This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

SBI Life Insurance IPO Details

I covered the details of SBI Life Insurance IPO in my previous post yesterday. In this post, I have tried to cover its fundamental factors based on which we decide whether we should invest in this IPO or not. So, please go through these factors before taking a final decision.

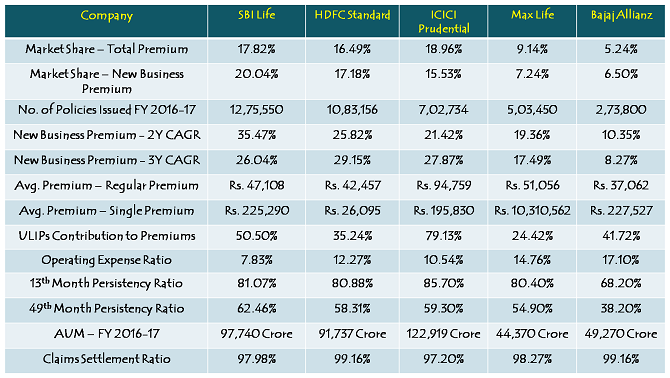

Peer Comparison of Top 5 Private Life Insurance Companies

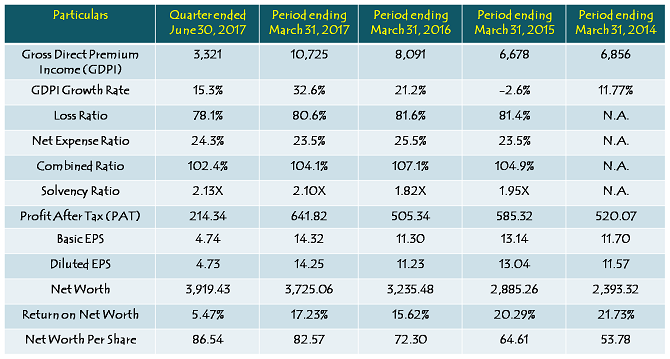

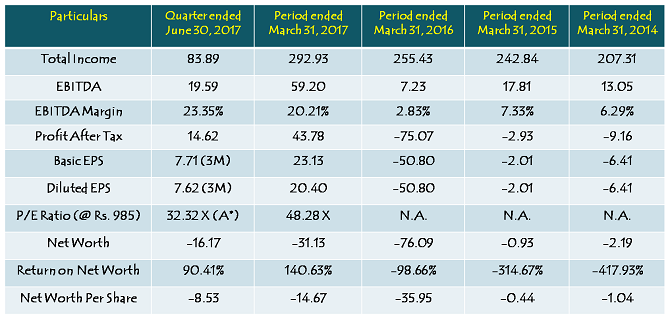

Financials of SBI Life Insurance Company Limited

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

Comparing SBI Life’s fundamentals with that of its rival companies in the industry, there are many factors which augur well for SBI Life over its peer companies. In the previous 2-3 years, SBI Life has been the fastest growing private life insurance company among the top five private insurance companies listed in the table above. It has grown at a CAGR of 35.47% since FY15 as against HDFC Life’s 25.82% and ICICI Prudential’s 21.42%.

Moreover, its operating expense ratio at 7.83% has also been the lowest among the top 5 private life insurance companies listed in the table above. ICICI Prudential’s operating expense ratio comes next at 10.54% and HDFC Life’s expense ratio stands at 12.27%.

But, the question is why everything looks rosier when there is an IPO just around the corner and why it falters quickly after the money gets raised at high valuations?

ICICI Life Insurance came out with its IPO exactly one year from today and successfully raised Rs. 6,057 crore from the investors. Its Indian Embedded Value (IEV) on March 31, 2016 was Rs. 13,939 crore and at Rs. 334 a share at the time of its IPO, the company was valued at Rs. 47,957 crore. That made the company to be valued at 3.44 times its embedded value.

Now, as the SBI Life has come out with its IPO, its own Indian Embedded Value (IEV) has been calculated as Rs. 16,538 crore as on March 31, 2017. At Rs. 700 a share, the insurance company would be valued at Rs. 70,000 crore, which translates it to be 4.23 times its embedded value.

At 3.44 times, ICICI Life IPO looked expensive to me one year back, and even after one year of it getting listed on the bourses, currently it is trading at 3.8 times its embedded value. I still have a view that ICICI Life is trading at expensive valuations. So, if ICICI Life at 3.8 times its embedded value is trading at expensive valuations, then I think SBI Life is more expensive at 4.23 times its embedded value.

SBI Life reported Rs. 954.65 crore in profits, Rs. 9.55 a share as EPS and Rs. 55.52 as book value per share during the previous financial year i.e. FY 2016-17. At its likely issue price of Rs. 700 a share, the company is valued at 73.3 times its 12-months trailing EPS and 12.61 times its book value as on March 31, 2017. Despite of its rapid growth in the previous few years, these are highly stretched valuations the company is seeking from its prospective investors.

Like ICICI Lombard, SBI Life too is seeking a hefty premium of more than 50% over its last transaction of share sale in less than a year’s time. On December 9, 2016, SBI Life’s parent company, State Bank of India (SBI) entered into an agreement with Temasek Holdings and KKR Asian Fund to sell its 3.90% stake in the company for Rs. 460 a share. Now, just 9 months after that stake sale, its promoters are seeking a steep premium of 52% from its new investors, including the common investors like you and me.

Again, I think it is highly unreasonable to seek such a steep premium in such a short period of time. Even if the company succeeds in carrying out this IPO at Rs. 700 a share, I don’t think this investment could be a multibagger for its investors. I think it should list at a maximum of 10% premium to its issue price and a profit booking could drag its price below the issue price post listing.

So, at these valuations, I would avoid this IPO personally and advise my clients as well to do so.