Direct Tax Code (DTC) is supposed to be implemented from the next financial year, but there hasn’t been much news on it lately, and people are beginning to doubt if it will be implemented next year or be delayed even more.

I don’t think it’s a bad thing if it does get delayed because the main premise behind the DTC was that it will simplify the current tax code, and while the first draft was superb, the subsequent revisions have made it somewhat complex.

I think this is best epitomized by the way capital gains on shares is calculated where they will reduce the value by a specified percentage first and then add that to your income. Who comes up with these percentages and why tax people on capital gains on shares now when you haven’t done it earlier?

The first draft of the DTC had tax slabs much higher from the current ones, but the revisions made the slabs come down as well, so even that benefit doesn’t exist to the same extent as earlier.

I have written a few posts about changes related to DTC but they are not very easy to find and when Sowmya left a comment about a primer on DTC – I thought it will be a good idea to have a post that links to the various other posts that I have written on DTC and gives a summary of the changes.

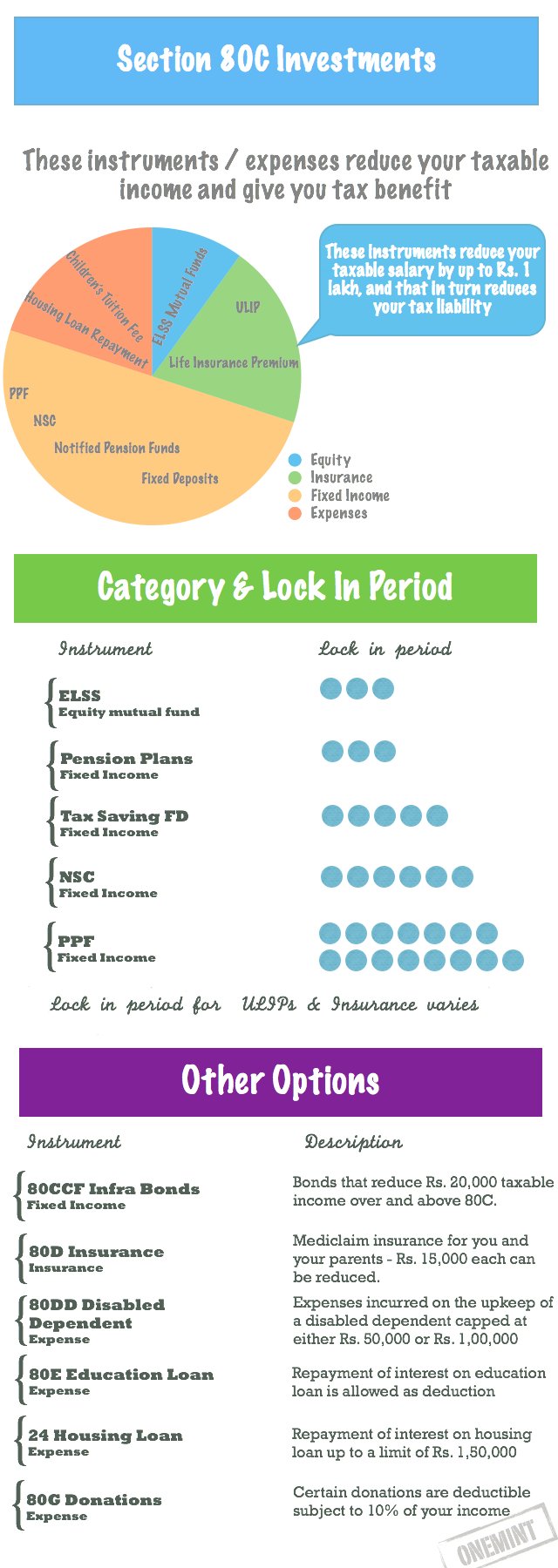

The following table lists down the various changes that will come with the DTC.

| S.No. | Head | Details |

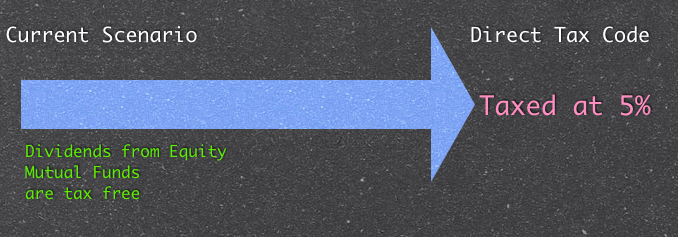

| 1 | ELSS Mutual Funds | These mutual funds that were covered under Section 80C and gave tax relief will no longer reduce your taxable income. The lock in period in the funds will probably be removed, and in some cases the fund sponsor may even merge them with other bigger funds. |

| 2 | Double Indexation Benefit on FMPs | Holding period will be calculated from the end of the financial year instead of the date when you buy the units so that means double indexation benefit on FMPs will no longer exist. |

| 3 | Long term Capital Gains on Shares | Presently, there is no long-term capital gain on shares but in the future capital gains will be charged using a fairly involved formula. |

| 4 | Short term capital gains on shares | Presently, it is 15% of the gain, but in the future it will be taxed on the slab of the investor. |

| 5 | Wealth Tax | Wealth Tax will be charged if wealth is assessed at more than 50 crores. |

You can click through the links in the above table to read more details about each of these topics, and as more clarity comes in about DTC and other topics get added – I will link them through this table as well.