Yes, you read it right. You can enjoy certain tax benefits with personal loans as well. Since it is a tax saving season, undoubtedly, it seems a big news for people who are looking for ways to save taxes! However, the tax benefit would depend on the final use of the personal loan.

Before we discuss the tax benefits available, let’s discuss what a personal loan entails. A personal loan is considered to be one of the easiest ways to get the money, which can be used for any purpose. Both banks and non-banking financial institutions (NBFCs) offer personal loans with minimum documentation and easy repayment schedule. It can be availed online as well.

Tax Benefits of Personal Loans

As per our income tax laws, there is no specific tax deduction for a personal loan. However, in order to get tax benefits on a personal loan, the purpose for which the loan has been used does get considered. It means, if a personal loan has been taken and used for the ultimate purpose for which the tax deduction is available, the borrower becomes eligible to get a tax benefit, else it would not be given.

Usually, tax benefits on personal loans would be applicable if the online personal loan amount has been used for the below purposes:

- Loan amount used for purchasing/constructing a residential house – If you take a personal loan for purchasing or constructing a house, you would be eligible for a tax deduction under section 24(b) of the Income Tax Act against the interest portion of your loan repayment. While for a self-occupied house, interest amount up to Rs 2 lakh can be claimed as tax-deduction, in case of a rented property, the entire interest paid on a home loan is eligible for the tax benefit. Further, if the loan amount is used towards paying the down payment, it would also get tax benefits. Similarly, the interest paid on the home improvement loan gets a tax deduction for up to Rs. 30,000.

Remember, the tax benefit is available only on the interest paid and not on the repayment of the principal amount. Having said that, it’s worth mentioning that a borrower has to give adequate proof to tax authorities to validate that the online personal loan money has been used to buy and renovate/repair the house.

- Loan amount invested in business – If the online personal loan amount has been used in the business, the interest paid on the loan would be considered as an expense, and thus, it would be deducted from the gross revenue. This, in turn, will help in reducing the net taxable profit of the business, thereby lowering the tax liability.

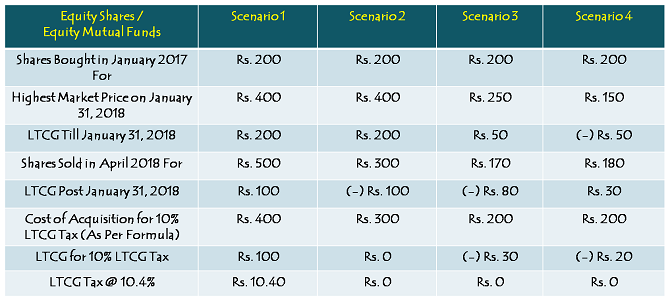

- Loan amount used for buying the asset – If the borrower has used the personal loan to buy assets like jewellery, shares, non-residential house etc., the interest paid on loan would be added to the cost of acquisition of the asset. Though tax deduction would not be available immediately in the year in which the interest has been paid, it would be added to the cost of acquisition and would be available in the year the asset gets sold.

Important Things to Remember Regarding Tax Benefits on Personal Loans:

* When the lender disburses the personal loan amount, no tax would be levied in the hands of the borrower as the loan amount is not an income.

* To claim a tax deduction, it is essential to submit evidence to prove that the loan amount has been used for any of the above-listed purposes.

* Personal loans must have been availed from a valid source, like a bank or an NBFC, as loans from an unknown source may be considered as income and thus, will not be eligible for tax benefits.

* As tax benefit is available only on the interest portion of your home loan and not on the principal amount, a borrower needs to submit the interest certificate to get the tax incentive.

To conclude, with personal loans, you get the freedom to use the loan amount as per your wish without informing the lender. So, if you need money for any of the above mentioned purposes, just apply for a personal loan and don’t forget to avail tax benefits as well.