This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

As the sentiment in the stock market has improved considerably, we are seeing a flood of new initial public offers (IPOs) getting launched. These issues, big or small, are getting lapped up in huge numbers. No IPO has been able to satisfy the appetite of retail investors fully and they are getting left disappointed with no allotment or only one lot getting allotted.

To tap these favourable market conditions, ICICI Bank has decided to sell its 12.63% stake in ICICI Prudential Life Insurance Co. Ltd. and get it listed on the stock exchanges. ICICI Bank will sell around 18.13 crore shares in ICICI Pru Life through its initial public offer (IPO) at an expected price of Rs. 334, thus amounting to Rs. 6,057 crore. This will be the biggest IPO since Coal India’s Rs. 15,200 crore IPO in October 2010 and as it is a big issue, one can expect a better allotment this time around.

But, how good is the company, how is it valued and if it is worth investing in this big IPO either for long term wealth creation or short term quick gains? Before we come to any conclusions, let us quickly take a look at its salient features first.

Price Band – ICICI Life has fixed its price band to be between Rs. 300-334 per share and no discount will be given to the retail investors or ICICI Bank’s existing shareholders.

Size & Objective of the Issue – As mentioned above, ICICI Bank will sell its 12.63% stake in ICICI Life i.e. 18,13,41,058 shares at a price between Rs. 300 to 334 a share. At the upper cap of this price band, ICICI Life will be able to raise Rs. 6,057 crore from this issue. As it is an OFS and no fresh shares will be issued, ICICI Life will not get any proceeds from this IPO.

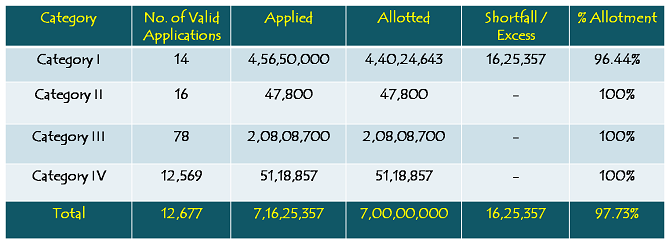

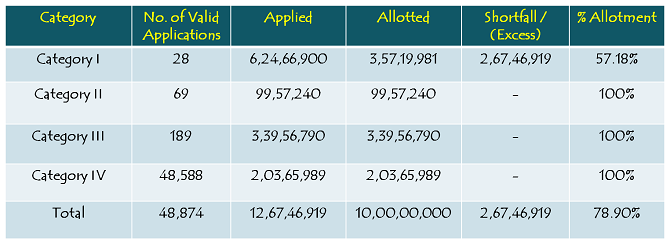

Retail Allocation – 35% of the issue size, after 10% reservation for ICICI Bank shareholders, is reserved for the retail individual investors (RIIs) i.e. 5.71 crore shares out of 16.32 crore shares, 15% is reserved for the non-institutional investors and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

Reservations for ICICI Bank’s Shareholders – ICICI Life has reserved 10% of its shares on offer i.e. approximately 1.81 crore shares for the existing shareholders of ICICI Bank. Such shareholders will be allotted ICICI Life shares out of such reserved 1.81 crore shares.

No Discount for Retail Investors or ICICI Bank Shareholders – Though there is 35% and 10% reservation for the retail investors and ICICI Bank shareholders respectively, no discount will be given to any of such categories of investors.

Anchor Investors – Out of 16.32 crore net issue size, ICICI Life has already roped in some big anchor investors for 30% of its net issue size i.e. 48.96 lakh shares. These investors have agreed to pay Rs. 334 for their subscription, thus amounting to Rs. 1,635 crore. Some big anchor investors include Morgan Stanley Mauritius, Government of Singapore, UTI Trustee Co., SBI Trustee Co., Birla Sun Life Trustee Co., L&T Mutual Fund, Nomura India Investment Fund and Goldman Sachs (Singapore).

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 44 shares and in multiples of 44 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,696 at the upper end of the price band and Rs. 13,200 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 44 shares @ Rs. 334 i.e. a maximum investment of Rs. 1,91,048. However, at Rs. 300 per share, you can apply for 15 lots of 44 shares, thus making it Rs. 1,98,000. Investors opting for the “Cut-Off Price” option can apply for a maximum of 13 lots of 44 shares.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on 21st September. September 29th is the tentative date for such listing.

Here are some of the important dates to consider for this IPO:

Issue Opening Date – September 19, 2016

Issue Closing Date – September 21, 2016

Finalisation of Basis of Allotment – On or about September 26, 2016

Initiation of Refunds – On or about September 27, 2016

Credit of equity shares to investors’ demat accounts – On or about September 28, 2016

Commencement of Trading on the NSE/BSE – On or about September 29, 2016

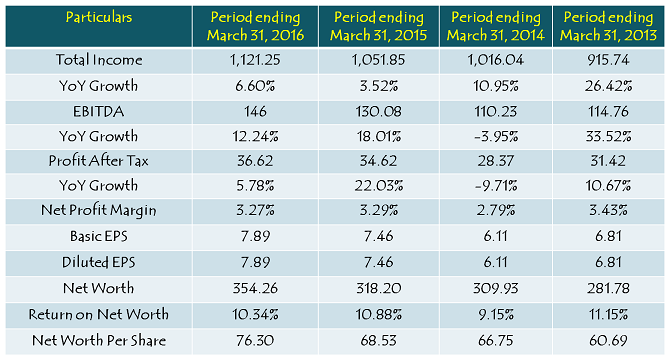

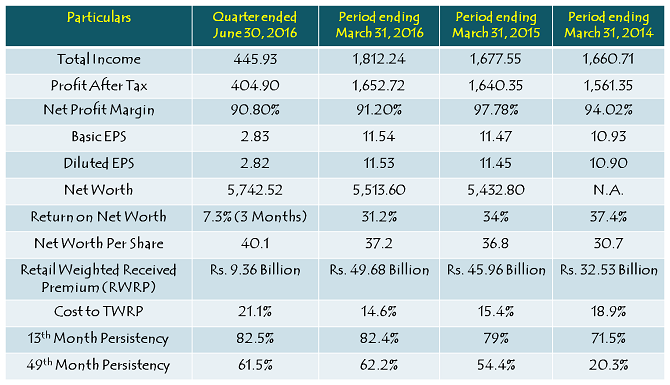

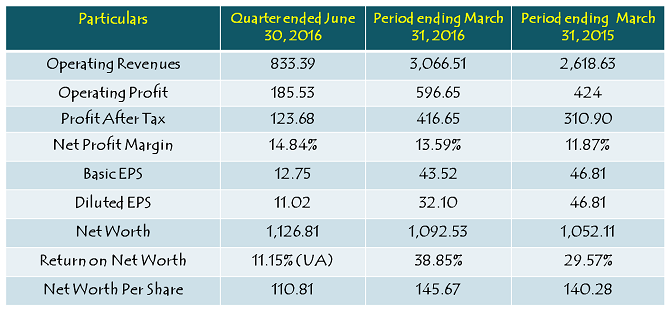

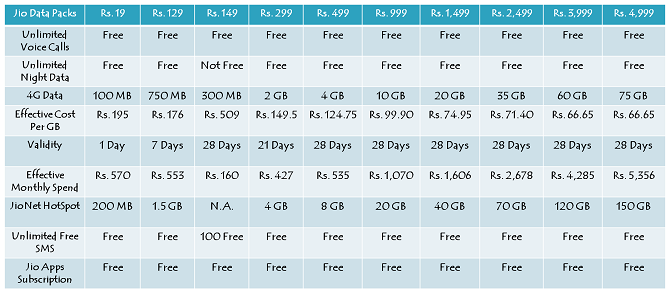

Financials of ICICI Prudential Life Insurance

Note: Figures are in Rs. Crore, except per share data, figures in billions & percentage figures

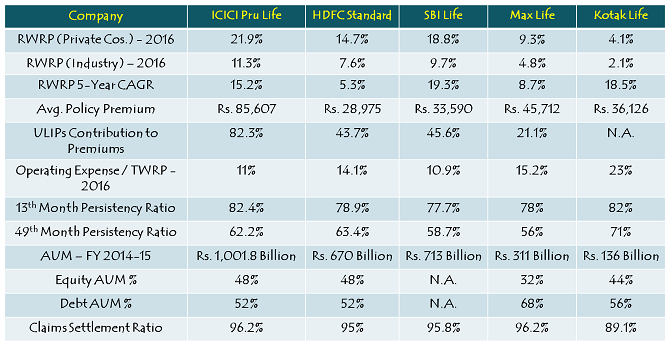

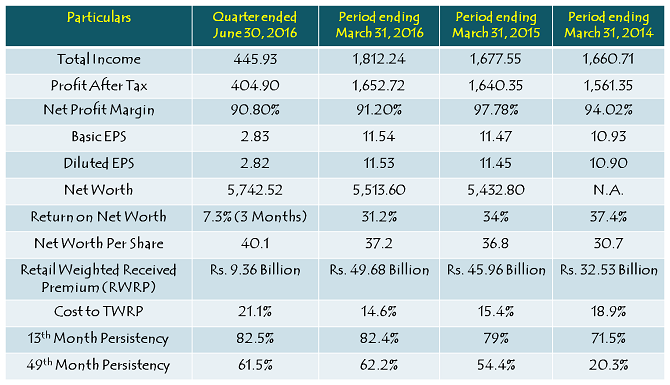

Comparison of the five largest private sector life insurers

Should you invest in ICICI Prudential Life IPO @ Rs. 334 a share?

This IPO doesn’t excite me at all. First of all, I am not a great fan of the way life insurance companies carry out their businesses here in India and probably outside India as well. I think life insurance business should have nothing to do with one’s investments and insurance & investments should strictly be carried out separately.

Investors have hardly made any money with life insurance companies in the first 5 years of their investments. High commissions, high operating expenses and complicated fee & expense structures have always resulted in relatively lower returns for insurance plans. Also, there is no clarity how life insurance companies will expand their reach and operations going forward.

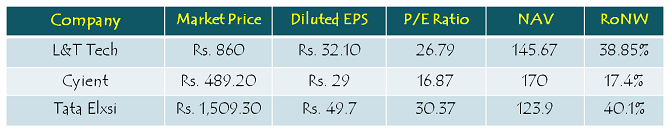

Moreover, this IPO seems steeply overpriced to me. Presently, it is valuing ICICI Life at 29 times based on its FY 2016 earnings. With ICICI Life showing a very dismal growth in its profits in the last 4-5 years, buying its shares at 29 times would be highly unjustifiable.

ICICI Life is a JV between ICICI Bank, holding 67.52% stake and Prudential Corp. Holdings Ltd. (PCHL), holding 25.83% stake. ICICI Bank sold its 4% stake in ICICI Life to Wipro Chairman Azim Premji’s Hasham Traders on November 27, 2015 at Rs. 226.34 per share. Can anybody explain me what has changed in the last 9-10 months to make ICICI Bank seek a 47.57% premium from the general public and other investors?

ICICI Bank reported a profit after tax (PAT) of Rs. 101.80 billion in FY 2015-16 and Rs. 122.47 billion in FY 2014-15. On the other hand, ICICI Life reported PAT of 16.53 billion in FY 2015-16 and Rs. 16.40 billion in FY 2014-15, which is less than 20% of ICICI Bank’s PAT in both these financial years.

At Rs. 334 a share, ICICI Life would be valued at Rs. 47,957 crore and that makes ICICI Bank’s 67.52% stake worth Rs. 32,381 crore. However, at Rs. 267.35 a share, ICICI Bank itself is valued at Rs. 1,55,533 crore. Interestingly, ICICI Bank had a market cap of Rs. 1,05,153 crore when it made its 52-week low early this year on February 26. It clearly shows it is just a turnaround in the investors’ sentiment which has made ICICI Bank seek higher valuations for ICICI Life. Its fundamentals remain intact based on which it doesn’t make any sense for me to invest in ICICI Life at 29 times its FY 2015-16 EPS.

Comparing these financials and giving it a consideration that ICICI Bank is a much bigger company having many other profitable subsidiaries other than ICICI Life, I find no justification for me to assign such a steep valuation to ICICI Life. I would give this issue a miss and advise my clients as well to avoid it.