This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

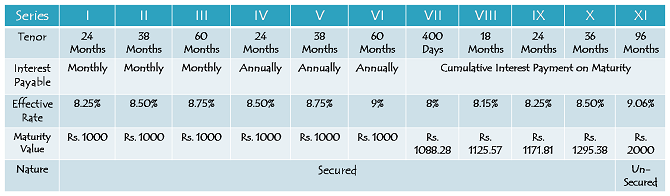

Muthoot Finance is launching its issue of non-convertible debentures (NCDs) of Rs. 2,000 crore from today. Like its January 2017 issue, Muthoot is offering coupon rates of 8% to 9.06% for different maturities ranging between 400 days to 96 months, having both Secured, as well as Unsecured NCDs. Though the issue is scheduled to remain open for a month to close on May 10, going by the response its previous issue received, I don’t think it would take one month for Muthoot to raise this amount.

Here are the salient features of this issue you should consider before taking a decision to invest or not:

Size of the issue – Base size of the issue is Rs. 200 crore and Muthoot will have the option to retain oversubscription to the tune of Rs. 2,000 crore, including the green shoe option of Rs. 1,800 crore. The company plans to raise this Rs. 2,000 crore by issuing Secured NCDs up to Rs. Rs. 1,950 crore and Unsecured NCDs up to Rs. 50 crore.

Minimum Investment – Minimum investment in this issue has been fixed at Rs. 10,000 i.e. 10 NCDs of face value Rs. 1,000 each.

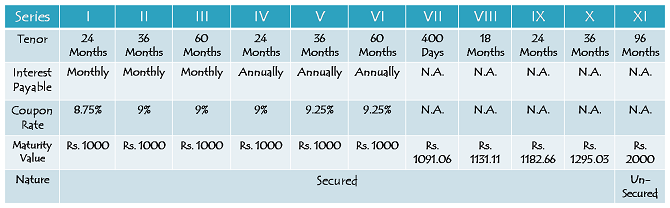

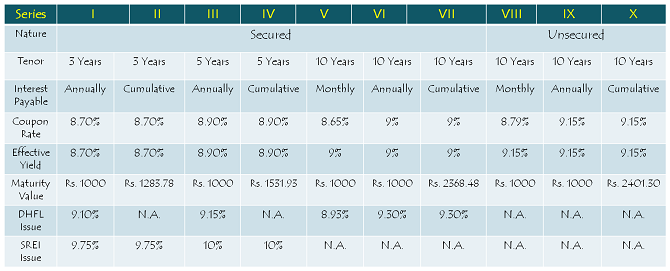

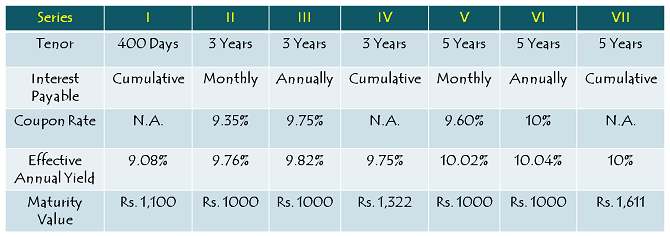

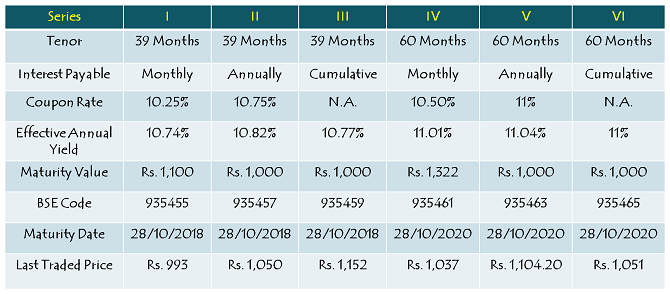

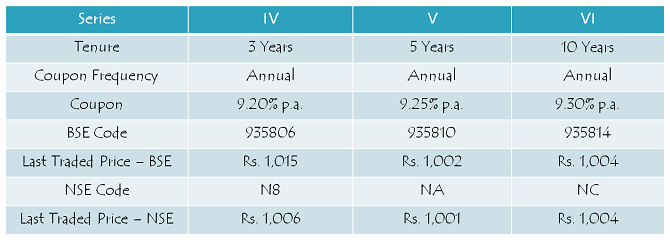

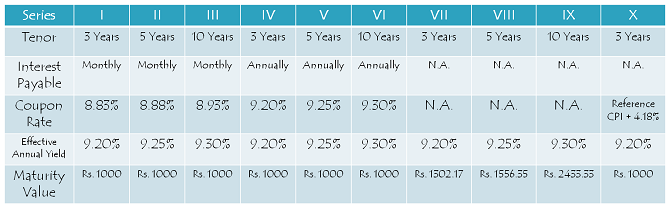

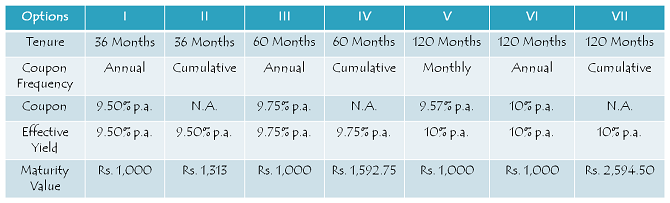

Coupon Rates – Muthoot has again reduced its interest rates as compared to its previous issue in January. These NCDs will carry coupon rates in the range of 8% for 400 days to 9% for 60 months. Series I-X will all be Secured NCDs and Series XI will have Unsecured NCDs. Series XI NCDs will provide you an effective annual return of 9.06% in a period of 96 months.

Double your Money Option – As mentioned above, Series XI NCDs will offer cumulative interest option and will earn you a 100% return on your investment in a period of 8 years or 96 months. It would translate to an effective yield of 9.06% per annum. But, NCDs issued under this option are ‘Unsecured’ in nature, thus carry a slightly higher risk than Secured NCDs.

You can check the rates offered for different maturities and different payment options from the table below:

No Special Rates for Retail Investors – Unlike its previous issues, Muthoot has decided to offer same returns to all categories of investors this time around. I think this move would disappoint the retail investors and might make some of them to not invest in this issue.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage fixed for the allotment:

Category I – Qualified Institutional Buyers (QIBs) – 20% of the issue is reserved i.e. Rs. 400 crore

Category II – Non-Institutional Investors & Corporates – 20% of the issue is reserved i.e. Rs. 400 crore

Category III – High Net Worth Individuals (HNIs) & HUFs investing more than Rs. 10 lakhs – 30% of the issue is reserved i.e. Rs. 600 crore

Category IV – Retail Individual Investors, including HUFs investing up to Rs. 10 lakhs – 30% of the issue is reserved i.e. Rs. 600 crore

Allotment on First-Come First-Served Basis – NCDs will be allotted on a first-come first-served basis in all these four categories.

NRI/QFI Investments – Non-Resident Indians (NRIs), foreign nationals and Qualified Foreign Investors (QFIs) among others are not allowed to invest in this issue.

Ratings & Nature of NCDs – CRISIL and ICRA, the two rating agencies involved in this issue, have assigned ‘AA/Stable’ rating to the issue, indicating the issue to be safe as far as timely payments of interest and principal investments are concerned. All these NCDs are ‘Secured’ in nature, except NCDs issued under option XI which offer to double your money in 96 months.

Demat Account Mandatory – Muthoot has decided to issue these NCDs compulsorily in demat form. So, if you don’t have a demat account, you won’t be able to apply for these NCDs.

Taxability & TDS – Interest earned on these NCDs will be taxable as per the tax slab of the investor. However, as these NCDs will be allotted compulsorily in your demat accounts, no TDS will be deducted from your interest income.

Listing on BSE – Muthoot has decided to get its NCDs listed only on the Bombay Stock Exchange (BSE). Allotment as well as listing of these NCDs will happen within 12 working days from the closing date of the issue.

Should you invest in Muthoot Finance NCDs?

At present, there is huge liquidity floating around in the system. Investors are sitting with huge investible surplus in their bank accounts and waiting for the stock markets to correct before deploying their cash. Also, with inflation at multi year lows and no signs of interest rates moving up considerably from here, investors have very few bankable fixed income options either.

To cash it in such an investment scenario, Muthoot has been lowering its interest rates for a long time now. In this issue as well, Muthoot has lowered its interest rates for the retail investors and now it is not offering any preferential rates for the retail investors as compared to other categories of investors. So, as mentioned earlier as well, these interest rates by a private gold finance company do not attract me at all. If I need to invest my money with Muthoot, I would seek a higher return as compared to the rates it is offering in this issue of NCDs. Only aggressive investors should invest their money in this issue to get a slightly better return as compared to bank fixed deposits or post office schemes. Other investors should skip this issue and wait for some better opportunities.

Application Forms – Muthoot Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in Muthoot NCDs, you can contact us at +919811797407