Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) vs. LIC eTerm Plan, SBI Life eShield Plan, Kotak Preferred e-Term Plan & Max Life Online Term Plan

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

People have been very excited about the recently launched social security schemes – Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Atal Pension Yojana (APY). They are flocking to their banks to get more details about all these schemes and get themselves subscribed to these schemes as early as possible.

With a life cover of Rs. 2 lakhs, I think PMJJBY is a great scheme which promises to cover India’s entire population for a low annual premium of just Rs. 330. This scheme is highly suitable to our working population on whom their family members are dependent for their survival and growth. On the other hand, at an annual premium of Rs. 12 for an accidental disability and death cover of upto Rs. 2 lakhs, there is no doubt in my mind that PMSBY is a really cheap mode of getting yourself covered against fatal accidents.

But, if I analyze whether PMJJBY is the cheapest term plan available in the market with an annual premium of Rs. 330 for a life cover of Rs. 2 lakhs, I find that it is not the case if you are a relatively young person, can afford to pay higher premiums and probably don’t mind getting yourself covered with private insurers as well. In other words, there are some better options available in the market as compared to PMJJBY with proportionately lower premiums and higher sum assured.

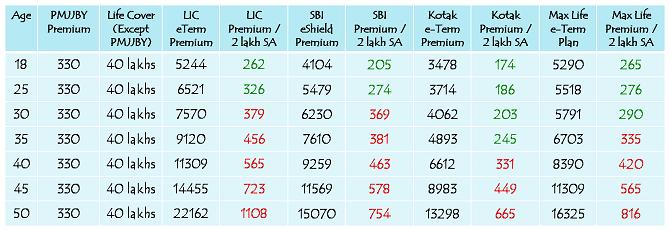

PMJJBY vs. LIC eTerm, SBI eShield, Kotak Preferred e-Term & Max Online Term Plan

Note: All figures in the table above are in Rupees, except Age.

LIC is the most trusted life insurance company in India with the highest claim settlement ratio. It is a known fact and I need not convince anybody about this fact. If you check the table above, LIC’s online term plan – LIC eTerm Plan, is costing Rs. 5,244 and Rs. 6,521 for a cover of Rs. 40 lakhs to a couple of individuals, aged 18 years and 25 years respectively. If I divide Rs. 40 lakhs by 20, I get a cover of Rs. 2 lakhs and if divide Rs. 5,244 and Rs. 6,521 by 20, then I get Rs. 262 and Rs. 326 respectively.

Rs. 262 and Rs. 326 are the premiums I need to pay to LIC per Rs. 2 lakhs of life cover at the age of 18 years and 25 years respectively. I need not emphasize that Rs. 262 and Rs. 326 are lower than Rs. 330 which I would be required to pay as the premium for a life cover of Rs. 2 lakhs when I subscribe to Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY).

As I become older, say more than 25 years of age, LIC starts charging me more for the same life cover of Rs. 40 lakhs. If I am 30 years old, LIC charges me Rs. 379 for a cover of Rs. 2 lakhs and if I am 50 years old, the premium goes up very sharply to Rs. 1,108 for the same life cover. Please note that these are only proportionate premiums and LIC would charge me more if it is to provide only Rs. 2 lakh of life cover.

Similar is the case with SBI Life’s online term plan, SBI eShield. SBI Life charges even less than what LIC charges for its online term plan. For a cover of Rs. 40 lakhs, you need to pay just Rs. 4,104 and Rs. 5,479 if you are 18 and 25 years old respectively. That is Rs. 205 and Rs. 274 respectively for a proportionate life cover of Rs. 2 lakhs.

As you can check from the table above, Kotak Life Insurance provides the cheapest online term insurance among the four companies I decided to select for this comparison. Even Max Life Insurance provides cheaper life cover as compared to LIC, but it is costlier than Kotak Life for all age groups and costlier than SBI Life in some extreme age groups and cheaper in some middle age groups.

So, why PMJJBY is costlier than other Online Term Plans? The answer lies in the fact that every insurance policy has some operational expenses and incentives for the intermediaries which provide services to their customers. All these expenses would be relatively higher for an insurance policy with a lower sum assured and lower premium and relatively lower for an insurance policy with a higher sum assured and higher premium. I think this is the reason why PMJJBY is costlier than other online term plans in some of the age groups.

So, younger age group subscribers would be subsidising older age groups in PMJJBY? Probably yes and rightly so. As you know, in PMJJBY, the premium would remain the same at Rs. 330 for a life cover of Rs. 2 lakhs for all the subscribers aged between 18 and 50 years, and going upto 55 years. We all know that the probability of dying at the age of 50 years or 55 years is way higher than the probability of dying at the age of 18 years or 25 years.

So, ideally the premium for your life cover should be lower at a younger age and higher at an older age, which is there in all other online term plans. But, that is not the case with PMJJBY. In order to keep it fairly simple and beneficial to all the Citizens of India, the government has decided to keep the premium uniform at Rs. 330. Though I do not favour any kind of subsidy and I think either younger subscribers or the government would be subsiding older subscribers in PMJJBY, I think it is a great move to keep it fairly simple and encourage a large population to get associated with PMJJBY.

Service Tax Exemption Advantage – Lastly, I would like to highlight it here that PMJJBY has been exempt from service tax of 14% and that already places this scheme at a slightly advantageous position as against other insurance plans. All other schemes attract service tax and it is included in all the premiums mentioned above in the table.

So, the conclusion of this exercise is that PMJJBY is a great scheme launched by the Modi Government, but if you are a relatively younger subscriber and feel Rs. 2 lakhs of life cover is on a slightly lower side than your actual requirement, then you should opt for an online term plan of a higher value either with LIC or SBI or Kotak Life or even Max Life. Older and eligible subscribers should simply subscribe to PMJJBY as Rs. 330 is the cheapest premium of all for their age groups.

Moreover, I think Pradhan Mantri Suraksha Bima Yojana (PMSBY) is the cheapest accidental death and disability insurance policy and you should definitely subscribe to it. PMSBY covers you till the age of 70 years, as against 50-55 years till which PMJJBY provides you the life cover.

Please share your views about this exercise and also, whether you think there is still a better way of making such comparisons. Your views, suggestions to improve this comparison and critical opinions are most welcome.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Hi

U have done a great exercise.

Thanks

Thanks Mr. Rao for your encouraging words!

How I can apply ?

Depending on your bank, you can subscribe to these schemes online or by sending an SMS to the bank or by visiting the bank branch & filling the subscription form.

The scheme is well intended as it provides some social security benefit to the person or his family, in the event of accidental death or disability, up to a sum of rupees two lakhs. The popularity of the scheme could be judged from the fact that already some 4 crore persons have taken the policies. As the intention was to cover as many people as possible, it entails enormous workload on the institutions servicing the policies. Further, there was a huge recurring burden on the institutions in order to ensure that the policies were renewed every year. It is everyone’s experience that even in the case of high premium policies, one often forgets to renew the policy if not reminded by the insurance company. Considering that the premium collected was only Rs 12 per annum, which was negligible when compared to the administrative costs involved, it would be beneficial to waive the premium altogether and keep every member of the target group covered for the benefits under the scheme, even without having to individually enroll. The servicing institutions could make payments to the affected members or their families, in the event of death or disability, if they belonged to the target group entitled for the benefit.

This would save considerable administrative work and costs involved in collecting the premium and for renewal of policies every year, eventually from some 20 crore policy holders.

Kindly resolve my problem to PMJJBY in PNB my bank

i have so many tried to register by mobile phone but i am received massage INVALID date of nominee .

I think you should check the recorded date of birth with the bank.

Is there any money returned to insurer on maturity of policy? or only death coverage before 55 years only exists? What about the other policies by Lic, state bank, kotak listed in comparison?

All these are term plans and nothing is paid back to the insured in case he/she survives the policy period.

Hello Sir,

I have one Confuge about Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Becuase I have got Message in What’sUp.

The Message is “If Any Person have Allready other LIC Policy and other Company Policy and Other Company Mediaclam then that person is not eligble for this two plane”

is it Right or wrong??

please clear me and provide me proper gideline for purchase this policy.

I have Lic Jivan Anand Policy and New India Insurance Medical So can i eligible for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY).

please Reply me as soon as possible.

Thanks

Regards

Dhaval

Hi Dhaval,

You are eligible for these schemes as well. There is no problem applying for these schemes with other insurance policies in place.

Hello Shiv Kukreja,

I want to exit from both of Policy Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY).

I have to close this policy. which action i follow?

please tell your suggestion as soon as possible.

if you know about exit to this policy please suggest me

Thanks

Hi Dhaval,

There are no exit provisions under these two policies in the running year from June 1 to May 31. You may stop paying premium for your policies from the next year onwards.

Hello Shiv Kukreja,

Bank automatically deduct premium from my account.

so, how to possible to stop paying premium.

please suggest me

Thanks

HI

how can i apply by online these Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY).

and what is the last date of these polocy. it is extended or not

can you please send me web address.

Hi,

You can apply for these schemes through net banking. August 31, 2015 is the last date for applying for these schemes.

Hi Shiv,

Very informative. Thanks for pulling this together.

One Q though: Both PMSBY and PMJJBY are “term” plans? If yes, what’s the term like? I did visit official website but it’s not clear.

For PMSBY, I pay INR 12 per year till the age of 70, and if I encounter no accidents/disability till 70; nothing 71 onwards. Correct?

For PMJJBY, I pay INR 330 per year till age of 55, and if I survive 55; nothing 56 onwards. Correct? Pl also confirm if it is 50 or 55.

Thanks very much,

Vish.

Hi Vish,

1. Term is June 1st to May 31st every year.

2. Yes, 71 years of age onwards PMSBY will not cover you.

3. Yes, 56 years of age onwards PMJJBY will not cover you.

4. 50 is the entry age for PMJJBY, but you can continue it till 55.

DEAR SIR/MADAM

HOW CAN I VIEW MY PMSBY CERTIFICATE IN ICICI BANK.

SUJIT

HYDERABAD

Hi Sujit,

There is no certificate of insurance as such for these schemes. Your passbook entry is the proof of your policies.

Hi…

Kindly suggest about

I have Lic Jivan saral Policy So can i eligible for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY).

Yes Mr. Rajput, you are eligible for these schemes.

Dir sar

pmsby pmjjby apy agent sunil pawar BC code 04001678

jiska paymet abhi Tak nahi aaya Branch kalmukhi uco bank 1345

mobile n. 9977409797

Sir.

iam already join the scheme but I can’t receive any documents pls help me

My address:13/30,n.n.garden,1st,street.oldwashermenpet,Chennai:600021.

My sbi branch:tondiarpet,t.h,road,chennai

Hi sir.

iam already join the pmjjby scheme but I don’t have any documents please post me.

My name: B.shankarlingam.

My address: 13/30,N.N.GARDEN.1st,STREET.

OIDWASHERMENPET

CHENNAI:600021

MY BANK:

STATE Bank of India

TAMILNADU (Branch:tondiarpet)TH,ROAD CHENNAI

Ph:9884132353

Hi sir.

iam already join the pmjjby scheme but I don’t have any documents please post me.

My name: Debashis kolay

My address: Ichapur, Canalside Purbopara, Santragachi

jagachi,

Howrah – 711104

MY BANK:

STATE Bank of India

Dasnagar, Howrah Amta Road, Howrah

respected sir, I am also join pmjjby before 8 month. but I am not get any documents. please gice saggetion

my address. Raju m KOUJALAGI at uttur c/o Indian cane power ltd. ta.mudhol. dist. BAGALKOT. 587313. BANK MUDHOL PHONE. 9741499368

I have take Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) in SBI, Krishnagiri, but till date I have not received document for the above policy, how to obtained this pl. be guide

dear sir

my name is shiva am in live in telangana sir my mother priemiam amount is nill balance am forget the may last week so i loss amount polacy is continue or not but i will pay next year

sir iam already join the pmjjyojna scheme but i cant recive any document pl ease post memy name bedprakash shukla adress bhojpur coloney chas dist ,bokaro jharkhand my bank sbi chas court area