This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

ICICI Lombard General Insurance IPO Details

Anchor Investment

ICICI Lombard has sold 24,580,447 shares to the anchor investors @ Rs. 661 a share, which makes their investment to be Rs. 1,625 crore as the issue gets opened for subscription today. These anchor investors include Nomura India Stock Mother Fund, Amansa Holdings Private Limited, Franklin Templeton Investment Funds, DSP Blackrock, Abu Dhabi Investment Authority, Birla Sun Life Trustee Company, SBI Mutual Fund, Kotak Mutual Fund, L&T Mutual Fund and Reliance Top 200 Fund, among others.

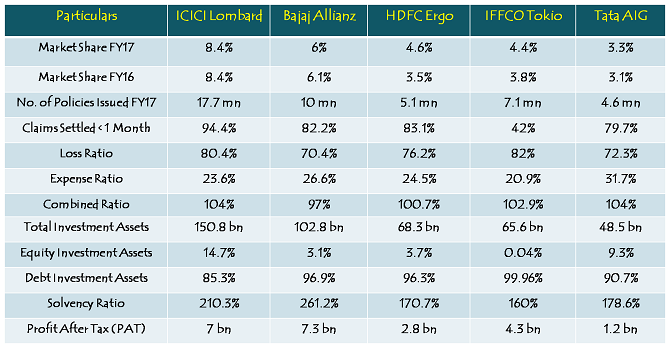

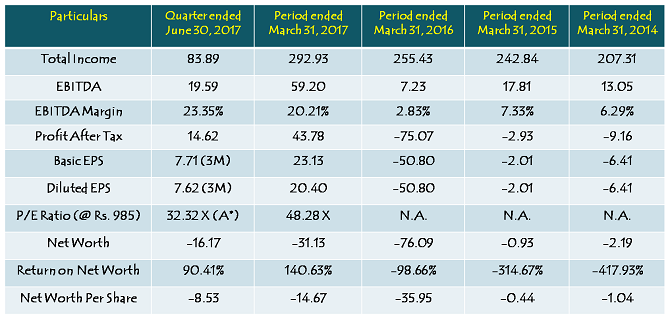

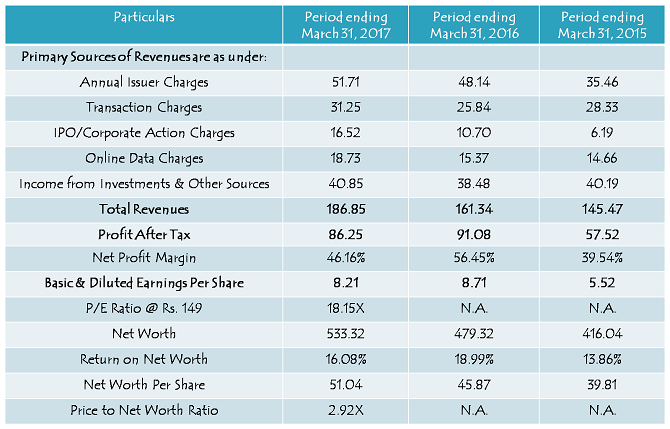

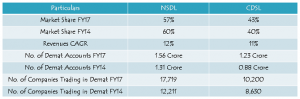

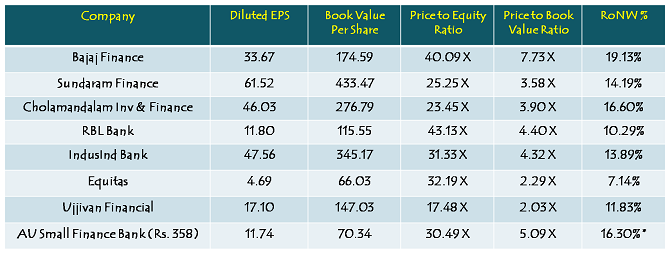

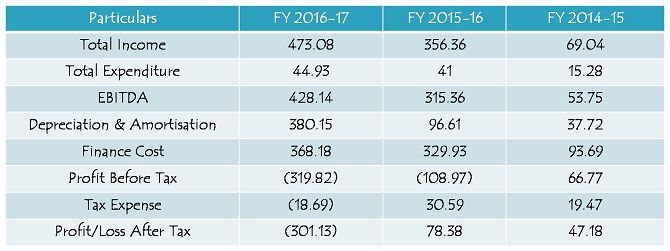

Peer Comparison

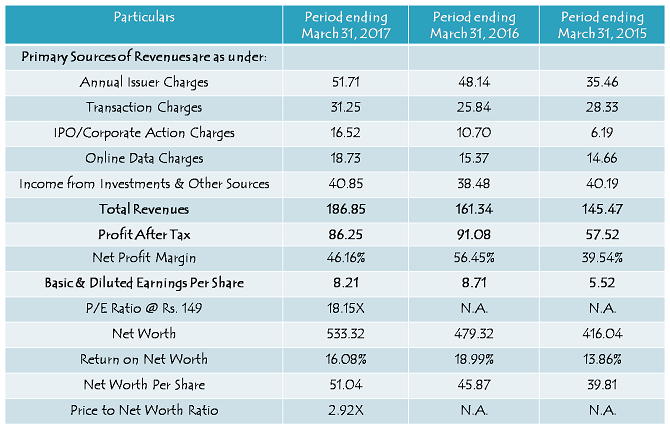

(Note: Figures are in Rs. Crore, except per share data, figures in millions/billions & percentage figures)

ICICI Lombard is the largest private sector non-life insurance company in India with a market share of 18% among private insurers, and 8.4% market share across all non-life insurance companies. The company issued around 1.77 crore policies in FY17 amounting to Rs. 10,725 crore in Gross Direct Premium Income (GDPI). During FY17, it settled 94.4% of its claims within 1 month of their filing, which is the fastest among all non-life insurance companies.

The company has around Rs. 150.8 billion in investment assets, out of which 14.7% is equity investments, both of which are highest among all of the non-life private insurance companies. As the “Combined Ratio” of ICICI Lombard is more than 100%, the company earns its profits by making these equity and debt investments. In a falling interest rate environment and bullish stock markets scenario, it is working well in favour of the company.

Loss Ratio – Loss ratio is the ratio of the claims incurred, net to the Net Earned Premium (NEP).

Net Expense Ratio – Net expense ratio is the ratio of the sum of operating expenses related to insurance business and commission paid (net) to the NWP. The net expense ratio is a measure of an insurance company’s operational efficiency.

Combined Ratio – Combined ratio is the sum of loss ratio and net expense ratio. The combined ratio is a measure of the profitability of an insurance company’s underwriting business. A ratio below 100% usually indicates that the insurance company generates a margin in its insurance operations, while a ratio above 100% usually indicates that insurance company is paying out more money in claims and operating expenses than it is receiving from premiums.

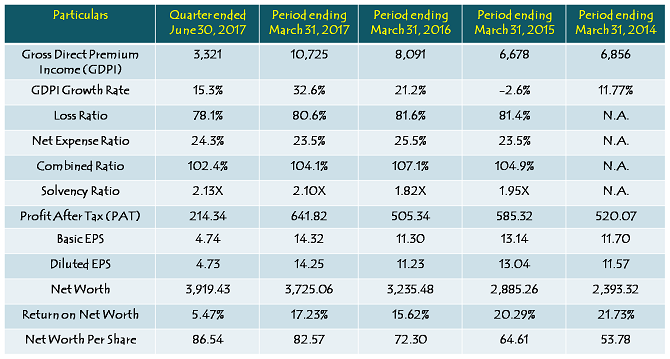

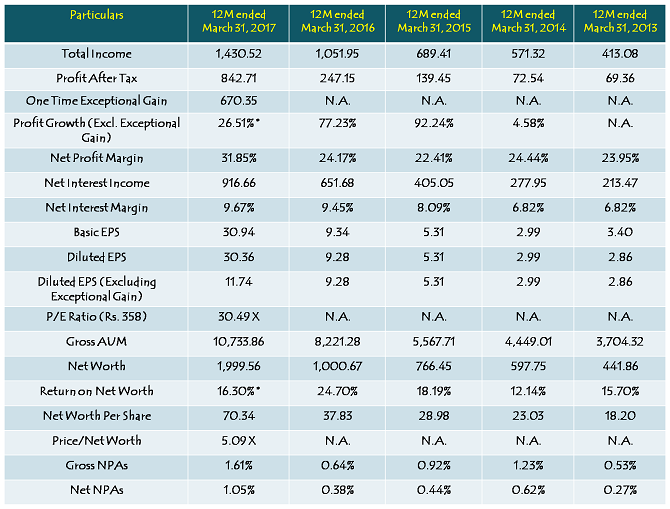

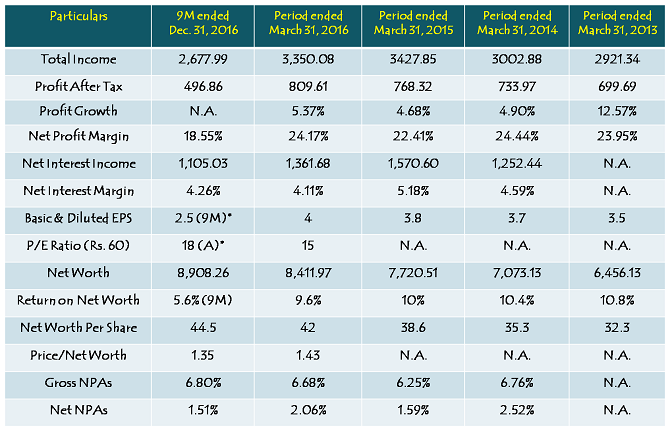

Financials of ICICI Lombard General Insurance Company Limited

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

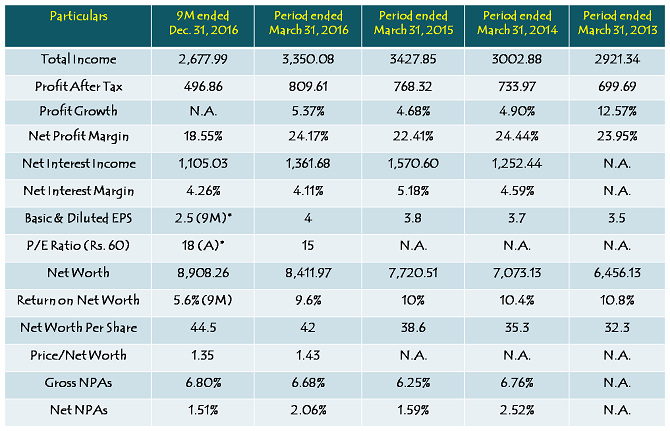

ICICI Lombard reported Rs. 641.82 in profits, Rs. 14.25 a share as diluted EPS and Rs. 82.57 as book value per share during the previous financial year i.e. FY 2016-17. At Rs. 661 being the likely issue price, the company is valued at 46.38 times its 12-month trailing EPS and 8 times its book value as on March 31, 2017. I think these are stretched valuations by any standards and makes me extremely uncomfortable to put my money in this IPO.

What disturbs me more than anything else is the steep premium the company is seeking in this IPO as compared to the transaction carried out in May 2017 with the selling shareholder being the same. Fairfax sold its 12.18% stake in ICICI Lombard in May 2017 for Rs. 2,473 crore, which valued it at Rs. 450 a share. Now, in less than 4 months’ time, what fundamental changes have been carried out in the company to seek a 47% premium from the common investors?

I think it is highly unreasonable to seek such a steep premium in such a short period of time and probably the biggest reason for me to avoid this unreasonably expensive issue. Exuberance might help ICICI Lombard to have some listing gains, but then there is no way this investment could be a multibagger for its investors. I would advise my clients to avoid this issue at these valuations.

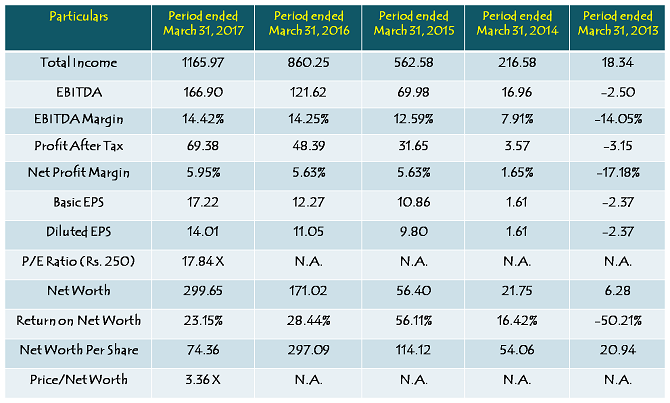

Note: Figures are in Rs. Crore, except per share data & percentage figures

Note: Figures are in Rs. Crore, except per share data & percentage figures