Also read about the REC Infrastructure bonds here or the IDFC Infrastructure Bonds Tranche 2 here.

The IDFC Infrastructure Bond post has thrown up some interesting questions from readers which were not part of the post itself, and while I am replying to them in comments – I thought I’d do a fresh post with 5 questions that I thought deserved a post of their own.

1. Is opening a demat account compulsory for investing in the IDFC Infrastructure bonds?

No, it is not.

When this scheme opened there was just the option to invest in it if you had a demat account, but some changes have been made (pdf) and opening a demat account is not compulsory now. You can buy them in physical form also. Their website tells you how to do this.

You can also subscribe to the Bonds in physical form by following these simple steps:

- Don’t fill up the demat details in the application form

- Compulsorily provide the following three documents with the application form:

- Self-attested copy of the PAN card;

- Self-attested copy of a cancelled cheque of the bank account to which the amounts pertaining to payment of refunds, interest and redemption, as applicable, should be credited.

- Self-attested copy of the proof of residence. Any of the following documents shall be considered as a verifiable proof of residence:

- Ration card issued by the Government of India; or

- Valid driving license issued by any transport authority of the Republic of India; or

- Electricity bill (not older than 3 months); or

- Landline telephone bill (not older than 3 months); or

- Valid passport issued by the Government of India; or

- Voter’s Identity Card issued by the Government of India; or

- Passbook or latest bank statement issued by a bank operating in India; or

- Leave and license agreement or agreement for sale or rent agreement or flat maintenance bill; or

Letter from a recognized public authority or public servant verifying the identity and residence of the Applicant.

2. Is the interest earned from the IDFC Infrastructure bond tax-free?

While IDFC Infrastructure bonds may not attract TDS – the interest itself is not tax – free. It’s only the Rs. 20,000 you get reduced from your taxable salary that helps save tax.

3. Has the closing date to invest in IDFC Bonds extended?

Yes, the closing date has been extended from 18th October to 22nd October.

4. When do the bonds start trading in the stock exchange?

After the initial lock – in period of 5 years is over, the bonds will list on the NSE and BSE, and start trading there.

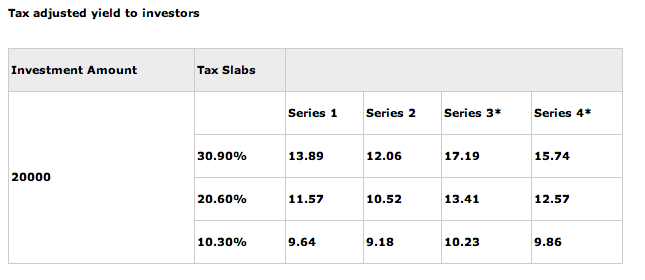

5. Which option has the highest yield?

Yield table from the website. Now keep in mind this is just the yield, the lock in periods differ between various series, and that needs to be taken into account while making your decision, however since my earlier post didn’t have this yield table I am including it here.

Click here to read the earlier review of the IDFC Infrastructure Bond.

Guys,

For Sharekhan demat holders, you will not see the bonds in the DP/SR report where you see the usual demat held scrips. You will see it in NSDL holdings report as Ashutosh correctly pointed out.

I also checked with Sharekhan and they are not going to give any documents for tax proof. They are advicing to use the NSDL holdings report as tax proof.

Will IDFC give for sure? Can someone confirm?

I purchased the bonds throguh JM Financial and have not received any communication as of now regarding the certificated. I also tried the get informmation by sending them email at [email protected], [email protected] but there is no response.

You are right: “Better safe than sorry “.

In fact they should have send the docs by now, but no one has received yet. So please write to let them know that we need the receipts…… :))

That’s a clever idea 🙂

For the clients of ICICIDIRECT, the bonds will appear in your DEMAT account at the icicibank login to your account. So check in ICICIBANK.com.

However you need documents for tax cut purpose. Ask IDFC or write to idfc at the following address:

Investor Contact

The Company Secretary

Infrastructure Development Finance Company Limited

Naman Chambers, 6th Floor,

C-32, G-Block,

Bandra Kurla Complex,

Bandra (East), Mumbai – 400 051

022 – 42222016/ 42222000

022 – 26540354

[email protected]

[email protected]

Thanks a lot Ajay! This is certainly helpful!

Do people need to write in to get the tax proof? Wouldn’t this be sent automatically, or are you taking the better safe than sorry approach?

Hi,

Could you please let us know how to see the IDFC allotted bonds in ICICIDIRECT.

Under which screen?

Hey Subhro,

Where do you see those bonds in demat. I applied through icici direct and i dont see it till date. I am looking under section IPO –> Demat Allocation –> Allocate.

Hi Boarders,

You can see IDFC bond allotment status to your sharekhan account itself via “Reports” => “Transaction Report” => DP => NSDL Holdings => Show.

But I hope they give us a Physical certificate that can be used for tax purposes.

Thanks

Ashutosh

Hi

If any body has been allocated the bonds (through icicidirect), can you please tell me under which screen, are the bonds showing?

my bonds also not reflecting in my demat

Applied through ICICI direct….Yet to get the bond allocated.

Have received the bonds in the demat account finally :()) however still to receive the receipt or physical certificates for claiming Tax cut.

Awesome man – one down – another to go! 🙂

For people who are wondering why they can not see the bonds even after receiving the SMS, I have an update. I applied through ICICI Direct. My ICICI Bank account is linked with the ICICI Direct trading account. I can see the bonds credited in demat section of the bank account.

Thanks Subhro, this will be helpful for guys here. When was the first time you started seeing them – today?

I have applied for IDFC infra bonds but i cannot see them in my IIFL demat account. when I contacted the IndiaInfoline they have no clue. The amount has been deducted from my account. i am worried. Can anyone suggest what should be done. thanks.

As you might have noticed a lot of people haven’t got the bonds in their demat yet, so best thing is to wait and watch. Don’t get worried yet.

Hello ALL,

I got an SMS stating that I have received 4 bonds of IDFC. I am waiting to see when it will reflect in my DEMAT (sharekhan) account. I am sure it will be done soon. Will keep u all updated.

Cheers.

Thanks Sandeep,

Please do let us know when it appears in sharekhan and under what screen. I have applied through sharekhan, but got no sms.

Thanks

Ashutosh

Ashutosh,

I too got an SMS yesterday that I have received the bonds. Do note that the SMS came from NSDL and not Sharekhan, So i don’t think that Sharekhan will send any SMS. I don’t see them in my demat account yet. I will post here when they hit my demat.

BTW, does anyone know if we will get any proof of investment from sharekhan. Some folks here have mentioned ICICIdirect will provide some proof, anything on Sharekhan

Go to Reports->Transaction Reports->DP Tab->DP Statement of Holding. Click Show button against your client ID.

Thank you for taking the time out to post this message here and let everyone know Sandeep!

I can see that IDFC bonds (4 in number) are credited to my demat account. I have checked this online (reliancemoney). I don’t know when/will I get physical bond copies or anything such for claiming exemption

Thanks for the info Nageswara – you’re one of the lucky ones to get the bonds already 🙂 Appreciate your comment.

Nageswar… Can you please tell me where did you see them under Reliance Money… was it under holdings or any other place

I had applied through HDFC, they had given me the acknowledgement copy of the form, May i know when i will get the IDFC Bond Certificate, Will it come through post?

ICICI Direct has told one of our readers that they will send the certificate so I’d expect HDFC to do that as well. Please call them and check with them Basha, as that would give you the most concrete answer.

I received the SMS from NSDL today (15/11) informing credit of IDFC bonds to my demat account on 13/11. I am not yet seeing the bonds in my demat (using IIFL), but I think they will be there in a few days.

Thanks for the info Satish.

I see the IDFC bonds listed online under DP Holdings (IIFL)

INE043D07260 IDFC LTD 4.00

I have also applied for the bonds but still I didn’t get those in my demat account. When can I expect that to be alloted to me?

I don’t think anyone knows the exact date because it’s not been communicated but based on the fact that people have started seeing the security in their demat account I’d expect it to appear this month.

Loney seems to be the only guy receiving. I applied in ICICIDIRECT but don’t see the bonds.

-Ajay

I guess they’re not appearing at the same time for everyone, and there is some process where they are getting allocated gradually to people who applied. Let’s hope everyone gets this quickly Ajay.

Ajay could you please check now and see if you got it because Subhro used ICICI Direct and he seems to have gotten the bonds now?

i have applied for Rs 20K bond by cheque.The money has been debited but demat account has not been credited with bond.can u explain?

Shatadru, not everyone has gotten the bonds yet, so you might have to wait a bit. As far as I know there isn’t any communication about when they will credit it, so everything is guesswork as of now.