I didn’t plan to do a budget post originally because I didn’t feel anything of great interest has been announced, but then Amit left a comment on the Suggest a Topic page, so I thought I’d do one on it anyway.

Leading economist Bibek Debroy (@bibekdebroy on Twitter) tweeted the following earlier today:

Para 196 of budget speech sums up what entire budget is about.

The para says that as a result of the budget there will be a direct tax loss of Rs. 11,500 crores, and an indirect tax gain of Rs. 11,500 crores, so a net loss of Rs. 200 crores.

I don’t think anything really noteworthy took place, and whatever little did take place has already been reported upon quite extensively, so let me take a look at this budget at a higher level, and see how the numbers look like.

Specifically, for this post, I’ll take you through the revenue side of the budget. The Revenue of the government has three components:

- Tax Revenue: This is the revenue raised from taxes like your income tax and corporate tax.

- Non Tax Revenue: This is the revenue the government earns by things like dividends from PSUs, royalty from selling petroleum, spectrum fees etc.

- Capital Receipts: Includes mostly borrowings

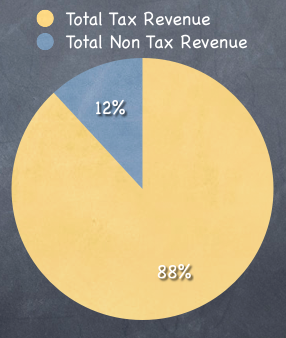

First off, let’s take a look at how the two revenue heads contribute to the government’s coffers.

As you can see the majority of the revenues are generated through taxes, and here is how they’d look like in absolute numbers.

Total Tax Revenues are expected to be Rs. 9,32,439.88 crores, while Total Non Tax Revenues are expected to be Rs. 1,25, 435.12 crores.

I say expected because that’s what the budget is really – it is an expectation of how much the government will earn and spend in the coming year.

I also use crores because that’s the number used in official documents and makes it slightly easier for me to prepare this post. For simplicity – 1 lakh crore is equal to a trillion rupees.

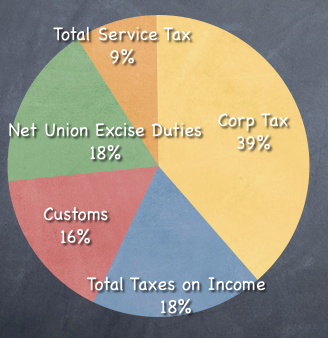

Now that you know how much taxes contribute to government’s coffers – can you guess how much income tax contributes to the total tax collected?

Here is a pie chart that shows the breakup of various tax heads.

As you can see companies pay the largest share of taxes at 39%, and income tax contributes 18% along with excise duties. The next highest is customs with 16%. What this shows is that income tax paid by individuals is actually quite small when you compare it to the other ways the government collects taxes.

This is probably because a very small percentage of the population pays income tax.

Here are the absolute numbers.

| Heads | In Cr. |

| Corp Tax | 359,990.00 |

| Total Taxes on Income | 172,026.00 |

| Wealth Tax | 635.00 |

| Customs | 151,700.00 |

| Net Union Excise Duties | 164,115.66 |

| Total Service Tax | 82,000.00 |

| Total taxes on UT | 1,973.22 |

| Total Tax Revenue | 932,439.88 |

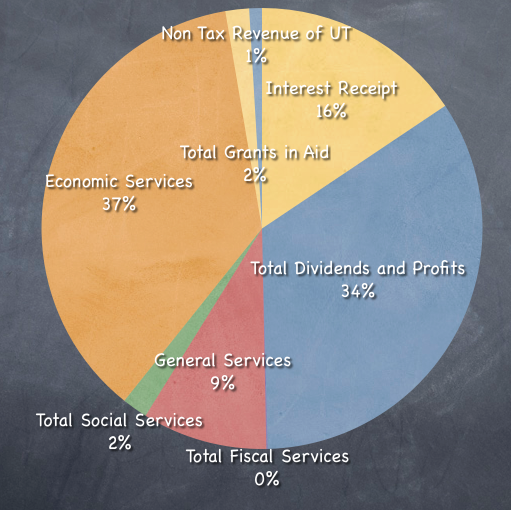

Next up is a look at all the heads of the indirect revenues, and here is how that pie chart looks like.

So, the two biggest contributors are dividends and economic services. Dividends are of course dividends from PSUs like MOIL, and that number will go down in the years to come as disinvestment continues and government continues to reduce their holding in the PSUs. Of course it could happen that some of the loss making PSUs start earning a profit, or that the profit of the existing PSUs become much higher, but I wouldn’t count too much on that.

Economic Services are really dominated by two things – royalty on petroleum products, and spectrum fee that has been generated from the telecom auctions.

So, if you really see the 12% non tax revenue that the government gets is higher this year because of the spectrum auction.

Here are the absolute numbers.

| Heads | In Cr. |

| Interest Receipt | 19,577.78 |

| Total Dividends and Profits | 42,623.68 |

| Total Fiscal Services | 127.82 |

| General Services | 11,494.36 |

| Total Social Services | 2,353.90 |

| Economic Services | 45,915.27 |

| Total Grants in Aid | 2,172.96 |

| Non Tax Revenue of UT | 1,169.35 |

| Total Non Tax Revenue | 125,435.12 |

So, this is how the government “earned” money but like you and me our government has got a credit card as well – that too an international one because it gets money from abroad as well.

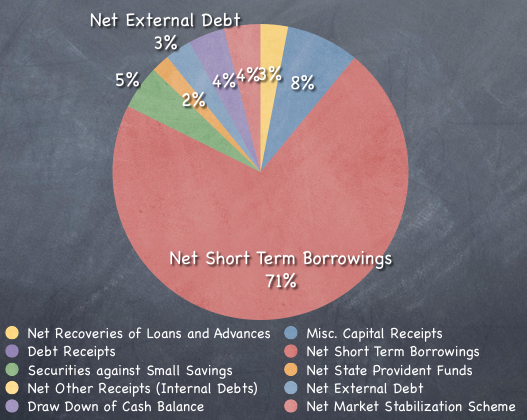

The government gets Capital Receipts and this is part of the revenue as well. These are things like short term borrowings, and external debt.

Most of the borrowing is short term in nature, and the external debt forms only 3% of our total capital receipts which is a good thing because we don’t want to borrow in another currency from foreigners.

Here are the absolute numbers for you.

| Heads | In Crores |

| Net Recoveries of Loans and Advances | 15,020.00 |

| Misc. Capital Receipts | 40,000.00 |

| Net Short Term Borrowings | 358,000.00 |

| Securities against Small Savings | 24,182.46 |

| Net State Provident Funds | 10,000.00 |

| Net Other Receipts (Internal Debts) | (13,865.89) |

| Net External Debt | 14,500.00 |

| Draw Down of Cash Balance | 20,000.00 |

| Net Market Stabilization Scheme | 20,000.00 |

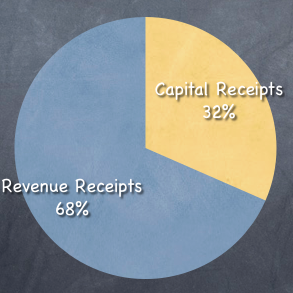

Now, of course you want to see how the capital and revenue receipts are relative to each other.

So, here is that chart.

They project to earn a lot more in taxes and revenues than they project to do via borrowings.

A quick word about these capital receipts is that they include miscellaneous receipts of Rs. 40,000 crores which is really the disinvestment target for the coming year. So, expect to see more PSU IPOs in the coming year.

I have taken all these numbers from the Budget website, which is really fabulous. The website itself is easy to navigate, and the documents are very easy to read as well.

Let me make an honest admission and say that if I were to guess any of these numbers or percentages I would have never been able to guess them correctly. I had vague numbers in my heads, but they were not accurate at all. So, this has been a really good if a very time consuming exercise for me.

How about you? Which of these numbers surprised you the most? I think a lot of people are going to find this information useful, so I’ll request you to share this post on Facebook, Twitter and email, and of course I’m really looking forward to comments on this one, and if you have any specific budget related questions then those are welcome as well!