DHFL 9.30% Non-Convertible Debentures (NCDs) – August 2016 Issue

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

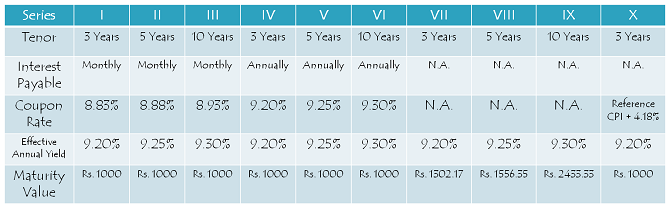

After the successful issue of Edelweiss Housing Finance Limited (EHFL), DHFL, or Dewan Housing Finance Limited, is coming out with its issue of Non-Convertible Debentures (NCDs) from the coming Wednesday i.e. August 3, 2016. These NCDs will carry coupon rates in the range of 8.83% to 9.30%, resulting in an effective yield of 9.20% to 9.30% for the individual investors.

Though the issue is scheduled to close on August 16, it is likely that it will get oversubscribed prior to its closing date. Given a bumper response to the Edelweiss Housing Finance NCDs issue, there should be a reasonably high demand for this issue as well.

Before we take a decision whether to invest in this issue or not, let’s first check the salient features of this issue.

Size & Objective of the Issue – The company plans to raise Rs. 4,000 crore from this issue, including the green shoe option of Rs. 3,000 crore. The company plans to use the issue proceeds for its lending and financing activities, to repay interest and principal of its existing borrowings and other general corporate purposes.

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 9.20% p.a. for a period of 3 years (36 months), 9.25% p.a. for 5 years (60 months) and 9.30% p.a. for 10 years (120 months). Investors will have the option to receive interest on a monthly, annual or cumulative basis.

CPI Linked Floating Interest Rate NCDs – This is the most unique feature of this issue. The company has decided to offer CPI-linked floating interest rate to its Series X NCD investors and there will be a ‘Floor’ as well as a ‘Cap’ on the interest rate. Floor has been set at 8.90% p.a. and Cap at 9.50% p.a. The specified spread will be 4.18% p.a. for Category III & Category IV investors. For the first year, reference CPI has got calculated at 5.02% p.a., so it is 5.02% + 4.18% = 9.20%.

Suppose, we have 4.72% as the reference CPI for the next year. In that case, the rate of interest will be 8.90% for the second year.

Categories of Investors & Allocation Ratio – The investors have been classified in the following three categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue i.e. Rs. 800 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue i.e. Rs. 800 crore

Category III – High Net Worth Individuals (HNIs) including HUFs – 30% of the issue is reserved i.e. Rs. 1,200 crore

Category IV – Resident Indian Individuals including HUFs – 30% of the issue is reserved i.e. Rs. 1,200 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – CARE and Brickwork Ratings have rated this issue as ‘AAA’ with a ‘Stable’ outlook. Moreover, these NCDs will be ‘Secured’ in nature.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will get listed on both the national exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can always sell these bonds on the exchanges.

Demat, Physical Application – Demat account is not mandatory to invest in these NCDs as the investors have the option to apply for these NCDs in physical or certificate form as well.

TDS – Though the interest income would be taxable with these bonds, NCDs taken in demat form will not attract any TDS. The investor will have to pay tax on the interest income while filing his/her income tax return.

Should you invest in DHFL NCDs?

In 2013-14, when G-Sec yield was ruling above 9%, investors were scared to invest in debt securities due to negative returns on their investments. With falling yields on Government Securities (G-Secs) and corporate bonds, interest rates on various investment products like fixed deposits (FDs), post office small saving schemes, non-convertible debentures (NCDs) and tax-free bonds have all fallen by 1% to 2.5% in the last two years or so.

Now, with a fall in bond yields and 15-20% appreciation in bond prices, investors are chasing theses debt investments. But, I think that period of making easy money is over now and it would be very difficult for us to have similar returns going forward. Investors should not expect returns in double digits now on.

That being said, these rates of 9.20% to 9.30% do not attract me much, despite the issue being rated as ‘AAA’ by the rating agencies. I would rather prefer SBI NCDs yielding ~8.50% or Tax-Free Bonds yielding ~7% or equity mutual funds earning an average annual return of 15% or so. Conservative investors should avoid these NCDs and explore other options like post office saving schemes, tax-free bonds, debt mutual funds or other listed NCDs.

Investors, who are not required to pay any tax on their annual taxable income or who fall in the 10% tax bracket or who have high degree of confidence in the execution capabilities of DHFL’s management, can consider investing in these NCDs for a period of 3 years or at max 5 years. I personally avoid longer term investment periods with private companies, so would advise my clients too to avoid the 10-year option in this case.

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in DHFL NCDs, you can reach us at +919811797407

i think issue is not of 400 cr but 4000cr. and it is too big a issue to get return on listing .your comment please

Thanks a lot Amit for pointing it out, I just overlooked this info! I have made the required corrections in the post. I too think there is very little scope of any listing gains with this issue, not only due to its issue size, but also due to lower coupon rates on offer.

is there cumulative option available

Series VII, VIII & IX are cumulative options.

and interest payment dates of all different options please shiv

Interest Payment Date is not announced as yet by the company.

Thanks for yr write up on DHFL NCD whici is exhaustive & informative

Thanks Swaminathan!

interest in x series will be paid monthly or annually shiv and difference between v11 and X series options please

Interest in Series X will be paid annually. Series VII will have cumulative interest and Series X will have annual interest which would be variable and fall between 8.90% & 9.50%.

my agent is giving me 0.70 incentive back on 10 years monthly & 0.60 on 5 years option so even if these ncd list at 993 or below issue price then also I am not in a loss so should I go for it dear shiv

Paying back incentives is illegal as per SEBI, so please do not discuss such things here on this forum.

Hi,

It’s Non Convertible Debentures, instead of Cumulative, right?

Hi Swati,

That’s right, it has been corrected now.

thank u Mr.Shiv for detailed review once again. Kudos to your good work.

well i have applied for few NCD in 5 years monthly option.

regards

abhinav .

Thank you Abhinav!

Dear Shiv,

pls explain what is the meaning of effective yield , as in case monthly interest for 5 years is 8.88% but effective yield is 9.25% .pls explain in brief.

thanks

Effective yield of 9.25% incorporates the compounding effect of 8.88% / 12 payable monthly.

bse site is showing 3 times issue has been subscribe til now please comferm thi shiv and how many times on nse this issue has been subscribe till now because I will be subscribe this issue on the basis of till 2am supscription figures so please give latest supscription figures please shiv

At 1 p.m., it is subscribed 1.31 times. The issue should get oversubscribed today itself.

Hi,

Is there any possibility for listing gain ?

Hi Jainidhi,

There is a good probability that these NCDs will list at a premium. But, the premium will not be very high.

today’s supscription figures please and what percentage of allotment would retail can get invester can get shiv

Its oversubscribed overall. Its oversubscribed in all categories except category 2. But 30 more mins to go…

Day 1 (August 3) Subscription Figures:

Category I – Rs. 4,947.80 crore as against Rs. 800 crore reserved – 6.18 times

Category II – Rs. 2,666.03 crore as against Rs. 800 crore reserved – 3.33 times

Category III – Rs. 9,321.69 crore as against Rs. 1,200 crore reserved – 7.77 times

Category IV – Rs. 1,856.08 crore as against Rs. 1,200 crore reserved – 1.55 times

Total Subscription – Rs. 18,791.60 crore as against total issue size of Rs. 4,000 crore – 4.70 times

Shiv,

Cumulative Demand Schedule page is blank in BSE.. http://www.bseindia.com/markets/publicIssues/DisplayIPO.aspx?id=1154&type=DPI&idtype=1&status=L&IPONo=1227&startdt=8%2f3%2f2016

So how did u get BSE + NSE category-wise details?

Yes Chaitanya, above figures are total of BSE & NSE category-wise.

Extraordinary subscription numbers these are. Huge liquidity available in the markets right now, both in stock markets as well as debt markets.

yes.. do you know if any more NCDs are expected in near future?

SREI Infra NCDs issue will hit the markets sometime this month.

tremendous response to a huge issue dear shiv I have applied for 65 ncd so what would be my allotment

You will be allotted approximately 42-43 NCDs.

I have applied 40 so ho many will I get ? Is it 8

Hi Pradeep,

You should get 26-27 NCDs allotted.

is this issue is closed or can we apply tomorrow in retail category and how much allocation we accept if we apply tomorrow

I don’t think you will get any allotment if you apply tomorrow.

Thanks Shiv for the informative updates.

Thanks Jainidhi!

DHFL NCDs issue will get closed today i.e. August 4, 2016, at 5 p.m.

Hi

Can you please explain term ” Secured ” on practical terms.

Thanks.

Aalok Arya

today’s subscription figures please

Day 2 (August 4) Subscription Figures:

Category I – Rs. 4,947.80 crore as against Rs. 800 crore reserved – 6.18 times

Category II – Rs. 2,666.03 crore as against Rs. 800 crore reserved – 3.33 times

Category III – Rs. 9,222.36 crore as against Rs. 1,200 crore reserved – 7.69 times

Category IV – Rs. 1,814.85 crore as against Rs. 1,200 crore reserved – 1.51 times

Total Subscription – Rs. 18,651.04 crore as against total issue size of Rs. 4,000 crore – 4.66 times

The issue stands closed today.

how can subscription category IV of 1st day of 1.55 times becomes 1.51 times on 2nd day??

it should increase or steady but not going to decrease sir??

Reply awaited

Hi Vishal,

This could be because of technical rejections, modifications/withdrawal of applications.

if your retail supscription

figures is correct shiv then we could get allotment 60 percent if applied on second day please correct me if I am wrong

Hi Nitesh,

2nd day applicants will not get any allotment.

those who applied for 100 debentures will approximately get 65.

Thanks Dr. Bhatia for your inputs!

dear shiv please clear our doubts regarding second day supscription figures

Due to the small savings rate cut, we, Senior Citizens are constrained to go in for such investment options to get an interest rate of about 9%.

Hi Mr. Parthasarathy,

Senior citizens are there in each & every country. India is the only big economy where you get such high rates. One should take these opportunities with both hands. Rates should fall more here if India needs to grow.

Does any no the portion of allotment ?

I have applied for 200 NCD’s how much allotment will i ge t?

130 approx

Thank you for the response

Hi JD,

You should get around 133-134 NCDs allotted.

Thank you Shiv.

You are welcome JD!

can we have complete article on security traded on clean price & yield w.e.f 8/8/16 on bse. circular no 20160725-14

if i sell tax free bond today and accrued interest is credited in my bank a/c . then this interest is tax free or not for taxation point

Interest received post allotment is always tax-free with tax-free bonds.

Hi Vishal,

I’ll try to cover it in a few days.

according to today’s et paper nhai will issue tax free bonds in 2016 so is this true and can retailers can subscribe this issue or not dear shiv

I don’t think NHAI will issue tax-free bonds and if at all they will be allowed to do so, it will be done on a private placement basis.

any idea when will the NCD wld be credited in our demat ac

Hi Abhinav,

DHFL NCDs should get credited by tomorrow evening.

I didnt get allotment still. no refund also. Applied 1st day. Should I wait further or contact Karvy?

I heard of SREI Infrastructure Bonds coming up around 20th August ?

Ne update on the same?

please use common sense ..

on 20th august saturday how srei ncd start ???

Please take some English reading classes tuition and then reply

I have said that i just heard it and used the word around 20th august.

Google the around word and then come back.

Increase your common sense first then give advice.

Hahaha chill guys..take it light..

when will be the allotment ? will the listing be atleast 2 % ?

45 out of 65 alloted to me

dear shiv

Where did you see the allotments ? received any SMS ?

Have u got credit in ur de mat ac. Me still not got any??

i have applied for 840 lots

18003454001 toll free number of Karvy give your pan number or application number they will confirm you whether you have alloted or not abhinav

Ok.thanks. have the same been credited to your demat ac??

allotted 137 against 200 application…………

when is the listing dear shiv??

Hi Guys;

Have you received refunds of the partial amount from DHFL. By when do they show up in the investment portal; i.e the share registrar process for allotment is completed?

Hi Sunil,

Allotment/Refund process has completed. NCDs should soon get reflected in your demat account as they get listed tomorrow.

according to business line dhfl to raise another tranchee of ncd of about 10 thousand crore we can accept good allotment in that isue isn’t it shiv

Hi Nitesh,

Subscription/Allotment will depend on the rate of interest offered by the company as the issue details get announced.

DHFL NCDs to get listed on the BSE & the NSE tomorrow i.e. August 19th – http://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20160818-11

Here are the BSE and the NSE codes for the same:

8.83% 3-year NCDs – Monthly Interest – BSE Code – 935794, NSE Code – N2

8.88% 5-year NCDs – Monthly Interest – BSE Code – 935798, NSE Code – N4

8.93% 10-year NCDs – Monthly Interest – BSE Code – 935802, NSE Code – N6

9.20% 3-year NCDs – Annual Interest – BSE Code – 935806, NSE Code – N8

9.25% 5-year NCDs – Annual Interest – BSE Code – 935810, NSE Code – NA

9.30% 10-year NCDs – Annual Interest – BSE Code – 935814, NSE Code – NC

9.20% 3-year NCDs – Cumulative Interest – BSE Code – 935818, NSE Code – NE

9.25% 5-year NCDs – Cumulative Interest – BSE Code – 935820, NSE Code – NF

9.30% 10-year NCDs – Cumulative Interest – BSE Code – 935824, NSE Code – NH

9.20% 3-year NCDs – Floating Rate Annual Interest – BSE Code – 935828, NSE Code – NJ

Deemed date of allotment has been fixed as August 16, 2016. Annual interest will be paid on August 16th every year. Monthly interest will be paid on 16th of every month starting September 16th, 2016.

Will the listing gain atleast 2 % ?

I don’t think there should be a listing gain of 2%. It is not justified to have this kind of listing gain. But, I won’t be surprised either if it is there.

9.3% bond price is almost at par 1000 on nse. ?

Yes Manoj, that is due to low coupon rate these NCDs are carrying. These NCDs are good for long-term investment if you expect interest rates to go down further in future.

thanks.

I’m holding 500 EHFL 10%.

Also bought 61 DHFL 9.3% on listing day. I can buy more approx 340 NCD’s.

which one i should buy?

or i should buy any other NCD?

please suggest.

despite issue got good response from all categories why listing in all series is not good dear shiv ecl finance ncd Ten years monthly interest is trading at 1037 and dhfl n6 monthly interest 10 years is trading at 993 well below the issue price inspite dhfl is a tripple rating company why such a huge difference I can’t understand dear shiv

i think indiabulls ncd and dhfl ncd will coming in future increases supply. shivji please give expert comment

Hi Vishal,

I didn’t get your query. Can you plz reframe your comment?

EHFL 10-year NCDs carry 9.57% coupon rate, while DHFL 10-year NCDs carry 8.93% coupon rate. Moreover, Rs. 1031.90, at which EHFL 10-year NCDs are quoting on the BSE, includes 35 days accrued interest. ‘AAA’ rating matters, but not much in this case as Edelweiss is a bigger group as compared to DHFL.

Link to check allotment status – http://kosmic.karvy.com:81/ipotrack/

From 29th August Another DHFL bond series is comming ?

Whats your review on that ?

Any specific reason for back to back NCD bonds from DFHL ?

Hi JD,

Please check – https://www.onemint.com/2016/08/26/dhfl-9-25-non-convertible-debentures-ncds-august-2016-tranche-ii-review/

9.10% for 3 year’s 9.15% for 3 year’s and 9.20%

for 7 years both anual amd cumulative option there is no monthly options for 10 years this time correct me if I am wrong dear shiv

9.25% for 7 years dear shiv a little correction in my previous coment

Hello shiv. Do you have any idea about dhfl’s upcoming Rs 10000 crore ncd issue?

why is the issue opened at end of month. Salaried people cannot apply.

Here is the issue details.

http://www.indiainfoline.com/article/news-top-story/dhfl-to-open-proposed-secured-ncd-public-issue-on-29th-august-2016-116082600308_1.html

also no cumulative option apparently in this issue.?

Dhfl series N6 trading at 992 on nse below face value it’s a good buy at current levels.

DHFL 9.25% Non-Convertible Debentures (NCDs) – August 2016 Tranche II Review – https://www.onemint.com/2016/08/26/dhfl-9-25-non-convertible-debentures-ncds-august-2016-tranche-ii-review/

I wanted to know the taxability of NCDs.

If I hold cumulative NCD for more than one year and sell in the market, what will be my interest income/capital gain or both.

when will be allotment of dhfl ncd–29/08/16

Indiabulls Housing Finance Limited (IHFL) 9.15% NCDs Issue – https://www.onemint.com/2016/09/12/indiabulls-housing-finance-limited-ihfl-9-15-non-convertible-debentures-ncds-september-2016-issue/