This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at shivskukreja@gmail.com

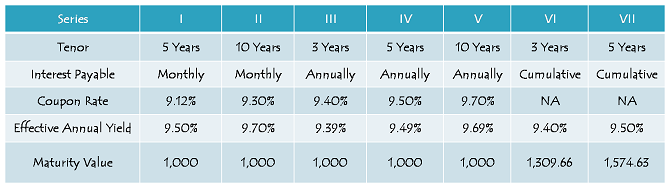

Indiabulls Commercial Credit Limited (ICCL) has launched its public issue of secured redeemable non-convertible debentures (NCDs) from today, September 11, 2018. The issue is rated ‘AAA’ by the rating agencies CRISIL and CARE and will carry an effective annual rate of 9.20% for 10 years, 9% for 5 years, 8.90% for 3 years and 8.80% for 2 years.

The company plans to raise Rs. 2,000 crore from this issue, including a green-shoe option of Rs. 1,000 crore. The issue is scheduled to close on September 28, unless the company decides to foreclose it in case of oversubscription.

As we take a decision to invest in this issue or not, let us first have a look at its salient features.

Size & Objective of the Issue – Base size of the issue is Rs. 1,000 crore and the company will have the right to exercise the green-shoe option to raise an additional Rs. 1,000 crore in case of oversubscription, thus making it a Rs. 2,000 crore issue. The company plans to use at least 75% of the issue proceeds for its lending activities and to repay its existing loans and up to 25% of the proceeds for general corporate purposes.

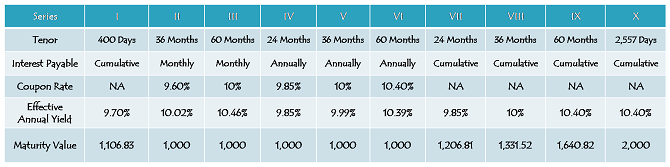

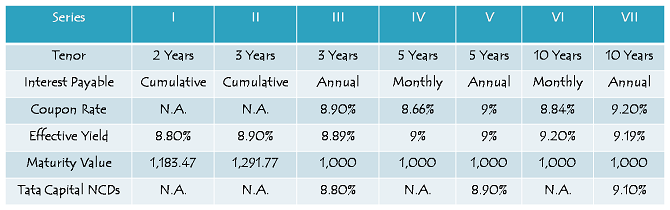

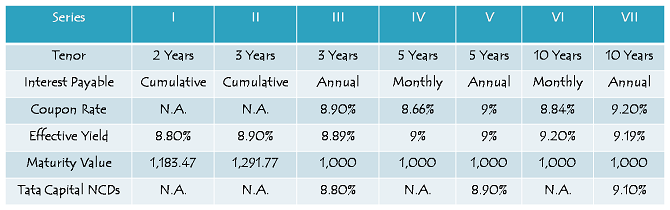

Coupon Rate & Tenor of the Issue – The company is issuing these NCDs for a period of 2 years, 3 years, 5 years and 10 years. These NCDs will yield you a return of 8.80% to 9.20%, with monthly, annual and cumulative interest payment options. Monthly interest payment option will carry a lower coupon rate as compared to the annual interest payment option. You can check the differential interest rates in the table below.

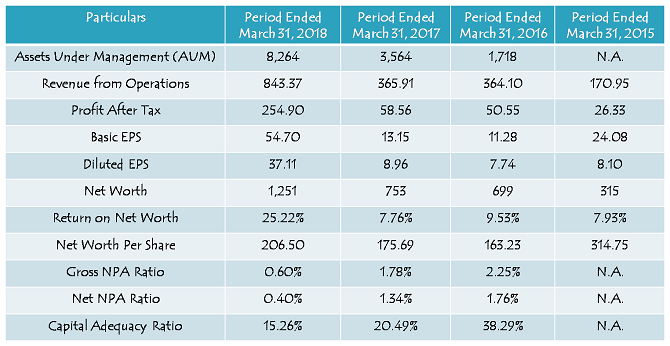

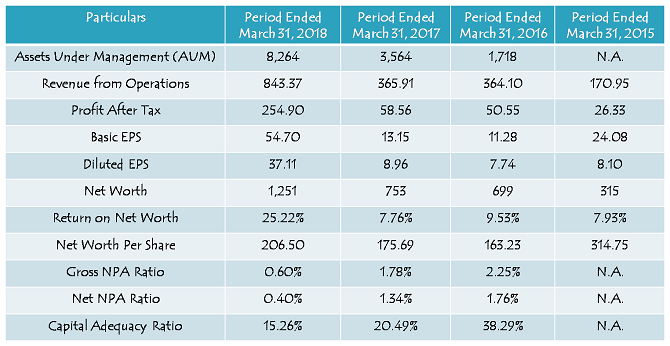

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

Minimum Investment – Investors need to apply for a minimum of 10 NCDs in this issue with face value Rs. 1,000 each i.e. an investment of Rs. 10,000 at least.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue i.e. Rs. 200 crore

Category II – Non-Institutional Investors (NIIs) – 10% of the issue i.e. Rs. 200 crore

Category III – High Net-Worth Individuals (HNIs) – 40% of the issue i.e. Rs. 800 crore

Category IV – Retail Individual Investors (RIIs) – 40% of the issue i.e. Rs. 800 crore

Allotment on First-Come First-Served Basis – Subject to the allocation ratio, allotment will be made on a first-come first-served basis, as well as on a date priority basis, i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – CRISIL and CARE have rated this issue as ‘AAA’ with a ‘Stable’ outlook. Moreover, these NCDs will be ‘Secured’ in nature for all the investment periods, i.e. 2 years, 3 years, 5 years and 10 years.

Listing, Premature Withdrawal Option – These NCDs will get listed on both the stock exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. As there will be no option of a premature redemption, the investors can always sell these bonds on the stock exchanges.

Demat A/c. Mandatory – Demat account is mandatory to invest in these NCDs as the company is not providing the option to apply for these NCDs in physical or certificate form.

TDS – Though the interest income would be taxable with these bonds, NCDs held in demat form will not attract any TDS. The investor will have to pay tax on the interest income while filing his/her income tax return.

Financials of Indiabulls Commercial Credit Limited

Indiabulls Commercial Credit has done an excellent job in growing its assets under management (AUM) from a mere Rs. 1,718 crore in FY 2016 to Rs. 8,264 crore in FY 2018, a CAGR of 119.32% and also its profit after tax from Rs. 50.55 in FY 2016 to Rs. 254.90 crore, a CAGR of 124.56%.

Moreover, it has improved on its asset quality as well. From a high of 2.25% of gross NPAs and 1.76% of Net NPAs in FY 2016, the company has been able to reduce both of these numbers to 0.60% and 0.40% respectively in FY 2018.

Should you invest in Indiabulls Commercial Credit Limited NCDs?

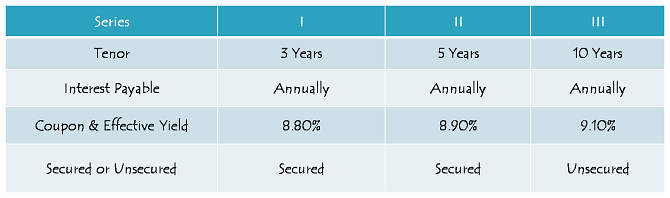

As compared to Tata Capital Financial Services, Indiabulls NCDs would yield 0.10% higher on an yearly basis. However, despite its healthy financials, investors would have more confidence in Tata Capital NCDs as compared to Indiabulls. As I expressed my views for the Tata Capital issue, this issue too carries coupon rates which do not attract me as an investor. I consider these coupon rates, offered by a private company, to be below my expectations.

Again, investors who understand mutual funds, should invest in gilt funds or other debt funds as compared to these NCDs with lower yield. However, conservative investors can consider investing in these NCDs, as it is not easy to find many ‘AAA’ rated issues these days offering coupon rates higher than the bank FDs.

Investors, who fall in the lower tax brackets and are looking for relatively safer options to invest their investible surplus, can think of investing in this issue. Again, I think one should go for the shortest possible time period to invest with a private company. So, either a 2-year option, or 3-year option, or 5-year option should be preferred to invest in these NCDs.

Application Form – Indiabulls Commercial Credit NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in Indiabulls NCDs, you can reach us at +91-9811797407