This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

In an attempt to meet its disinvestment target for the current financial year 2016-17, the government of India has decided to launch one more tranche of the CPSE ETF to raise Rs. 6,000 crore by selling its partial stakes in some of the listed public sector undertakings (PSUs). The first tranche of the CPSE ETF got launched during the tenure of the UPA government in March 2014 and it successfully raised Rs. 3,000 crore from various investors. This second tranche is getting launched this week on January 17 and would remain open for four days only to close on January 20.

While January 17 subscription is reserved for the Anchor Investors, retail investors and other non-anchor investors would be able to submit their applications starting January 18. Once successfully allotted, its units are expected to get listed on the stock exchanges on or before February 10.

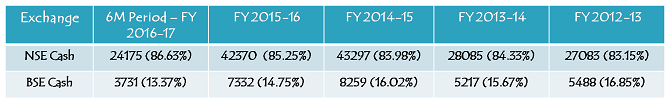

CPSE Nifty Index – It is one of the indices of the National Stock Exchange (NSE) carrying 10 public sector undertakings (PSUs) in which the central government has more than 55% stake and these companies have more than Rs. 1,000 crore in market capitalisation. All these companies are profitable and are either Maharatnas or Navratnas.

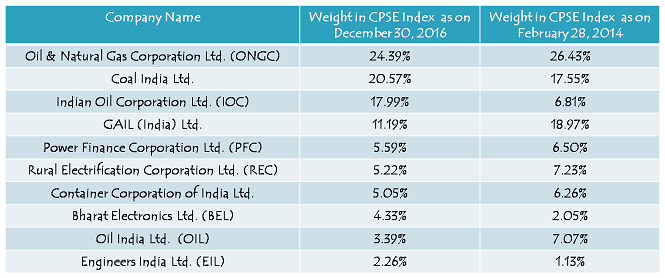

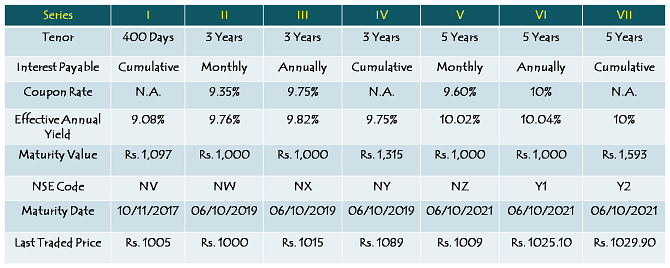

CPSE Index Composition as on December 30, 2016 & February 28, 2014

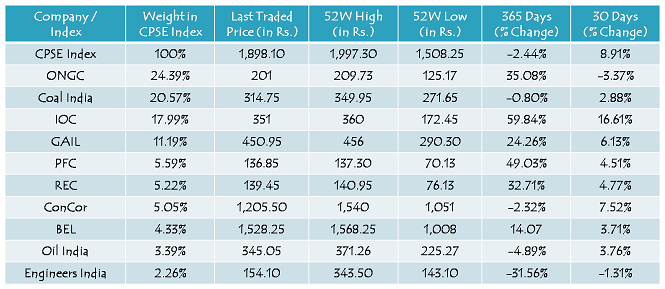

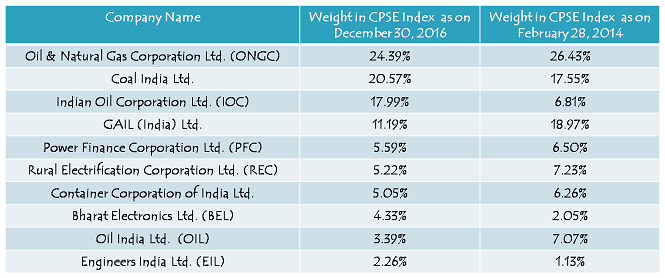

CPSE Index Composition as on December 30, 2016 & Trade Data as on January 13, 2017

CPSE ETF or Central Public Sector Enterprises Exchange Traded Fund – This ETF got launched in March 2014 by Goldman Sachs Asset Management Company and listed in April 2014 on the stock exchanges. While the retail investors got its units allotted at Rs. 17.45, it quickly touched a high of Rs. 29.82 in less than 2 months in May 2014 when there was a euphoria after Mr. Modi took charge to serve this big nation as the PM. However, even after more than two and a half years, this ETF has not been able to cross its previous highs made during that euphoric period and is currently trading at Rs. 26.87 a unit.

FFO Opening & Closing Dates – For Anchor Investors, this fund will open for subscription from January 17 and for non-anchor investors i.e. retail investors, QIBs and non-institutional investors, subscription will start from January 18. This FFO will remain open for four days only to close on January 20.

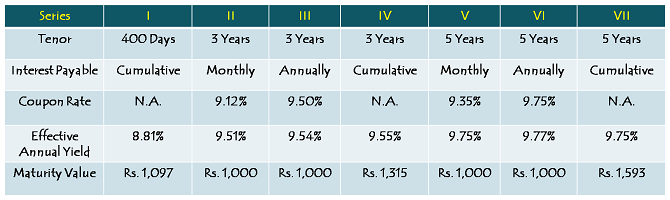

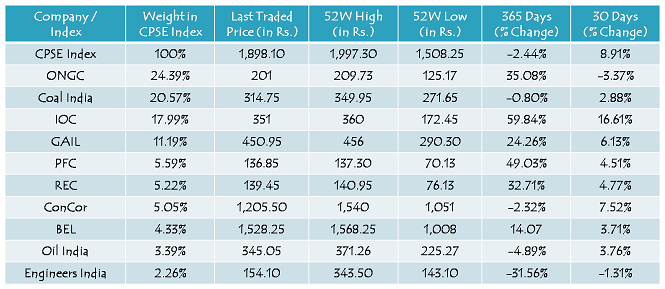

Features of CPSE ETF Further Fund Offer (FFO)

High Dividend Yield & Reasonable Valuations – All the constituents of the CPSE Index are profitable and pay reasonably high dividends on a regular basis. Though high dividend yield does not guarantee positive returns, but it reduces volatility in returns as downside in their market prices gets fairly limited. Moreover, I think these CPSEs are trading at reasonably fair valuations and bold reforms, if taken post elections, could result in unlocking value for their shareholders.

5% Discount for Investors – Like most public offers of government companies, this FFO will also offer a 5% discount to the retail investors as well as other categories of investors. This 5% discount will be calculated on the “FFO Reference Market Price” of the underlying shares of the Nifty CPSE Index and will be passed on to the CPSE ETF by the government of India.

Reference Market Price/NAV – As mentioned above, CPSE ETF is currently trading at Rs. 26.87 on the stock exchanges. This is also its reference market price or NAV. As the investors get allotment and FFO units get listed on the stock exchanges, market price of each unit of this ETF will be linked to the Nifty CPSE Index and its returns would be quite close to the returns generated by the CPSE Index. Investors will get their units allotted post an adjustment of 5% discount offered by the government to CPSE ETF for buying the underlying CPSE Index shares.

Investment Objective – The scheme intends to generate returns that closely correspond to the total returns generated by the Nifty CPSE Index, by investing in the securities which are constituents of the Nifty CPSE Index in the same proportion as in the index. However, the performance of the scheme may differ from that of the Nifty CPSE Index due to tracking error, scheme expenses and the initial discount of 5%.

Unlike NFO, No Loyalty Units in FFO – Retail investors in April 2015 received 1 additional unit as bonus against their investment of 15 units of CPSE ETF, as a reward for being loyal to this scheme for one full year from the date of allotment. However, the current scheme does not offer any such loyalty units this time around and that makes it slightly unattractive to me.

Minimum/Maximum Amount to be Raised – This ETF would target to raise Rs. 6,000 crore during this 4-day offer period, including the green-shoe option to retain Rs. 1,500 crore over and above the base target of Rs. 4,500 crore. However, in case of oversubscription beyond Rs. 6,000 crore, partial allotment will be made to the investors.

Minimum/Maximum Investment Size – Individual investors can invest in the scheme with a minimum investment amount of Rs. 5,000 and there is no upper limit on the investment amount. However, in order to get preference in allotment as a retail investor, you need to keep your investment amount capped at Rs. 2 lakhs.

Allotment & Listing – As per the offer document, units of this ETF will get allotted within 15 days from the closing date of the issue and listing on the NSE and BSE will happen within 5 days from the date of allotment. However, I expect the allotment and listing to happen sooner than these indicative times.

Demat Account Mandatory – As this is an exchange traded fund, the units of the scheme will be available only in the dematerialized/electronic form. So, you need to mandatorily have a demat account to apply for its units. Applications without relevant demat account details are liable to get rejected.

Tax Saving u/s. 80CCG – This FFO is in compliance with the provisions of Rajiv Gandhi Equity Savings Scheme (RGESS) and thus qualifies for a tax exemption of up to Rs. 25,000 under section 80CCG. However, most of the investors would find it difficult to fulfill its two most important conditions to avail this tax exemption. These two conditions are – one, your gross total income should not exceed Rs. 12 lakh in the current financial year and two, you must be a first time investor in equities. Though it is quite difficult to satisfy both these conditions together, people who fulfil both these conditions can avail tax exemption u/s 80CCG by making an investment of up to Rs. 50,000.

Lock-In Period with Tax Exemption – Investors, who seek tax exemption u/s. 80CCG, will be subject to a lock-in period of 3 years – 1 year of fixed lock-in and 2 years of flexible lock-in. The fixed lock-in period will start from the date of your investment in the current financial year and will end on March 31st next year i.e. 2018.

The flexible lock-in period will be of two years, beginning immediately after the end of the fixed lock-in period i.e. beginning April 1, 2018 till March 31, 2020.

No Tax Benefit Availed – No Lock-In Period – Investors who do not avail any tax benefit out of this ETF, would be free to sell their holdings any time they desire to do so. There is no lock-in period applicable to those investors. However, in order to avail long term capital gain tax exemption, it is advisable to hold on to your investments for at least one year.

Entry & Exit Load – You are not required to pay any entry load or exit load with this fund.

Categories of Investors & Allocation Ratio

Anchor Investors – Maximum 30% of Rs. 6,000 Crore i.e. Rs. 1,800 Crore will be allocated to the anchor investors.

Retail Individual Investors – After the anchor book gets over on January 17, retail individual investors are allowed to take up all of the remaining portion of this FFO whatever remains left out of Rs. 6,000 crore i.e. 70% of Rs. 6,000 Crore i.e. Rs. 4,200 Crore + under-subscribed portion of Anchor Investors.

Qualified Institutional Buyers (QIBs) & Non-Institutional Investors (NIIs) – QIBs and NIIs will have nothing reserved for them in this FFO. They will be allotted units of this FFO only if the subscription numbers of the retail investors and/or anchor investors fall short of their reserved quota.

Fund Manager – There has been no change in the fund manager of this ETF. As it was the case with this ETF at the time of its NFO, its 36-year old fund manager Payal Kaipunjal, who is an MBA from Wellingkar Institute of Management and also a Financial Risk Manager (FRM) from GARP University, will continue managing this ETF with further infusion of funds. She has a total experience of 12 years and worked with Benchmark Asset Management Company and then Goldman Sachs India before it got acquired by Reliance AMC in 2016.

Risks

High Exposure to Oil & Gas Sector – CPSE Index has an exposure of approximately 57% to the oil & gas sector, having ONGC, GAIL and Indian Oil as 3 of its top 4 constituents. So, any adverse event for the oil & gas sector might result in a sharp fall in the stock prices of these companies resulting in negative or low returns for the CPSE ETF.

High Exposure to Public Sector Enterprises – Public sector enterprises are often used by the governments to either bridge their fiscal deficit targets or to meet any of their political obligations. Moreover, managements of these companies are often driven by objectives other than value maximisation for shareholders. As their objective of adding value to shareholders gets diluted, it becomes a pain point for the shareholders. So, the investors need to consider this as a big risk for their future returns.

Passive Management – ETFs are passively managed funds and their performance largely depends on the index they track. As CPSE ETF tracks the CPSE Index, its performance will completely hinge on the performance of the constituents of the CPSE Index. So, there is little scope for the fund manager to show her skills in picking high growth stocks and outperform the benchmark index in a significant manner.

Should you invest in this FFO of CPSE ETF?

I covered the NFO of CPSE ETF in March 2014 and recommended investors to invest in it for a few reasons – 5% discount to the investors, loyalty units after holding it for more than a year, depressed valuations of its constituents at that time and most importantly, hope of a strong government at the centre taking bold measures to turnaround these CPSEs and make their managements run them professionally.

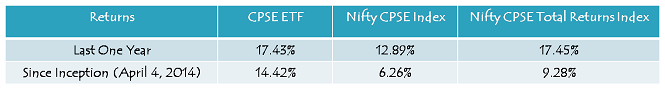

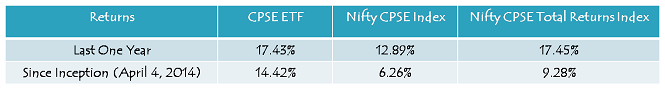

Compounded Annualised Returns as on December 30, 2016

While many factors have turned in favour of these CPSEs and in a way the CPSE ETF investors and we also have a reasonably strong government at the centre with a clear majority, I think we are yet to have desirable results for our investments. I think there is still a lot of scope of making these companies truly competent and add a significant value to their stakeholders. I strongly feel that it is not the job of the government to run many of these businesses and hence most of these companies should be sold to the private players strategically.

This government has recently taken a decision to sell its 26% stake in BEML, after which the government’s stake will come down to 28%. I think it is a great move by the government and I strongly wish to see many such decisions get taken after the upcoming elections in five states. If this government succeeds in increasing the pace of reforms in the last two years, then I think it would not be difficult for these CPSEs to generate 50-100% returns for their investors in the next 2-3 years.

From investors point of view, it would have been great had the government offered issuance of loyalty units in a similar manner as done earlier, but it is still not bad to have a 5% discount. I think running these companies in a professional manner and making their managements accountable for their duty of creating value for their shareholders is much more important than offering loyalty units or any such freebies. I still have high hopes from this government and on the basis of that, I would invest some part of my money in this offer and would advise my clients also to take some exposure to this ETF.

Application Form – CPSE ETF FFO

For any further info or to invest in the CPSE ETF Further Fund Offer (FFO), you can contact us on +91-9811797407 or mail me at skukreja@investitude.co.in