This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Budget 2018 has reintroduced the long-term capital gain tax on equity shares and equity mutual funds. There were speculations about its comeback, but I never expected it to materialise, at least in this budget. Personally I believe cons of having it outweigh pros of having it, but it doesn’t matter at all. What really matters is how harsh this LTCG tax is and why there was no panic selling in the markets today. Let us try to find out.

Firstly, this is what the Finance Minister Arun Jaitley announced in his budget speech today – “I propose to tax such long term capital gains exceeding Rs. 1 lakh at the rate of 10% without allowing the benefit of any indexation. However, all gains up to 31st January, 2018 will be grandfathered. For example, if an equity share is purchased six months before 31st January, 2018 at Rs. 100 and the highest price quoted on 31st January, 2018 in respect of this share is Rs. 120, there will be no tax on the gain of Rs. 20 if this share is sold after one year from the date of purchase. However, any gain in excess of Rs. 20 earned after 31st January, 2018 will be taxed at 10% if this share is sold after 31st July, 2018. The gains from equity share held up to one year will remain short term capital gain and will continue to be taxed at the rate of 15%.

In view of grandfathering, this change in capital gain tax will bring marginal revenue gain of about Rs.20,000 crores in the first year. The revenues in subsequent years may be more.”

What seems a simple thing to read carries many ifs and buts behind it, and the most important here is the “Grandfathering Clause”. We’ll try to clear all these ifs and buts here, so let us take it one by one.

What is this ‘Grandfathering’ clause?

As per Wikipedia, “A grandfather clause is a provision in which an old rule continues to apply to some existing situations, while a new rule will apply to all future cases”.

In our case, whatever gains we have earned on our investments in equity shares or equity mutual funds (including balanced funds) till January 31, 2018 will be grandfathered, or will not be taxed at all. So, whether you sell your equity shares or equity mutual funds tomorrow, or between now and March 31, 2018, or even anytime after March 31, 2018, you will not have to pay any LTCG tax on your gains earned till January 31, 2018, if your holding period is more than 12 months.

So, please keep in mind, there is no need to panic in this situation, as there is nothing which is going to affect your gains till 31 January. There is only one thing that could affect your gains (future gains) adversely in this situation and that is your panic behaviour and nothing else. You should take your ‘sell’ decisions only if you think that other investors will panic and markets will move down sharply from here. Even in this case, your previous gains are not taxable and you would be able to protect your gains from probable future losses.

When will this 10% LTCG Tax come into effect?

It will come into effect from April 1, 2018 onwards. It is still a proposal and not applicable for the gains you book on or before March 31, 2018.

So, should we book our gains before it gets applicable with effect from April 1, 2018?

Absolutely NOT, there is no point doing it for this reason. Your long term capital gains earned till January 31 are 100% safe from this tax and it makes absolutely no difference to that portion of LTCG, whether you sell it tomorrow, or after April 1, or even after 2 years from today.

How would our long term capital gains be taxed if we sell them on or after April 1?

There will be 2 portions of your LTCG when your actually book your gains on or after April 1 – first, LTCG earned till January 31, 2018 and second, LTCG earned between February 1 and the date you sell your holding(s). First portion will be tax exempt, and second portion will be taxed at 10.4%, including 4% health and education cess.

What will be our cost of acquisition for the gains made after January 31, 2018?

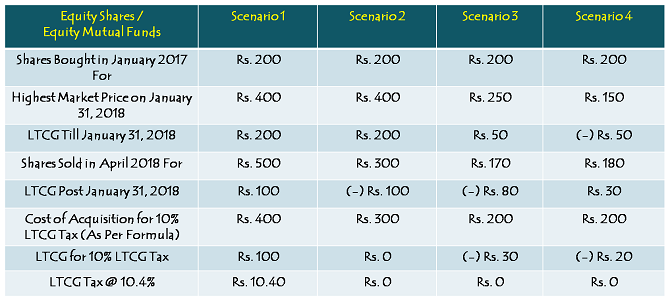

There is a formula for determining your cost of acquisition for the shares or mutual funds bought on or before January 31, 2018, LTCG gains earned after January 31, 2018 and gains booked after holding them for more than 1 year. Here you have the formula:

The cost of acquisition will be HIGHER of:

a) Actual cost of acquisition, and

b) LOWER of:

(i) Fair Market Value of the shares/units as on January 31, 2018

(ii) Actual consideration received at the time of transfer

Let us take a look at the table below to understand it with four different scenarios:

How much LTCG is tax exempt?

LTCG upto Rs. 1 lakh per financial year is not liable to any tax, and you will have to pay 10% tax only on your long term gains over & above Rs. 1 lakh of exempt LTCG.

Like debt mutual funds, is there any indexation benefit available for calculating LTCG tax?

No, as the LTCG tax rate of 10% is considered to be on a lower side, indexation benefit to incorporate inflation effect has not been provided for in the budget.

Dividend Distribution Tax (DDT) @ 10% on Equity & Balanced Mutual Funds

Finance Minister Arun Jaitley has decided to tax your dividend income also which you get on your investments in equity mutual funds or balanced mutual funds. Here is what he announced in the budget:

“I also propose to introduce a tax on distributed income by equity oriented mutual fund at the rate of 10%. This will provide level playing field across growth oriented funds and dividend distributing funds.”

The onus of paying it to the government will not be on you. It will be the responsibility of the mutual fund which has announced to pay you this dividend, and it will be in the form of dividend distribution tax of 10%. This 10% will be deducted from the dividend announced and then dividend will be paid to you.

What’s your view on this reintroduction of LTCG tax and dividend distribution tax? Do you think it is going to have a substantial impact on our markets? Please share your views here. Also, if you have any query regarding any of the points mentioned in this post, please share it here.

Thanks, very well explained

You are welcome Paritosh!

How TDS will be done for Long Term Capital Gains on shares sold? Will broker calculate and deduct the tax?

Hi Neeraj,

TDS is not applicable on LTCG tax payable. Only DDT is applicable on dividends announced & paid to the investors.

Thanks for the clarifications

You are welcome Neeraj!

All MFS now deduct 10% on total dividend payable and balance only be paid to investors. That deducted 10% shall be paid by them directly to govt. Is it so? Individual investor need not pay..is it?

Yes Shrao, that is correct. Investors are not required to pay it.

Sir, what is the tax treatment for capital gains (long or short term) on Tax Free Bonds? Is there any change in this budget? Are the gains till 31st Jan Grandfathered? I know that the interest on these bonds is tax free.

Hi Melwyn,

No change, it is still 10% flat for listed tax-free bonds.

well written article…whole article was very smooth and easy to read..keep posting good articles like this one..

Excellent and detailed article. Very informative! thanks for sharing …….

Thanks Inox Capitals!

how is market value for share on 31st Jan 2018 is determined, closing price or highest price during that day ?

Hi Ajay,

It would be the highest price of January 31.

1 strategy is to redeem and re-purchase funds to the extent of 1 lakh LTCG every year, so that the overall LTCG is kept under control to some extent when we finally redeem the fund.

Your thoughts Sir?

Hi Melwyn,

I think it is a good strategy, nothing wrong with it, except that your subsequent investment is also for a long term.

Thanks Shiv for the detailed post on LTCG.Overall it was a horrible budget with no relief for the salaried class, who are the only guys who pay regular tax.STT has been retained.What does Mr.Jaitley want, bring down a booming stock market? On one side no relief for the salaried guy and taxation for the investors other side hike in pay for MPs wow! Allocation of funds to farmers budget after budget is useless unless we actually see it reaching the farmer at ground level.Structural change needed at bureaucracy level and local administration is the need of the day else all the money will as usual go into a blackhole called corruption.

Hi Harinee,

I agree with all your views, except that it was a horrible budget. 🙂

Thanks Shiv !

Can you also provide your view as to what in the budget makes you feel it is not an average budget ?

Hi Ams,

The budget’s practical approach, focus on the agricultural, healthcare, education and infrastructure sectors, government’s attitude of not succumbing to the undue pressure of adjusting tax slabs and 80C limit upwards, keeping its fiscal deficit at 3.3% and many other factors make me feel that this budget was above average.

Thanks Shiv for your explanation. Agree with you on few things also on Fiscal Deficit, it could mean investment for development.

The abandoning of setting target for Revenue Deficit in my view is not good as the revenue expense is usually not a development expense and will sway the expense away form productive capital expenditure.

Hi Ams,

Revenue Deficit is under control as of now and is more volatile as compared to Fiscal Deficit. So, targeting a number for revenue deficit is much more difficult than fiscal deficit. Moreover, even if it is higher, it becomes very difficult to control it once its factors go out of control. However, I am still neutral to their decision of not setting any target for it.

Sure. Thanks for views !

Thank you very much Shiv for this excellent article on LTCG which is easy to comprehend.

Thanks Subramaniam!

What happens to Balanced funds say 65% Equity is it taxed 10% ? or It is not even considered as Equity Fund?

Hi Rajkumar,

Yes, even balanced funds will be taxed at 10%, same treatment as equity mutual funds.

Cost of share purchased in 2014 – Rs. 100

Market value on 31-1-2018 – Rs. 500

Sold on 31-3-2018 – Rs. 700

What is Capital Gain / LTCG Tax payable on sale in FY 2017-18

No LTCG tax is to be paid in FY 2017-18.

Cost of share purchased in 2014 – Rs. 100

Market value on 31-3-2018 – Rs. 500

Sold on 31-3-2018 – Rs. 700

What is Capital Gain / LTCG Tax payable on sale in FY 2017-18

For shares purchased in 2014, What happens if I sell my shares before 31-3-2018.

No LTCG tax if you sell your shares on or before March 31, 2018. Even if you sell your shares after that, no tax is payable for capital gains earned till January 31, 2018.

Hi Siva,

DDT is only on Dividend option MFs, so there won’t be any impact on Growth option MFs?, correct?

Equity MFs with “Growth” option will be taxed? will those MFs comes under this LTCG?

Kindly suggest.

Warm Regards,

Niraj

Hi Niraj,

1. Yes, that’s right, there won’t be any impact on Growth option MFs.

2. All equity MFs will be taxed at 10.4% for LTCG. Growth option MFs will not be taxed for dividends announced & paid.

3. All equity & equity oriented MFs come under this LTCG now, even balanced funds as well.

LTCG – will it be applicable for long term capital gains booked during Feb & Mar 2018? This tax applicable only from 1st April 2018?

Hi Henry,

If you book your profits on or before March 31, 2018, you are not liable to pay LTCG tax. It is applicable only with effect from April 1, 2018.

Hi Siva,

1)Are you sure on this, if we sell before 31st March then there is no LTCG? I thought post 1st Feb now anytime you sell LTCG will be applicable.

2) Moreover, if that is the case then if I sell now to save LTCG then it’ll make sense only if I’m planning take money out of Equity, else it won’t make any sense, correct? because if I sell now, and re-enter again then also at exit anyway I’ll have to pay LTCG (or STCG if further holding is < 1 yr), correct?

Hi Niraj,

1. Yes, I am 100% sure about it. It is applicable w.e.f. April 1, 2018. But, if you sell on or after April 1, 2018, you’ll have to pay tax on the gains made after January 31, 2018, if any.

2. Absolutely correct. It makes no sense at all to sell now and purchase again, now or later. This way you are going to gain nothing and only increase your transaction costs. If you sell now and purchase again, you’ll have to again wait for one year to qualify for long term.

Thanks a lot Shiv for your kind reply.

Warm Regards,

Niraj Parikh

You are welcome Niraj!

Thank you Shiv! I have a follow up question and a comment as below:

1. Do you know the treatment of set off of carried forward long term and short term capital losses against taxable long and short term capital gains?

2. There isn’t much gap between 10% LTCG and 15% STCG. this will lead to increased volatility and dissuades longer term investment holding in my view

Hi Sonal,

1. Before this budget, STCL could have been set off against any gains from transfer of any capital asset (Long term or Short term) and the LTCL could have been set off against gains from transfer of long term capital asset only. I believe the same set-off rules will apply going forward as well.

2. Exactly that is my view as well. Now, people will trade more frequently and will not like to wait for 1 year period to book their profits in equities.

Don’t like this rule at all. The current system was working quite well and there was no need to reintroduce this rule specially as it discourages people from buying and holding for a long term.

100% agree with you!

Dear Sir,

I have a concern.

1) If in a FY my LTCG is RS.2Lakh and my Long Term Loss is Rs.1Lakh.

Is My net LTCG of 1Lakh Exempt?

Hi Milind,

Yes, your LT capital loss of Rs. 1 lakh would be set-off against your LT capital gain of Rs. 2 lakh, and your remaining Rs. 1 lakh would also be tax exempt.

Hi Nitin,

1. Yes, this 10% LTCG tax is applicable to equity mutual funds and balanced funds as well.

2. This tax is applicable to ELSS as well.

I have two concerns relating to this topic. Request your views on the same-

1) Is this applicable on equity mutual funds as the finance minister only referred to equity shares.

2) Is this applicable to ELSS funds. If not, I think it makes sense to transfer your mutual funds holdings to ELSS.