchor investors @ Rs. 299 per share for Rs. 561 crore. Some of these anchor investors include Smallcap World Fund, New World Fund, Government Pension Global Fund, General Atlantic Singapore Fund, FIL Investments Mauritius, First State Indian Subcontinent Fund, Fidelity International Discovery Fund, Franklin Templeton Investment Funds, Government of Singapore, Wasatch Emerging India Fund, Goldman Sachs India Fund, HSBC India Equity Mother Fund, JP Morgan India Smaller Companies Fund, Nomura India Stock Mother Fund, Acacia Banyan Partners and T Rowe Price New Asia Fund.

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 50 shares and in multiples of 50 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,950 at the upper end of the price band and Rs. 14,700 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 50 shares @ Rs. 299 i.e. a maximum investment of Rs. 1,94,350. At Rs. 294 a share also, you can apply for 13 lots only, thus making it Rs. 1,91,100.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on 8th March. March 21st is the tentative date for its listing.

Here are some other important dates after the issue gets closed:

Finalisation of Basis of Allotment – On or about March 16, 2017

Initiation of Refunds – On or about March 17, 2017

Credit of equity shares to investors’ demat accounts – On or about March 20, 2017

Commencement of Trading on the NSE/BSE – On or about March 21, 2017

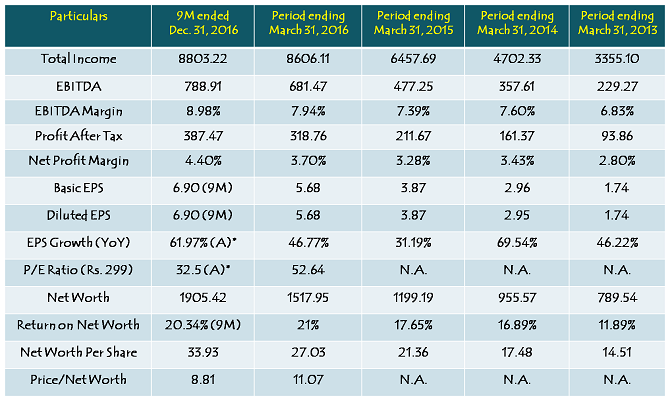

Financials of Avenue Supermats Limited

Note: Figures are in Rs. Crore, except per share data, figures in billions & percentage figures

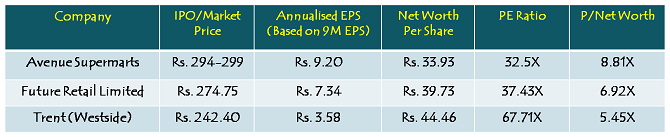

Peer Comparison – Avenue Supermarts, Future Retail & Trent (Westside)

Should you invest in Avenue Supermarts @ Rs. 299 a share?

What I like about this company is that it operates most of its stores predominantly on an ownership model. The company usually buys land for its stores, builds them and operates these stores rather than taking premises on rentals. This way the company is not required to pay rentals for most of its stores and thereby saves a huge amount it would have to shell out on paying rentals for its leased premises. Its biggest competitors, Future Retail and Reliance Retail, operate most of their stores from leased premises and thereby pay a hefty amount in rentals.

Moreover, the company procures its goods directly from the vendors and manufacturers, thereby eliminating the costs of middlemen. The company also focuses on minimising inventory build-up through product assortment.

At its expected issue price of Rs. 299, Avenue Supermarts will have an enterprise value of close to Rs. 19,300 crore. Based on its annualised EBITDA of around Rs. 1,060 crore, it will be valued at an EV/EBITDA of 18.21 times. Its listed peer Future Retail currently trades at an EV/EBITDA of 24.5 times, which makes this issue relatively more attractive.

At Rs. 299 a share, the company is valued at 32.5 times its expected FY 16 annualised earnings and 8.81 times its net worth. These valuations are not cheap. But, then the way the company has been growing and its profitability and margins have improved in a healthy manner over all these years, the issue doesn’t seem expensive from medium to long term perspective. As the sentiment is positive for the issue as well as for the stock markets, it looks extremely safe and attractive from listing gains point of view as well.

However, undue exuberance is the only thing I am worried about in this IPO. Investors are underinvested in the stock markets right now. A sharp recovery in the stock markets post demonetisation gloom has left all of us surprised. Most investors are still sitting on the sidelines waiting for the markets to correct. They are grossly disappointed with their less than potential investment in stocks. Cash balances are huge, but opportunities are limited for that cash to get deployed.

In this case, though the company is highly efficient and the issue is good, but then it is made out by the brokers and analysts that it would be a multibagger stock on the listing day itself. That is why I expect a huge oversubscription for this issue. That might result in some kind of euphoria as the stock gets listed on the stock exchanges. I would advise the investors to not feel euphoric about it and take this opportunity to book their profits on the listing day itself. However, everything else is fine with this issue and I would advise my clients and other investors to subscribe to it.

ill Agree With Niveza India

Lottery system is really difficult to understand. Many investors have applied for the IPO and ended with weird expressions. Looking at the numbers, nothing was extra ordinary about it but the hype created by the investors these days for the IPO actually making it attractive. Sharing personal experience about new entrants of the stock market, even many of them want to buy IPO without analysing anything, just on the attraction of listing gains. Listing gains are actually added value in the recent past IPOs and making market more attractive in coming time as well.

Avenue supermarts is making DHOOM in the market. Thanks for such a nice post. Please keep posting.

Thank you.

Lottery system is really difficult to understand. Many investors have applied for the IPO and ended with weird expressions. Looking at the numbers, nothing was extra ordinary about it but the hype created by the investors these days for the IPO actually making it attractive. Sharing personal experience about new entrants of the stock market, even many of them want to buy IPO without analysing anything, just on the attraction of listing gains. Listing gains are actually added value in the recent past IPOs and making market more attractive in coming time as well.

DMart had a great listing today. It is one of the best listings of the last 10-15 years. Market cap of Rs. 40,000 crore. Phew!

Is the great listing justified? Is its value really that much or that the hype and heavy subscription caused it?

Fear and Euphoria are part of stock market investments and it is very difficult to justify fear when there is fear and euphoria when there is euphoria. In this case as well, we are required to respect markets. DMart seems overvalued at current prices, but then you cannot do anything about it in a rising stock price scenario.

D-Mart listed at Rs 604.4: 102% Return

D-Mart listed at Rs. 604.4 on the Bombay Stock Exchange, up 102 percent over issue price of Rs. 299.

1. Avenue Supermarts, the operator of supermarket retail chain D-Mart, more than doubled on debut due to hefty buying by investors.

2. The stock listed at Rs. 604.4 on the Bombay Stock Exchange, up 102% over issue price of Rs. 299.

3. Investors earned huge returns on their money invested in the IPO of this company.

4. One lot of 50 shares at issue price of Rs. 299 cost Rs. 14,950 for an investor.

5. At listing price of Rs. 610, the total value of investment jumped up to Rs. 30, 500.

6. So, if an investor having one lot earned solid returns of 15, 550 (Excluding brokerage charges).

7. This stock touched an intraday high of Rs. 615 (approx. 105.68 per cent) and on the lower side it touched Rs. 558.75 (up by 86.87 per cent) after opening the IPO.

More @ https://www.moneydial.com/blogs/d-mart-listed-at-rs-604-4-102-return/

Hi Shiv,

Thank you for sharing your thoughts on DMART IPO..It gave 100% returns on the listing day..

Thnak you,

Satyam

Thanks Satyam! 🙂

CL Educate IPO Hits D-Street – Analysts say IPO Valuation is very high

CL educate is one of the leading player in the education provider space, but recently it witnessed slightly higher debtors. Hence, the current valuation leaves limited upside and recommend that investors avoid the issue.

The company’s business is working capital-intensive, which coupled with expensive valuations may not provide significant upside to the investor. So the brokerage has a neutral rating on the issue.

Under the union budget 2017-18, the allocation to the education sector comprised Rs. 46, 356 crore for school education and Rs. 33, 330 crore for higher education.

Also Read: Important facts about CL Educate Ltd. IPO – Updates

In total, the Union Budget 2017-18 announced Rs. 79, 686 crore to the education sector, up 10.1 per cent over Rs. 72, 394 crore in the previous year.

More @ https://www.moneydial.com/blogs/cl-educate-ipo-hits-today-on-d-street-analysts-say-ipo-valuation-is-very-high/

Shankara Building Products IPO: Facts You must Consider before Investing in

1. Low revenue growth at 6.4% CAGR.

2. Although, company earns thousands of crores of revenue, but it just earns 0.6% as profits. This small profit can be eliminated with just a small %age of increase of cost.

3. Success of a company depends on the value, perception and product quality associated with its retail stores.

4. Any negative publicity of its products, its retail stores or its processing facilities may adversely impact its brand equity, sales and results of operations.

5. Success of a company depends upon its ability to attract, develop and retain trained store representatives while also controlling its labour costs.

6. They are subject to payment-related risks that could increase its operating costs, expose them to delays, fraud, and litigation, subject us to potential liability and potentially impact the goodwill of its stores.

7. This company had instances of non-compliances in relation to regulatory filings to be made with the RoC and the RBI under applicable law.

8. Uncertainty regarding the housing market, real estate prices, economic conditions and other factors beyond its control could adversely affect demand for its products and services. Its cost of doing services and its financial performance would also affect.

9. They do not have definitive agreements with a majority of its vendors for supply of its raw materials and retail products which may adversely affect its business and results of operations.

More @ https://www.moneydial.com/blogs/shankara-building-products-ipo-facts-you-must-consider-before-investing-in/

Shankara Building Products Ltd IPO: You Must Know

Hightlights:

1. Shankara Building Products is one of India’s leading organised retailers of home improvement and building products in India.

2. IPO will Open on Mar 22, 2017 and close on 24, March,2017.

3. Fresh Issue of Rs. 45 crores & Offer for sale of 816252 shares.

4. Issue Price is in between Rs. 440 – Rs. 460 Per Equity Share.

Shankara Building Products Ltd IPO Details:

? Issue Open: Mar 22, 2017

? Issue will close on – Mar 24, 2017

? Issue Type: Book Built Issue IPO

? Issue Size:

Fresh Issue of Rs. 45 crores.

Offer for sale of 816252 shares by the Promoter and 5705488 shares by selling shareholders.

? Face Value: Rs 10 Per Equity Share

? Issue Price: Rs. 440 – Rs. 460 Per Equity Share

? Market Lot: 32 Shares

? Minimum Order Quantity: 32 Shares

? Listing At: BSE, NSE

6. Category-wise Break up:

? Anchor – 22,50,000 Shares = 103.50Crs.

? Net QIB – 15,00,000 Shares = 69.00Crs

? NII – 11,25,000 Shares = 51.75Crs

? RII – 26,25,000 Shares (82,031 Forms) = 120.75Crs. (Lot size = 32)

More @ https://www.moneydial.com/blogs/shankara-building-products-ltd-ipo/

I’m seeing 0 shares allotted to me! Is it because of the lottery?

Hi PP,

Yes, that is due to the lottery system of allotment in case of huge oversubscription.

Same here IPOs really have become hard to get.

Hi Shiv,

I had applied for 12 lots (600 shares). If retail was oversubscribed 7 times, how is it that not a single lot got allotted?

Thanks,

PP

Hi PP,

It makes no difference in a highly oversubscribed IPO if you apply for a single lot or 12 lots. You get only one lot allotted, and that too on a lottery basis. To understand the new basis of allotment, please check this post:

http://www.onemint.com/2012/12/26/new-basis-of-allotment-explained-with-care-ipo/

I see!

What at chances for retail allotment for an application of 350 Shares ?

Maximum 50 shares will be allotted, and that too on a lottery basis.

Last Day (March 10) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 144.62 times

Category II – Non Institutional Investors (NIIs) – 277.74 times

Category III – Retail Individual Investors (RIIs) – 7.51 times

Total Subscription – 104.59 times

Day 2 (March 9) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 9.14 times

Category II – Non Institutional Investors (NIIs) – 4.97 times

Category III – Retail Individual Investors (RIIs) – 4.06 times

Total Subscription – 5.71 times

Thanks Mr Shiv.

RK Bhuwalka

Thanks Mr. Bhuwalka!

Dear Mr Shiv

Don’t you think that this post has been delayed by 2/3 days as the said IPO has been fully subscribed on Day 1 i.e. on 8th?

RK Bhuwalka

Hi Mr. Bhuwalka,

It is a delayed post, but not because the issue has got oversubscribed. It is not on a first come first served basis, so we can still subscribe to this issue and get allotment. The post got delayed by a day or two due to some unexpected reasons.

Shiv

Will this also have the minm allottment rule?

Hi Harinee,

Minimum allotment rule is applicable in case the issue is reasonably oversubscribed. In case of high oversubscription, even minimum allotment is made on a lottery system.

Day 1 (March 8) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 1.84 times

Category II – Non Institutional Investors (NIIs) – 0.52 times

Category III – Retail Individual Investors (RIIs) – 1.44 times

Total Subscription – 1.36 times