This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

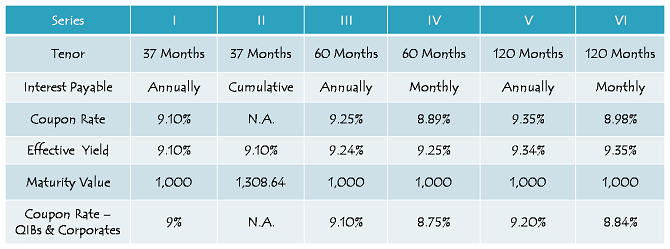

L&T Finance is going to launch its public issue of secured, redeemable, non-convertible debentures (NCDs) from this coming Wednesday, 6th of March. The company plans to raise Rs. 1,500 crore from this issue, including the green-shoe option to retain oversubscription of Rs. 1,000 crore. These NCDs will carry coupon rates between 8.89% for 60 months and 9.35% for 120 months.

Maturity period will range between 37 months to 120 months, having monthly, annual and cumulative interest payment options. The issue is scheduled to remain open for 15 days only to close on March 20, 2019. However, in case of high demand for these NCDs and raising Rs. 1,500 crore before 20th March, the company might close it prematurely.

Here are the salient features of the issue you should consider before taking a decision to invest or not:

Size of the issue – Base size of the issue is Rs. 500 crore and the company will have the option to retain oversubscription to the tune of Rs. 1,500 crore, including the green-shoe option of Rs. 1,000 crore.

Minimum Investment – Investors are required to apply for a minimum of ten bonds of Rs. 1,000 face value i.e. an investment of at least Rs. 10,000.

Interest Rate on Offer, Effective Yield & Tenor of the Issue – The issue will carry coupon rate of 9.35% p.a. for a period of 120 months, 9.25% p.a. for 60 months and 9.10% p.a. for 37 months. These rates would be applicable for annual interest payment options only. Monthly interest payment option is also available with 120 months and 60 months, and coupon rates for these periods would be 8.98% p.a. and 8.89% p.a. respectively.

You can check the rates offered for different maturities and different payment options from the table below:

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage fixed for the allotment:

Category I – Qualified Institutional Buyers (QIBs) – 20% of the issue is reserved i.e. Rs. 300 crore

Category II – Non-Institutional Investors & Corporates – 20% of the issue is reserved i.e. Rs. 300 crore

Category III – High Net Worth Individuals (HNIs) & HUFs investing more than Rs. 10 lakhs – 30% of the issue is reserved i.e. Rs. 450 crore

Category IV – Retail Individual Investors, including HUFs investing up to Rs. 10 lakhs – 30% of the issue is reserved i.e. Rs. 450 crore

Allotment on First-Come First-Served Basis –Allotment will be made on a first-come first-served basis, as well as on a date priority basis i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

NRI/QFI Investments – Non-Resident Indians (NRIs), foreign nationals and Qualified Foreign Investors (QFIs) among others are not allowed to invest in this issue.

Ratings & Nature of NCDs – ICRA, CARE and India Ratings, the three rating agencies involved in this issue, have assigned ‘AAA/Stable’ rating to the issue, indicating the issue to be safe as far as timely payments of interest and principal investments are concerned. As mentioned above as well, all these NCDs are ‘Secured’ in nature.

Demat Account Mandatory – The company has decided to issue these NCDs compulsorily in demat form. So, if you don’t have a demat account, you won’t be able to apply for these NCDs.

ASBA Mandatory – Like equity IPOs, SEBI has made ASBA mandatory to apply for debt issues also, effective October 1, 2018. So, you are no longer required to issue cheques to apply for these NCD issues. In case of physical applications, you just need to sign on the application form as per your bank records.

Taxability & TDS – No TDS in Demat Form – Interest income with these NCDs is taxable in the hands of the investors and you will have to pay tax on the interest income while filing your income tax return. However, as demat account is mandatory to invest in this issue, no TDS would get deducted from your interest income on NCDs held in demat form.

But, in case you decide to close your demat account, you can get these NCDs rematerialised. So, if rematerialised and held in physical form after the allotment, and if the annual interest income is more than Rs. 5,000, TDS @ 10% will be deducted.

Listing, Premature Withdrawal – L&T Finance has decided to get its NCDs listed on both the stock exchanges, Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). Allotment as well as listing of these NCDs will happen within 6 working days from the closing date of the issue. There is no option of a premature redemption back to the company. However, the investors can always sell these NCDs on the stock exchanges to encash their investments.

Should you invest in L&T Finance 9.35% NCDs?

What we have seen recently in the cases of IL&FS and especially DHFL, it has taught us that nothing is permanent in the financial world and things could change very quickly with any of the private lenders. It doesn’t mean that we should never invest with private companies. I just want to reiterate here that one should be mentally prepared for any kind of adverse event with private companies, and enough research should be done before you hand over your hard-earned money to these private companies.

L&T Finance is a fundamentally sound company and has the brand name of L&T to generate trust with its investors. Probably that is why also it has been rated ‘AAA’ by the rating agencies. But, after all it is a private company. As I have expressed my views earlier as well, one should invest in such debt instruments of private companies for the shortest maturity period, and here 120 months is a very long period of investment with a private company. So, personally I would advise my clients to avoid such a long period of investment with L&T Finance. If you trust L&T Finance more than any other private lender, then you should go with 60-months tenor, otherwise there is not much difference in interest rates of 60 months and 37 months tenors. So, ideally one should invest for 37 months only.

On the other hand, more conservative investors should wait for the NHAI issue details to get announced. God knows why, but the wait for the NHAI issue has been longer than what I initially expected. I hope they issue their bonds this month itself, otherwise I don’t think their issue will see the light anytime before the elections get over and it could even get delayed by 2-3 months after the new government gets going.

Application Forms – L&T Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in L&T Finance NCDs, you can contact us at +91-9811797407