This is the next article in my series for investing for beginners (first, and second post), and focuses on asset allocation.

What is Asset Allocation?

Most people start out investing without having a strategy, and invest their money in different assets without necessarily thinking about the distinction between them, and how the risk – return profile vary from one to the other.

Asset Allocation means taking your money, and investing it across different classes of assets like stocks, fixed deposits, commodities like gold, silver, crude etc., postal deposits, provident fund, and of course cash in a certain percentage that helps spread risk.

The way I look at asset allocation is to first have some liquid cash for emergencies stashed away in a savings account, and then start thinking about spreading your investing corpus in other asset classes.

Avenues for Asset Allocation

This is how I think of the major asset classes where you can put your money:

1. Savings account: Savings account give out 3.5% interest per annum, and with inflation rates close to 10%, the real return on this is negative. So, I’d consider this only for emergency funds, and day to day expenses. A lot of you might feel that this is not really an asset class, so just think of this as a placeholder for emergency funds. You can replace this with cash if you like that better.

2. Government of India bonds, Postal deposits: This is an ultra – safe investment class if you are in India, because the bonds are backed by the Government of India. The returns are higher than that of savings account, but lower than that of fixed deposits from banks.

3. Bank and Company Fixed Deposits: You can make fixed deposits with banks or companies, and in general — companies pay a higher interest rate than banks. Fixed deposits with companies are considered to be riskier than banks, so they give you a slightly higher interest rate. In general, I see that the fixed deposit rates are closer to the inflation rates, so you can hope for your money to keep pace with inflation, and over the longer run, have a real return of a few percentage points.

4. Debt Funds: There are plenty of mutual funds that invest in debt instruments, and if you don’t want to go the way of a bank or company fixed deposits because you are interested in investing periodically instead of lump – sum, then you can choose a bond fund.

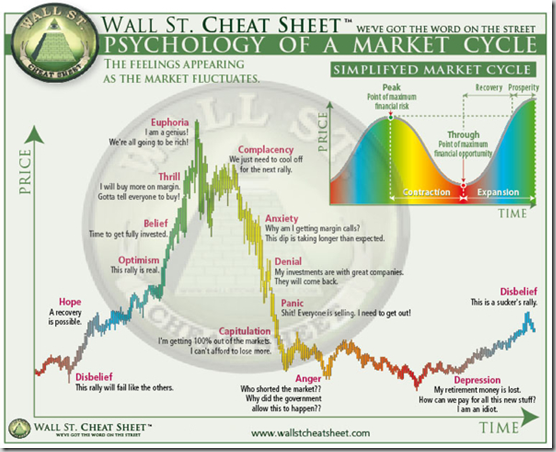

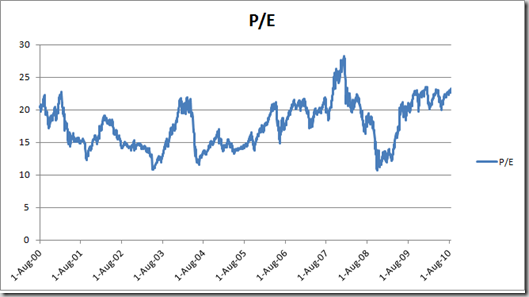

5. Equities: Equities consist of investment in mutual funds, ETFs and directly investing in stocks. This class is the riskiest because there is no guarantee of returns, and in fact a lot of people do lose money in equities. Over the long run however indices like Nifty have given a much higher return than fixed deposits. Again, this doesn’t mean that everyone who invests in equities makes that higher return, if that were the case then there wouldn’t be any need for asset allocation at all. This simply means that if you look at the last ten years or twenty years – Sensex has risen faster than the returns offered by banks, but there has been a lot of volatility which has led to losses as well.

6. Gold: I really don’t know how to place gold in all of this. It is conventionally thought of as a safe haven, but given the recent interest in gold, there is a lot of speculative interest built up on this, and I feel that it is riskier than it once used to be, and would ask investors to treat it with caution.

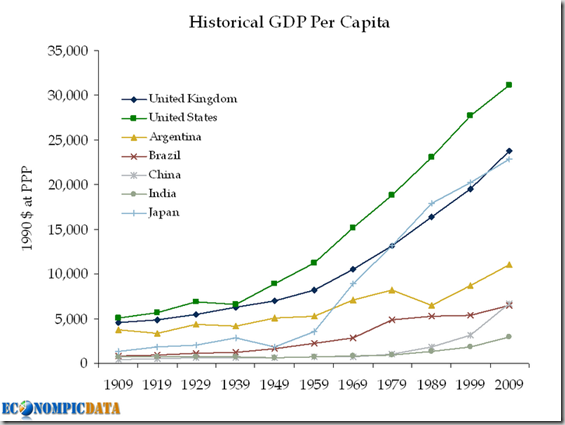

7. Real estate: A lot of people consider real estate as an asset class, when they shouldn’t. Personally, I don’t think that the house you live in is really an asset. If you are still paying an EMI on it, then it is probably more of a liability than an asset. Sure, you are leveraged and if the prices are rising, then you can make some money out of it, but if prices fall, then you are stuck with it as well. This is what happened in the US recently, and Japan in the late 80’s. Real estate prices crashed, and people who were leveraged had a really tough time, as is quite well documented by now.

For me, real estate is only an asset if it is a second house, if it is commercial property or farmland, and is not a place I call home. The real estate mutual funds I have looked in India primarily invest in companies engaged in real estate and don’t directly invest in real estate, so to me, they fall under the umbrella of equity more than they fall under real estate.

Takeaway

These are some asset classes that come to my mind, and each of these can be further broken down, like debt can be broken down into floating rate bond funds, gilt funds or equities can be broken down into large caps, small caps, international equities, gold into gold coins, gold ETFs.

But for now, the takeaway from this post should be understanding that different asset classes give you different risk – returns, and your portfolio should be balanced.

If you have too many stocks then you risk losing a lot of money if the market crashes, as Tony recently told us in his story.

On the other hand – I spoke with a friend yesterday who has all his money in his savings account. The number that he spoke of was quite significant, and he just never got around to doing anything about his savings. And now inflation is eating it up, obviously this is a much better problem than having no money at all, but at some point he will have to face the fact that his real return is negative, and he has to invest the money somewhere.

So understand the importance of asset allocation, and think about your own risk profile, and which of these asset classes interest you.

Once you have determined what your asset allocation should be, the next step is to look at each of these categories, and determine where to invest in that. It is not necessary for one person to invest in all of these categories, so for example – you could have some liquid cash, fixed deposits, and equities, and that way your risk is spread, which is what asset allocation aims for.

The key is to understand that different asset classes have different risk – reward structure, and then build a portfolio according to that.