Value traps are stocks that have been beaten down in price to the point where they start looking like a bargain — only, to remain stagnant for a long period of time. Basically, you get trapped into a stock that looks undervalued.

When Does a Stock Look Like a Bargain?

A stock looks like a bargain when its P/E Ratio, P/B Ratio has fallen considerably below its peers and historical averages. On the other hand, when the dividend yield or sales to market cap ratio rises above its peers and historical averages — this is also an indicator that the stock is cheap. Value traps look like great buys in the first look; especially in bear markets. Investors who are used to see a company trade at 20 or 30 times earnings suddenly see that the stock is trading at just 5 times its future earnings and it looks like a great bargain.

There is no formula for detecting value traps, but, there are some common sense guidelines that can help investors watch out for value traps.

Investor Bias

The most tempting value traps are those stocks which you already own and that have fallen considerably. Something that looked the right price when it was $20, looks like a great bargain, when it comes down to $10 and of course, there is the added incentive of dollar cost averaging.

Losing Market Share

During recessions — the composition of key players in most markets change. The best example of this is the financial sector across the globe. If a company has lost market share in the ongoing recession, has piled up debt, lost its key talent to competitors — then, when the recession ends and the economy eventually turns around — such companies will not be able to grow at the same pace as its competitors and their stock price will be stuck.

Is the Management Willing to Unlock Shareholder Value?

There are some companies that are willing to pay decent dividends, be transparent about their results, issue conservative earnings estimates and generally don’t manage the company from one quarter to another. On the other hand — there are certain managements that are not as investor friendly. When the rebound comes — investors are likely to flock to companies that have investor – friendly practices and are willing to demonstrate them.

Past Performance is Not an Indication of Future Performance

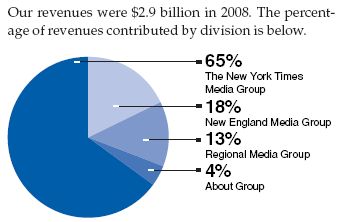

Going by historical numbers is not enough; it is inevitable that the landscape in which companies operate changes. Is the company keeping up with the changing times? A good example of this is the newspaper industry. There are managements that acknowledge that the landscape has changed and they have to innovate accordingly, and there are managements that believe that the landscape has not changed enough to warrant a change in their core strategy. Which management would you prefer?

These were some qualitative measures that point out a value trap. There is no fixed formula to define a value trap, so it is impossible to avoid them all the time, but, understanding changing business models and environments — helps screen out dud stocks from your portfolio.

Photo Credit: Dave_7