This is a guest post by Priyanka Khandelwal, who is heading eBusiness vertical at MediManage, a specialist health insurance advisory service for Individuals, Families and Corporates. Know more about Medimanage’s free advisory services here.

A quote that is often attributed to the Taxman goes like this: “We have what it takes to take what you have”. And Albert Einstein – the smartest human ever – once lamented, “The hardest thing in the world to understand is the income tax”. Benjamin Franklin goes a step further and says, “In this world nothing can be said to be certain, except death and taxes”. Singer Kishore Kumar is known to have major income tax problems, he said in an interview he used his tax record files as pesticides, because the moment a rat bites on them they would die immediately!

We all share a love-hate relationship with taxes. We know it has to be paid, we know it is used for the benefit of society as a whole, we know its role in the economy, but we still are uncomfortable paying it. As our income increases, the discomfort with rising taxes also goes up. This is where tax saving investments come in. There are a plethora of schemes available, that help you save taxes. Traditionally, Insurance has been known as an important medium to save taxes. So, where does Health Insurance fit in? Let’s see.

Health Insurance and Taxes

The tax exemptions available to Medical Insurance schemes is summed up in Section 80D of the Income Tax Act. For any health insurance policy bought, a policyholder can claim deduction on premium paid for up to Rs. 25,000 (according to Budget 2015). The deduction for senior citizens is Rs. 30,000.

For those very senior citizens (80 years and above) to whom health insurance is not available, any payment made on the account of medical expenditure for such people shall be allowed as a deduction under Section 80D, subject to a maximum limit of Rs. 30,000. This deduction will be given subject to the fact that any premium towards any health insurance is not being paid for such person.

However, total deduction for health insurance premium and medical expenses for parents shall be limited to Rs 30,000.

Section 80D allows for tax deduction from the total taxable income for the payment of medical insurance premium paid by an individual or a Hindu undivided Family (HUF), in any mode other than cash. This deduction is over and above the normal deduction of Rs. 1,50,000 allowed under Section 80C.

The deduction under Sec 80D is allowed for making a payment towards maintaining an insurance policy which:-

In case of an Individual:- Is for the health of the self or the spouse, dependent parents or dependent children, or

In case of HUF:- Is for any Member of the Family.

Amount of Deduction Available

The deduction is to be claimed while filing income tax returns. The deduction is the sum of the following amounts –

In case the payment of medical insurance premium is for self, spouse, dependent children or parents (dependent or not) – Rs. 25000. In case the person insured is a Senior Citizen, the deduction allowed should be Rs. 30,000.

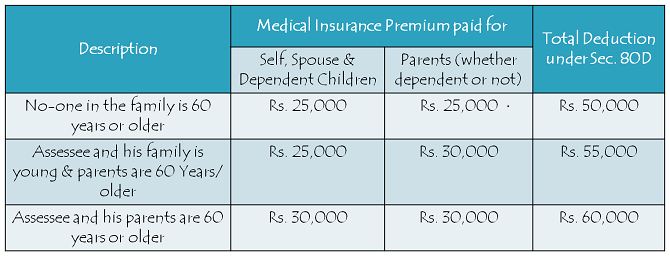

So, the total deduction that can potentially be claimed by a family under Section 80D is as below:

Criteria for claiming deductions

The criteria for claiming deductions under Section 80D by way of health insurance premiums is as outlined below:

* The said policyholder/ tax payer is an individual or HUF (Resident or NRI)

* The insurance premium paid is in accordance with the schemes framed by General Insurance Corporation of India & approved by Central Government.

* The premium has been paid by any mode other than cash.

* It is paid out of taxable income

Proof of payment

As proof of payment, mediclaim receipt has to be furnished while claiming the deduction.

Illustration

During a financial year, a policyholder/ tax payer pays medical insurance premium as below:-

- Rs. 24,000 as premium on his own health policy &

- Rs. 29,000 as insurance policy premium on the health of his parents

In the above mentioned scenario, the assesse would be allowed a deduction of Rs. 49,000 (Rs. 24,000 + Rs. 25,000) in case neither of his parents is a senior citizen. However, if any of his parents is a senior citizen, he will be allowed a deduction of Rs. 53,000 (Rs. 24,000+ Rs. 29,000).

The importance of having a judicious Health insurance cover cannot be emphasized enough. Even if the premiums seem like too high an expense, one should also keep in mind that these premium payments not only help save lives but income tax as well! The limits of deduction by age has to be understood properly before claiming such deduction while filing for returns.

As illustrated above, Health Insurance can also be an important instrument for saving taxes, and should be an inseparable part of one’s tax planning. Albert Einstein would approve. And apparently, so would Kishore Kumar.

If you want to speak to Priyanka’s team of expert advisors for a one-to-one discussion on your requirements, post your inquiry here.