This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Shriram Transport Finance Company Limited (STFC) is launching its public issue of non-convertible debentures (NCDs) from today, June 27, 2018. This will be the first public issue by the company after a gap of four years. The company plans to raise Rs. 5,000 crore from this issue, including the green shoe option of Rs. 4,000 crore.

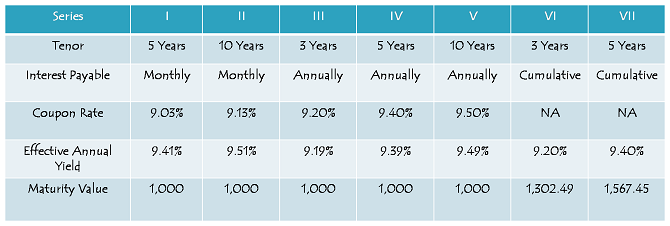

These NCDs will carry coupon rates in the range of 9.03% to 9.50%, resulting in an effective yield of 9.19% to 9.51% for the retail individual investors. The issue is scheduled to close on July 20, unless the company decides to foreclose it.

Before we take a decision whether to invest in this issue or not, let us first check the salient features of this issue.

Size & Objective of the Issue – Base size of the issue is Rs. 1,000 crore, with an option to retain oversubscription of an additional Rs. 4,000 crore, making the total issue size to be Rs. 5,000 crore. The company plans to use the issue proceeds for its lending and financing activities, to repay interest and principal of its existing borrowings and other general corporate purposes.

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 9.50% p.a. for a period of 10 years, 9.40% p.a. for 5 years and 9.20% p.a. for 3 years. These rates would be applicable for annual interest payment only. Monthly interest payment option is available only with 5 years and 10 years tenors, and coupon rates for these periods would be 9.03% p.a. and 9.13% p.a. Respectively.

0.25% Additional Coupon for Senior Citizens – The company has decided to offer an additional coupon of 0.25% p.a. to the retail investors, as well as HNI investors, who hold these NCDs on the relevant record date for the purpose of interest payment.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue i.e. Rs. 500 crore

Category II – Non-Institutional Investors (NIIs) – 10% of the issue i.e. Rs. 500 crore

Category III – High Net Worth Individuals (HNIs) including HUFs – 40% of the issue is reserved i.e. Rs. 2,000 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 2,000 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first-come first-served basis, as well as on a date priority basis, i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – CRISIL and India Ratings have rated this issue as ‘AA+’ with a ‘Stable’ outlook. Moreover, these NCDs will be ‘Secured’ in nature.

Listing, Premature Withdrawal – These NCDs are proposed to get listed on both the stock exchanges, Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can always sell these NCDs on the stock exchanges.

Demat A/c. Mandatory – Demat account is mandatory to invest in these NCDs as the company is not providing the option to apply for these NCDs in physical or certificate form.

TDS – Though the interest income would be taxable with these bonds, NCDs taken in demat form will not attract any TDS. The investor will have to pay tax on the interest income while filing his/her income tax return. TDS @ 10% will be deducted if these NCDs are held in physical/certificate form and annual interest income is more than Rs. 5,000.

Minimum Investment Size – STFC has fixed Rs. 10,000 as the minimum amount to invest in this issue. So, if you want to invest in this issue, you need to apply for a minimum of ten NCDs worth Rs. 1,000 each.

Should you invest in Shriram Transport Finance NCDs?

Shriram Transport Finance issued its NCDs in a public issue four years ago in 2014 at an effective yield of 11% to 11.50%. During that time, inflation was still high, but bond yields and interest rates had just started their downward journey. Now, these NCDs are offering an effective yield of 9.19% to 9.51%. So, if we compare NCDs of the same issuer with its previous issues, there is a material downward shift that has happened. But, if we compare other companies’ coupon rates from their latest issues with that of STFC’s coupon rates, STFC scores over other issuers.

Moreover, STFC is a fundamentally sound company with a long track record of strong income and earnings growth. It also carries a credit rating of ‘AA+’ with a ‘Stable’ outlook. All these factors augur well for this issue and as interest rates on bank FDs are still ruling lower, this issue gives risk-averse investors an opportunity to invest their surplus money into high yielding NCDs.

Application Form of Shriram Transport Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in these NCDs, you can contact us at +91-9811797407