Inox Wind Limited IPO Review – Subscribe or Not?

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

After a poor response to the Initial Public Offers (IPOs) of Ortel Communications and Adlabs Entertainment, Inox Wind Limited is knocking your doors to raise money for its expansion plans. The company is in the business of manufacturing wind turbine generators (WTGs) and plans to raise approximately Rs. 700 crore in this Initial Public Offer (IPO). The issue got opened yesterday, March 18th and will get closed tomorrow, March 20th.

About Inox Wind Limited & its Business

Inox Wind Limited is a company promoted by Gujarat Fluorochemicals Limited (GFL) and incorporated on April 9, 2009. Inox Wind is one of India’s leading providers of integrated wind energy solutions. The company manufactures WTGs and its major components, provides turnkey solutions by supplying WTGs and offering services including wind resource assessment, site acquisition, infrastructure development, erection and commissioning and also long term operations and maintenance of wind power projects.

Inox Wind has an order book for WTGs with aggregate capacity of 1,258 MW, comprising orders for supply and erection of WTGs with aggregate capacity of 694 MW and orders for only the supply of WTGs with aggregate capacity of 564 MW.

Inox has an exclusive license from AMSC Austria GmbH (AMSC), a NASDAQ listed leading wind energy technology company, to manufacture 2 MW WTGs in India and a non-exclusive license to manufacture the same outside India, based on AMSC’s proprietary technology.

Currently, the company has a combined manufacturing capacity of 800 Mw at two of its manufacturing facilities — Una in Himachal Pradesh and Ahmedabad in Gujarat. The company plans to double its capacity by the end of FY 2016. The company is also progressing very well at its Madhya Pradesh plant.

GFL currently holds 75% stake in Inox Wind and will continue to own a substantial stake in the company after the completion of this issue.

What’s on Offer?

Inox Wind has fixed its price band to be between Rs. 315-325 per share and is offering Rs. 15 per share discount to the retail investors and its eligible employees. The issue is a mix of fresh issue of 1.32 crore shares and offer for sale of 1 crore shares by its promoter, Gujarat Fluorochemicals Limited (GFL). Inox Wind will not receive any proceeds from the share sale by GFL.

The company will be issuing a total of approximately 2.32 crore shares to the investors as the offer gets fully subscribed. 35% of the issue size is reserved for the retail individual investors. At Rs. 325 per share, the company is expected to raise approximately Rs. 700 crore in the offer and GFL is expected to garner approximately Rs. 325 crore.

Approximately 94.25 lakh shares have been issued to the Anchor Investors, namely Sundaram Mutual Fund, IDFC Fund, FIL Investments (Mauritius), SBI Infrastructure Fund, Grandeur Peak Global Reach Fund, Blackrock India Equities Fund (Mauritius), Reliance Capital Trustee Company, Morgan Stanley Investment Management, Tata AIA Life Insurance Company, Birla Sun Life Insurance Company, Kotak Fund, Goldman Sachs India Fund, Swiss Finance Corporation (Mauritius) and Indus India Fund (Mauritius).

Bid Lot Size – Investors need to bid for a minimum of 45 shares and in multiples of 45 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 13,950 at the upper end of the price band and Rs. 13,500 at the lower end of the price band.

Objective of the Issue – The company plans to use the IPO proceeds to expand and upgrade its existing manufacturing facilities by spending Rs. 147.48 crore, to invest Rs. 131.54 crore in its subsidiary, Inox Wind Infrastructure Services Limited (IWISL), primarily for development of power evacuation infrastructure, for long term working capital requirements up to Rs. 290 crore and other general corporate purposes.

IPO Grading – The company has opted not to get its IPO graded by any credit rating agency. SEBI had made IPO grading voluntary in December 2013.

Listing – The shares of the company will get listed on both the exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Risks

* High Working Capital Requirement – The business, Inox Wind is into, is capital intensive and also requires huge working capital, as manufacturing and maintaining WTGs require huge investments in project sites and equipments etc.

* Limited Diversification – Top 5 customers of the company contributed approximately 85% of its revenues for the nine months ended December 31, 2014, which makes me a little uncomfortable as far as customer diversification is concerned.

* Limited Operating History – Inox Wind got incorporated in April 2009 and since then, the economic growth has been weak and the government policies have not been clear as far as renewable energy business is concerned. So, the conservative investors should wait & watch before they invest with the company.

Financials of the Company

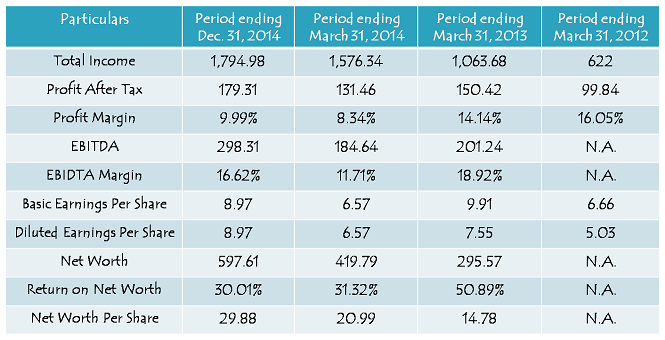

For the financial year ended March 31, 2014, total income of the company was Rs. 1,576.34 crore as against 1,063.63 crore for the year ended March 31, 2013. The company reported profit after tax (PAT) of Rs. 131.46 crore for the financial year ended March 31, 2014 as against 150.42 crore for the financial year ended March 31, 2013.

Note: Figures are in Rs. Crore, except per share data & percentage figures.

For the nine months ended December 31, 2014, its total income has been Rs. 1,794.98 crore and it clocked a net profit of Rs. 179.31 crore, resulting in a net profit margin of 9.99%. The company reported EBITDA margin of 16.62% for the nine months ended December 31, 2014, 11.71% for the year ended March 31, 2014 and 18.92% the year ended March 31, 2013 respectively.

Total debt/equity ratio of the company stands at 1.25 as on December 31, 2014, whereas long term debt/equity ratio of the company stands at a very comfortable 0.09.

Though the valuations seem to me a bit on a higher side, I think for a growing company with high historical growth, reasonable debt-to-equity ratio, efficient management and a strong promoter group, the valuations Inox is seeking in this offer are reasonably justified. If all goes well for the company, I think its stock price could double from its expected allotment price of approximately Rs. 310 in the next 2-3 years time.

Day 1 (March 18) subscription figures:

Category I – Qualified Institutional Buyers (QIBs) – No Bidding

Category II – Non Institutional Investors (NIIs) – 0.04 times

Category III – Retail Individual Investors (RIIs) – 0.16 times

Total Subscription – 0.09 times

What is your opinion on subscribing for listing gains??

I would not like to speculate on this, but I think there is a high probability of good listing gains if the sentiment remains positive.

not a good supscription figures today aswell so can you suggest to subscribe tomorrow &please update us with today’s latest subscription figures

Day 2 (March 19) subscription figures:

Category I – Qualified Institutional Buyers (QIBs) – 0.55 times

Category II – Non Institutional Investors (NIIs) – 0.30 times

Category III – Retail Individual Investors (RIIs) – 0.77 times

Total Subscription – 0.59 times

mind blowing subscription on last day buy qib biders & I have applied for 90 shares today can I get any allotment

Yes, you’ll get allotment.

Shiv,

700 crores fresh issue

300 cr. OFS

35% is reserved for Retail category.

Does DAT mean it is 35% of 700 cr. I.e appx.

245 crore for retail.

Who participates in the OFS???

Co. Doesn’t gets any cash against the OFS shares

It is approximately Rs. 348.57 crore for the Retail Investors. Offer for Sale (OFS) has been made mostly to the Anchor Investors. OFS money has gone to the selling shareholder GFL.

today’s final subscription figures please

Final Day (March 20) subscription figures:

Category I – Qualified Institutional Buyers (QIBs) – 35.68 times

Category II – Non Institutional Investors (NIIs) – 35.38 times

Category III – Retail Individual Investors (RIIs) – 2.15 times

Category IV – Employees – 0.12 times

Total Subscription – 18.60 times

please provide me link to check my allotments & thanks for subscription figures shiv

I don’t have the link as yet to check the allotment status.

Hi Shiv,

If you compare with the your retail allotment analysis of CARE IPO, Here also there is no use of applying more than 1 lot from 1 account, right ?

Hi Omkar,

No, I think that will not be the case. CARE IPO got subscribed 6.11 times in the retail category, whereas Inox Wind IPO retail subscription is 2.15 times. I think there will be good enough allotment for the retail investors, approximately 35% to 100% (investors who applied for 45 shares) of their application.

I want to buy the shares of Inox Wind Limited, pls suggest how I can ??

Hi Madhuri,

IPO has closed, so now you can buy its shares once it gets listed on the stock exchanges.

What about Allotment pl.

Allotment information is still not available, it will be disclosed this week.

Pl lnform about allotment and listing date

I received an intimation on allotment. I had applied for 90 (2 lots of 45) and I received 45 @Rs310

Today’s got allotment conformation

Please give a date of listing?

Inox Wind got listed today on the stock exchanges and currently trading at Rs. 424.70 on the NSE.

I’ve sold all alotted shares @450 today. Now it’s start falling and expected to come @190-220 in few months.

That’s great! Any fundamental reason behind this expected fall from here to Rs. 190-220 levels?

I did some research online and experts says that stock is heavily over priced and it would reach @190-220 in few months. Even few says that it would be @150. So it be better to re-enter in this stock at @200-250.

Ok, thanks Samir!

Welcome. VRL Logistics IPO issue opens on15-apr-2015. Can you write your review on it?

I’ll cover it if I get time to do that. I’ll definitely try.

Just Posted – UFO Moviez IPO Review – https://www.onemint.com/2015/04/28/ufo-moviez-ipo-review-subscribe-or-not/