One of the questions that came up a few times in the last term insurance post was how much insurance should you get and Hema wrote a comment with a rule of thumb that states you need about 10 times your annual salary.

That sounds reasonable enough to me and I wouldn’t want to get into an analysis paralysis with determining how much insurance I need because term insurance can be bought without spending a lot of money, but I did want to share the way I thought about it, and see what feedback I can get.

Do I Need Insurance?

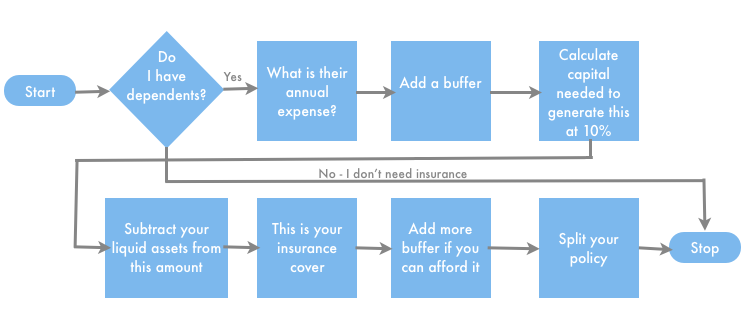

The first thing to do is to determine if you need term insurance at all or not. The answer to that is straightforward – if you have people who are financially dependent on you then you need term insurance, else you don’t.

If your parents are not financially dependent on you, your spouse is working, and you don’t have kids, then I don’t really see a need for insurance.

But, if someone is financially dependent on you then you need to take out insurance.

How Much Insurance Do I Need?

So, once you determine that you need insurance, the next step is to think about how much insurance you need. One way of thinking about that is to think of your dependents and their annual financial needs, then buffer it up by 20% or so.

For example, say you determine that their annual expense will be 5 lacs, so at a 20% buffer you need 6 lacs per annum. To generate 6 lacs per year you need capital of 60 lacs assuming the investment can generate 10%.

Then think about the assets you already own – your savings for retirement, any real estate (apart from the house you live in), jewelery, or whatever you think can be practically cashed in.

Subtract that from the capital amount, and you will get a number that you should have cover for.

I expect that most people will be able to do this calculation mentally and it shouldn’t take more than 5 minutes or so. In my opinion this will be a good ball park in terms of  your term insurance need and can get you started.

This kind of thinking is better than having no framework at all, but the only thing I’d caution you against is that this calculation doesn’t take into account escalating costs.

So, you could say that your family’s expenses will rise significantly once your children start going to school, and this method doesn’t take that into account. Or if inflation continues to be high then this method doesn’t protect your family many years from now as well.

If you feel that’s the case, then get more cover – how much more depends on how much more in premium you’ll be able to afford. No point in talking about cover without thinking about premium – just like risk and return.

One last thing about this is to bring to your notice this insurance calculator I found which allows you to input a lot of parameters and seems quite exhaustive. You can play with it and see if it gives you a reasonable number.

How many insurance policies should I buy?

In my last post I expressed my preference on buying two different insurance policies, as a means to hedge risk and quite a few of you pointed out that it doesn’t make sense because there is no chance of a claim getting rejected if all the information provided upfront is accurate and honest.

I understand this point of view, but would rather stick to two policies because there will always be some things that you don’t know that you don’t know.

There are things that you know you don’t know, and then there are some things that you don’t know you don’t know.

For example – you buy an oil ETF that tracks oil prices by buying future contracts because you are bullish on oil. You know that this ETF will not be able to track oil 100% due to expenses or other tracking errors, so this is a known – unknown, but you don’t know that you don’t know big institutional traders can game the system because they know this ETF has to square off its positions every month end, and that eats your profits big time.

So you are hit by a factor that you didn’t even know existed.

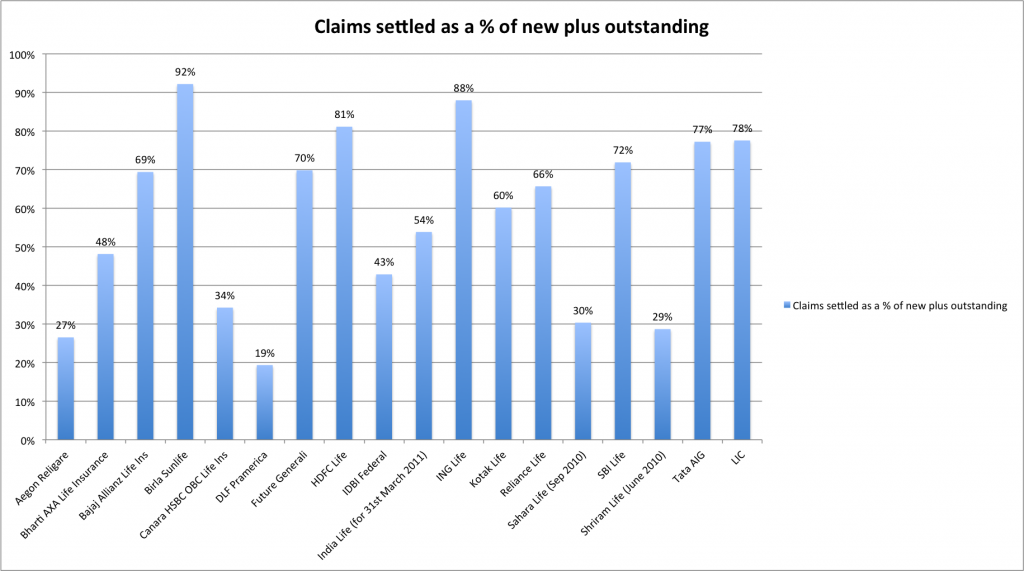

That’s primarily my reason for buying two policies – what if the cheaper company goes bust, who is liable then? What other things don’t I know about this?

Obviously not everyone is so risk – averse (or cynical?), but that’s my rationale for two insurers.

Those were my thoughts on whether you need insurance, how much you need, and how many policies you should buy. Time for your thoughts now.