This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Indian Railway Finance Corporation Limited (IRFC) will be the next company to launch its tax-free bonds this financial year from January 21st. The company plans to raise Rs. 1,000 crores from this issue with an option to retain oversubscription up to Rs. 8,886.40 crores.

This will be the second such issue by IRFC as the company issued tax-free bonds last year also. The issue will close on January 29th, coincidently on the same day on which the RBI is scheduled to announce its monetary policy.

Investors who want to invest in these tax-free bonds for their higher effective yields, I think this is the last such opportunity this financial year. I am saying this because IRFC was among those few companies which filed their final prospectus in December when the yield on the 10-year government securities was higher at around 8.15-8.20%. It has fallen by 35-40 basis points (or 0.35-0.40%) since then.

As the interest rates offered by these companies are linked to the benchmark government securities, the upcoming tax-free bond issues are going to offer lower rate of interest and hence, will be very unattractive.

As most of these tax-free bonds are quite similar in their regular features, here are some of the unique features of this issue:

Interest Rate

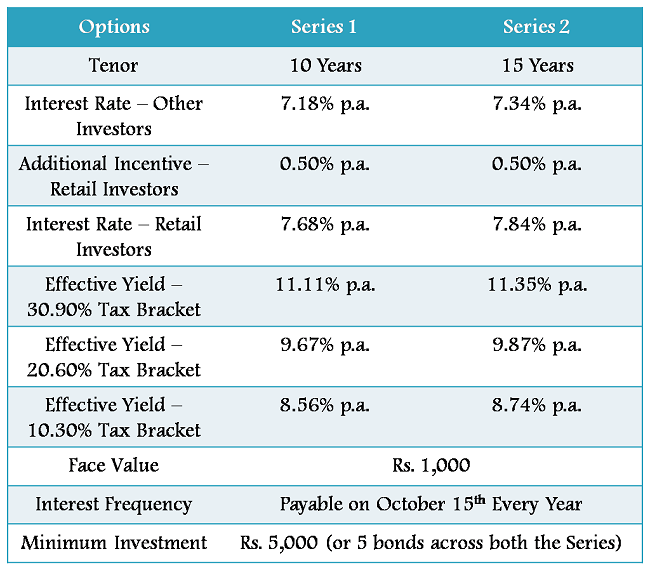

IRFC is offering 7.84% per annum for its 15-year option and 7.68% per annum for the 10-year option to the retail investors investing up to Rs. 10 lakhs. Again, the additional incentive of 0.50% will be payable to the original allottees only who invest in these bonds during this offer period. In case these bonds are sold or transferred by the original allottees, except in case of transfer of bonds to legal heir in the event of death of the original allottee, the coupon rates will be revised downwards to the base coupon rates.

As with all of these issues, the interest rate for the other categories of investors, like QIBs, corporates and HNIs, will be 0.50% lower than the above rates offered to the retail investors. For 15 years, it will be 7.34% per annum and for 10 years, it will be 7.18% per annum.

NRI Investment: Like HUDCO tax-free bonds, NRIs can also invest in this issue, but only non-US based NRIs. They can apply for these bonds both on repatriation basis as well as non-repatriation basis. Eligible NRIs can use their NRE/NRO/FCNR/NRNR/NRSR account to invest in this issue but will be required to get a bank certificate made to confirm that the money has been used out of an NRE/NRO/FCNR/NRNR/NRSR account. If the NRI is a Person of Indian Origin (PIO), then it is mandatory to attach the copy of the PIO card.

Other Terms of the Issue

The issue is secured in nature and has been rated ‘AAA’ by CRISIL, ICRA and CARE. The bonds will get listed within 12 working days post closure of the issue on both the national exchanges, National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Like its first issue last year, IRFC has fixed October 15th as the interest payment date for this issue as well. The investors have the option to apply for these bonds either in the demat form or physical form and thus, demat account is not mandatory to apply for these bonds.

40% of the issue is reserved for the retail investors, another 20% of the issue is reserved for the high net worth individuals (HNIs) i.e. for the individual investors investing above Rs. 10 lakhs. 20% of the issue is reserved for the institutional investors and the remaining 20% is for the corporate investors.

The minimum amount of application is Rs 5,000 with face value of Rs 1,000 per bond. The allotment will be made on first-come-first-serve basis.

About IRFC

Indian Railway Finance Corporation Limited (IRFC) is a wholly-owned public sector undertaking (PSU) and works as a financial arm of Indian Railways. It is also registered with the RBI as Infrastructure Finance Company-NBFC (IFC-NBFC). IRFC has strong asset quality zero gross and net non-performing assets (NPAs) as on March 31, 2012.

The proceeds raised from the issue will be utilised by the company towards financing the acquisition of rolling stock that will be leased to the Ministry of Railways and for funding other projects approved by the Ministry of Railways.

As mentioned above, interest rates have fallen by around 0.35-0.40% in the last few days and going by this trend, the upcoming issues of tax-free bonds will offer lower rate of interest. As much anticipated, if the RBI decides to cut interest rate this time on January 29th, the bond yields should fall more from these levels.

So, it is highly recommended now for the investors in the higher tax brackets to use this opportunity to invest their money either in the ongoing HUDCO tax-free bonds which offer the highest interest rates or in this issue which is rated higher at ‘AAA’.

Click here to download the application form