This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

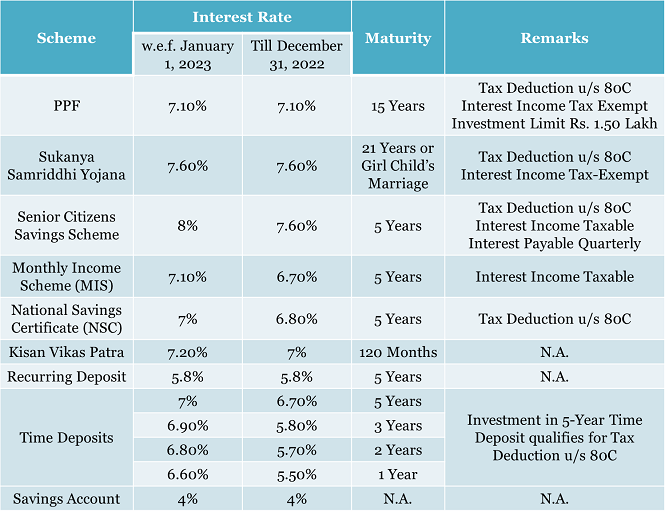

The government has announced the interest rates on Post Office Small Saving Schemes for the January-March 2023 quarter. The finance ministry made this announcement yesterday only through a notification. The interest rates on schemes like the Senior Citizen Savings Scheme (SCSS), National Savings Certificate (NSC), Monthly Income Savings Scheme (MIS), Kisan Vikas Patra (KVP) and 1-5 year time deposits have been hiked in the range of 0.20% to 1.10% per annum.

However, interest rates on the Public Provident Fund, popularly called PPF, Sukanya Samriddhi Yojana/Account (SSA), post office savings bank account and recurring deposits have been left unchanged, leaving many of the investors quite disappointed.

Here you have the table having all the small saving schemes with their applicable interest rates and tax benefits for the quarter starting January 1, 2023:

Public Provident Fund (PPF) – Rate Left Unchanged at 7.10% – Leaving most investors disappointed, interest rate on PPF, the most popular small savings scheme, has been left unchanged at 7.10%. Interest earned on PPF is tax-free on maturity and investment up to Rs. 1.50 lakh gets you tax exemption under section 80C.

Sukanya Samriddhi Yojana (SSY) – Rate Left Unchanged at 7.60% – Government’s pet scheme for girl child, Sukanya Samriddhi Yojana, has also been left untouched with interest rate fixed at 7.60%. So, the gap of 0.50% between this scheme and PPF still exists, which should keep its popularity intact.

Interest earned on Sukanya Samriddhi Yojana is also tax-free on maturity and investment up to Rs. 1.50 lakh gets you tax exemption under section 80C.

National Savings Certificates (NSCs) – Rate Hiked from 6.80% to 7% – There is good news for the investors interested in National Savings Certificates (NSCs) and RBI’s Floating Rate Bonds also, which are linked to the prevailing interest rate on NSCs. The government has decided to increase interest rate offered with NSCs from 6.80% to 7%. So, RBI Floating Rate Bonds, which carry coupon rate of 7.15% till now, will carry 7.35% with effect from January 1, 2023, 0.35% higher than 7% interest NSCs will offer. Your investment in NSCs will keep giving you tax exemption under section 80C.

Senior Citizens Savings Scheme (SCSS) – Rate Hiked from 7.60% to 8% – There is some good news for the senior citizens at least. The interest rate on Senior Citizen Savings Scheme has been increased to 8% from 7.60% earlier. The interest earned on this scheme is taxable for its investors and subject to TDS as well. However, your investment gets you a deduction of up to Rs. 1.50 lakh under section 80C.

Post Office Monthly Income Scheme (POMIS) – Rate Hiked from 6.70% to 7.10% – Post Office Monthly Income Scheme will also have an interest rate hike from an earlier 6.70% to 7.10% p.a. Once favourite with its investors, this scheme has become less favourable now.

Kisan Vikas Patra (KVP) – Tenure Reduced from 123 Months to 120 Months – Your investment in KVP used to get doubled in a period of 123 months till now. With effect from tomorrow, it will take 120 months for it to do the same. This scheme will earn you 7.20% p.a. effectively.

Our take – Though it is a tough thing to digest for the small savers, especially with PPF and Sukanya Samriddhi Yojana in which no changes have been made, I think the government has done it rightly. It is a difficult task to keep everyone happy in the country and at the same time, carry out economic reforms for an overall development.

Inflation and interest rates have been going up for a while now. The government has cautiosly increased interest rates on these small saving schemes, hoping inflation to cool down at some point of time in the near future. This move will send right signals to the global investors that the government is still serious about keeping its borrowing costs and debt levels in check and removing anomalies existent in the system.