Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) – One Rupee a Day Life Cover – Salient Features & Application Form

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Before leaving for his three-nation tour to China, Mongolia and South Korea from May 14, Prime Minister Mr. Narendra Modi will launch three of his government’s social security schemes on Saturday – Pradhan Mantri Jeevan Jyoti Bima Yojana (Life Insurance), Pradhan Mantri Suraksha Bima Yojana (Accidental Death & Disability Insurance) and Atal Pension Yojana (Pension Scheme).

These schemes would be an extension to Pradhan Mantri Jan-Dhan Yojana (PMJDY) and would be covered under the government’s Jan Suraksha initiative. These schemes are designed to be pro poor and promise to provide protection against the risks of dying too early (Pradhan Mantri Jeevan Jyoti Bima Yojana) or living too long (Atal Pension Yojana) or unable to work & earn due to partial or full disability (Pradhan Mantri Suraksha Bima Yojana).

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Age of the Insured – Bank account holders aged between 18 and 50 years are eligible to apply for this scheme. So, if you are aged more than 50 years, you are not eligible to enroll yourself for this scheme. But, once enrolled, you can continue with this scheme till you attain the age of 55 years.

Premium Amount – Less than Re. 1 a day or an annual premium of Rs. 330 is what you need to pay to get a life cover of Rs. 2 lacs. No matter what your age is, the premium is fixed at Rs. 330 for a life cover of Rs. 2 lacs. This annual premium of Rs. 330 has been fixed for the first three years from June 1, 2015 to May 31, 2018, after which it will again be reviewed based on the insurers’ annual claims experience.

Period of Insurance – June 1st, 2015 to May 31st, 2016 is the period for which this scheme will cover all kind of risks to your life in the first year of operation. Next year onwards as well, the risk cover period will remain June 1 to May 31.

LIC as the Administrator – The scheme would be offered / administered by the Life Insurance Corporation (LIC) and other life insurance companies like SBI, ICICI etc. through their tie ups with the interested banks like SBI, ICICI, Canara Bank etc. Participating banks are free to engage any such life insurance company for implementing this scheme for their subscribers.

Auto Debit Facility – Annual premium of Rs. 330 will get deducted from your savings bank account through auto debit facility. You will have to give your consent for auto debit of premium from any one of your bank accounts at the time of enrolling for this scheme.

Last Date for Enrolment – May 31, 2015 is the last date for getting enrolled for this scheme, but the government has given an extension of three months up to August 31, 2015 for us to get enrolled and give auto-debit consent for this scheme. This enrolment period may be extended by the government for another period of three months, up to November 30, 2015.

Those joining this scheme subsequent to May 31, 2015 will have to pay the full year’s premium of Rs. 330 and submit a self-certificate of good health in the prescribed proforma.

Toll-Free Numbers – 1800 110 001 / 1800 180 1111 – These two are the National Toll-Free Numbers for this scheme. You can check the state-wise toll-free numbers from this link – State-Wise Toll Free Numbers

Service Tax Exempt – Finance Minister Mr. Arun Jaitley has proposed to exempt this scheme from service tax. So, you will not be charged any service tax on the premium payable.

Know Your Customer (KYC) – Aadhaar Card issued by the UIDAI will be the primary requirement for your KYC under this scheme.

Application Form – Here you have the link to the application form for you to enroll yourself for this scheme – Application Form for PMJJBY

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

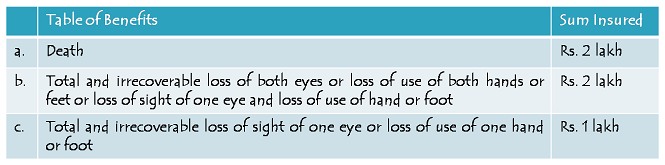

Policy Coverage – The scheme offers to provide you or your family a cover of up to Rs. 2 lacs in case of any mishappening, resulting into death or disability of the insured. In case of death or full disability, you or your family will get Rs. 2 lacs and in case of partial disability, you will get Rs. 1 lac. Full disability means loss of both eyes or both legs or both hands, whereas partial disability means loss of one eye or one leg or one hand.

Age of the Insured – Savings bank account holders aged between 18 years and 70 years are eligible to apply for this scheme. People aged more than 70 years will not be able to get the benefits of this scheme.

Premium Amount – It costs you just Rs. 12 in annual premium for having an accidental death or disability cover of Rs. 2 lacs under this scheme. It works out to be just Re. 1 a month, which is extraordinarily low. Again, your age has nothing to do with the premium payable for your insurance cover under this scheme as the premium is fixed at Rs. 12 for a cover of Rs. 2 lacs.

Period of Insurance – You will remain insured for a period of one year from June 1, 2015 to May 31, 2016. Next year onwards as well, the risk cover period will remain to be June 1 to May 31.

Administrators for PMSBY – The scheme would be offered / administered by many of the general insurance companies, both in the public sector as well as in the private sector. Participating banks will be free to engage any such general insurance company for implementing the scheme for their subscribers. National Insurance Company Limited, Oriental Insurance Company Limited and ICICI Lombard are some of the companies which would be offering this scheme.

Auto Debit Facility – You will be required to provide your consent for auto debit of Rs. 12 as the annual premium from any one of your bank accounts at the time of enrolling for this scheme. This premium of Rs. 12 will get deducted from your savings bank account through auto debit facility every year between May 25 and June 1.

Last Date for Enrolment – May 31, 2015 is the last date for getting enrolled for this scheme, but the government has given an extension of three months up to August 31, 2015 for us to get enrolled and give auto-debit consent for this scheme. This enrolment period may be extended by the government for another period of three months, up to November 30, 2015.

Those joining this scheme subsequent to May 31, 2015 will have to pay the full year’s premium of Rs. 12 and agree to specified terms of this scheme.

Toll-Free Numbers – 1800 110 001 / 1800 180 1111 – These two are the National Toll-Free Numbers for this scheme. You can check the state-wise toll-free numbers from this link – State-Wise Toll Free Numbers

Service Tax Exempt – Yes, Finance Minister Mr. Arun Jaitley has proposed to exempt this scheme from service tax. So, you will not be charged any service tax on the premium payable.

Know Your Customer (KYC) – Aadhaar Card issued by the UIDAI will be the primary requirement for your KYC under this scheme.

Application Form – Here you have the link to the application form for you to enroll yourself for this scheme – Application Form for PMSBY

Should you subscribe to Pradhan Mantri Jeevan Jyoti Bima Yojana?

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a term life insurance scheme and we all know that a term plan is the cheapest form of covering ourselves against the risks of untimely death. I think the government is doing a wonderful job in taking the initiative to attract low income group people to get themselves covered against the risks of untimely death.

I think the premium is reasonably justified for people in their middle years, probably between the age of 40-50 years. For younger people, you might still find cheaper life cover policies with some of the private insurers, like Max, Aviva, Aegon Religare etc.

I’ll keep on updating this post as and when I have some interesting data to insert into. If any of you has anything to share about this scheme, please feel free to do that, I’ll update that as well here in the post.

I covered Atal Pension Yojana in March this year and I have covered Pradhan Mantri Jeevan Jyoti Bima Yojana in this post. I will cover Pradhan Mantri Suraksha Bima Yojana also as soon as possible.

very important life security schemes by the NDA govt . we the general people are very grateful to PM Norendra Modi and his Team ……

Yes, all these schemes are excellent initiatives from the Modi Government for the low to middle income group people. I hope enough efforts are made to implement & regulate these initiatives in a proper manner.

Its really a very good by Modiji Govt.

I appreciate it

Yes, it is Hemant, thanks!

This is fanstatic. Is there any income limit to join the scheme and is there an online option to join for this?

Thanks

No Harinee, there is no income limit for subscribing to this scheme.

Hi,

A great initiative by the Govt. My question is, if a person having multiple bank Accounts, will he or she will be eligible to take this scheme more than one???

Hi Babumon,

It is not allowed to get yourself enrolled with two or more than two different banks. In case the same is found to exist, your premium(s) will get forfeited and no claims would be paid.

It’s really benificial for lower and middle class income people .

Yes, it is definitely pro poor and quite beneficial as well.

What is the difference between both the policies? And can i buy both of them?

Hi Deepika,

PMJJBY provides you life insurance cover of Rs. 2 lakhs and its annual premium is Rs. 330. PMSBY provides you accidental death & disability insurance cover of Rs. 2 lakhs and its annual premium is Rs. 12. Also, you can buy both these policies. Your total cover would be Rs. 4 lakhs and total premium would be Rs. 342.

Sir,

I want to know that after 50 years of age will I get my money back. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

No Vishant, it is a term insurance plan and nothing is payable if you survive the period of insurance.

Nobody wants to die. I think they should be return money back also. Because after 55/60 years they need money for live life.

Rs. 330 premium is too low for a life cover of Rs. 2 lakhs. If they add money back clause also to the basic terms of this scheme, then the premium would not be as low as Rs. 330. For life beyond 60 years of age, you have Atal Pension Yojana (APY), NPS, PPF or other social security schemes.

Is it beneficial for income taxpayers?how much

Hi Pawan,

You’ll get a tax exemption of Rs. 330 under section 80C. There is no other tax benefit available.

can i buy atal pension,pmjjby,pmsby

Hi Debendra,

Anybody can subscribe to PMJJBY and PMSBY, but Atal Pension Yojana is for people working under the unorganised sector. So, if you are not covered under any other social security scheme, then you can subscribe to Atal Pension Yojana as well.

Can a person enrolled all three schemes e.g.

Pmjjby. Pmsby and atal pension scheme

Yes, it is possible. But, APY is for the unorganised sector only.

sir,

A person who joined both schemes as PMJSY & PMJJY so what his nominee get;if

(1) He dies in an accident

(2) He dies due to simple death by illness and such etcs.

means, Whether get 4 lac or 2 lac.

Hi Nitesh,

1. Nominee will get Rs. 4 lakhs

2. Nominee will get Rs. 2 lakhs

deelip

how can get policy no and where we go for claim and how?

mahesh kumar

delhi

Master Policy No. will be provided to every subscriber by the servicing bank at the time of depositing the application form. You will be required to approach the bank for making a claim by submitting the claim form – http://www.kotak.com/sites/default/files/PMJJBY_Claim_Form_English.pdf

Sir, will bank give insurance certificate by post or simply they will give acknowledgment slip.

Acknowledgement Slip in itself will be considered as the Certificate of Insurance.

I have other insurance policies like LIC SBI Max New York Life insurance am I eligible for this policy whether I will get any insurance claims.

Hi Harish,

You are eligible for this scheme and I don’t think there is any reason for insurance companies to deny you a claim in case of any unfortunate event.

Hi Sir,

What is the main difference of PMJJBY and PMSBY?

If for both the schemes one gets 2 Lakhs of coverage for each, then why one will go for PMJJBY by paying 330 instead of PMSBY by paying only 12?

Hi Bapi,

PMJJBY is a term insurance plan which covers death due to all covered possible reasons. While PMSBY covers death & disability only due to accidents. I also think PMSBY is quite cheap at Rs. 12, but even PMJJBY is cheap for people in the age group of 40-50 years.

Hi Mr Kukreja,

I want to know how can we enrol to this using SBI on-line banking. They are displaying an add there that login and enrol, but I am unable to find any options inside.

Regards,

Ashfaq

Hi Ashfaq,

I think SBI is still working on its systems to facilitate online subscription to these schemes. It should be up & running in a few days time.

Hi,

I’m married I have bank account but my wife don’t have any bank account so we can apply for Pradhan Mantri Jeevan Jyoti Bima Yojana please give me answer

so if possible please give me how to do explain the procedure.

Hi Swastik,

Having a bank account is compulsory to subscribe to these schemes.

I want to know how can we enroll to this using SBI on-line banking. I am unable to find any options inside.

With Regards,

Even I am not sure where exactly its details are on the SBI website. Also, I do not have SBI account, so can’t really be sure whether it is there under net banking platform or not. But, it is confirmed that it will be made available on SBI’s online platform.

Sir,

1.Is this scheme auto renewable or we have to renew it every year?

2.and if in future I want to move this scheme other bank saving account can this possible?

Hi Atul,

1. Auto debit mandate will be required to be given for these schemes so that it automatically gets renewed every year.

2. Yes, that is possible.

Sir

1:Agar admi 50 aur 70 saal tak pmsby pmjjby premium bharta hai aur vah jinda hai to kya vah abhi tak bhara huva amount vapas mil sakta hai?

2:agar milta hai to pmsby aur pmjjby ka kitna amount milega?

Nahin Gopal, dono schemes mein premium amount waapis nahin milega.

How are these schemes MJJBY PMSBY AND APY different and beneficial from other schemes already available by other companies except premium amount??

Hi Mr. Rai,

I am trying to make a comparison table for PMJJBY. I hope to complete it either today or tomorrow.

THIS IS GREAT AND SUPERB POLICY HAS INTRODUCE BY MODI GOVERNMENT SARKHAR EVEN POOR PEOPLE CAN ALSO TOTAL BENEFIT FOR HIS FAMILY

I APPRECIATE IT

I HOPE THIS MODI GOVERNMENT GIVEN MORE BENEFIT IN FUTURE ALSO TO MIDDLE CLASS AND SMALL CLASS PEOPLE

Hi

Is it possible for Non resident Indian can join all these three schemes.mainly for atal pension..

I am working in dubai,an unorganised sector

Hi Saju,

NRIs cannot subscribe to any of these schemes.

IS it possible after reaching India..I have savings account in SBI

Can one take pmjjby in one bank & pmsby in another bank?

Yes Rakesh, you can do so.

Is it possible for Non resident Indian can join all these three schemes after reaching India for leave or final settlement

Yes, it is possible, but I think claim would be settled if something happens to the subscriber while he/she is in India.

Hi,

I don’t have Aadhar card but have an account in the bank..can I avail this insurance

Yes Deepti, you can subscribe to these insurance schemes even without providing your Aadhaar Number.

Nominee can claim amount in any branch in India or will have to come in same branch of respective bank.

Hi Ajeet,

Claim can be made anywhere in India.

My mom’s age is 60 plus can she avail these 2 polices

Please confirm

No Reema, your mother is eligible for PMSBY, but not for PMJJBY.

my mom is going to be 50 in 4 years so does that mean she is required to pay about 4 premiums only that is until she ages to 50 ?

will both schemes provide 2 lac rupees only if death or disability happens before reaching the age of 50 or 70?

Hi Krishna,

Entry age for PMJJBY is 50 years. But, once enrolled, you can take it further upto 55 years of age. Also, in case of accidental death, the nominee will get Rs. 4 lakhs. Death, due to other reasons, will entitle the nominee Rs. 2 lakhs. It is assumed the insured subscribes to both these policies.

can i apply for both ??

If you are 50 years or younger, you can subscribe to both these policies.

SIR I am 29 years old, so, muze PMJJBY me invest karna hai, so, muze premium kab tak bharna padega, aur premium ki maturity date kya hogi, aur iske benefit kya hoge, agar premium bharte bharte hi agar uski mrityu ho jaaye chale accident se ya natural death !, to uska primium amount nominee ko hi milenga kya ? aur kab tak milenga ? ya uske bawjood nominee ko premium bharna padega please esir clearyfy my this kind of issues

Hi Sayali,

1. Aap 55 saal tak is scheme ko avail kar sakte ho.

2. Ye ek term insurance plan hai. Agar aapko kuch ho jaata hai to aapke nominee ko Rs. 2 lakh milenge.

3. Is scheme mein Rs. 2 lakh milenge, premium amount waapis nahin milega. Nominee ko kabhi premium nahin bharna hoga.

If next government comes, will they continue these policies???

Is there any law made (for continuity plan) that the subsequent Governments have to stick to these schemes???

Hi Sanjeev,

1. This is something which only the next government can answer.

2. There is no such law which can stop the next government to discontinue these schemes. But, I don’t think any good government would stop any such scheme.

Rajiv Ghandhi scheme is stopped now.

Hi Shiv Kukreja ji,

First of all Thanks for your time, patience and effort to answer to all, these are very good scemes from NDA govt, my question is can i enroll these policys online or i have to go to bank ? pls let me know

Thanks

Thanks Mr. Subhash for your kind words!

Kotak Mahindra Bank, HDFC Bank, ICICI Bank, SBI & IndusInd Bank are providing online subscription facility. Some other banks would also provide such online facility soon.

dear sir,

in whitch day insurance refund after the claim

Hi sir,

Is bank giving acknowledge cum certificate of insurance immediatly after submitting form in bank or they send it by post to address of subscriber?

Yes Atul, the application form itself has the acknowledge slip cum certificate of insurance – http://www.kotak.com/sites/default/files/PMJJBY_Consent_cum_Declaration_Forms.pdf

Yes sir it contain in form..am asking about will bank give that slip after submission. .I went yesterday to sbi bank, they only take form but not provide slip when I ask about slip staff said this will clear only after 1 june..

So I have this confusion will bank provide this certificate by post or immediately?. .i think so this is the only proof for future use..

Yes sir it contain in form..am asking about will bank give that slip after submission of form?. .I went yesterday to sbi bank, they only take form but not provide slip when I ask about slip, staff said this will clear only after 1 june..

So I have this confusion, will bank provide this certificate by post or immediately?. .i think so this is the only proof for future use..

Hi Atul,

I think the amount will get debited from the account between May 25 & June 1. Once it gets debited from the account, the bank will provide the acknowledgement slip cum certification of insurance to you. However, as a proof, I think the banks should immediately provide it, they should not delay it.

Hi sir is it pmjjy scheme is eligible for govt employees and atal pension is eligible for house wife who r working at home.

Hi Rajeshwari,

Govt. employees are eligible for PMJJBY and housewives are eligible for APY. In APY, there are certain conditions to be eligible for government contribution.

hi,

Dear any new plans are there deposit

Hi Mr. Rajesh,

Your query is not clear.

good thought about public by pm .very imp for public

Yes, I agree.

Hi Mr. Shiv ,

The main advantage of other Insurance companies over PMJJBY is that they provide longer period of Term i.e, till the age of 65 Years or more in some companies.That is the period of age ( >55 yrs) when you need life cover the most.

Hi Mr. Sudhir,

Yes, I agree with you that longer period coverage with other insurance companies is an advantage. But, then these insurance companies charge very high premiums for covering you till 65-70 years of age. Also, I do not agree with you that 55-70 is the age group when a person needs life cover the most. I am of the view that 25-55 is the age group when you need a life cover the most, as this is the time when you earn and there are dependents on your income. Loss of life in this age group hurts a family the most in financial terms.

Dear Sir,

I was born on 1.4.1965 am i elgible to pmjjyby policy pl let me know sir

Hi Syed,

I think you are eligible, but you need to confirm it with your bank.

Dear sir,

please let me know which policy i can opt for my age sir i appreciate your reply

I think you are eligible for both these policies – PMJJBY & PMSBY.

Dear sir,

My date of birt is 01 04 1965 am i eligible for pmjjyby pl advised me any other policy thank you sir

Dear Shiv

My wife is second holder in joint a/c with me at ICICI & HDFC Banks, I joined in both scheme through HDFC Bank’s a/c. Now to join my wife for same suggest what to do

Hi Mr. Panwala,

You can use either of your joint accounts for her as well.

Can a person already having a life insurance policy can enrol for Prime minister Bima Yojana? Kindly confirm.

Yes Mr. Rajesh, you can get yourself enrolled for PMJJBY & PMSBY even if you have other insurance policies.

Hi sir,

I appreciate that the newly implemented schemes by PM will be very beneficial for all.congratulations!!!..And i also appreciate your kind patience to answer our queries.

Sir,i want to know that if a person doesn’t die within the cover period in both PMSBY and PMJJBY ,will he get the premium back??will money be refunded to the nominee?

Thanks and regards..

Thanks Kanika for your kind words!

No premium will be paid back to the subscriber if he/she survives the policy period. Nominee will be paid only the sum assured if something happens to the subscriber.

dear sir,

what happen in case of joint a/c ,either both a/c holder can take these policies or not ?

Hi Shashi,

Yes, both joint holders can subscribe to these schemes.

Respected sir,

1-My father is 60 years old, he is suffering from cancer & hepatitis c last august 2014. Can he eligible for these pmsby & pmjjby.

2-kya yeh scheme ke liye medical certificate submit karna jaruri hai?

3-yadi mai pitaji ke naam se pmsby aur pmjjby karwadeta aur kal ko kuch ho jata hai to kya hum claim kar sakte hain? Pls sir answer these questions.

With regards.

Hi Gopal,

1. Your father is not eligible for PMJJBY. In case of PMSBY, your father is eligible, but death/disability due to accident only is covered. Also, you’ll have to disclose accidental disability, if any.

2. Medical certificate is not required if you subscribe to it before June 1, 2015.

3. Agar death kisi pre-exisiting disease/disability ki wajah se hoti hai, to in dono schemes mein claim nahin milega.

Some social sites are informing that if any individual has any kind of insurance with LIC, Max etc. and then also insures with pmjjby, he will not get any claim in case of any eventuality despite premium being deducted fro his account. Only people with NO insurance will be benefited. Please clarify on this. Thanks.

Hi Dipak,

That is completely incorrect information. We are eligible for PMJJBY even if we have other insurance policies and we will get its benefits in case of an unfortunate event.

I am having a saving account in SBI. Being a account holder I have taken a accidental cover of Rs.4 lacs under “SBI Personal Accident Insurance Policy” in July’2014 thereafter Rs.200.00 deducted from my said account.

Now, I have enrolled myself for Rs.2 lacs cover under “Pradhan Mantri Suraksha Bima Yojana” for Rs.12.00 in this month.

My query is “Whether at the time of any eventuality my family would be entitled to get (Rs.4+2)= Rs.6 lacs under both policy coverage or not?”

Pls guide me.

Hi Prem,

In case of any eventuality, your family will get Rs. 6 lakhs under both these policies.

Dear sir,

Could you please give details about ATUL PENSION SCHEME.

Here you have the link to our post on Atal Pension Yojana – https://www.onemint.com/2015/03/13/atal-pension-yojana-government-guaranteed-pension-scheme-for-the-unorganised-sector/

Is it possible to enroll under both the schemes PMJJBY & PMSBY at a time ?

Yes, it is allowed to get yourself enrolled under both the schemes.

Your comment is awaiting moderation…

Regarding PMJJBY, Is there any money returned to insurer on maturity of policy? or only death coverage before 55 years only exists? What about the other policies by Lic, state bank, kotak listed in comparison?

Regarding PMJJBY, Is there any money returned to insurer on maturity of policy? or only death coverage before 55 years only exists? What about the other policies by Lic, state bank, kotak listed in comparison?

Hi Vineeth,

No term insurance scheme, including PMJJBY, returns any money back to the insurer in case he/she survives the policy period.

My wife suffered with right breast cancer during 2014 and now fully cured after surgery in the month of June 2014. Can we apply for PMJJBY & PMSBY.

Hi,

If your wife has fully recovered, then she can apply for this scheme. Death or disability due to pre-existing diseases will not be covered under both these schemes.

My father is of 49 years 9 months old is he eligible for PMJJY? one of the bank said he is not eligible

Hi Srinath,

I think your father is eligible for PMJJBY. I don’t know why the bank has refused to accept your father’s subscription.

I am having four saving accounts like SBI, ICICI, IDBI and HDFC.

Now, I have enrolled in all bank account or only one account.

Pls guide me.

Hi Nazia,

You can enrol yourself only once (with only one bank) for this scheme.

Sir

Can one change nominee in the schemes after enrolling for them

Yes Shrishti, you can change your nominee details in these schemes.

hello Sir

Thanks for your inputs. Will there be any policy copy which will be given to us once we enroll for these 2 schemes.

Thanks

Shrikanth Achar

Hi Shrikanth,

The application form has the acknowledgement slip which will also be considered as the certificate of insurance.

Hi Shiv,

Meri age 46 saal hai. Mujhe 330/- premium kab tak bharna padega (55 ki age tak ???). Agar koi mishappening 55 saal ki age ke baad hoti hai to kya claim nominee ko milage ya phir 55 saal ki age tak kutch hota hai to hi milega ??? Pls. guide.

Hi Mr. Singh,

Aap PMJJBY 55 saal tak avail kar sakte hain aur premium bhi har saal dena hoga. 55 saal ke baad aap is scheme ko avail nahin kar sakte aur uske baad aapko life cover nahin milega.

I have a sbi a/c . What is the last date for pradhan mantri jeevan jyoti bima yoyona? can i do next month?

Hi Manas,

August 31, 2015 is the last date for subscribing to PMJJBY, if not further extended by the government. You can get yourself subscribed to this scheme next month, but you’ll have to pay the full premium of Rs. 330.

Hi Shiv,

Can we use our Either or Survivor account for enrolling both PMJJBY & PMSBY or separate savings accounts are mandatory. Please advise.

Thanks

Ajit

Hi Ajit,

Either or Survivor account will also do for these schemes.

Thanks Shiv for the clarification 🙂

You are welcome Ajit!

Sir I have a doubt . pmjjby scheme ki maturity ke bad kya paisa refund hoga ??

Nahin Sourabh, maturity ke baad aapko kuch bhi refund nahin milega.

hi sir

in jiven jyoti yojana your premium is anual 330 and coverage upto 55 yars and in bima yojana it is 12 pm and coverage up to 70 years of age,so what is diffence in these scemes,is bima yojna scheme is more benefecial bcoz premiun is 12,plz reply

Hi Ravikant,

PMJJBY is pure term life insurance, covering death due to any reason, whereas PMSBY is death & disability insurance only due to accident. I think PMSBY is more beneficial than PMJJBY, but one should go for both these schemes.

Hi sir,

I want to know some explanations

1. If i opt PMJJBY will my next of kin get death benefit after my death at any age even at 100

2. If i opt PMJJY will premium changes every year or will be same evey year.

Hi Pritam,

1. PMJJBY provides life coverage till 55 only. So, no benefits are available beyond 55.

2. Annual premium will remain fixed at Rs. 330 irrespective of your age.

Sir, I have wrongly given nominee name for my Pmsby policy how can I change it, and I have done it just sending SMS to axis bank. amount also debited from my account.is that enough or do I have anything to do pls advise me.

Hi Pavan,

You need to contact your bank for correction in your nominee data. For policy, you need not do anything else.

Dear sir,

me Ne pradhan mantri bima yojana Nikala ne . Agar meje kush jo jata je to mere nomini ko kaha infrome karna padega ?or kya process karna padega

Hi Sandip,

Please check this post for claim settlement process – https://www.onemint.com/2015/05/27/pmjjby-pmsby-claim-settlement-process/

I am out of town now for my vacation is it possible to apply in the nearest bank branch in which I have account?

Yes, you can do so.

Hello Sir,

I have an account with ICICI bank and i enrolled in both these schemes that is pmjjby and pmsby .

Now i want to know that if anything accidental matters occurs with me will nominee get benefit of both schemes or any single scheme will applicable.

Thanks in advance.

Hi Chandranauli,

Your nominee will get benefit under both the schemes.

please give me the link for hdfc bank forms for pradhanmantri jeevan jyoti and beema suraksha yojna forms

Sorry Upendra, I don’t have the links of HDFC Bank’s forms for PMJJBY & PMSBY.

Hi,

can you please guide me how to enroll for Pradhan Mantri Suraksha Bima Yojana , Pradhan Mantri Jeevan Jyoti Bima Yojan through HDFC bank or SBI bank.

Regards,

Naveen

Hi Naveen, Y” or ?”PMJJBY Y” to 5676712 from your registered mobile number.

You can get yourself enrolled for these schemes with HDFC Bank/SBI through their respective net banking platforms or by visiting any of their branches. SMS service is also there, but I don’t have the details of it for SBI. To subscribe with HDFC Bank, you need to SMS “PMSBY

Hi Shiva,

Thanks for your prompt response.

Can you please let me know how to enroll through HDFC netbanking.

Regards,

Naveen Kumar

Hi Naveen,

It is under the ‘Insurance’ tab – Insurance > Social Security Schemes – Jan Suraksha.

Please let me know that if i already have a life cover with LIC of India Can i opt for these Scheme

Yes Aslam, you can do so.

Hi Shiv,

Pmjjbj life insurance bima.but I confused after 50 years any return or any benefit?

What is atal pension scheme? age limit? and how benefits this scheme. ..plese Guide me Sir.

Hi Santosh,

PMJJBY is a pure insurance scheme and provides no returns on your premium payments. If you survive the insurance period, then you won’t get anything back. Please check this link for Atal Pension Yojana – https://www.onemint.com/2015/03/13/atal-pension-yojana-government-guaranteed-pension-scheme-for-the-unorganised-sector/

Dear sir, i want to know that if i join this scheme of pmjjby and in future goverment has been changed, so will my family get the claim, Is there any right to change or close the schem to other gov expect bjp during his rule over india.

These policies are issued by the insurance companies and not any government. So, I don’t think we should worry too much about the government getting changed. If the government gets changed and the next government changes its rules, then you are free to stop paying for it.

Sir sabhi yojna poori hone k baad kya paisa vapas milega

Nahin Vishal, premium amount waapis nahin milega.

hii gopal

My name is purna chandra iam just 25yeras old today i already applied to pmjby…is this schem will help me bcoz am just 25 and i have to pay till the end of 55 and its slight costlier compared to oters i think for the age people 45 to 50 this scheme is helpful

Next is after 10 years my age is 35 that time can i receive any amount for my health care bcoz of urgency….and last thing is if i want to come out can they provide me any amount…plllllsssss help me

Hi Purna,

You should subscribe to this scheme even if you are 25. This scheme does not cover healthcare expenses. Nothing is paid back if you want to come out.

Me apply the scheme named ‘pmjjpy’ through netbanking option where I can fill up one form & click on submit after 8 day I am get message that u r debited 330 rs from ur account shall I get this scheme & I don’t need any form to submit the bank again or not please tell me

Hi Mr. Nagnath,

Aapko ab koi form fill karne ki zaroorat nahin hai.

I have joint accont in axis bank .ls it possible to enorol the scheme in the name of both account holder ?.

If no,in both which account holder will

get the scheme facility ? .

Hi Awadumbar,

Only First Account Holder is eligible to apply for these schemes.

What is hdfcs SMS number for pmsjy

With HDFC Bank, you need to SMS “PMSBY nominee name Y” to 5676712 from your registered mobile number.

Sir kya mai dono policy mai apply kar sakta or kya mai online apply kar sakta hu kyo ki mai home town mai nahi hu plz reply me thanks sir

Yes Dipesh, aap dono schemes mein apply kar sakte hain. Also, net banking ke through online apply kar sakte hain.

Respected Sir,

My Brother applied for both the policies (PMSBY ,PMJBY) and unfortunately total amount has debited for some other cause and account is nil . Thus the premium for policies has not debited. So, he got a message that policy registration has failed and apply afresh. He enquired at bank , he got a reply that once failed will not be accepted and new registration also not possible. Please tell me what he has to do for this.

Hi Sindhura,

I am not sure why the bank is denying his application again. You brother needs to check it with the bank itself.

there is any maturity benefit both the insurance policys

No Parthajit, nothing will be paid back in case the insured survives the insurance period.

What is SBI SMS number for pmsjy and PMJJY ?

Sorry Mukesh, I don’t have the SMS number of SBI for PMJJBY & PMSBY.

Hi Shiv, could you please guide how to apply for PMSBY & PMJJBY through online sbi .Help appreciated.

Thanks

Hi, I have applied for the both policies through SBI online and submitted. Should i get any policy document from SBI (or) from any third party? Kindly confirm.

Hi Naresh,

I don’t think you will get any physical policy document as such. But, the bank should provide you with a certificate of insurance through mail and SMS confirmation as well.

Thanks a lot Shiv

You are welcome Naresh!

Hi Naresh , Could you please provide the path to apply online for PMJJBY through SBI online.

Thanks.

It is under My Accounts > Account Summary > Social Security Schemes.

Hi….. will you please tell me the last date for applying PMJJBY ?

Hi Rahna,

Interim last date is May 31st, but there is an extended period of 3 months also till August 31st.

Hi, can someone please guide how to apply for PMSBY through online sbi.help apprriciated.

Thanks.

Hi Mukesh,

You can apply for it through SBI’s net banking platform.

HOW TO CANCLE THIS SCHEME WHICH I WILL START AFTER SOME YEARS, PLS HELP ME WITH THIS

Just stop paying further premiums and cancel the auto debit instruction.

Sir

I will take policy June 1st different between May 31 before ple explain

how to make online insurance OF PMSBY through SBI.

Hi Swadhin,

You need to log in to SBI’s net banking platform. It is under My Accounts > Account Summary > Social Security Schemes.

Sir

I will take policy June 1st different between May 31 before pls pls

Hi Rajashekar,

Joining subsequent to May 31, you will to submit a self-certificate of good health in the prescribed proforma.

Without bank account this take policy are not pls tell me

Your query is not clear.

Bank account is mandatory. Without a/c can’t take this policy.

Without bank account how do take a policy

Savings bank account is mandatory for these schemes. You cannot subscribe to any of these schemes without a savings account.

Dear sir,

Is there is any changes to enroll after 31st may 2015. How can i enroll

throw online guide me plz.

Hi Prabhu,

If you subscribe after May 31, you will have to submit a self-certificate of good health in the prescribed proforma. You can subscribe to it through net banking.

Hii Shiv,

Where I van get the prescribed proforma of health certificate?

Where do I need to submit it after subscribing the policy through SMS.

Thanks in advance

Hi Mohan,

You need to approach your bank branch for the health certificate proforma & submit it there itself.

Sir,i have nominated myself..

Can i change the nominee name?? Should i contact my operating bank???

Yes Aishwarya, you need to contact your bank branch for making the required changes.

Hello sir maine ye insurance online kar diya hai lekin mere account se koi amount debit nahi hua hai to ye amount kab debit hoga ? Or hame koi policy bhi milegi bank se ya nahi ya online kar diya wo hi kafi hai ?plz clear karna sir thanks

Hi Dipesh,

I think the amount should get debited from your account in a day or two. I think you should get a confirmation on your mail and/or SMS.

My one was joint account in state bank of India

Both of the holder can apply for the scheme

Hi Muthu,

Only the first account holder can apply through a joint account.

I Want join in this and Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Suraksha Bima Yojana and Atal pension Yojana through my SBI bank , May I know the process. And my mother(46) and father(55) having joint account is there any chance to have above 2 bima schemes on there both names.

Hi Naresh,

You can apply for PMJJBY & PMSBY through net banking platform of SBI or by visiting a nearby branch. Also, only the first account holder can apply for these schemes through a joint account. For APY, you need to visit the nearest POP – SP – https://npscra.nsdl.co.in/pop-sp.php

Can I apply this scheme through my friend’s account…

No Naresh, that is not allowed.

Hi

How can I enroll both the insurances via sms of SBI account? Please assist.

Thank you.

Hi Surjya,

SBI’s SMS number is not yet available for these schemes. I’ll try to find out today whether they are servicing these schemes though SMS or not.

Sir, can i opt out from PMJYBY in future,if yes what is the process?

Hi,

PMJJBY is a term insurance scheme, which is to be renewed every year. If you do not renew it next year and instruct your bank to stop auto debit of premium, then you are out of its purview.

Kyunki mujhe apni aagai futuredeakhna hai

Sir,I want to enrol in PMSBY with Bank of India through a SMS till 31 May,2015.How can I do this?

Though May 31 has passed, I still do not have the SMS details of Bank of India for PMSBY.

Why no provision of maturity amount payable. ?

People who have paid 330 ×15 , 20, 30 years should get some maturity value with cumulative bonus.

Other wise this scheme appear s to be fit insurance company.

It would be a misinterpretation if you think these schemes benefit the insurance companies more than its subscribers. PMJJBY is a pure term insurance scheme and the cost of providing this insurance is very cheap at Rs. 330 per annum. Other plans, in which bonus gets paid, are costlier than PMJJBY with high premiums.

As the last date has passed by can i submit the forms of these Bima in the bank

Last date for these schemes is August 31, 2015, which again can be extended by the government of India.

Thanks Shiv Kukreja

Dear sir ,

The average life expectancy in india is 67 yrs as of date.

the jeevan Jyot yojana is limited only till 55.

that means the insurance cover will be withdrawn at 55.

One pays premium all his youth with NO maturity benefits.

As an independent authority I would like to hear your unbiased view.

Hi,

I think the government has tried to keep the age up to 55 years of age as it is the age by which most children complete their higher education, start earning and become independent. By keeping it 55, the government and the insurance companies have been able to keep the premium so competitive at Rs. 330 and Rs. 12 per annum. No insurance company can provide a life cover of Rs. 2 lakhs for annual premium of Rs. 330.

How to change nominee name thtu sms in axis bank

Hi Prakash,

You need to contact Axis Bank for this info.

Sir ,

if an average person is going to live up to 67 yrs .

he has no justifiable reason to join this scheme.

It appears an eyewash.

What if an average person dies at the age of 35 or 40 ?? This is insurance, taken primarily to cover the risk of dying too early.

Sir. My husband working singapore. He is account in NRI STATE BANK OF INDIA.How Can apply this insurance scheme

Hi Subha,

I am not sure whether NRIs are eligible for this scheme or not.

I want to change the nominee.

How can I do that?

I have enrolled for these services through ICICI bank.

Hi Laxmi,

You need to contact ICICI Bank for change of nominee details.

Hello

If a person is enrolled in both plans of premium rupees 12 hnd rupees 330 respectively and died, in such a case can his or her nominee received claim from both plans. please suggest.

Thanks

Hi Alok,

If a person dies in an accident, only then insurance amount can be claimed under both the schemes.

If a person enroll for both PMSBY and PMJJBY,and if he die at the age of 70 or above it naturally, whether his nominee will get the benefit what has been announced for the scheme

No, nothing will be paid to the nominee beyond the insurance period.

For both PMSBY and PMJJBY scheme ,who will pay the benefits whetherthe bank or insurance company, and any bond is issued to this scheme

Insurance company will pay the sum assured. Acknowledgement itself will work as the certificate of insurance.

dear sir,

what is the last date for submitting application. banker not accepting the application please provide the details.

Hi Nagaraja,

This scheme is valid at least up to August 31st. If your bank is not accepting your physical application, then use net banking or SMS service to apply for this scheme.

Dear sir,

I applied for pradhan mantri jeevan jyoti bima yojna thru online in my Axis Bank A/C but by mistake i put wrong nominee name overthere. My que is Can i change nominee name ?

Yes, you can change the nominee or correct your mistake in nominee’s name.

wht is the procedure for that?

Hi Rajesh,

You’ll have to contact Axis Bank to know their procedure to change the nominee details.

Sir ,

i visited to axis branch to change a nominee name but they don’t know how to change that.

Hi Rajesh,

If the bank itself doesn’t know the procedure to change/update the nominee details, how could we be updated with the same? As this is a new scheme, please wait for a few days more for further info in this matter.

How can I apply this scheme through bank of baroda.?

Through net banking or by visiting their branches across India.

Iam interested for apply PMJJBY&PMSBY Thhrough net banking plat form of SBI.

You can do so. Just log in to your SBI net banking platform and apply for it.

Hello,

My bank doesn’t provide any receiving for both policies. Can this create any problem at the time of claim. Bank employee told me that record of enrollment in both plans will reflect in my passbook and same will be proof of enrollment and help at the time of claim. Please suggest.

Thanks

Hi Alok,

There won’t be any problem in the absence of any receiving. Your application is the proof of your subscription.

i am intersted for apply PMJJBY.when is the last date to apply.how to apply through net banking and mobile services

August 31, 2015 is the last date for subscription, if not extended by the government. Subscription process will depend on your bank whether it is providing these services or not.

OK thank you sir

You are welcome Santhosh!

What is the Canara bank SMS format for PMSRY

For Canara Bank, here is the SMS format – “PMSBY last four digit of your Savings A/c., your DOB (DDMMYYYY), nominee name, your relationship with the nominee” and send it to 9266623333.

For PMJJBY, just replace PMSBY with PMJJBY.

Sri what is last date can I apply now

August 31, 2015 is the last date for these schemes.

Sir can i change the nominee name and bank account in future.

Yes Krishna, you can do so.

What about existing “Janath Personal Accident Policy” of the Insurance Companies ? with a premium of Rs. 15 per 25,000 and age Limit upto 70 years , is not the best ?

I have no idea about this scheme.

Dear Sir ,

We have applied? for PMSBY but my bank records updated name is-Dilip Kumar my all document updated name is-Dilep Kumar Rajput it is possible to change the name?

Regards

Dilep Kumar Rajput

Hi Dilep,

You need to check it with your bank whether you can change the details now or not.

date of birth is 20/04/1965. i am 50 years and one month old. is it possible to join in pradhan mantri jeevan jyothi bima yojana.

Yes Mr. Ali, you can subscribe to PMJJBY.

Sir I have registered through online banking I don’t have any acknowledgement slip how can I get if possible can I cancel my policy will I get my money back also also i doesn’t met with any accidents will i get my money back after 55 years can you clarify my doubts through email provided above

Hi Prashanth,

It is not possible to cancel this policy. Debit entry in your passbook or bank statement is the proof for subscribing to these schemes. Also, no money will be paid back in case you survive the policy period.

Hello, I have registered for the PMJJBY and for my personal reasons i would like to enquire weather it’s possible to withdraw .

No Wayne, it is not possible to withdraw from this scheme.

Hey hi..I want to apply for Pradhan mantri Atal pension yojana..can I get dis n SBI Bank.. plz guide

Hi Sagarika,

Here is the link to the list of servicing POP – SP where these accounts are getting opened – https://npscra.nsdl.co.in/pop-sp.php

good

when i contacted indian overseas bank for joining pradhan mandri jeevanjyothi bima yojana they refused to accept my application,because of i am 50 years and one month old. Moreover they closed the scheme by 30th May,2015. So where can i and in which bank can i join please disclose the complete details.

Regards,

MIR ANVER ALI.

Please check this link for the list of participating banks – https://www.onemint.com/2015/05/12/participating-banks-insurance-companies-servicing-pradhan-mantri-jeevan-jyoti-bima-yojana-pmjjby-pradhan-mantri-suraksha-bima-yojana-pmsby/

Hi , am dinesh. sorry, from recent only i know about this scheme . But there mentioned date has been expired. So i want to know now there is any chance to join this scheme .so may i know complete detail about this.

Hi Dinesh,

August 31, 2015 is the last date to subscribe to these schemes.

can i get myself enrolled for both PMSby and PMJJBY from a single bank account or from different bank accounts of same bank or from different accounts of different banks?

Hi Mr. Singh,

You can subscribe to both these schemes from a single account or from two different accounts as well. But, you cannot subscribe to each of these schemes twice from two different accounts.

Dear sir

My age is 57 ,am I eligible for PMJJBY ?? Please advoice

No Kumar, you are not eligible for PMJJBY.

Sir my uncle age 57 is eligible for pmjjby ? Please do reply

No Apsana, your uncle is not eligible.

Sir ,

I read about PMJJB on one of the link related to it . It stated that there will be termination of assurance on following point.

1. On attaining age 55 years (age near birth day) s

ubject to annual renewal up to

that date (entry, however, will not be possible bey

ond the age of 50 years).

What does this mean ??

Hi Bhushan,

It means the entry age is 50 years, however, you can continue getting a life cover of Rs. 2 lakh till 55 years of your age by paying an annual premium of Rs. 330.

hello sir ….

Dear sir ,

My adhar card date of birth and SSLC certificate date of birth is different.

Hi Sowmya,

You need not submit any of the proofs for subscribing to this scheme.

Is it possible to operate PMSRY through a Private Nationalised Bank like South Indian Bank or Federal Bank. Please help me….

Hi Dhilwin,

Please check this link for a list of banks servicing these schemes – https://www.onemint.com/2015/05/12/participating-banks-insurance-companies-servicing-pradhan-mantri-jeevan-jyoti-bima-yojana-pmjjby-pradhan-mantri-suraksha-bima-yojana-pmsby/

Shiv Ji,

I would like to apply these schemes through HDFC bank… i do remember that SMS from HDFC bank however unable to trace it.

Can i able to enroll through online through HDFC or it is it to be done through Govt bank only – SBI.

Please help.

Also can we enroll for both the plans ..

June 1st, 2015 to May 31st, 2016 is the period for which this scheme will cover all kind of risks to your life in the first year of operation. Next year onwards as well, the risk cover period will remain June 1 to May 31.

… when it says all kind of risk? is this medical insurance type?

Pls clarify.

Thank you.

Vimal

Hi Vimal,

1. HDFC Bank is providing online subscription also for these schemes. Go to the insurance section on HDFC netbanking platform. For SMS subscription, type PMJJBY Nominee Full Name and send it to 5676712.

2. All kind of risks means natural death as well as accidental death risk.

Hi,

I have applied for all the 3 schemes (PMJJBY, PMSBY, Atal Pension Yojana). However, I haven’t received any PROOF that I am insured, i.e. I have NOT received any documentation. Could you please share if the insurance policy documents are directly sent to the subscriber by post or can we download it from the internet?

Regards

Nipun

Hi Npun,

It is a master policy and no additional document will be sent to you for the same. Debit entry in your passbook/bank account statement is the proof of your subscription.

Sir I applied for pmjjby of my uncle on 1 st June and he died on 6 th June whether it is able to claim for insurance or not please tell me as soon as possible

Hi Ashwini,

No claim is admissible for deaths during the first 45 days from the entry date, except for cases of death due to accident – http://www.canarabank.com/Upload/English/Content/terms%20and%20conditions.pdf

sir,..i have applied for this scheme but it has automatically deducted 330 annual plan…if i wasnt got any risk upto 55 years ….my all money was waste….as u r giving replies to all….i would like to change it from 330 to 12…will it possible to change…if not i would like to stop it….what was the procedure pls .

give me a solution

Hi Manikanta,

I don’t think it is possible to change it from PMJJBY to PMSBY. You need to contact your bank to know the procedure to stop it next year onwards.

If a person is enrolled in both plans of premium Rs. 12 and Rs 330 respectively and died (either affected by any disease or naturally ) at the age 54, in such a case can his/her nominee received claim (Rs 4 lac) from both plans ? if not then what amount of claim will be received by nominee ? please suggest.

Hi Suvankar,

Nominee will get Rs. 4 lakh in case of accidental death. In case of natural death, the nominee will get Rs. 2 lakh.

Sir..I have inrolled in both pilicy but ,yet i have not recive any bond from bank…what is the proof for this ,help me please thanks.

Hi Ramesh,

Debit entry in your bank statement/passbook is the proof of your policy.

Hello Sir,

my query :

In PMJJBY, at 48 year age entering a man in this policy, and Rs. 330/- paid upto 55 year age. If he die in 56 year or 60 year (after 55 year), then what will happen? Because the scheme clearly say that amount will cover 1 year only. and renewable amount year to year.

Hi Anup,

Beyond 55 years of age, there is no life coverage.

Sir can u tell me how to change the nomination in both the policies once the policies are made???

Hi Sanya,

You need to approach your bank for the same and they’ll provide you with the form & the formalities.

whether any policy documents sent to subscriber on enrollment of both PMSBY and PMJJBY

Dear Sir,

Accordingly APY, min. age is 18 yrs, but I saw APY circular, in which stated, that other pensions are not allowed. In this condition, an 18 year old candidate will not do any such job in which pension scheme applicable. Please clarify.

Hi Jeetendra,

In case you are covered under any other pension scheme, then you’ll not be eligible for the government contribution.

Sir, In PMJJBY, the claim is possible only after the subscriber’s death?

Yes Surendran.

I have enrolled PMJJY via ICICI bank. Bank has deducted Rs 330 amount from my account. Please suggest how can i get my policy certificate?

Hi Sumit,

Banks/Insurance companies are not issuing any certificate for the same. Debit entry in your passbook/bank statement is the proof of this policy.

please answer my question—A man cover under pmjjby & pmsby both with a premium of rupees 330& rupees 12 respectively of 40 year. he expired in an accident how much amount his nominee get received from insurance company.Can a man insured under both scheme.

Hi Mr. Sindal,

Nominee will get Rs. 4 lakh as the insurance amount in this case.

sir, govt officials bhi PMJJBY aur PMSBY me subscribe ho sakte hai? Kitne saal tak mere account se amount auto debit hoga?

Yes Manjunatha, govt officials bhi PMJJBY and PMSBY ke liye enrol karwa sakte hain. PMJJBY mein 55 years aur PMSBY mein 70 years tak amount debit hoga.

My age is now 50 years 5 months, can I apply for 330 Scheme?

No Piyali, you are not eligible for this scheme.

I have applied for PMJJBY scheme in my bank account (canara bank) but it is not getting enrolled and they told me to update my DOB in my account therefor i submit, xerox copy of my birth certificate and adhar letter and i have update my DOB in my account but still I have not getting enrolled. What is the reason pls answer for it …? How to I enrolled with this pmjj bima yojana.

Hi Moolchand,

You need to check it with the bank officials the reason for such a problem.

Sir,

330 wala palan lena chata hu per ek kanfusion h ki maturity ke bad kitna rupey milange, without death to police holder

Hi Bhavan Singh,

Rs. 330 waale insurance plan mein aapko maturity pe kuch waapis nahin milega.

I applied PMJJY and PMSBY plan for both of my family through ICICI bank account by online deduction of money. Please help me how to download the policy copies?

Hi Ravi,

Banks are not providing any policy copies/documents for these schemes. Debit entry in your passbook/bank statement is the proof of your insurance cover.

Dear sir, please describe if account had been joined with nomini….. then both are can participent ?

No Mr. Jitu, only the first account holder is covered under this scheme.

Dear sir, please describe if account had been joint A/C with Wife….. then both are can participent ?

Namaste sir.

I want to apply for pmjjy is there any document i have to give ? Like good health certificate?

Namaste Karan,

You need not give any document for this scheme. Good Health Certificate would be required if you go for this scheme after 31st August.

Unknowing I have enrolled PMJJBY in my three saving account and simultaneously debited from three saving account so please help or reply me how i will stop the premium in two bank for next upcoming premium…how to write the bank.

Hi Abul,

You need to approach the banks to cancel your auto debit mandate.

One nomnee can get both yojna.

Yes Rahul, nominee can claim insurance amount for both the policies.

Dear Sir,

My father who aged 48 on 24th May subscribed under this policy and on 15 June his account was debited for INR 330/. On 17th June he died due to heart attack. I wish to know whether I can claim anything or not as there was an sms also that he is covered under this scheme.

Regards,

Ritesh Kumar

Yes Ritesh, you can claim insurance amount from the insurance company.

Mr Kukreja

My bank (ICICI) a/c debited of Rs 330 against PMJJY on 1st June where as till this time haven’t received any document. From where I get the confirmation that I’m insured under this scheme & how my nominee claim if any thing happen to me.

how can we change nominee under pmjjby.what we can do if nominee die before applicant

Hi Sanjeev,

You can change the nominee if the nominee dies before the applicant. To know the procedure to change the nominee, you need to contact your bank.

Hi Mr. Krishan Kumar,

Insurance companies are not issuing any policy document against PMJJBY or PMSBY. You need to contact your bank to get the confirmation.

hello sir..if bank do 330 wala insurance without my permission so what can I do??? is it cancel it????

Hi Sonam,

Yes, you can cancel your insurance and file a complaint also against your bank.

Hi, my age is 22 years, if i apply PMJJBY plan on my neme now & can I update my nominee name latter ?

Hi Babita,

You need to have a nominee right from the beginning, but you can change your nominee later.

Hi, Good Day, does this mean that the person has to expire before the age of 70 to avail the benefits of PMJJBY. ? Or is just the enrollment cut off at 70 years or less ?

Hi Ashwin,

PMJJBY is applicable only till 55 years of age. It is the PMSBY which is applicable till 70 years of age. If anything happens between 1st June and 31st May, only then your nominee will get the insurance amount. If nothing happens to you till 55 years of age, then you’ll get nothing under PMJJBY.

last day pmjjby&pmsby

September 30th is the last date for enrolment under PMJJBY & PMSBY.

Sir, money (Rs 330 + Rs 12) has been debited from my savings account for PM life insurance and accidental insurance from Indian Overseas Bank without my consent. What should I do?

Hi Vineetha,

You should first register your written complaint in the bank. In case the bank doesn’t help, you should approach the Banking Ombudsman.

hi sir,

my mother age is 61 year old.

i want pmjjby & pmsby yojana

which yojana 61 year old is perfect.

Hi Suhas,

PMJJBY is not available to 61 years old. You can go for PMSBY for your mother.

Sir,

Mera salary ac.axis bank me he, muje axis bank se direct debit karvana k liye msg aaya, aur mene kar diya, mere ac. Se 12 deduct ho gaye, aur kuchh din bad kera aplicatin cancel ho gaua aesa msg. Mila, aesa kyu hua, 12 rs, refund nahi mila

Hi Khodubha,

Aap bank se pata keejiye ki aapki application kyun reject hui.

My Account debited twice Rs. 330 for PMJJ by Bank. How can I stop for further deduction. Is it possible to credit same amount. Please advice me.

Regards

Lalit

Hi Lalit,

You should approach your bank to reverse the amount deducted for one application and cancel the auto debit instruction for the same.

sir.

1)Agar kisi ka accidental death hota he, to kya dono bima(12+330) ka subidha milega?

2)sirf 330 pe kya facility milta he?

3)can I deactivate the bima anytime from my bank account?

4)or , paisa to kat liya but policy bond kab milega?

Hi Meer,

1. Yes, dono policies ka benefit milega.

2. Rs. 2 lakh ka life cover.

3. Yes, you can do so.

4. Policy bond nahin milega, kyunki ye group policy hai.

sir meri bhabi ka dihant ho gaya sap ke katne se unkey a/c se 12 rupese nahi dbit hue keya clam miliga

Hi Ajay,

Jab account se premium debit nahin hua, to claim amount kaise milega.

if some one die at 50 or 80 who will get this schem after them

Hi Ravinder,

Nothing is to be paid if the insured survives the insurance period.

Namaste Sir, Mera Indian bank Account main Dono bima kelia apply kia tha, par mera account Se kewal 12 ruppes hi debet hua , air dusra 330 kuyn nehi hua please bataye.

ek baat batana chahunga ki mera account main 330 rupes se cum balans he. too kya jubbhi deposit yoga karunga too 330 debit ho jayega?

or ek baat mera abhitak debit nehi hua he. or me usko chancel kardunga too kya 330 debit hojaega .

Namaste Suresh,

Aapke account mein Rs. 330 balance nahin hoga, isiliye bank ne paisa nahin kaata hoga. Iski jaankaari ke liye bank se sampark karen.

pradhan mantri jeevan yogana

Dear Sir,

My age are 50Years and 5 months. I gave the request for the open policy of PMJJBY scheme. The Rs. 330/- has also deducted form my account. Now I wanted to know that suppose I expire naturally in 60 yrs then my nominee will be eligible to receive the Rs. 2 lac or not?

No Mr. Hari Lal, nothing will be paid to you beyond 55 years of age.

Hi Shiv, I would like to ask

1. I am a taxpayer, am i allowed to join PMJJBY or PMSBY schemes?

2. My wife is a home-maker and not a taxpayer and dependent on me, so my being a taxpayer, is she allowed to join these schemes?

3. For how long insurer will have to pay premiums?

Hi Kamal,

1 & 2. Taxpayer or not, you are eligible for these schemes.

3. You’ll have to pay premium for these schemes every year. PMJJBY till 55 years of your age and PMSBY till 70 years of your age.

what happend if i dont died at age of 50.did get the money?

No Angiras, nothing will paid to you if you survive the insurance period.

Can NRIs apply for PMJJBY and PMSBY scheme

No Tarun, NRIs are not eligible for this scheme.

Hi,

There are lot of confusions and ambiguities regarding these plans and policies, for which I require proper information and clarification.

I have already joined Pradhan Mantri Jeevan Jyoti Bima Yojana and Pradhan Mantri Suraksha Bima Yojana through (both yojanas) my savings bank account both at ICICI bank as well as both at Kotak Mahindra bank ,

But I have not received any confirmation mail.

Also, I have not received either any policy details with number or preium paid certificate.

Bank are not guiding me , regarding this.

They are only ignoring these types of queries.

May I know the process– How shall I track my policy details?

How to know the status of the yoganas.. policy numbers.. etc?

If I want to transfer the policies from one bank to another bank , what I should do?

If I want to close the existing policies, what should I do?

What is the website or URL, from where I shall be to view these details?

How can I do online monitoring of these policies?

Could you please inform me the exact procedures?

I am eagerly waiting to receive positive response vial email or via call.

Thanking you a lot in prior anticipation.

With best regards-

Jyoti Debnath.

Mob – 8697443425

Mail id – [email protected]; [email protected]; [email protected]

Hello Sir,

I am a central government employee. My age is 32 years. I already have some other insurance policies for 30lakhs coverage. I would like to take PMJJBY and PMSBY policies. Is my family get benefit from these after my death? and am I eligible or not? Please reply me.

Thank You.

Hi Madhu,

You are eligible to take PMJJBY & PMSBY. Your family will get benefits of all your insurance policies in case of any unfortunate event.

Thank you Shivji.

Sir, Can I apply for both policy’s PMJJBY and PMSBY

sir , my father age is 49 . can he join both yojna ?

I activated 330 plan policy from my Sbi account. Can I get money back (330) by cancellation the plan? Please help me sir.

Dear sir, please describe if account had been joint A/C with Wife….. then both are can participent ?

Sir, i am 22 years old.. I want to stop the auto renewal debit from my axis bank account.. How does it possible or what procedure should i follow to stop the auto debit or auto renewal.. Sorry..it is because if i will not face any accident upto 55-60 years,, then my entire money will be lost.. Thus i want to stop it..

i have joined PMSBY and PMJJBY . my age is 19 years .. If i die at the age of 30 years – natural death . how much sum will be credited to my nominee ?

Sir

Sir how to change enrolment from PMJJBY to PMSBY .

my brother got expired few days before…he had taken this PMJJBY through HDFC BANK kamdlivli west ..I had gone to this branch but they says it will take some time since they are now aware of the procedure to follow and they are not sure also whether nominee will get the benefit or not because my brother was having other policy from LIC

So please guide me sir what shall I do ?

whether my bhabhi ( the nominee ) will get the claim amt or not and what i shall do help her

I have done the 2 policies SBY & JBY from my Sbi bank account. Now if anything had happen in my life. How can I use this policy. .I got only their Reference no. Otherwise nothing to me

Sir,

I am an assistant in a Cooperative Bank and at present dealing with the policies under PMJJBY. We have been issued the Master Policy no as well. I want to know the procedure to find out the proposals booked under the said policy without disturbing the LIC authorities . Please guide

warm regards

Namaskaar sir,

Sabse pahle mai aapka shukriyaada karunga ki is Mahattavpurn Bima Yojna par aap sabhi swalon ke jawab saralta aur satikta se dekar hamaari madad kar rahe hai. Bahut shkriya h aapka.

Sir mera bhi ek ye Prashna h ki maine apna PNB me PMJJBY ke liye May me aavedan kiya tha parantu abhi tak uska Premium nahi kata h. Bank se puchne par veh koi mukkamal jawab nahi de paa rahe h aur dubara Enrollment karne par is Yojna me pahle se hi enrolled batlaate h lekin koi deduction nahi ho pa rahi h.

Kripya koi Sujaav dijiye.

Dhanyawaad.

Anil kumar

Delhi

Job pmjjy scheme matured ho jayegi meri 55 age pe to wo sare rupees withdrawl kr sakenge kya plz reply

hello sir.. My father has expired on 2nd oct. 2015 and he had the bima of PMJJBY and and i also fill up all types of forms and submitted in the bank before 1 month but bank doesn’t response me that till when i get the claim..plz tell me which types of action can i take..or i have to wait for more time..

Sir, my father has expired before some time and he had the bima of pmjjby. I have completed all types of fomality. But i didn’t get any respose towards the bank.. I have waiting since october. Please tell me how much time it required to give me claim..?

how can i cancel PMJJBY

Sir, I have submitted claim for my brother and about 45 days already gone but there is no reply or no credit in nominee’s account

so please guide me what to do and also please let me know normally how much it takes to settle the claim

Hi sir,

my father open PMSBY 24 July 2015. my father death due to suicide he had done on 28 nov. can i claim for policy?

Hi sir,

my father opened PMSBY 24 july 2015.my father death due to sucide he had done 28 nov. can i claim for policy?

Ya its applicable for death due to any reason. If u have that acknowledgement u can apply for claims.

Yes.insurance applicable in any death

I have lost my mother on Nov 3rd and applied for pmjjby scheme claims on last month but I’m not getting any information regarding claim status. So in which web Id I should get information abt status

My wife death in13.9.17.my wife pmjjby policy claims all documents submitted on account holder branch at 25.9.17.but still not respond and how to check claims process!

Maine complen 05_12_2015 ko claim kiya tha par abhi take Pisa nahi mila hai help kare 9334375990

nice information thanks for sharing with us

Sir I’m sreenu not applyed pmjdy is there any chance to apply now pls tell me 9908093143

i have an account in pmjdy and also have pmsby of rs 12 , what is amount of claim, can we found amount of rs 3 lac (1 lac of pmjdy + 2 lac pmsby)

certificate/any details of insurance not received from bank/company

wow article thanks a lot for sharing with us.

nice article thanks for sharing with us.

Sir,my acknowledge ment slip is loss,what I can do?

It is good to note that there is a entry gate, but there is not a mention of exit gate. Once insured, bank will continue deduction of premium, but, if one want to exit this scheme, there is nothing mentioned about procedure to exit. What does it mean ? Once enrolled, need to be punished for rest of life if not interested in the middle ?

Can anyone exit from these scheme after joining as he / she is alive.

i want to exit from this Pradhan Mantri Suraksha Bima Yojana (PMSBY) what should i do? pl guaide me.

DEAR SIR,

This is Hari Balineni,i have pmjjby with karur vysya bank tirupathi branch with account no-1412166000015102.But iam not getting any insurance bond from your side .please rectify the problem as early as possible.mobile no-9703106862.

1. Need Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) insurance policy Number and policy details as the premium Rs 330 auto debit from canara bank, Sivasagar

2.Need Pradhan Mantri Suraksha Bima Yojana (PMSBY) insurance policy Number and policy details as the premium Rs 12 auto debit from canara bank, Sivasagar.

kindly send both the policy Number & details to E-mail Id given above.

Hello sir would you please exit me from this

Insurance scheme

I already have this Pradhan Mantri Bima Yojana Policy from max insurance for 2 Lakhs. Can i buy normal online term policy from max? Is it ok, if i have 2 life insurance policies from same Insurance Company? Else i want to cancel the Pradahan mantri Bima Yojana Policy.

I am getting SMS from Bank/insurance co. that annual premium for PMJJBY/PMSBY of /Rs.330/12 will auto debited to your a/c.

I was enrolled in this scheme on May 2015. Under this scheme no certificate or Policy No. was received. I contacted my bank (SBI) asked about the issue, but they are not given the certificate from any source, they told my that your pass book is sufficient instead of any certificate.

My query is that after any incident/casualty the family may not aware of the insurance of their family member, then how can the surviving members claim the insurance in the absence of any evidence/certificate/policy no.

It is my appeal that raise the issue with appropriate authority to issue at least e-mail acknowledgement/online policy no. to insured persons so that they can keep it as proof of their insurance.

SULAIMAN

leave me u number

more people want join it

I have an account of “PMSBY ” and “PMJJBY”.

Can i close the account?

Respected sir,

i have applied for both above insurance through my bank account via online

banking and now i want to change it or continue with other bank account of

my own,is it possible to do that and if it is possible then what is the procedure.

please help me

thanks®ards

Raghavendra Prasad M S

+91-8951051014

For these two different schemes amount will auto debited from my two different bank accounts. Please tell me how to exit from this schemes.

I am no more interested in dubious policy. I have opened policy throu my ICICI bank account with auto debit. I have NOT EVEN RECEINVED any policy certificate from ICICI bank.

Mr. Narendra Modi and Ms. Chanda Kochar is looting general public together.

How can I unsubscribe. How do I ask them stop debiting this? Please help.

Maire do account se debit ho gaye he paise kya iska claim double milega ya 1 bank se cancelled karana padega or Jo paisa kata he wo wapas mil jayega

hai sir i have pmjjby , i did’t get any information i want my policy details how i got my deatails

I have been applied for both of yoyr pradhan mantri bima policie bu until toaday I have not recieved the policy Number nor any policy certificate from your side and also not from the bank.

In case if any thing happen to us how we should claim

respected

sir,

I have pmjjby , i did’t get any information i want my policy details how i got my details

REPLY

respected

sir,

I have pmjjby , i did’t get any information i want my policy details .But next year PMJJBY renewal no is SBIJB00132201614709474963,Updated passbook.Please sent the my Policy number & details our this mail, as early as possible.

With regards

Prasanta Maity

REPLY

Sir , im G senthil kumar from chennai (tamilnadu) , I have applied for PMJJBYandPMSBY , from the starting of the policy still yet I’ve not received any documents regarding the policy, how could I get the policy documents, help me sir,

Sir , im G senthil kumar from chennai , I have applied for PMJJBYandPMSBY , from the starting of the policy still yet I’ve not received any documents regarding the policy, how could I get the policy documents, help me sir,

Sir , I have applied for PMJJBYandPMSBY , from the starting of the policy still yet I’ve not received any documents regarding the policy, how could I get the policy documents, help me sir,

I need a Policy mumber

Sir before 15 days ago my father-in-law was dead due to sleep in our local minor. We are not opened any policy, so how will claim any govt help. Pl reply and what is the procedure.

my mob no is 7056845528

Dear sir

please let me know how can I get certificat for PMSBY.

Thanks

hii sir gi may bhi

rupis rs12 per mants 3year pimiyam nomine joy sarkar a/c3926493298

Hi,

I am unable to track Pradhan Mantri Jeevan Jyoti Bima Yojana and Pradhan Mantri Suraksha Bima Yojana .

What is the procedure?

How can I get these details?

I have done these via my savings bank account through online banking.

But I have not received either any confirmation mail or premium paid certificate.

How Can I receive all these details?

If I want to shift these accounts from one bank to another bank, what is the procedure, what should I do then?

If I want to close these policies, what should I do?

If any body can inform me the exact way for obtaining the details, I would be very much thankful.

Best regards-

Jyoti Debnath

Mail – [email protected]; [email protected]; [email protected]

MOb – 8697443425

sir,

this is the 2nd year i renued the policy of pmjjby . but i could not recd

any documents or any thing for this.. the people of your customer care &

near branch people also not given correct information.. so many of customers are face this problem…. pl. give the solution

Halp me sr

How i can check the application status in online after submission of claims form, any link is available for checking the status it was applied through the CANARA BANK , BRANCH: kALPAKKAM.

Pls let me know how it will be checked.

I need lic

Hi sir, my death of birth 30 June 1992, how to apply pmswy..

I am interested in having a policy of pmjjby can anyone help me out with it.

Please suggest the way so that I would enable to apply in this scheme.

How ?

Where to go ?

Regards

Sir

Can I open an account now in 2017.

My sister deaths on 6th dec 2016.her insurenace in pmjjby still we not applied for claim due to bank communication problem.

Still it is possible for applying.

Hi Myself Monojit das.Which procedure i close my pradhan mantrijeban bema yogna….any weblink open for this ??….330 insurance policy.

Sir my brother committed sucide…

Sucidal death eligible for pmjjy?

Please reply to my mail or Mobile [email protected]

9666807980

Can i deactivated my pmjjby ?

my friend experied with heat stroke on 1st June, 2017 he was PMjjy account holder how to apply this scheme

i want to exit from this Pradhan Mantri Suraksha Bima Yojana (PMSBY) what should i do? pl guaide me.

My Contact 9777734249

i want to exit from this Pradhan Mantri Suraksha Bima Yojana (PMSBY) what should i do? pl guaide me

Sir/Madam

My Contact 9777734249

Hi sir pradhana mantri jeevan jothi bima yojana one rupees insurance I will apply that schem please send details to my email Id.