Shriram Transport Finance 9.50% NCDs – June 2018 Issue

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Shriram Transport Finance Company Limited (STFC) is launching its public issue of non-convertible debentures (NCDs) from today, June 27, 2018. This will be the first public issue by the company after a gap of four years. The company plans to raise Rs. 5,000 crore from this issue, including the green shoe option of Rs. 4,000 crore.

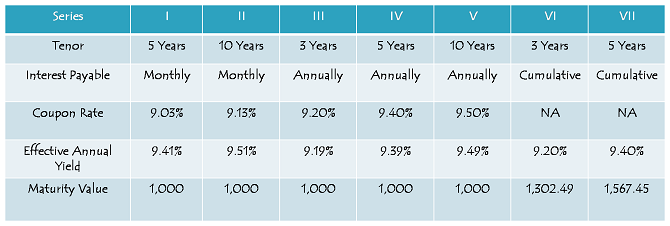

These NCDs will carry coupon rates in the range of 9.03% to 9.50%, resulting in an effective yield of 9.19% to 9.51% for the retail individual investors. The issue is scheduled to close on July 20, unless the company decides to foreclose it.

Before we take a decision whether to invest in this issue or not, let us first check the salient features of this issue.

Size & Objective of the Issue – Base size of the issue is Rs. 1,000 crore, with an option to retain oversubscription of an additional Rs. 4,000 crore, making the total issue size to be Rs. 5,000 crore. The company plans to use the issue proceeds for its lending and financing activities, to repay interest and principal of its existing borrowings and other general corporate purposes.

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 9.50% p.a. for a period of 10 years, 9.40% p.a. for 5 years and 9.20% p.a. for 3 years. These rates would be applicable for annual interest payment only. Monthly interest payment option is available only with 5 years and 10 years tenors, and coupon rates for these periods would be 9.03% p.a. and 9.13% p.a. Respectively.

0.25% Additional Coupon for Senior Citizens – The company has decided to offer an additional coupon of 0.25% p.a. to the retail investors, as well as HNI investors, who hold these NCDs on the relevant record date for the purpose of interest payment.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue i.e. Rs. 500 crore

Category II – Non-Institutional Investors (NIIs) – 10% of the issue i.e. Rs. 500 crore

Category III – High Net Worth Individuals (HNIs) including HUFs – 40% of the issue is reserved i.e. Rs. 2,000 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 2,000 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first-come first-served basis, as well as on a date priority basis, i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – CRISIL and India Ratings have rated this issue as ‘AA+’ with a ‘Stable’ outlook. Moreover, these NCDs will be ‘Secured’ in nature.

Listing, Premature Withdrawal – These NCDs are proposed to get listed on both the stock exchanges, Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can always sell these NCDs on the stock exchanges.

Demat A/c. Mandatory – Demat account is mandatory to invest in these NCDs as the company is not providing the option to apply for these NCDs in physical or certificate form.

TDS – Though the interest income would be taxable with these bonds, NCDs taken in demat form will not attract any TDS. The investor will have to pay tax on the interest income while filing his/her income tax return. TDS @ 10% will be deducted if these NCDs are held in physical/certificate form and annual interest income is more than Rs. 5,000.

Minimum Investment Size – STFC has fixed Rs. 10,000 as the minimum amount to invest in this issue. So, if you want to invest in this issue, you need to apply for a minimum of ten NCDs worth Rs. 1,000 each.

Should you invest in Shriram Transport Finance NCDs?

Shriram Transport Finance issued its NCDs in a public issue four years ago in 2014 at an effective yield of 11% to 11.50%. During that time, inflation was still high, but bond yields and interest rates had just started their downward journey. Now, these NCDs are offering an effective yield of 9.19% to 9.51%. So, if we compare NCDs of the same issuer with its previous issues, there is a material downward shift that has happened. But, if we compare other companies’ coupon rates from their latest issues with that of STFC’s coupon rates, STFC scores over other issuers.

Moreover, STFC is a fundamentally sound company with a long track record of strong income and earnings growth. It also carries a credit rating of ‘AA+’ with a ‘Stable’ outlook. All these factors augur well for this issue and as interest rates on bank FDs are still ruling lower, this issue gives risk-averse investors an opportunity to invest their surplus money into high yielding NCDs.

Application Form of Shriram Transport Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in these NCDs, you can contact us at +91-9811797407

I think you have by mistake said..should you invest in J M financial..instead of saying Sriram

Yes, copy-paste error, have corrected it now. Thanks!

Thanks Shiv for timely details on this. Eagerly awaiting your inputs on whether one should invest or not in this.

Hi Bobby,

I have updated it now, plz check.

Perfect. Your comments reinforce my understanding. Thanks Much ?

Great 🙂

THNXS AGAIN & AGAIN FOR GIVING UPTODATE & CURRENT INFO ON SHRIRAM NCD.

I SINCERELY APPRECIATE YOUR FINANCIAL WISDOM.

PL KEEP IT UP

VKGUPTA

Thanks Mr. Gupta!

On line application for shriram transport finance ncd 2018

Please contact us on 9811797407

A very much informative blog thank you for sharing with us.

Thanks Ronan!

Thanks for the update & current info on Shriram. I really appreciate the your investment advise. Keep posting .

Thanks Mr. Mehta!

Shiv,

As always, Is the 5 yr annual interest option the better bet ?

I would personally prefer the 5-year monthly interest option or the 3-year annual interest option.

I don’t see a senior citizen checkbox while applying on ICICIDirect. Am assuming they will determine who holds the bond at the time of coupon payout and pay accordingly?

Yes, that will be the case.

Thanks!

Hi…so which interest rate and tenor do you recommend..Shiv sir

I prefer the 5-year monthly interest option or the 3-year annual interest option.

Monday issue Is open?

Can we apply on Monday

Yes Vishal, it is still open, you can apply for it on Monday.

Issue being closed today….?

Yes, it is getting closed today.

Dear Sir, I want to invest in Shreeram Transport June-18 NCD. How can I do that via my Zerodha Demat account?

Hi Rahul,

You need to contact Zerodha to check whether they are providing such facility or not.

Shiv, as you may know the recently issued DHFL NCDs are currently trading below the issue price of Rs. 1000. Would you know any specific reasons for this?

I think because issue size is very huge 12000 crore .need some time to absorb this amount in market. Expert can comment

Hi Bobby,

Low coupon rates offered by DHFL, high supply vs. low demand for its NCDs and bond yields not coming off, I think these are some of the factors affecting its market price.

Shiv why PPF interest rates not announced till time. Can we expect cross of 8% tax free for this quarter

Hi Vishal,

No announcement till date means no change in this quarter.

Sir,

The CPSE ETF is not performing well.

It had become par with issue price sometime back..i.e no gains.

And now it has gone below..in loss now.

Please advise what to do?

Hi Vanita,

If you have conviction in this government’s reform agenda, then you should hold on to your investment for the next 6-9 months. Otherwise, you should exit it.

Oh Sir,so sad. In the beginning it was showing promise.I could have sold and made 10 % gains. Now i will have to incur loss 🙁

Hi I have a query on tax implication of NCD

In case of 3 yr cumulative NCD. Since its cumulative I will get interest only after 3 years.

Suppose I sell it after 1 year. Do i still need to pay tax on interest not received or i will just pay long term capital gain tax only

Shriram ncd 2018 is still open

Please explain clearly STCG & LTCG on these Company NCDs versus Taxation comparison on Tax-Free Bonds. Which of the two are more tax-friendly to investors?

Thank you.

Hi Shiv,

Am new to buying NCD’s through DMAT- Apart from the interest earned , what other benefits does an NCD offer at the end of the term since its listed on the stock exchange. example – if an investment of 50,000 is done

Sir,recently there has been some controversy regarding Sriram company.

Its shares have fallen… something about the security given for debentures.

With this development..how safe is it to retain these Ncds alloted to us.

Can we continue to stay invested in them?

Hi Shiv

Recently there has been some controversy regarding STFC involving security given for debentures and henceforth STFC shares have nosedived.

With the recent development. how safe is it to retain these Ncds alloted to us.

Can we continue to stay invested in them?

Hi,

I had applied through ICICI direct on June 28, but have not received any intimation on allotment. Has allotment been done ?

Hi Shiv,

I applied for Shriram Transport Finance NCD in June-end and the amount was deducted from my bank immediately. However, I don’t see the allotment yet. Do you know whether they have started the allotment process yet?

Whether the current issue is closed already ? I want to apply for the same.

shriram ka ncd kab listing hoga?

And koi muje J m and dhfl ki ncd ka nce bse code de sakta hai?

Allotment date Of Shri Ram NCD?

Hi Sir,

Can I invest in Shriram Transport Finance NCD today or is it closed? How can I come to know whenever such schemes are launched. Thanks!

Any idea of the accurate allotment date of Shriram NCDS & when will they be reflected in our portfolio? No intimation received from Shriram till date.

SK

1. I received a SMS from NSDL on 13Jul/Fri at 11:15pm that the NCDs were alloted to me. So these should have been alloted to you as well around same time.

2. My DP is ICICI direct and I could see these in demat holdings on 16Jul/Monday but not in Portfolio page.

3. I contacted ICICI on 18Jul/Wed and they added these in Portfolio on 19Jul/Thu.

4. No email has yet been sent from STFC.

5. In case these are not showing in your portfolio or demat holdings area, you can check the status with your DP, NSDL or STFC team.

Thanks Bobby for your kind & informative response.

Sir,

once again high thnxs for your expert comments. we seek your valuable & commandable opinion on Edeliweiss NCD coming soon.

Further on Equity side, we request your opinion on :

which is better: fundamental or technical analysis on eq. shares.

MRF Eq: present valuations: fundamentally feasable ?

RELIANCE IND. LTD : Today all time high 1120 ? Petro business is only profit. JIO in competiton mode: should one stay with RIL or exit ?

high thnxs again

VKGupta

Mr. Kukreja, could you kindly dissect the proposed issue of Edelweiss NCD issue & oblige. Will appreciate your early analysis please.

Thank you, as always for your valuable help in our investment decisions.

Monthly interest when counting after issuing ncd

Hi Shiv,

Now that these NCDs have been allotted more than 2 months back, has they been listed and are being traded actively. Please also indicate it’s price band and if these are available on discount.

Thanks and regards,

S C Poddar

Dear Sir, Thanks for details. In one place you mentioned that holding these NCDs in Demat form is mandatory but in other place you mentioned that TDS @ 10% will be done if NCDs held in physical form? Kindly suggest.