What is the difference between mutual funds and ETFs

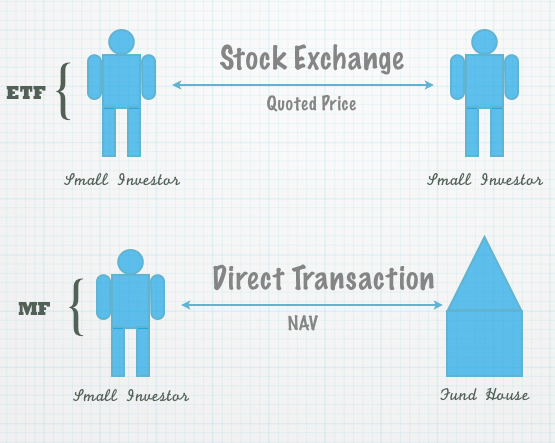

The first difference between an ETF and a mutual fund is that when you buy an ETF you buy it from someone else in the market, and not the ETF trust – however, when you buy a mutual fund you buy it directly from the fund house. In this respect an ETF is like a share that trades on the stock exchange.

The following picture should make this clear.

When you buy a Reliance share from the stock market – Reliance Industries doesn’t get the money, and much in the same way when you buy an ETF from the share market – the ETF trust doesn’t get the money.

These units are being bought and sold between people in the secondary market and that’s different from mutual fund units. When you buy a mutual fund – the fund gets your money, and issues you units based on the NAV on that day.

Now, the question is if you are buying and selling the ETF units from other small investors like you then where are the units coming from in the first place?

These units are being sold to you by what’s known as Authorized Participants who are large dealers / brokers / jewelers or other institutional players.

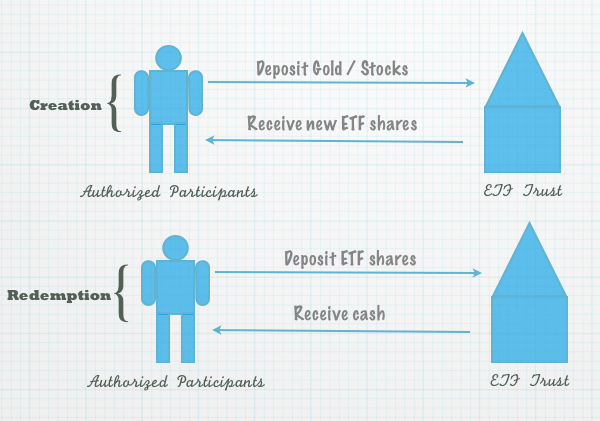

The Authorized Participants have the ability to buy and sell units directly from the ETF sponsor, and this process is called “Creation” and “Redemption”, and the units that are created like this are called “Creation Units”.

These creation units are very large in size, for example for a gold ETF liked Goldbees – the creation unit is one kilogram of gold, so the Authorized Participants needs to deposit one kilogram of gold with the ETF sponsor, and then the ETF sponsor creates new shares of their ETF and issues them to the Authorized Participant.

The Authorized Participant can then take those shares and sell a thousand of them in the stock exchange to thousand different small investors and thereafter these thousand investors can trade these units among themselves on the stock exchange.

Similarly, the Authorized Participant can take their ETF shares and redeem them with the ETF sponsor in exchange for cash.

This process is shown in the picture below.

To create new ETF shares, the authorized participant needs to deposit stocks or gold to the ETF trust and in exchange the ETF trust creates new shares and issues it to them. They in turn sell these shares on the stock exchange to the general public.

In that context, it’s important to keep in mind that when you go to buy a gold ETF or Nifty in the stock market – that has no effect on the gold holding or Nifty stock holding of the ETF trust. That’s only affected by the issue and redemption process of authorized participants.

This process also helps keep the NAV close to the traded value of the ETF because the authorized participants can arbitrage and make money whenever there is a difference between the two.

This is the fundamental difference between the structure of ETFs and mutual funds, and if you figure this out then the rest of the stuff is fairly easy. Here is a table that highlights some of the other differences / similarities between the two.

| Feature | Mutual Fund | ETF |

| Traded on a stock exchange | MFs are not traded on stock exchanges and you have to buy them directly from the fund house. | ETFs are traded on stock exchanges and you can buy and sell them on the exchange. |

| NAV or Quoted Price | MFs can only be bought and sold at their NAV | ETFs have NAVs and all ETFs show their real time NAVs on their websites. However, since they are listed, you can buy them on the quoted price. |

| Trading account needed | You don’t need a share trading account to buy a mutual fund. | Since ETFs trade on the market, you need a trading account to transact in them. |

| Expense Ratio | Expense ratios on mutual funds are generally higher, especially because a lot of them are actively managed. | Expense ratios of ETFs tend to be lower since they are passive in nature. |

| Brokerage | Since you buy mutual funds directly from the fund house you don’t have to pay any brokerage on it. | You will have to pay the brokerage on ETF transactions since |

At the end of the day, both ETFs and mutual funds are investment vehicles that let you take a position on an asset class without exposing yourself to too much of one company’s shares or bonds. There are differences but the goals of both the products are the same.

This post is from the Suggest a Topic page.Â

The myth is that you should invest your money in the mutual funds. But have you ever wondered where do the mutual fund’s managers invest your money. They invest your money in the stock market. Whenever the stock market goes down, the mutual funds also loose their value because they are directly related to stock market.

The mutual funds invest your money in stocks and give you only 20% profit and only if the stock market goes up but if the stock market goes down you loose money but the mutual fund managers still get their commissions. You should choose mutual funds carefully before investing your money in them.

There are two types of mutual funds, First type is active mutual funds where the manager buy and sell stocks almost every month, Second type is index funds where the manager invest money in a set of stocks, (let’s say sensex index) he does not sell any stocks, he just keeps buying more shares of the same bunch of stocks. Index mutual funds give much better return than active mutual funds because they have less expenses due to less transactions of buy and sell orders.

I personally invest my money in ETFs where manager does not buy or sell stocks.

This comment makes absolutely no sense I’m afraid. There is no myth about investing in mutual funds – you do that so you can hold a number of stocks and move away from stock specific risk. Of course the equity mutual fund will go down if the stock market goes down because that’s what they are invested in! The same will happen to an equity ETF also.

And I don’t know where the 20% number is coming from but that makes no sense either.

It is not true that index funds don’t sell any stocks ever – if people want to redeem their mutual fund units – the fund manager will have to sell units to raise money. Also, there are a number of active mutual funds that have outperformed the Sensex in the last five years.

Lastly, if the manager doesn’t buy or sell stocks in the ETF – what is he doing?

I’m sorry to be a bit harsh in my response, but there are other people who read these comments and get swayed by them so I felt important to point these things out.

readtoawake – It is true that any stock portfolio and MF folio will fall with the market, no surprises there. Direct stock investing is not everyone’s cup of tea. It needs a lot of focus and that is why Mutual Funds exist. For one, MFs invest in a lot of stocks thus diversyfying the risk away.

I agree it is a HISTORICAL FACT that Mutual Fund as an entire industry consisting of several hundred schemes have underperformed the market as a whole over any period of time. But.. But .. there are definitely a handful of funds that have beat the market in any 9 out of 10 years and thus have beat the market by a large margin. Thus when market falls 20% and the MF falls 15% it is indeed a higher performance.

I bet that 95 out of 100 individual stock portfolios underperform the market because individuals day trade and regardless of what we say they will not give up and underperform forever. The other 5% are the exceptions. Direct stock investing is only suitable for such minuscule number. Given the prevalent individual indiscipline (cutting across country barriers) MF investment is the ideal vehicle for a significant number of population.

I personally have a investment return of 20.46% CAGR over the last 10 years trading and holding stocks. But I am increasingly pumping my money in MF investments over the last 1 year because there are a few funds who have provided way over 20% over a period of 10 to 15 years. While I am actively monitoring my stock and MF portfolios – more so my stock portfolio , and trying to pick out value picks to beat the marker big time – I would recommend MF for almost all the population.

Recently I read two books that specify that 90% of the active mutual fund managers are not able to beat the market.

First book is written by John C. Bogle who is the founder of The Vanguard Group, the biggest mutual fund company in the world. John Bogle founded the first index mutual fund in 1975 that tracks the performance of 500 biggest companies of America. John Bogle has devoted his life creating a system that helps investors receive a greater return on their investments.

Only Index funds like Vanguard where mutual funds managers do not sell any stocks are able to get the market returns. Active Mutual funds are not good due to a lot of expenses.

You can look at google for similar graphs. Just search for the performance of active mutual funds Vs Index-based mutual funds and you will see the difference in returns.

Look at this graph…

http://www.investitwisely.com/wordpress/wp-content/uploads/2010/08/fund-returns-over-the-years.png

For more information read this book review:-

http://www.readtoawake.com/the-bogleheads-guide-to-investing/

http://www.readtoawake.com/25-myth-you-have-got-to-avoid-if-you-want-to-manage-your-money-right/

Hello Manshu,

I just found this another graph. Look at it:-

http://www.portfoliosolutions.com/assets/htmlimages/graph4.jpg

If you don’t want to publish these comments. It’s completely OK for me.

Okay, now this is much better. Your first comment attacked mutual funds and then supported passive mutual funds which are in fact a sub – set of mutual funds, which doesn’t make sense. If the stock market goes down even passive funds will go down, there is no escaping from that.

But now I think you’re saying that active mutual funds are bad, but passive funds are not. If that’s what you’re saying then I can appreciate that in a US context, because all the research that you have pointed out is in the US context.

If you see the Indian environment, you will find many active funds that have beaten the index for as long a time period as ten years.

Now, this doesn’t mean that they will do that in the next 10 years, but I would rather invest money in funds that have outperformed the market for such long time periods than not.

Also, since you have links in your comments they went into moderation because that’s one of the most common ways of identifying spam. That’s all. I have never disabled any comment for disagreeing with me as will be evident from the numerous comments that do disagree with me here.

Person caught in bad funds will say passive funds are better and vice versa ,isn’t it?

That’s gross over simplification.

MF as a industry underperforming the index IS A FACT as long as MFs have existed! However if some active funds are able to return consistently for 10-15 years then it is not happening by chance.

For someone to beat the index there is a much simpler formula (no guarantee it will work). Just buy index funds for 80% of your portfolio and take the remaining 20% to buy carefully selected, fundamentally strong, not-so-high-beta stocks. It is likely you will come out beating the index over a period of 3-5 years or more.

In the Indian context the fund management costs are capped at 2.25% no matter what. Also with increase in AUM (Assets under management) the expense ration dip to about 1.8-2.%. An Index fund has expense ratio of ~0.5%. Thus to start off Index funds have a 1.5% lead. A handful of funds have beat the market by 5%-6% over long periods so the initial advantage of index funds is nullified. Bear in mind I am a big big fan of Index funds. India is in a growth trajectory now so for the next 1 to 2 decades or so one can expect stellar returns in actively managed funds. When we mature into a developed economy all the problems surrounding large companies and large economies will afflict us. We will be so large that increase in valuation consisitently will be very difficiult. At that point even lesser number of funds will beat the market. AT that point being fully invested in Index funds alone will make sense for a good number of the general population (like is happening in the US after the stellar growth in economy and stock market in the 80s and 90s). Until then lets join the actively managed fund’ party!

For someone to say that most mutual funds lag the market and then say but you can invest 20% of your money yourself and be better than most mutual funds is a weird contradiction.

This is neither simple, nor will it hold true for a majority of investors who will end up trailing the index like the active mutual funds and lowering their returns.

I fail to see what relationship is there with a growing economy and mutual funds beating the index.

I think I combined too many thoughts here in a haphazard way. Let me clarify myself!

1) Mutual funds as an entire industry has indeed underperformed the index. But few funds have beat the index consistently (across the world). Both are facts.

2) Active churning + expenses leads a MF to underperform the market. Theoretically speaking it is very easy to beat the market just by buying index funds for a significant part of the portfolio and just giving a direct equity kicker for some 20% (you may under perform as well, but a small basket of sound securities is enough to outperform over 3-5 years). The index part will give market return and the last 20% will put you above the market (transaction costs are there, still). A MF manager has a lot of constraints. They have to maintain equity levels in a MF. But as an individual when market crashes if I get out of equity and move the 20% to debt even then I MAY beat the market (problem is I wont know when to enter the market back, as with almost all of the retail folks). What I am saying is one can beat the market themselves not necessary to go for a MF even – using the above approach. It is easier said than done, thats another story altogether. [I am giving an theory here. I still recommend everyone to go for MFs]

3) “When the tide goes down you know who is swimming naked”- to borrow Buffett’s words. In a bull market everyone can get good returns, some of them out of fluke. When the market slows down – due to a slowing of economic growth – and there is no decisive direction in the market more and more MFs churn and underperform. At that point the % of MFs underperforming the index will increase than it is today. In the US the good part from 1950 – 2000 was a period of significnat growth. Van Guard funds were less in vogue because they just bought the market. Boring, insipid story. Some other Active funds beat the market. Over the last 2 decades Van Guard funds are synonymous with good returns. The % of active MF beating the market is way lower of late than in the last century (I will get the link). Japan’s index, for example, has never gone back to the 1989 levels -for 22 years. True, a handful of funds may have beat the market but staying in the index fund would have bettered the returns of very many MFs – over any long periof of time.

1. Yes.

2. Theoretical, yes quite.

3. If I see any research that shows that there were more active funds outperforming the index in emerging economies than developed ones then I would leave a link here, but other than that I don’t see how this thing can be proved.

http://seekingalpha.com/article/84916-percentage-of-active-fund-managers-that-can-beat-the-market-shrinking-rapidly

I saw more such links and will share when I find them. The theory is that as economies become ‘developed’ the scope for higher Alpha reduces significantly so fund managers have to contend with several wrong decisions thereby lagging the market. Indian markets will reach the same spot after several years.

I appreciate the link and the research but I’m still having a hard time jumping to the conclusion that as economies develop – the scope for alpha reduces significantly. They did find that about 10% managers qualified when they look at pre – expense returns and they didn’t include hedge funds where a lot of those alpha generating managers might be.

Here is the link to the whole research document if you’re interested. http://69.175.2.130/~finman/Barcelona/Papers/fdr.pdf

Thanks for sharing the link to the report.

Hello friends,

I do not want to make any controversy, In my first comment, I wrote that the mutual funds invest your money in stocks and give you only 20% profit and only if the stock market goes up but if the stock market goes down you loose money but the mutual fund managers still get their commissions. You should choose mutual funds carefully before investing your money in them.

I said what I have learnt from investing Books. My favorite author is Robert Kiyosaki.

Robert Kiyosaki, author of Rich Dad Poor Dad – the international runaway bestseller that has held a top spot on the New York Times bestsellers list for over six years – is an investor, entrepreneur and educator whose perspectives on money and investing fly in the face of conventional wisdom. He has, virtually single-handedly, challenged and changed the way tens of millions, around the world, think about money.

Here is an interesting YOU TUBE video that will open your eyes about MUTUAL FUNDS.

Check it out!!

http://www.youtube.com/watch?v=pxTfhqML0Q8

Let me know What do you think about it?

If one YouTube video could open my eyes about *anything* I probably didn’t know very much about that thing in the first place and wasn’t curious enough to research more about that thing to read and learn more and develop a holistic understanding.

Wow! That sounded like a doomsday theory!

I will try to take this point by point:

1 – World has moved to defined contribution and not defined benefit.

TRUE. In India only Govt service comes with fixed pension amounts. For private sector employees it is just the EPF that is contributed to one’s retirement in India. Banks and public sector giving VRS is to stop payments from going out in future with a single lump sum now.

2-You get only 20% of the ‘profits’. Well this is applicable in the US context. If the return of a MF is 10%, some 5-6% is consumed in expenses. The remaining is taxed at short term or long term gain – say – average of 20%. So out of 10% you lose 20% in taxes making net return = 8%. Again 6% of AUM is expense leaving you with 8% – 6% = 2% out of initial 20% return making this 20%. I feel the expenses are extrapolated. That is how Robert arrived at this number. In India, at least for now, there are no long term gain taxes + expenses are to be capped at 2.25%. So a 10% return in Indian context will let us retain 7.75% of the returns ~78% of the profits.

3-You withdraw money from 401(k) it is taxed at the current income rate. The retirement plan is intended for a purpose. Premature withdrawal is taxed. Compare that with ULIPs of today. High expenses for running, high expenses for exiting etc.. Solution: Avoid ULIPs!

4- Talk about Enron, Worldcom and UAL. How did they conveniently forget Microsoft, Dell, Walmart, IBM, Cisco, Amazon, Ebay, Google and Apple – firms that have multiplied shareholder value several hundred times more than the wealth destroyed by these bankruptcies. In the US the pension fund is run by a 3rd party, nowadays. Since Enron ran Enron pension plan they bought all Enron stock in their portfolio. If Enron had entrusted this pension fund managemen to a third party, lets assume Vanguard, then the Enron bankruptcy would only have left 1000s with no job. But in reality it also killed their retirement savings. Just because of a handful of such funds we cannot blame the entire MF industry with 1000s of schemes floating.

5-They discussed about insurance on house and car. That comparison was incorrect. Well is there any insurance to prevent the value of the house from falling? NO way. Can you prevent the value of car falling. Absolutely not. Stocks/MF are the same. The discussion touched few sensitive points and portrayed investing in the market is evil! Not true.

Real estate will not give the liquidity one needs in an emergency. Stocks, even if sold at a loss, will provide liquidity. Real estate, must be a part of everyone’sportfolio, no doubts there. Much of the discussion, although, US focussed will eventually apply to India when DTC starts taxing MF returns. But since ours is a controlled economy the expenses wont shoot up so the returns from MF, as long as India growth story is intact, are reasonably reliable.

1.Who are the ETF sponsorers in India? How do they profit from the trading of ETF’s?

2. From where “Authorised Participants” buy the gold ?

3. Where is the gold stored by ETF sponsor, given by “Authorised Participants” in exchange of units

Companies like Goldman Sachs, IIFL, SBI MF etc are all ETF sponsors – basically anyone that has an ETF. They don’t profit from trading per se but they benefit when new shares are issued and the assets under their management increase because they charge a fee on that.

It is my understanding that the APs in the gold market are all big jewelers or institutional players that import gold.

Thank you for this valuable post….I am new in this field and this is very helpful to me …..thank you so much

nice article

Very informative

Sir,

Regarding Niftybees (benchmark is Nifty index), my doubt is : Suppose Nifty index is going up, at the same Goldman Sach has some problem, will value of Niftybees go down, though it follows Nifty index.